Get the free Budget Contents

Get, Create, Make and Sign budget contents

Editing budget contents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget contents

How to fill out budget contents

Who needs budget contents?

Budget Contents Form: A Comprehensive How-to Guide

Understanding your budgeting needs

Before diving into the budget contents form, recognizing your specific budgeting needs is essential. Tailoring your approach to meet either personal or team objectives ensures that you establish clear financial goals. Individuals often focus on personal expenses, savings goals, and debt repayment, while teams need to consider collective overheads, project-based expenses, and departmental budgets.

To effectively assess your financial situation, start by identifying your income sources. This might include salaries, side jobs, or passive income streams. Next, track your current expenses meticulously. Documenting all bills and discretionary spending helps paint a clearer picture of your financial landscape, laying the groundwork for your budget contents form.

Getting started with a budget contents form

A budget contents form is a structured document that helps you organize your financial data systematically. Its primary purpose is to provide clarity and insight into your financial behaviors, facilitating efficient budget management. Common components of this form include income sections, expense classifications, and savings goals.

Utilizing a budget contents form streamlines the budgeting process, allowing users to enhance tracking and accountability of their finances. By having a dedicated space to note all financial activities, it becomes easier to monitor where funds are allocated and where adjustments need to be made.

How to fill out the budget contents form

To effectively use the budget contents form, adherence to a step-by-step approach can simplify the process. Begin by gathering necessary information, which should include all forms of income, fixed and variable expenses, and your desired savings goals.

1. **Income section**: Document all income streams in detail. Include salaries, freelance work, and any ad hoc earnings. 2. **Expenses section**: Categorize your expenses into fixed and variable. Fixed expenses include rent or mortgage, while variable expenses might involve entertainment and groceries. 3. **Savings goals section**: Outline achievable savings targets, whether it's for emergencies or a planned vacation. Make sure these targets are specific and measurable.

For accurate data entry, refer to past financial statements or bank statements. This historical data can help ensure that your figures are precise. Additionally, adjust your budget for seasonal or irregular income to build a more realistic financial picture.

Editing and customizing your budget contents form

pdfFiller provides robust editing tools that allow users to modify templates to better fit their needs. Essential features include adding comments or notes for added context, ensuring everyone involved understands your decisions and rationale.

Additionally, integrating your budget contents form with other financial tools like spreadsheets or finance apps enhances your budgeting capabilities. This allows for seamless syncing across platforms, giving you a holistic view of your financial situation while benefiting from the insights generated by connected tools.

Advanced budget strategies

Exploring various budgeting methods can significantly enhance your financial planning. Popular techniques include zero-based budgeting, which allocates every dollar of income until you reach zero; the 50/30/20 budgeting rule, where 50% goes to needs, 30% to wants, and 20% to savings; and cash envelope budgeting, which utilizes physical envelopes for different spending categories.

Choosing the right budgeting method hinges on your financial goals and circumstances. Implementing a budget requires scenario planning for unexpected expenses, ensuring that your budget has enough flexibility to accommodate emergencies. Event-driven budgeting is another useful strategy, especially for larger expenses such as vacations or home repairs, allowing for anticipation and planning.

Collaborating on budgets with teams

When working on budgets collaboratively, sharing a budget contents form is crucial. pdfFiller offers features that enable team collaborations, allowing team members to contribute and provide inputs efficiently. eSign capabilities ensure that approvals are gathered seamlessly, fostering consensus among all team members.

To maintain version control and track changes, it's vital to keep a history of edits and revisions. Utilizing features that allow visibility into the document's evolution can help instill transparency within team discussions, ensuring that every member has access to the most updated information.

Tools and resources for budget management

Choosing the right tools can simplify your budgeting journey significantly. pdfFiller provides interactive budgeting tools, such as budget calculators and specialized templates designed to cater to various financial situations. These features can lead you towards more informed financial decisions.

Creating periodic review forms is also essential for tracking your progress. Regular financial check-ins help to ensure that you remain on track with your budget. This practice not only keeps you accountable but also allows for timely adjustments to your budgeting strategies.

Troubleshooting common budgeting challenges

Even the best-laid financial plans can encounter unexpected expenses. Developing strategies for emergencies, such as setting aside an emergency fund, is essential. Reassessing your budget priorities to accommodate these unforeseen circumstances will improve your financial resilience.

Financial setbacks can also challenge motivation levels. It is crucial to remind yourself of your long-term goals and consider financing options if necessary. Staying informed about various financial resources can also assist you in navigating tough times.

Legal and ethical considerations in budgeting

Understanding financial privacy is paramount when using online forms like the budget contents form. Ensure that your data is secure and uphold best practices by sharing sensitive financial information cautiously. Familiarize yourself with the privacy policies of any tool you utilize for added protection.

In a team setting, compliance with budgeting regulations is essential. Organizations need to ensure ethical practices in financial reporting, as maintaining transparency and integrity is vital for credibility. Establish protocols for regular audits and checks to uphold standards.

Enhancing financial literacy through budgeting

Instilling a culture of budgeting awareness within teams can lead to better financial practices. Conducting workshops or training sessions ensures that every member is equipped with essential budgeting skills. Resources available through pdfFiller can significantly aid in improving financial literacy.

Engaging with the community on budgeting efforts fosters collective financial education. Partnering with local organizations for community initiatives can magnify the impact of financial literacy programs, creating a more informed populace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit budget contents online?

Can I create an electronic signature for the budget contents in Chrome?

Can I edit budget contents on an Android device?

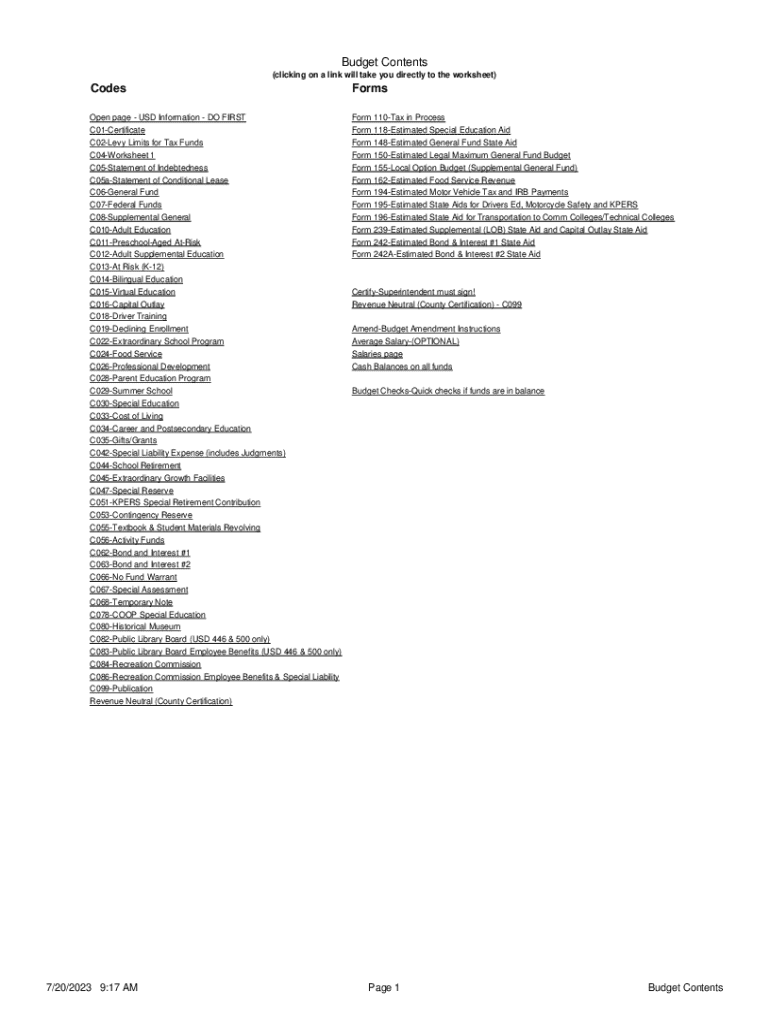

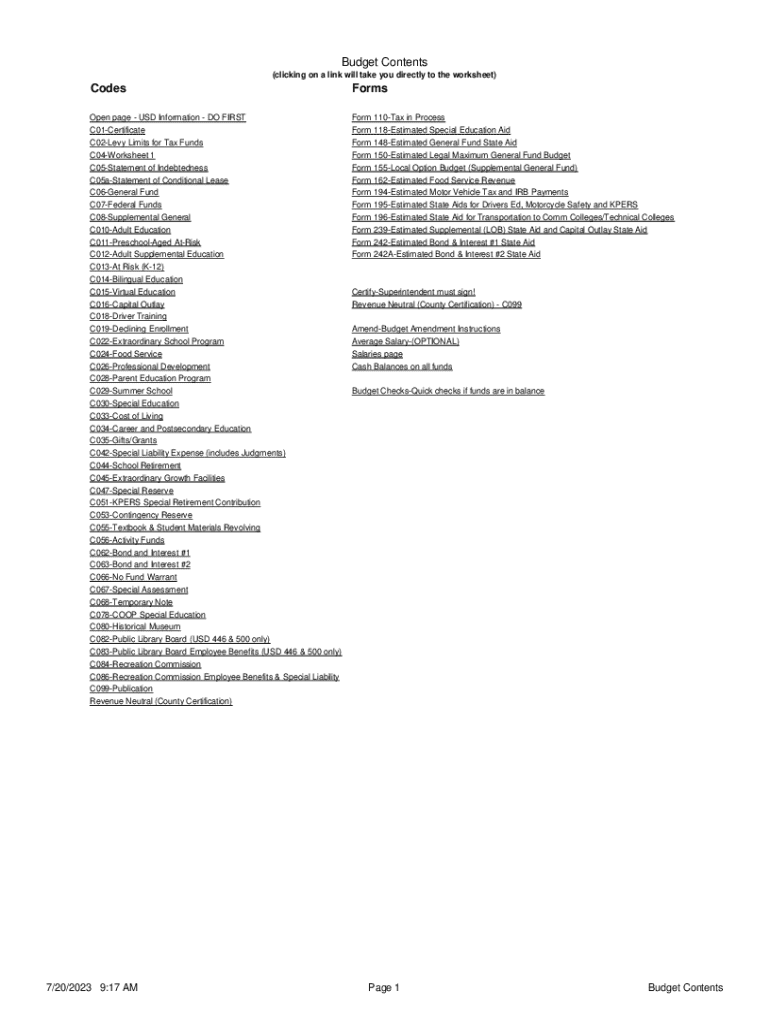

What is budget contents?

Who is required to file budget contents?

How to fill out budget contents?

What is the purpose of budget contents?

What information must be reported on budget contents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.