Get the free pdffiller app

Get, Create, Make and Sign pdffiller app form

How to edit pdffiller app form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller app form

How to fill out payment policy

Who needs payment policy?

Payment Policy Form: A Comprehensive How-to Guide

Understanding the importance of a payment policy form

A payment policy form is a crucial document for any business. It outlines how payments are to be made and what the expectations are for both the provider and the client. Without a clearly defined payment policy, misunderstandings can arise, leading to disputes over payments and potential financial losses.

The benefits of having a clear payment policy are manifold. It establishes clear expectations, reduces misunderstandings, and protects business interests. For instance, a clear due date helps clients know when to pay, minimizing delays. Moreover, common use cases for payment policies vary from service providers, freelancers, and corporate entities, each requiring tailored wording to suit their specific operational needs.

Key components of a payment policy form

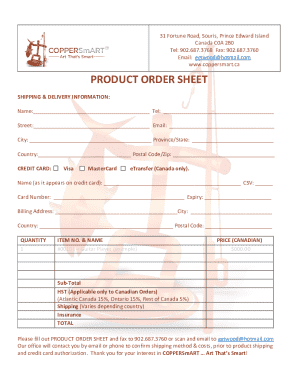

Creating an effective payment policy form requires incorporating key components that provide clarity and guidance. Some of the most important elements include the scope of the policy, types of payment methods accepted, and scheduled payment deadlines. Each of these components plays a vital role in ensuring smooth transactions.

Moreover, it's important to include essential terms and definitions in your payment policy. Clearly defined payment terms will help clients understand their obligations and can include stipulations such as penalties for late payments and incentives for early payments. This information is crucial to guide the expectations of both parties.

How to prepare your payment policy form

Creating a robust payment policy form involves a systematic approach. First, prepare a file where you can draft your policy. Step two is to have a policy-making discussion with relevant stakeholders, gathering insights to shape the content. Then, develop the policy based on the discussion, ensuring it covers all necessary points.

When drafting your payment policy, it’s essential to keep a few writing tips in mind. Aim for clarity and simplicity to communicate effectively. Utilize templates when possible for consistency, and always include visual aids like charts or tables to present complex payment schedules clearly.

Types of payment policy templates available

Various payment policy templates cater to different needs across multiple industries. Users can find options tailored for small businesses, freelancers, and healthcare organizations, each designed with the unique requirements of those sectors in mind.

When choosing a template, consider factors like industry relevance, necessary features, and ease of customization. Templates should allow you to tailor content to meet specific business needs without starting from scratch. This saves both time and effort.

Editing and customizing your payment policy form

Once you have a payment policy form drafted, it's time to edit and customize it for your specific needs. Utilizing tools like pdfFiller not only allows easy editing of PDFs but also offers interactive features that simplify the customization process. With pdfFiller, you can modify templates easily and ensure consistency across your documents.

Moreover, it's important to keep best practices in mind when updating your payment policy. Regularly communicate changes to stakeholders to ensure everyone remains informed. Additionally, maintain records of previous versions to ensure transparency and to refer back to when necessary.

Signing and managing your payment policy form

One significant advantage of using pdfFiller is the ability to eSign your payment policy form securely. This not only expedites the signing process but also provides a level of security that paper signatures cannot match. Implementing electronic signatures ensures that crucial agreements are finalized quickly, helping maintain transparent transactions.

Furthermore, the platform allows real-time collaboration with team members, enabling them to provide their input or feedback on the payment policy. This capability enhances the document's quality and ensures that all voices are heard before final approval.

Addressing common questions about payment policies

Common questions regarding payment policies often revolve around best practices and how to handle various payment situations. It's crucial to ask whether the payment terms set are industry-appropriate and if they reflect fair commercial practices. Additionally, managing early and late payments effectively can contribute to better client relationships.

Case studies showing successful implementation of payment policies can provide insights into effective strategies to adopt. Observing how different businesses manage their payment processes can help you refine your own policies and adapt to changing market conditions.

Examples of payment policies from various industries

In understanding payment policies, examining examples across industries can be enlightening. For instance, healthcare sector payment policies often incorporate patient financial responsibility and insurance processes. On the other hand, freelance and gig economy payment policies tend to emphasize timely payments and transparent service terms.

By exploring these examples, businesses can pick elements that resonate while creating payment policies suited to their specific context.

Ensure compliance and legal considerations

Creating a payment policy form isn't just about internal clarity; it's also crucial to ensure compliance with local regulations and laws. Different jurisdictions have specific requirements about payment terms, transparency, and consumer protection. Understanding these legal nuances can save businesses from potential disputes.

To safeguard your business, regular reviews and updates to your payment policy are advisable. Keeping abreast of any legal changes ensures that your payment practices remain aligned with regulatory expectations.

Takeaways for creating your payment policy form

Summarizing the key points when creating a payment policy form is essential for effective adherence. Ensure you capture the scope, payment rules, and deadlines in a clear format. Review the document collectively with all relevant stakeholders before finalizing the policy.

With the right approach, you can create a payment policy form that not only protects your interests but also fosters a positive relationship with your clients.

Stay updated: Resources for ongoing improvements

Staying updated and improving your payment policies is an ongoing process. Consider reading related blog articles to gain insights on effective management strategies. Networking with industry peers can also offer innovative practices and better understanding of market trends.

Using pdfFiller, you have access to tools that help streamline the document management process. Continuously update and refine your payment policy to ensure it remains relevant and effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller app form online?

How do I edit pdffiller app form straight from my smartphone?

How do I complete pdffiller app form on an Android device?

What is payment policy?

Who is required to file payment policy?

How to fill out payment policy?

What is the purpose of payment policy?

What information must be reported on payment policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.