Get the free Form 990ez

Get, Create, Make and Sign form 990ez

How to edit form 990ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990ez

How to fill out form 990ez

Who needs form 990ez?

Form 990EZ Form: A Comprehensive How-to Guide

Understanding Form 990-EZ

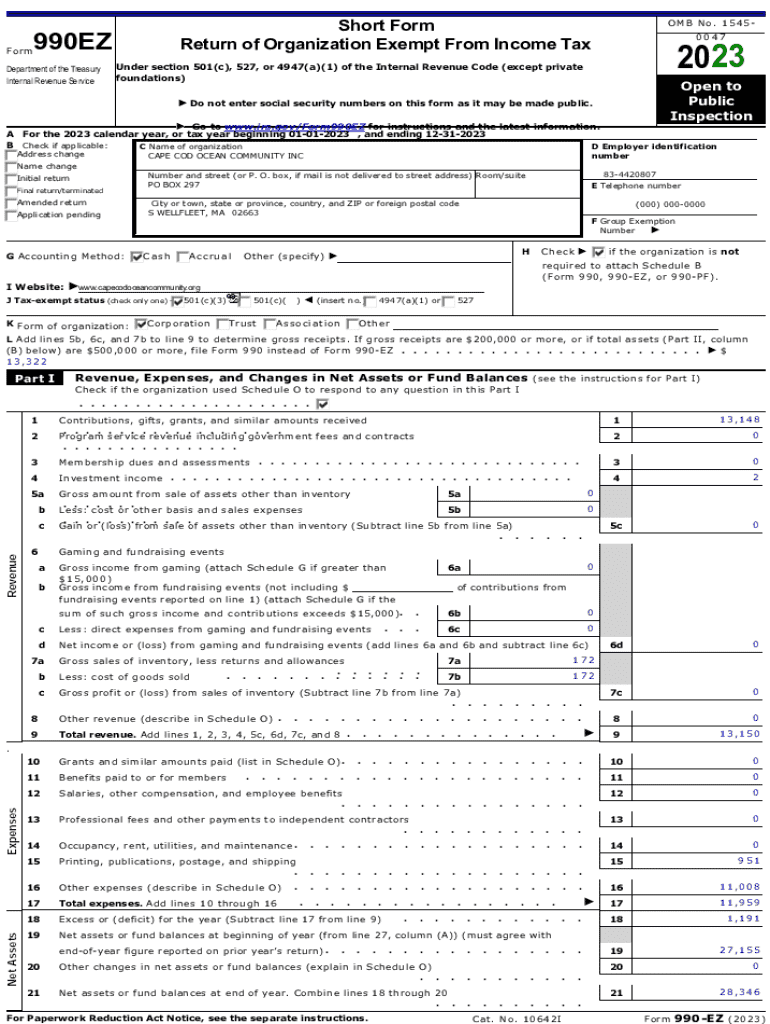

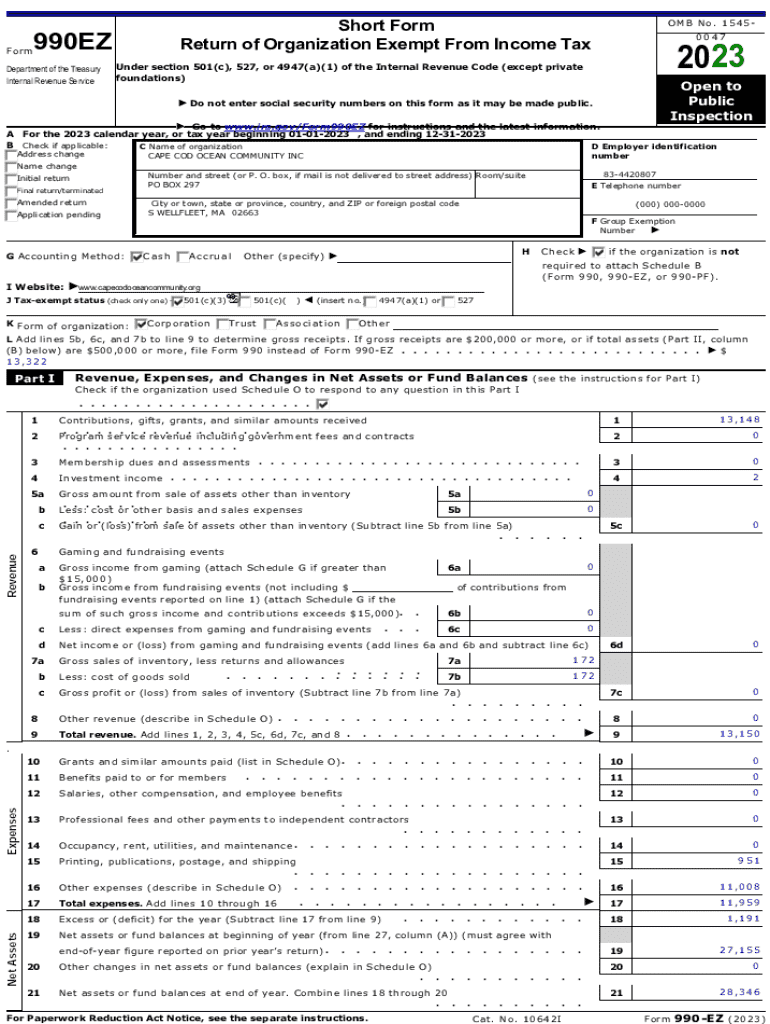

Form 990-EZ is a streamlined tax form used by small charitable organizations and nonprofits to report their financial information to the Internal Revenue Service (IRS). Designed specifically for organizations with gross revenues of less than $200,000 and total assets under $500,000, Form 990-EZ simplifies the filing process while ensuring compliance with federal regulations. Unlike the full Form 990, this shorter version enables smaller nonprofits to provide essential information without the extensive detail required by larger organizations.

The significance of Form 990-EZ extends beyond tax compliance. It serves as a vital tool for accountability and transparency, enabling nonprofits to share their financial health and operational transparency with donors, funders, and the public. By filing this form, organizations can showcase their commitment to fiscal responsibility and promote trust among their stakeholders.

Who needs to file Form 990-EZ?

Eligibility to file Form 990-EZ primarily hinges on the organization’s financial structure and gross revenue. Organizations eligible for this streamlined form include charitable organizations, religious entities, and other nonprofits that meet specific IRS criteria. Specifically, any organization with gross receipts under $200,000 and total assets below $500,000 is required to file this form instead of the more detailed Form 990.

Conversely, certain organizations, such as private foundations and organizations with revenues exceeding these thresholds, cannot file Form 990-EZ. Additionally, organizations classified as 501(c)(3) that are not active, or those who have received a notice of termination from the IRS, must refrain from submitting this form. Understanding these criteria helps organizations comply with IRS regulations while maintaining their tax-exempt status.

Important deadlines for filing

Timely submission of Form 990-EZ is crucial for organizations to avoid penalties and maintain their tax-exempt status. The IRS mandates that Form 990-EZ be filed annually on the 15th day of the 5th month following the end of the organization’s tax year. Typically, for organizations operating on a calendar year basis, this deadline falls on May 15. However, if the organization’s tax year differs, it is essential to adjust the deadline accordingly.

In cases where additional time is needed, organizations can apply for an automatic 6-month extension by submitting Form 8868. This extension allows for more time to prepare financial information, but it is important to remember that an extension to file is not an extension to pay any taxes owed. Organizations that miss their filing date may face penalties, which can accumulate over time, underscoring the importance of adhering to these deadlines.

Preparing to file Form 990-EZ

Before diving into the completion of Form 990-EZ, organizations should gather and prepare several essential documents and financial records. This includes the organization’s legal name, address, and Employer Identification Number (EIN). Additionally, all pertinent financial data, including income statements, balance sheets, and the statement of functional expenses, need to be compiled accurately.

Beyond basic organizational details, nonprofits must be prepared to disclose information about their governance structure, programs, and contribution sources. For instance, disclosures may be required regarding any compensation paid to key employees, detailed descriptions of the organization’s mission, and the impact of its programs. Ensuring that this information is thorough and accurate not only aids in compliance but also enhances the organization’s credibility with stakeholders.

Step-by-step instructions for completing Form 990-EZ

1. Basic information about your organization

The initial step in filling out Form 990-EZ is to provide basic information about your organization. This section requires the legal name, address, and EIN of the organization. Be sure to double-check these details for accuracy, as any discrepancies can lead to issues with IRS processing. If you need to report any address changes, it’s crucial to follow the correct procedures outlined by the IRS to avoid delays.

2. Financial information section

The financial information section is a critical part of Form 990-EZ, where organizations will report their total revenue, expenses, and net assets. This is where you will need to fill out a line-by-line breakdown, ensuring that all income sources, such as contributions, grants, membership dues, and program service revenue, are accurately reflected. Additionally, report total expenses incurred, which include program services, fundraising costs, and administrative expenses.

3. Schedule O - additional information

Schedule O is critical as it provides the platform for organizations to add additional context and disclosures pertinent to their operations. It is essential to use this section to detail special circumstances or prolonged explanations that cannot be captured through the standard form. For example, this could include important programmatic changes, operational challenges faced during the year, or unique events affecting finances. A thoughtful and thorough Schedule O can enhance the understanding of the organization's impact and transparency.

4. Reviewing form summary

Before submission, it's vital to review the entire Form 990-EZ thoroughly for accuracy and completeness. Look for any arithmetic errors, missing entries, or discrepancies in reported figures. Engaging a colleague or hiring a professional to conduct a secondary review can help catch errors that might be overlooked. Efficiently reviewing your form ensures a smoother process with the IRS and boosts the credibility of the submitted documentation.

Filing Form 990-EZ electronically

E-filing Form 990-EZ presents numerous advantages over traditional paper filings. Not only does it expedite the submission process, but it also enhances accuracy through integrated validation checks. When filing electronically, organizations receive immediate confirmation of submission, offering peace of mind that the form has been received by the IRS. Many nonprofit organizations are transitioning to e-filing due to these benefits, allowing essential time savings that can be redirected toward their operational goals.

To effectively file Form 990-EZ electronically, organizations should follow a systematic process. First, select a reliable e-filing platform that complies with IRS regulations. Next, prepare the completed Form 990-EZ and upload it onto the platform. Include all necessary attachments and supplementary disclosures as required. Finally, ensure to double-check the submission details before finalizing to prevent any issues.

Common questions regarding Form 990-EZ

As organizations approach the filing of Form 990-EZ, they often have critical questions regarding compliance and processes. One common query pertains to the penalties associated with late filing. The IRS imposes fines for late submissions, which can accumulate quickly, emphasizing the importance of filing on time. Organizations also frequently ask how to amend a previously filed Form 990-EZ in case of an error; this can be done by filing Form 990-X, which allows for rectifications.

Another area of confusion includes the differences between Form 990 and Form 990-EZ. While Form 990 requires extensive detail suited for larger organizations, Form 990-EZ is tailored for smaller entities with less financial complexity. Nonprofits may also wonder when they need to file an additional Form 990-T, which is required if they have unrelated business income exceeding $1,000. The Group Exemption Number (GEN) is crucial for organizations under a parent organization, facilitating streamlined filings and compliance across similar entities.

In-depth insights on schedules related to Form 990-EZ

Form 990-EZ has various related schedules that might need to be completed depending on the organization’s activities. Schedule A helps determine the organization's public charity status and how it supports public interests. Filling out Schedule B is essential if your organization receives substantial contributions from a limited number of donors, as it provides a record of significant contributors.

Furthermore, if your nonprofit engages in professional fundraising services, filling out Schedule G is necessary to outline these agreements. Lastly, Schedule O, as previously mentioned, provides supplemental information that enhances the understanding of your organization’s operations. Understanding which schedules are pertinent ensures complete transparency and compliance with IRS regulations.

Tips for nonprofits to avoid common pitfalls

Numerous organizations encounter pitfalls while filing their Form 990-EZ, which can lead to delays or penalties from the IRS. To avoid these, it’s crucial for organizations to maintain proper records throughout the year. Keeping meticulous financial records, including receipts, invoices, and bank statements, simplifies the preparation process as deadlines approach and ensures that all reported information is accurate.

Periodic financial reviews and audits, even if informal, can significantly mitigate errors in financial reporting. Implementing digital solutions for document management can also streamline record-keeping and improve collaboration among team members working on 990-EZ filings. Utilizing available software tools enables organizations to enhance accuracy and reduce stress during the filing season.

Utilizing pdfFiller for form management

pdfFiller offers a robust solution for nonprofits managing their Form 990-EZ filings. Its cloud-based platform provides seamless editing capabilities, allowing organizations to fill out, save, and share documents effortlessly. Users can collaborate in real time, making it easy for teams to work together on financial documents while accessing the platform from anywhere, enabling better management of time and resources.

Additionally, pdfFiller features eSigning and secure sharing capabilities, enhancing the compliance process while minimizing the risk of errors. Nonprofits can easily include the necessary disclosures and attachments with their submissions. The platform also offers a comprehensive knowledge base and customer support options, empowering users to navigate the complexities of Form 990-EZ with confidence.

Getting started with pdfFiller

Beginning with pdfFiller is a straightforward process designed to support organizations of all sizes. First, set up your account by providing the necessary information and selecting a subscription that fits your organization’s needs. Once your account is active, browse through the available templates and select those that pertain specifically to Form 990-EZ filings. This tailored approach streamlines the process and allows for quick access to relevant documents.

Navigating the user interface is intuitive, enabling organizations to efficiently fill out and manage their Form 990-EZ. Use the built-in tools to collaborate with colleagues, store important documents, and track all changes made to forms at any time. This functionality enhances the overall filing experience, empowering teams to stay organized and compliant throughout the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 990ez?

How do I edit form 990ez online?

How do I edit form 990ez straight from my smartphone?

What is form 990ez?

Who is required to file form 990ez?

How to fill out form 990ez?

What is the purpose of form 990ez?

What information must be reported on form 990ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.