Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out form 5500-ez

Who needs form 5500-ez?

Understanding the Form 5500-EZ Form: A Complete Guide

Overview of Form 5500-EZ

The Form 5500-EZ is a crucial document used by plan sponsors to report information about single-participant retirement plans and certain foreign plans to the federal government. This form serves such a purpose to fulfill the requirements of the Employee Retirement Income Security Act (ERISA). Unlike the standard Form 5500, which accommodates multiple participants, Form 5500-EZ is specifically designed for plans with a single participant or a business owner with a spousal participant.

Filing the Form 5500-EZ ensures compliance with federal regulations and provides detailed information to the IRS, including plan assets, liabilities, and operational details. This not only aids in the regulatory oversight of retirement plans but also protects participants' rights under the plan. Understanding the nuances between Form 5500 and Form 5500-EZ is vital for any plan sponsor, as it influences reporting requirements and potential penalties for non-compliance.

Who must file Form 5500-EZ?

Form 5500-EZ must be filed by any individual who sponsors a one-participant retirement plan or a foreign plan. This includes self-employed individuals, sole proprietors, and owners of small businesses with a only one participant in the plan, typically themselves or their spouse. To qualify for a one-participant plan, the participant must be the business owner or their spouse, and no other employees may participate in the plan.

Additionally, foreign plans that meet specific criteria can also use Form 5500-EZ for reporting. These plans must primarily cover physical work performed outside the United States by U.S. workers. When filing, individuals must ensure they meet these eligibility criteria to avoid unnecessary penalties or complications.

Who does not have to file Form 5500-EZ?

There are various exemptions applicable to Form 5500-EZ filings. Plans that do not qualify as one-participant plans, such as those with multiple participants or employees, are required to file the standard Form 5500. Additionally, plans with less than $250,000 in total assets at the end of the plan year may be exempt from filing altogether.

Many assume all retirement plans must file the Form 5500 series, leading to confusion and stress. Clarifying these exemptions upfront can save significant time and resources. Always consult a tax professional or plan administrator to clarify any filing doubts.

Detailed instructions for completing Form 5500-EZ

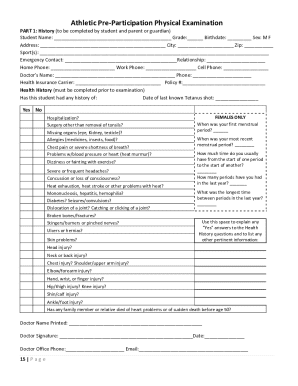

Completing Form 5500-EZ requires attention to detail and understanding of what each section entails. The form is divided into five main parts that cover identification, basic plan information, financial details, characteristics, and compliance questions.

1. **Part I: Annual Return Identification Information** - This section requires basic information about the plan, including name, plan number, and tax identification number. This information identifies the plan during processing.

2. **Part II: Basic Plan Information** - Detailed information regarding the plan specifics must be included here, such as the type of plan and whether it’s maintained or initiated in the reporting year.

3. **Part III: Financial Information** - This includes total plan assets, liabilities, and net assets available at the end of the year. Precise accounting is crucial to ensure compliance.

4. **Part IV: Plan Characteristics** - This section addresses the nature of the plan, including contribution types and eligibility conditions.

5. **Part V: Compliance and Funding Questions** - Answering these questions honestly is critical for IRS compliance checks. Misrepresentations can lead to investigations or fines.

Common mistakes in this section include failing to provide adequate financial data or misclassifying the plan type, which can complicate filing. Carefully reviewing the guidance notes for each part before submitting the form is advisable.

Filing tips and best practices

Preparing and submitting Form 5500-EZ accurately can save both time and potential penalties. Here are several best practices to keep in mind:

Filing must be completed by the seventh month after the end of the plan year, with the option for a 2.5-month extension available upon filing Form 5558 in a timely manner. Proper preparation enhances the chances of a smooth approval when audits arise.

How to file Form 5500-EZ

Form 5500-EZ can be filed electronically through the EFAST2 Filing System, which is the IRS's designated electronic submission platform. This system not only facilitates quicker processing but also provides immediate confirmation of submission.

Here’s a step-by-step guide for using EFAST2:

For those who face special circumstances, such as limited internet access, mail submissions can still be made using the IRS's physical addresses, ensuring that all provided information aligns with requirements to avoid processing delays.

When and where to file

Timely filing is critical for avoiding penalties. The deadline for Form 5500-EZ is typically the last day of the seventh month after the plan year concludes. Extensions can be requested, provided that Form 5558 is submitted properly within the specified timeline.

Filing addresses differ based on plan type and how the form is being submitted. It’s essential to verify the latest address on the IRS website or through relevant tax resources, as this can change annually. Ensuring that the form is properly directed can prevent unnecessary delays in processing.

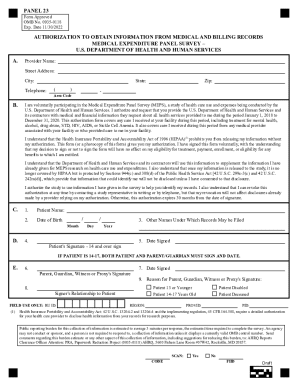

Who must sign the form?

The individual signing Form 5500-EZ must have the authority to act on behalf of the plan sponsor, which generally includes business owners or duly authorized representatives. If a plan is a corporation, an officer of the corporation must sign the form.

The importance of signatures extends beyond mere compliance; it validates the authenticity of the submitted document. Failing to properly sign the form can lead to processing delays or outright rejection from the IRS.

Consequences of late filing

Failing to file Form 5500-EZ on time can lead to significant penalties. The IRS imposes a penalty of $250 per day, up to a maximum of $150,000 for late submissions. This pressure emphasizes the necessity of adhering to deadlines.

For those who find themselves in a predicament of needing to file late, understanding the availability of late filer relief programs may offer some respite. These programs may reduce penalties or offer guidance on the necessary steps to take to get compliant as smoothly as possible.

Special scenarios and considerations

When encounter specific circumstances surrounding the Form 5500-EZ submission, understanding these can mitigate issues. For instance, if filing your first return or an amended return, aim to indicate this clearly on the form. If you have a short plan year or if you are filing a final return using Form 5500-EZ, ensure that this information is accurately documented.

Particular care should also be taken when addressing foreign plans or other classifications introduced by the SECURE Act. Familiarize yourself with the latest IRS rules for retroactively adopted plans and how they apply to your filing, as this often changes yearly. Special provisions may apply that simplify or extend timelines for qualified plans.

FAQ section

Here we've compiled common queries related to Form 5500-EZ to clear up confusion:

Providing detailed responses to these can ease apprehensions and provide a more straightforward path to compliance.

Interactive tools and resources

Utilizing comprehensive tools makes the process of completing Form 5500-EZ far more streamlined. Tools available on pdfFiller can enhance accuracy and ease the burden of paperwork. Features include:

Incorporating these tools can significantly diminish the chances of errors while boosting overall efficiency.

Additional information and updates

It’s essential to stay informed about the latest updates regarding Form 5500-EZ. The IRS regularly publishes new guidelines and procedural changes, and keeping abreast of these developments ensures compliance. In 2023, certain provisions and updates have altered filing requirements slightly, which could affect deadlines and penalties.

Reviewing the IRS website or contacting a tax professional will provide clarity and direction concerning these changes. This vigilance helps ensure that plan sponsors maintain proper compliance year after year.

Support and contact information

For individuals and small business teams navigating the complexities of Form 5500-EZ, having access to reliable support is invaluable. Resources such as IRS help hotlines offer assistance for filing-related queries, while companies like pdfFiller provide engaging platforms for document management.

Ensure you know the available channels for support as they offer guidance not just in filling out the form but in compliance requirements as a whole.

Related forms and resources

Understanding Form 5500-EZ is just one part of effective retirement plan management. Familiarize yourself with related forms and resources that can assist in your financial planning. Links to IRS citations detailing filing tips or alternatives like SIMPLE and SEP IRAs can expand your knowledge significantly.

Engaging with such resources can complement your understanding and assist in ensuring all aspects of your retirement plans remain compliant and effectively managed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

How can I get pdffiller form?

How can I edit pdffiller form on a smartphone?

What is form 5500-ez?

Who is required to file form 5500-ez?

How to fill out form 5500-ez?

What is the purpose of form 5500-ez?

What information must be reported on form 5500-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.