Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out how to transfer property

Who needs how to transfer property?

How to Transfer Property Form: Step-by-Step Guide

Understanding property transfer

Property transfer involves the legal process of changing ownership rights of a property from one party to another. This process is crucial not only for maintaining accurate property records but also for protecting the rights of both the seller and the buyer. Proper documentation is the backbone of a property transfer, as it safeguards against future disputes and clarifies ownership.

Overview of the property transfer process

Successfully transferring property requires clearly understanding the involved steps. The first step is usually determining the method of transfer according to the reason behind it—whether it's a sale, gift, inheritance, or divorce settlement. Knowing key terms and concepts is essential for navigating this process.

Step 1: Determine the method of transfer

Choosing the right method of property transfer depends on various circumstances, including the intended outcome, the relationship between parties, and any legal implications. Each method can have different legal requirements, tax consequences, and forms of documentation.

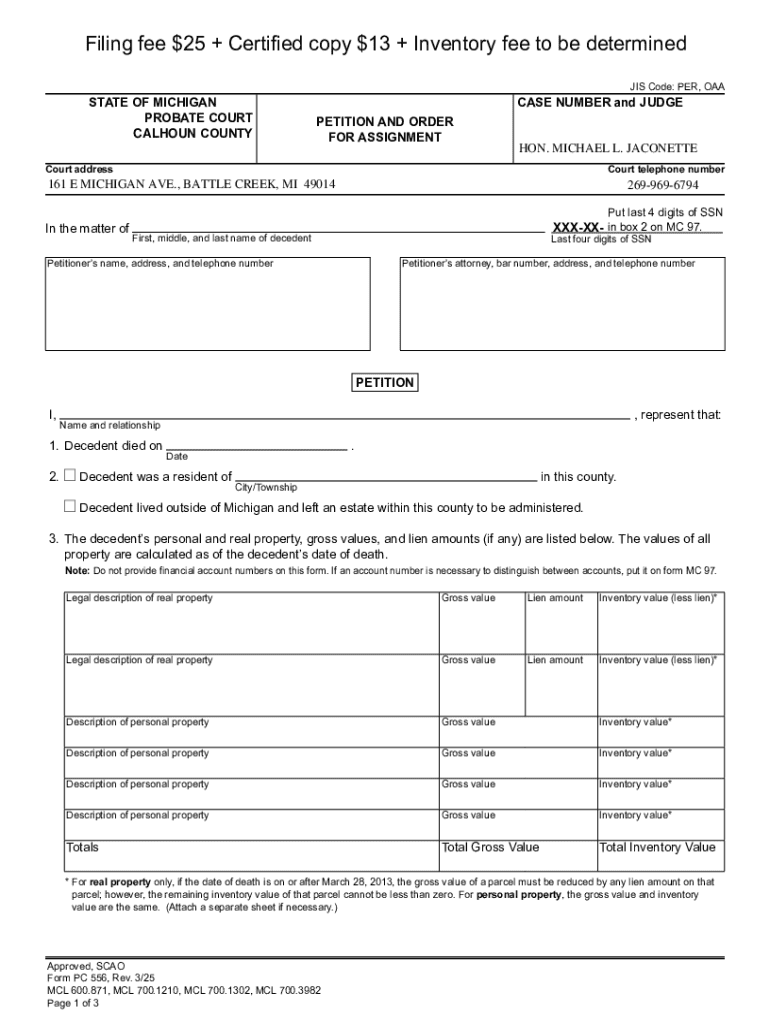

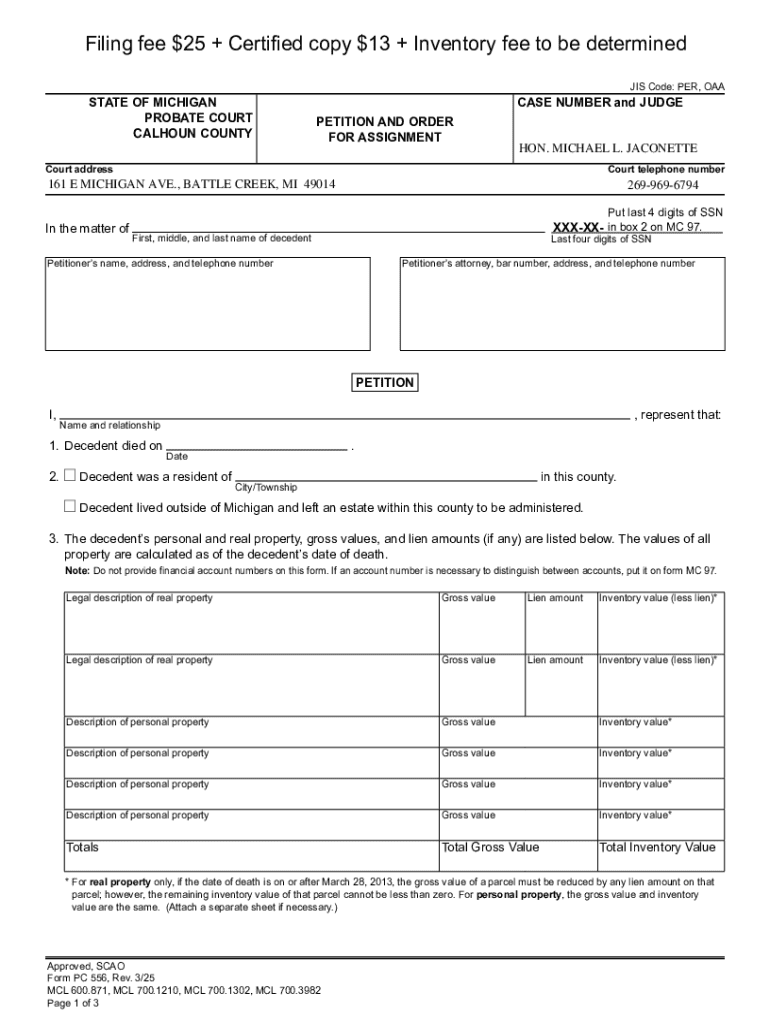

Step 2: Gather the required documents

Completing a property transfer requires gathering specific legal documents. Each method of transfer may have unique requirements, but certain documents are universally needed to validate the transfer and facilitate the process.

If any of these documents are missing, you may need to contact local property offices or legal counsel to obtain the necessary files.

Step 3: Fill out the necessary transfer form

The transfer form required varies based on the type of transfer. It's crucial to fill out this document accurately to prevent delays or issues in the transfer process. Each form usually asks for information about both the grantor and grantee, the property's legal description, and the nature of the transfer.

Accessing the form is easy with pdfFiller, where users can edit and sign forms in a user-friendly environment. Collaborating with others and managing the property transfer efficiently is just a few clicks away.

Step 4: Have the transfer form notarized

Notarization is a critical step in the property transfer process because it adds a layer of legitimacy to the document. A Notary Public serves to verify the identity of those signing the document and to confirm that they are doing so willingly and without coercion.

Step 5: Submit the transfer form and required documents

Once the transfer form is completed and notarized, the next step is submission. Each local jurisdiction may have different rules about where to file these documents, but it's primarily done through local government offices, such as the county recorder's office.

Special considerations in property transfers

When transferring property, especially between family members, it's essential to navigate the tax implications wisely to avoid unnecessary expenses. Many gift transfers between family members are exempt from taxes to a certain limit prescribed by law.

Unique scenarios in property transfer

Property transfer scenarios vary greatly and can introduce complexities. When multiple owners are involved, any transfer must include all parties' consent and signatures to avoid disputes.

Tips for a smooth-sailing property transfer

Whether you're embarking on a property transfer as a DIY project or working with professionals, ensuring all steps are followed precisely is crucial. Engaging legal counsel can help ensure compliance with local laws and procedures.

Evaluating the success of your property transfer

After completing the property transfer, confirming that everything has gone smoothly is important. This involves checking that all documentation is complete and that the new title reflects the change in ownership.

FAQs about property transfer forms

When navigating property transfers, many questions may arise concerning the specifics of the transfer form. This is particularly true for first-time property buyers or those newly navigating property law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdffiller form directly from Gmail?

How can I send pdffiller form to be eSigned by others?

Can I edit pdffiller form on an iOS device?

What is how to transfer property?

Who is required to file how to transfer property?

How to fill out how to transfer property?

What is the purpose of how to transfer property?

What information must be reported on how to transfer property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.