Get the free Credit Application and Account Agreement

Get, Create, Make and Sign credit application and account

How to edit credit application and account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application and account

How to fill out credit application and account

Who needs credit application and account?

Credit application and account form: A comprehensive guide

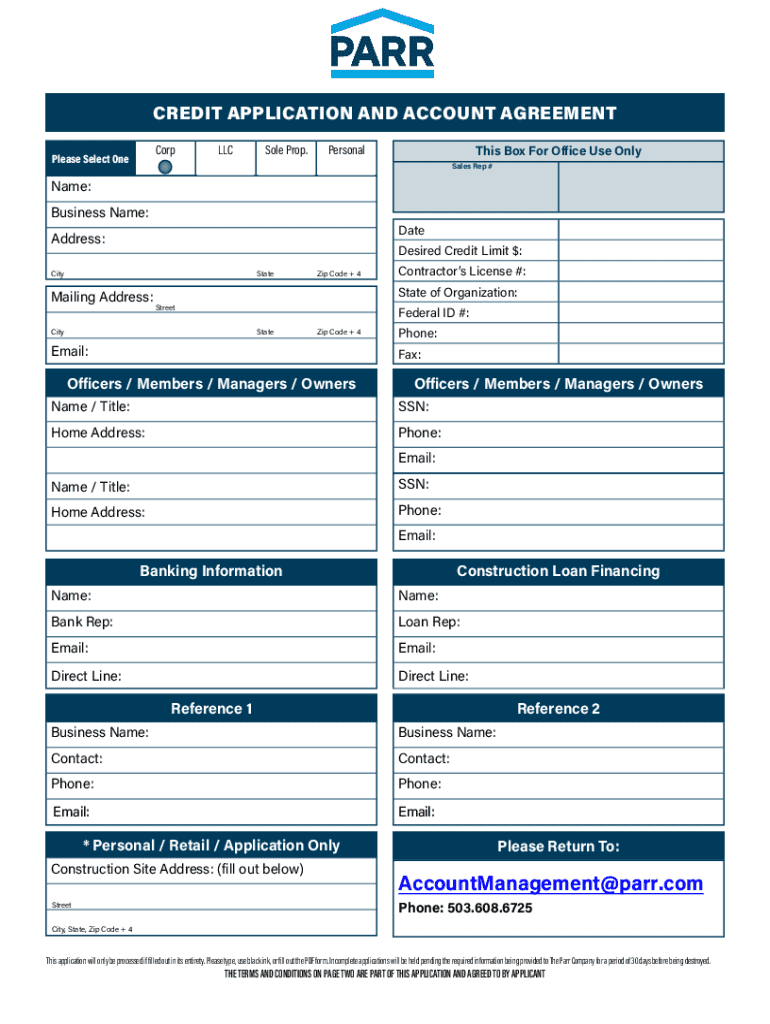

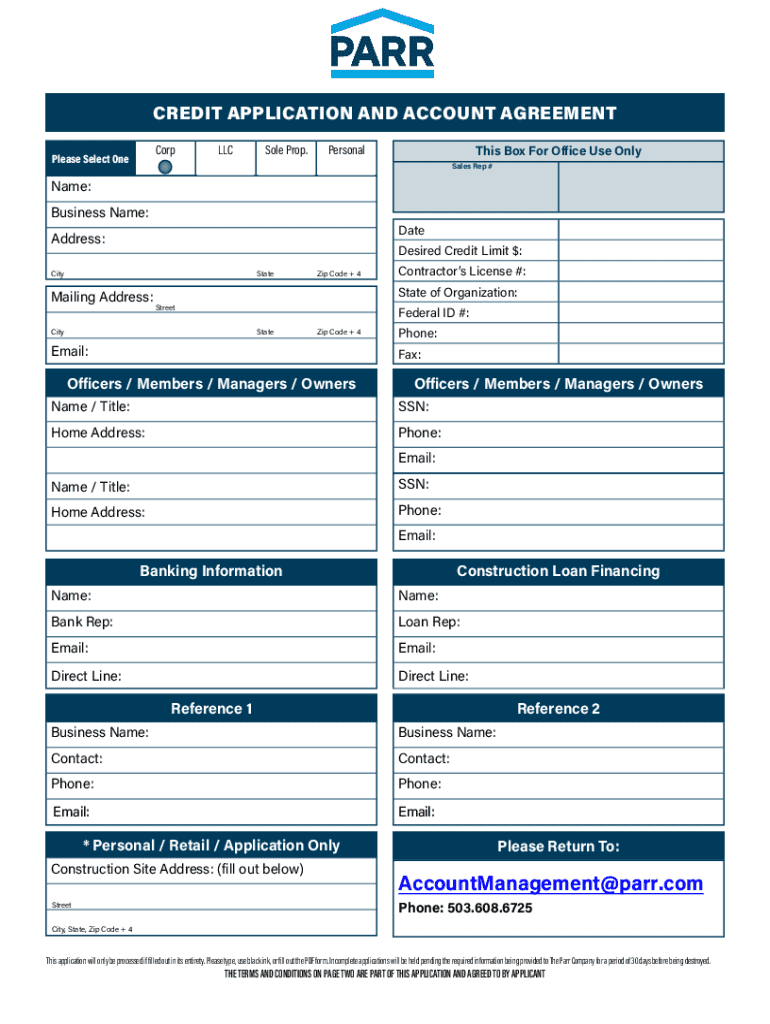

Understanding the credit application and account form

A credit application and account form serves as a pivotal tool for businesses seeking credit. It allows companies to present their financial history to potential creditors, enabling those creditors to evaluate the risk involved in extending credit. This form is crucial for organizations that wish to establish a line of credit for purchasing goods or services.

The account form typically accompanies the credit application, detailing the terms under which credit is granted. These forms are particularly important in transactions where trust needs to be established, as they lay the groundwork for financial responsibility between the parties involved.

Components of an effective credit application and account form

A robust credit application and account form consists of several critical sections, each requiring specific information to ensure a thorough evaluation process.

Required information sections

The first key section involves business or organization information, which provides basic details like name, address, and the business type. Following this, it's essential to include information about officers or owners, noting personal details of key personnel involved in financial decisions.

Next, accounts payable details should be clearly outlined, including name and contact of the billing personnel. This section also entails financial details including bank accounts, trade references, and credit history to give creditors insights into payment behavior.

Key sections of the form: A step-by-step guide

Filling out a credit application and account form can seem daunting, but breaking it down into manageable steps makes the process easier.

Filling out the application

Approving application checklist

After submission, an internal review process begins. It's important for businesses to be aware of common red flags that creditors may look for, such as discrepancies in financial history or incomplete sections.

Credit application best practices

When completing a credit application and account form, accuracy is paramount. Clarity and honesty in reporting financial standings not only expedites approval but also fosters a trustworthy relationship with creditors.

Furthermore, ensuring that all contact information is current will prevent delays in communication. Common mistakes such as missing information or providing inaccurate references can lead to complications in the approval process.

Digital signatures have become increasingly significant, as they streamline the signing process. eSigning offers benefits over traditional handwritten signatures, including enhanced security and simplified record-keeping.

Managing your credit application and account form

Adopting cloud-based document tools transforms how businesses handle their applications. Solutions like pdfFiller provide an array of features, ensuring ease of use in document management.

Utilizing cloud-based document tools

Tracking the application process is equally essential. Effective monitoring helps ensure evolving situations are communicated swiftly, thereby avoiding misunderstandings with creditors.

Understanding your rights and responsibilities

Within the context of credit applications, borrowers are entitled to certain rights, established by federal and state regulations. Understanding these entitlements is fundamental for businesses seeking credit.

Conversely, creditors have specific responsibilities, including conducting fair practices when making credit decisions. Awareness of these responsibilities fosters greater trust between borrowers and lenders.

Additional considerations

Customization can significantly enhance the effectiveness of a credit application and account form. Depending on the industry, different sections may be more relevant, allowing businesses to tailor applications to their unique circumstances.

Maintaining updated information is another important aspect. Regular reviews prevent inaccuracies and ensure compliance with any legal changes impacting business structures.

Conclusion: Enhancing your credit application experience

Leveraging tools like pdfFiller allows users to streamline their credit application process. With features that facilitate seamless editing, signing, and collaboration, pdfFiller empowers businesses to manage their documents efficiently.

By harnessing a centralized platform for document management, individuals and teams can enhance their credit application experience, creating a smoother and more effective interaction with creditors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit application and account in Gmail?

How can I fill out credit application and account on an iOS device?

How do I edit credit application and account on an Android device?

What is credit application and account?

Who is required to file credit application and account?

How to fill out credit application and account?

What is the purpose of credit application and account?

What information must be reported on credit application and account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.