Get the free Montana Employee’s Withholding and Exemption Certificate

Get, Create, Make and Sign montana employees withholding and

Editing montana employees withholding and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out montana employees withholding and

How to fill out montana employees withholding and

Who needs montana employees withholding and?

Montana employees withholding and form: A comprehensive guide

Understanding employee withholding in Montana

Employee withholding refers to the practice of deducting a portion of an employee’s salary or wages for tax obligations. In Montana, this withholding is primarily for state income taxes, which help fund essential services such as education, transportation, and public safety. Understanding employee withholding is crucial for both employees and employers as it affects overall income and tax liabilities.

Key information for Montana employees

Knowing who is subject to withholding is essential. In Montana, all employees earning an income are subject to withholding unless they qualify for specific exemptions. Understanding these exemptions can shield some employees from unnecessary tax deductions.

Montana state tax obligations vary based on the level of income and marital status. For the 2023 tax year, Montana has a progressive tax system with rates that range from 1% to 6.9%, applying to different income brackets. Local taxes may also apply depending on where you live and work, thus emphasizing the need for employees to stay informed about their specific tax obligations.

The Montana employee withholding form: A step-by-step guide

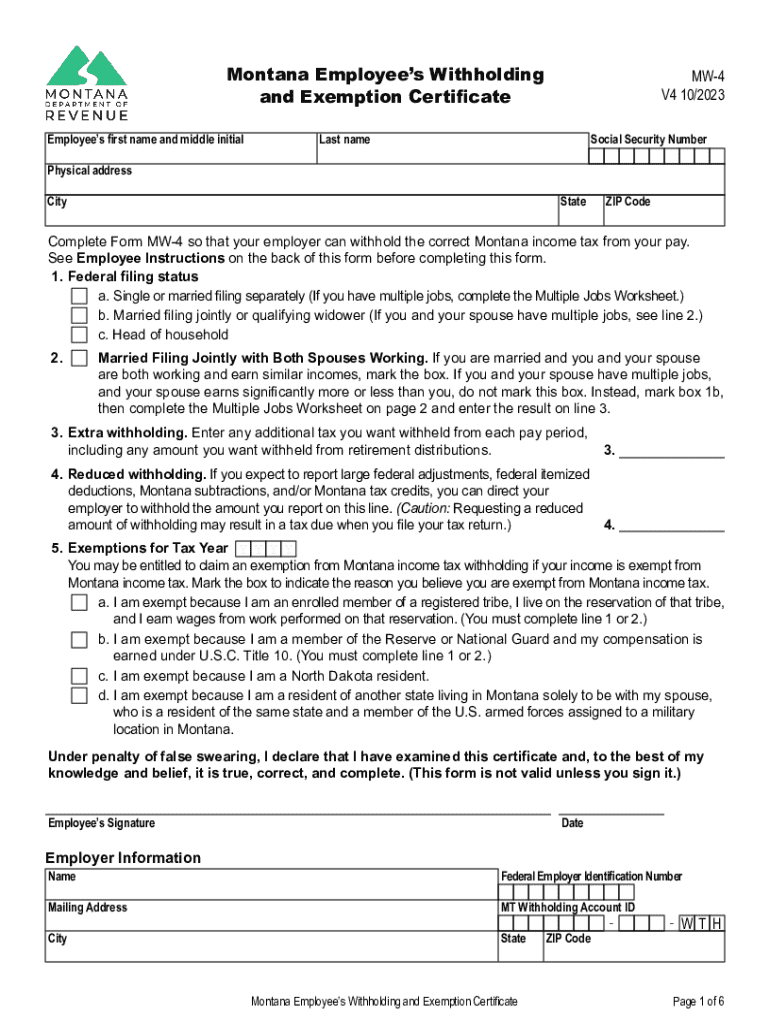

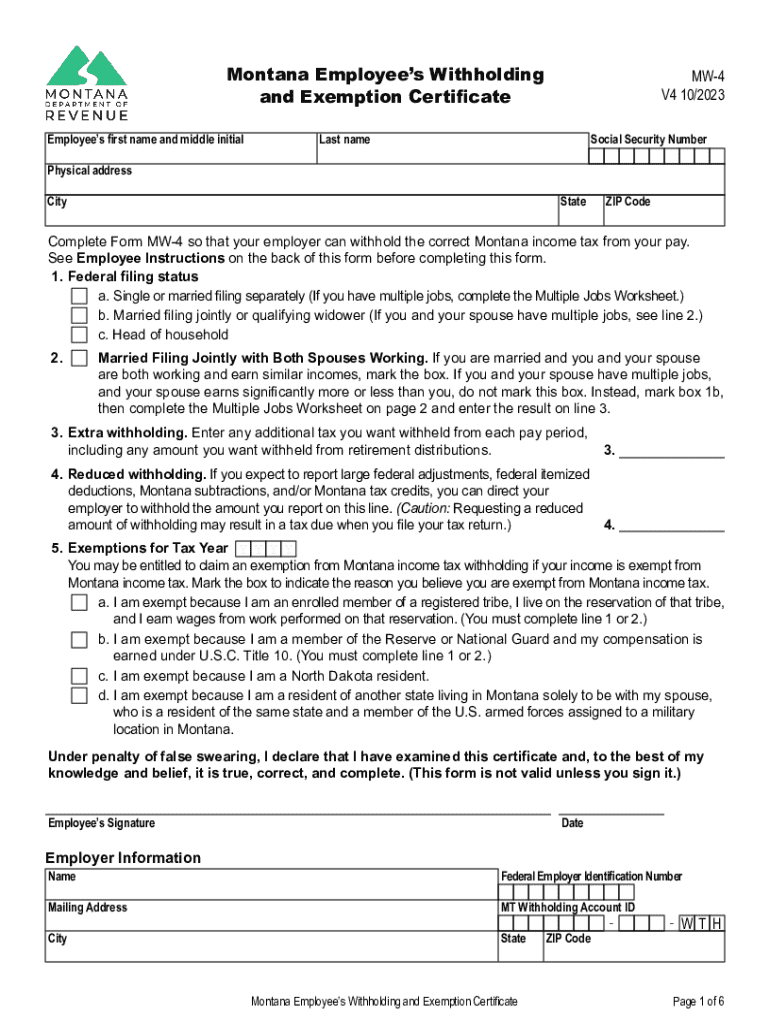

The Montana Employee Withholding Form, often referred to as Form MW-4, plays a pivotal role in determining the amount of state income tax withheld from your paycheck. This form is critical for both employees and employers to ensure compliance with state tax laws.

Employees should complete and submit this form upon starting a new job or when their withholding needs change. This proactive approach allows for adjustments to be made in a timely manner, preventing any surprises during tax season.

Filling out the form accurately is vital. Below, we provide a breakdown of the key sections.

Resources for completing your Montana withholding form

Accessing the Montana Withholding Form is straightforward. You can download the form directly from the Montana Department of Revenue's website or visit the pdfFiller website for easier access and editing options. pdfFiller allows users to fill out forms interactively, providing a user-friendly interface to assist in document completion.

pdfFiller offers additional tools that simplify the process of managing your withholding form. Users can effortlessly edit, sign, and share their forms. Features such as collaboration options make it easy for teams to work together on tax documents, ensuring that everything is filled out correctly and efficiently.

Frequently asked questions about Montana withholding

Understanding the implications of your withholding form is crucial. Here are some common questions employees may have.

Final thoughts on managing your withholding process

Keeping accurate records is essential for a smooth tax process. Maintaining copies of your MW-4 form and any communication with HR regarding your withholding will help you stay organized. Utilizing pdfFiller’s cloud-based solutions allows employees to access their documents anytime, ensuring that they remain compliant and up-to-date.

To further simplify your tax-related processes, consider setting reminders for annual reviews of your withholdings, especially after significant life changes like marriage, having children, or switching jobs. These proactive steps can smooth out your onboarding and tax requirements.

Interactive tools on pdfFiller

Exploring advanced features on pdfFiller can enhance your experience with documents like withholding forms. Users can take advantage of dynamic forms that auto-populate based on previous inputs, allowing for consistent and quick completion of similar forms in the future.

In addition, pdfFiller provides live support options, ensuring that users can connect with experts for assistance. This is particularly beneficial when navigating complex forms or resolving specific issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the montana employees withholding and electronically in Chrome?

How can I edit montana employees withholding and on a smartphone?

How do I fill out the montana employees withholding and form on my smartphone?

What is montana employees withholding and?

Who is required to file montana employees withholding and?

How to fill out montana employees withholding and?

What is the purpose of montana employees withholding and?

What information must be reported on montana employees withholding and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.