Get the free Servicers of VA Loans - VA Home Loans

Get, Create, Make and Sign servicers of va loans

How to edit servicers of va loans online

Uncompromising security for your PDF editing and eSignature needs

How to fill out servicers of va loans

How to fill out servicers of va loans

Who needs servicers of va loans?

Understanding Servicers of VA Loans Form

Understanding VA loans

VA loans, or Veterans Affairs loans, are a unique financing option available to veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans are designed to make homeownership more accessible without the burden of private mortgage insurance (PMI). Unlike conventional loans that often require hefty down payments, VA loans allow qualified borrowers to secure 100% financing, meaning no down payment is required, making it easier for veterans to buy homes.

The benefits of VA loans extend beyond the lack of down payment requirements. Borrowers may also enjoy lower interest rates compared to conventional loans and the absence of a prepayment penalty. Furthermore, VA loans are backed by the government, which means that lenders face less risk, enabling them to offer more favorable terms.

Eligibility for VA loans generally hinges on service duration, discharge status, and duty status. Veterans with a minimum of 90 consecutive days of active service during wartime or 181 days during peacetime typically qualify. Additionally, surviving spouses of veterans who died in service or from service-related injuries may also be eligible.

Key terms in the VA loan process include ‘Certificate of Eligibility (COE)’, which verifies a borrower’s eligibility, and ‘Funding Fee’, a fee charged to help keep the program running, which may be financed into the loan amount.

Role of servicers in VA loans

A servicer in the context of VA loans plays a critical role in managing the loan after it has been issued. Essentially, the servicer is responsible for collecting payments, managing the loan account, and providing customer service to the borrower. This partnership ensures that the borrower navigates the complexities of their mortgage efficiently.

The duties and responsibilities of a servicer encompass a range of tasks beyond simple payment collection. They are tasked with handling inquiries, sending out monthly statements, managing escrow accounts for property taxes and insurance, and addressing any issues related to loan servicing. An efficient servicer will proactively communicate with borrowers, particularly in situations involving missed payments or financial hardship.

The importance of servicers in managing VA loans cannot be overstated. They ensure that borrowers have the information and resources necessary to make their mortgage experience smooth. A trustworthy servicer provides clarity about the terms of the loans while addressing challenges that may arise, fostering a healthy borrower-lender relationship.

Overview of the VA loans form

The VA loan process is accompanied by specific forms that serve both the borrower and the servicer, crucial in establishing the terms and conditions of the loan. The most common form is the VA application for a Certificate of Eligibility, which confirms the borrower's eligibility for the VA loan program.

The VA Loans form is essential for ensuring compliance with federal regulations. It outlines pertinent loan information, including terms, payment schedules, and borrower responsibilities. Proper completion and submission of the form are vital to accessing the benefits associated with VA loans.

The regulatory framework for VA loans mandates strict adherence to guidelines set forth by the Department of Veterans Affairs and federal regulations. This ensures that loan programs maintain their integrity and offer the necessary protection to borrowers.

How to access VA loans forms

Accessing the correct VA loans forms is straightforward due to the resources provided by the Department of Veterans Affairs. Borrowers can find the right forms through the VA's official website or directly through their chosen loan servicer's platform.

Here’s a step-by-step guide to help you find the right form:

Interactive tools also exist to assist in selecting the right document based on the borrower’s situation. These tools guide users step-by-step to ensure the selected forms meet their specific needs.

Forms are generally available for download in PDF format. Some allow for online completion directly on the VA website, further simplifying the process.

Filling out the VA loans form

Filling out the VA Loans form accurately is critical to ensuring a smooth application process. Begin with the personal information section, where you will provide your full name, Social Security number, and contact details. Make sure to double-check for typos, as inaccuracies can lead to delays.

Next, focus on the loan information section. Here, you will indicate the type of loan you are applying for, the amount, and any existing loan details if applicable. It’s essential to be thorough and honest about your financial situation as this can affect loan approval.

The signature and authorization section requires you to sign the document, granting permission for the VA to process your application. Remember, common mistakes can arise from not reading instructions carefully or overlooking required fields.

To provide accurate information, consider using tools like pdfFiller’s editing and management platform. It allows for seamless document editing, e-signing, and collaboration, ensuring your application is perfectly tailored before submission.

Editing and managing your VA loans form

Once you've filled out your VA loans form, you may need to edit it before submission. Tools for editing PDF documents are available through platforms like pdfFiller. This allows you to make necessary corrections, ensuring the form is free of errors and ready for submission.

To collaborate with others on your form, utilize cloud-based document storage solutions. This feature empowers multiple users to work on the document simultaneously, ensuring everyone is on the same page.

Efficient document management also includes utilizing PDF editing software to streamline the process of completing forms. It is advisable to maintain backups of the edited forms to prevent loss of information.

Submitting the VA loans form

Once your VA loans form is accurately filled out, understanding the submission process is paramount. Here's a step-by-step breakdown of how to submit your form effectively.

After submission, tracking your application is crucial. Borrowers can monitor their application status through the VA’s online portal or by contacting their servicer directly, ensuring they remain informed throughout the process.

Frequently asked questions (FAQs)

Borrowers often have specific queries regarding VA loans forms. Common questions include; 'What documents do I need to submit with my VA loans form?' and 'How long does it take to process the application?' Addressing these concerns provides clarity and helps borrowers navigate the process more smoothly.

Typical issues may arise from servicer errors or delays in processing. To remedy these situations, having a direct line of communication with your loan servicer can be immensely beneficial. They can provide timely updates and assist in resolving any unforeseen problems.

Always remain informed about the latest updates on your application, as proactive communication can often alleviate concerns.

Resources for servicers and borrowers

Accessing resources is critical for both servicers and borrowers involved in VA loans. The VA’s official website offers numerous links to useful forms, policy updates, and detailed guides about VA loans. This ensures that all parties have the necessary information at their fingertips.

Additionally, helpful contact information for assistance includes dedicated VA hotlines and local mortgage representatives specializing in VA loans. Engaging with community forums can also yield valuable insights and experiences from other VA loan borrowers.

Joining support groups can help both borrowers and servicers stay informed about best practices and changes in policies affecting VA loans.

Additional insights on VA loan servicing

The landscape of VA loans is continually evolving, with recent updates in policies aimed at improving borrower support and accessibility. Servicers must stay abreast of these changes to provide the best possible service to their borrowers.

Innovations in loan servicing technology are also transforming how VA loans are managed. Tools and platforms like pdfFiller deliver efficiency and centralized document management, streamlining the administration process for both servicers and borrowers. Looking ahead, trends such as enhanced digital integration and borrower assistance programs are expected to further shape the future of VA loan management.

By staying informed and proactive, servicers can enhance their operational efficiency and provide a superior experience to borrowers.

Testimonials and success stories

Real-life experiences from borrowers utilizing VA loans provide valuable insights into how effective servicing can make a difference. Many borrowers report that their servicers offered personalized assistance, guiding them through the entire process, which ultimately led to successful homeownership.

Success stories often highlight instances where prompt communication from servicers has alleviated concerns and expedited the loan process, showcasing the critical role effective servicing plays in the VA loan ecosystem.

Platforms like pdfFiller have been praised for their user-friendly interface, which facilitates easier document management, further contributing to positive borrower experiences around VA loans.

Best practices for servicers of VA loans

Establishing effective communication channels with borrowers is a cornerstone of success in VA loan servicing. Servicers should stay approachable and responsive to inquiries, ensuring borrowers feel supported throughout the loan process.

Training resources are essential for onboarding new servicers, helping them understand VA-specific guidelines and borrower needs. Compliance with VA standards is paramount, as it reinforces trust and builds stronger borrower relationships.

Furthermore, servicers should leverage technology, such as document management platforms, to streamline their processes. This not only increases efficiency but also enhances the overall borrower experience.

Concluding note on VA loan management

Continual improvement and an emphasis on collaboration are crucial for effective VA loan management. Servicers that prioritize ongoing training and engagement with borrowers will find success in fostering lasting relationships. Leveraging technology such as pdfFiller’s robust tools can simplify processes and enhance communication.

The evolving landscape of VA loans calls for adaptability and open dialogue among servicers and borrowers. Emphasizing the value of technology in facilitating these processes can ultimately lead to a more efficient and satisfying experience for everyone involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my servicers of va loans in Gmail?

How do I make changes in servicers of va loans?

Can I sign the servicers of va loans electronically in Chrome?

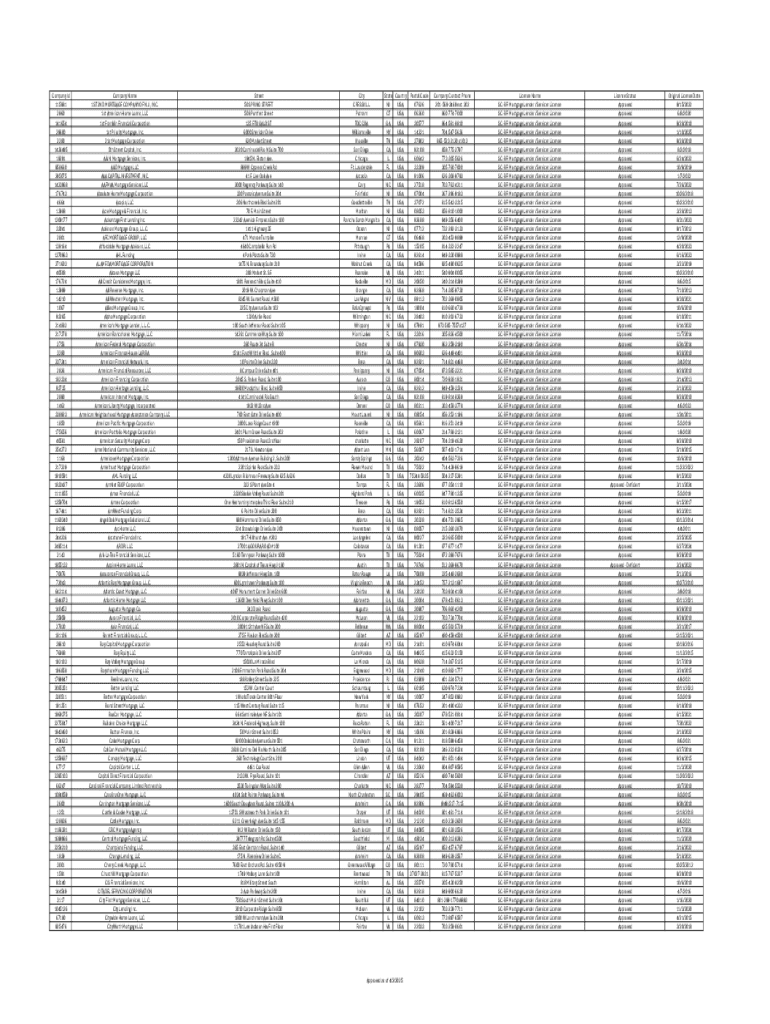

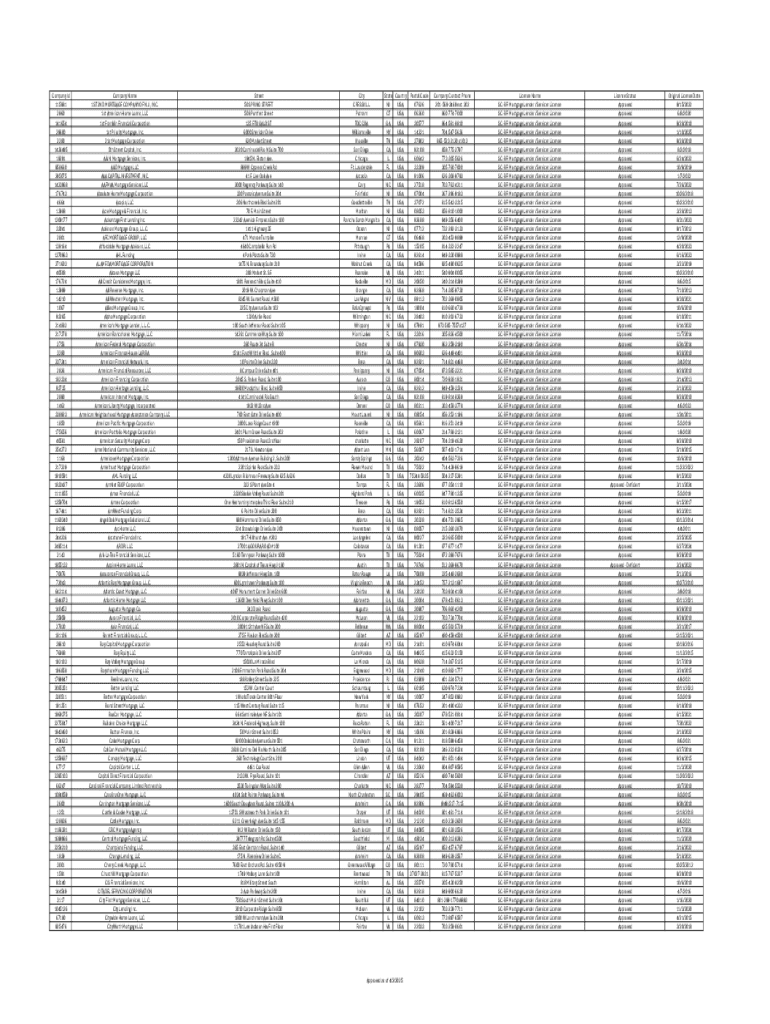

What is servicers of va loans?

Who is required to file servicers of va loans?

How to fill out servicers of va loans?

What is the purpose of servicers of va loans?

What information must be reported on servicers of va loans?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.