Get the free Company Tax Return

Get, Create, Make and Sign company tax return

How to edit company tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out company tax return

How to fill out company tax return

Who needs company tax return?

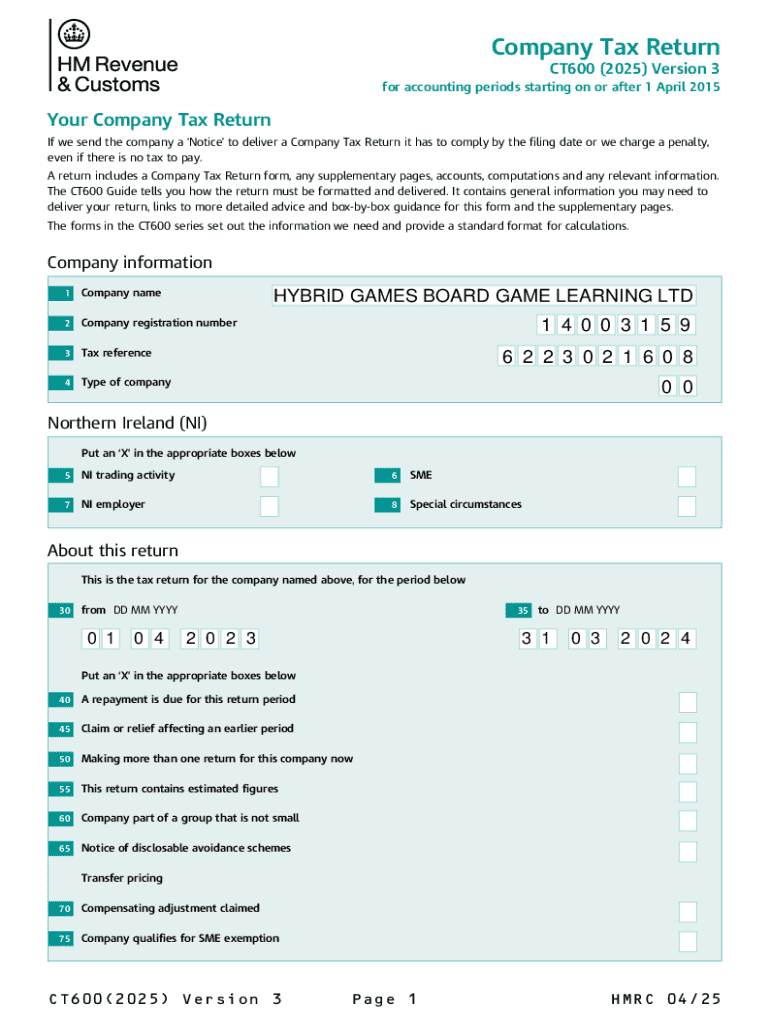

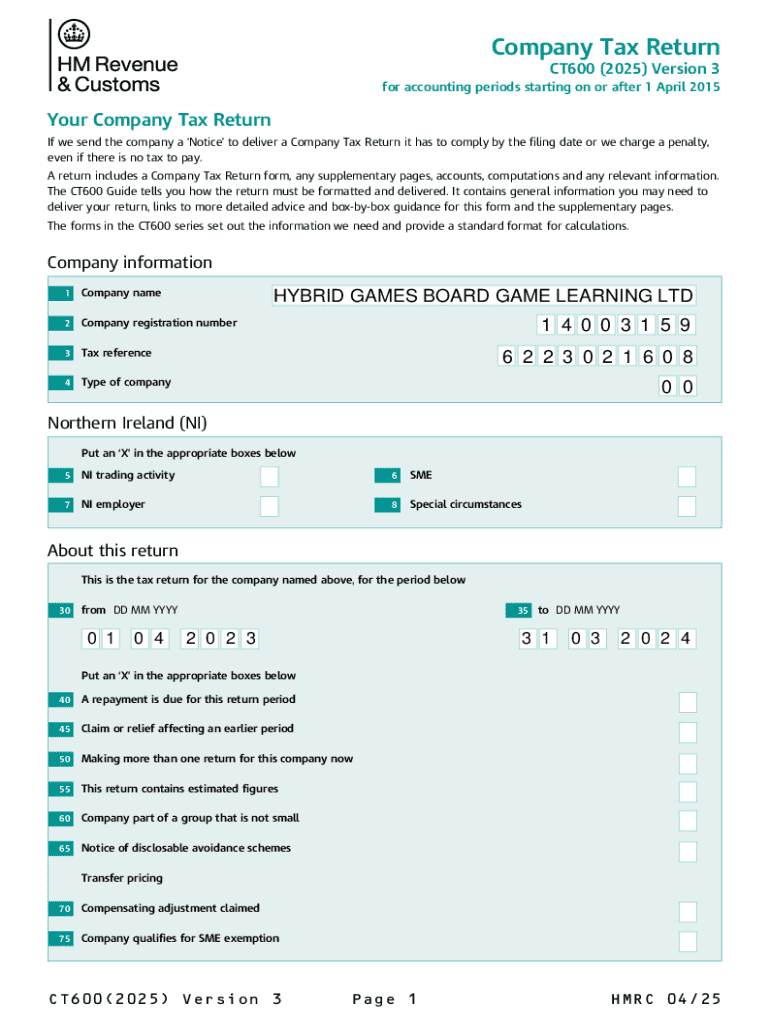

Understanding the Company Tax Return Form

Understanding the company tax return form

A company tax return form is a document that businesses submit to report their financial performance and pay their taxes. It serves as a reflection of a company's income, expenses, and overall financial dealings for a specific period, usually one year. These forms are essential for complying with tax regulations and allow the IRS to assess how much tax a company owes. Proper and timely filing not only fulfills legal obligations but also provides a clear financial picture that can aid in decision-making processes for business leaders.

The importance of the company tax return form in the business cycle cannot be understated. It ensures that taxpayers fulfill their obligations while also providing the government with necessary revenue. Furthermore, these forms can influence future business strategies, loan applications, and investment opportunities, making it crucial to handle them with care and accuracy.

What documents do you need?

To accurately complete a company tax return form, several essential documents are required. Start with checking the IRS tax form checklist tailored for businesses, which can provide clarity on required forms specific to your business type and structure. Common documents include profit and loss statements, statements of net worth, and comprehensive financial records.

Typically, the following financial records must be gathered:

Filing deadlines and requirements

Understanding the key IRS tax dates for companies is paramount for compliance. The standard deadline for filing most business tax returns is March 15 for S Corporations and partnerships, while C Corporations typically meet the April 15 deadline. However, these dates may vary based on state-specific regulations. Late filings can incur substantial penalties and interest, potentially aggravating a business's financial situation.

When it comes to filing formats, companies can choose between paper and electronic submissions. Electronic filing has become increasingly popular due to its efficiency, accuracy, and faster processing times. Platforms like pdfFiller offer seamless e-filing options, allowing users to complete and submit their company tax returns in a few simple steps. Choosing to e-file can significantly enhance the filing experience by reducing errors and speeding up refunds.

Step-by-step guide to completing your company tax return form

Before diving into completing your company tax return form, familiarity with the sections and requirements of the form is essential. Each section typically includes spaces for reporting income, deductions, and tax credits. Having organized and accurate records can streamline this process and ensure compliance.

Consider these steps for each form type:

Common mistakes include inaccurate reporting of income, missing crucial deadlines, and failing to retain proper documentation. A careful review of the form and an organized approach can significantly reduce these errors.

Managing and signing your company tax return

Utilizing pdfFiller for document management streamlines the process of managing your company tax return. With pdfFiller, businesses can easily upload and edit tax return forms directly in the cloud, simplifying collaboration across teams. When multiple stakeholders are involved, this platform allows for real-time updates and accurate submissions.

Additionally, employing electronic signature options within pdfFiller ensures that your tax return is signed swiftly and securely. eSignatures are recognized legally and ensure compliance, providing peace of mind. With simple steps to securely sign documents electronically, businesses can maintain thorough records and transparency in their filing processes.

Avoiding tax penalties

Understanding IRS penalties for late or incorrect filings is key to avoiding unnecessary fees and complications. Penalties can quickly accumulate and lead to audits if not in compliance. Companies can minimize potential audit risks by maintaining accurate financial records, ensuring clear communication among staff, and familiarizing themselves with the tax regulations specific to their business structure.

Consulting with tax professionals often proves invaluable. They can provide insights tailored to business structures and help navigate the complex tax landscape effectively. Proper guidance can also identify opportunities for tax savings and strategic planning that align with business goals.

Frequently asked questions

Changes in business structure can lead to confusion around tax requirements. For instance, what steps should you take to amend a tax return? Using Form 1040X for personal taxes or 1120X for corporate amendments is crucial if a mistake occurs. Additionally, businesses facing losses must understand how to carry these forward or backward in future returns to mitigate tax liabilities.

Understanding resources for further learning on business taxes can help demystify this process. The IRS website, local tax clinics, and various online courses can offer great foundational knowledge.

Additional considerations

Special tax considerations apply to international businesses, including compliance with foreign tax laws and potential treaties. These nuances can affect reporting requirements, which can ultimately influence the company tax return form.

Businesses must stay informed about changes in tax laws that impact company filings. As legislation evolves, adapting tax strategies in conjunction with business growth is essential. Utilizing tools like pdfFiller enables businesses to manage multiple company tax variations efficiently, simplifying the complex nature of compliance.

Related topics of interest

For those looking to expand their knowledge in tax-related matters, consider diving into essential IRS tax forms and deadlines every small business owner should be aware of, or explore how to prepare for a business tax audit with confidence. These topics provide critical insights that can aid in navigating the complex world of business taxes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send company tax return to be eSigned by others?

How do I make changes in company tax return?

How do I make edits in company tax return without leaving Chrome?

What is company tax return?

Who is required to file company tax return?

How to fill out company tax return?

What is the purpose of company tax return?

What information must be reported on company tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.