Get the free Tax Filer Status/income Clarification Form

Get, Create, Make and Sign tax filer statusincome clarification

How to edit tax filer statusincome clarification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax filer statusincome clarification

How to fill out tax filer statusincome clarification

Who needs tax filer statusincome clarification?

Understanding the Tax Filer Status Income Clarification Form

Understanding the tax filer status income clarification form

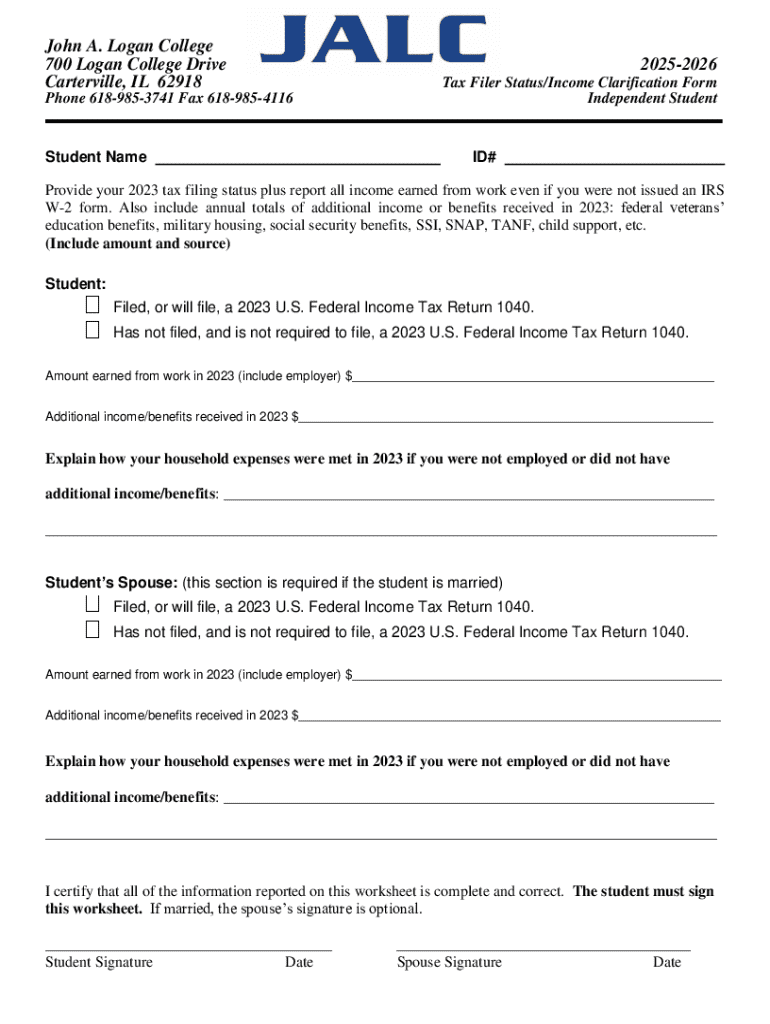

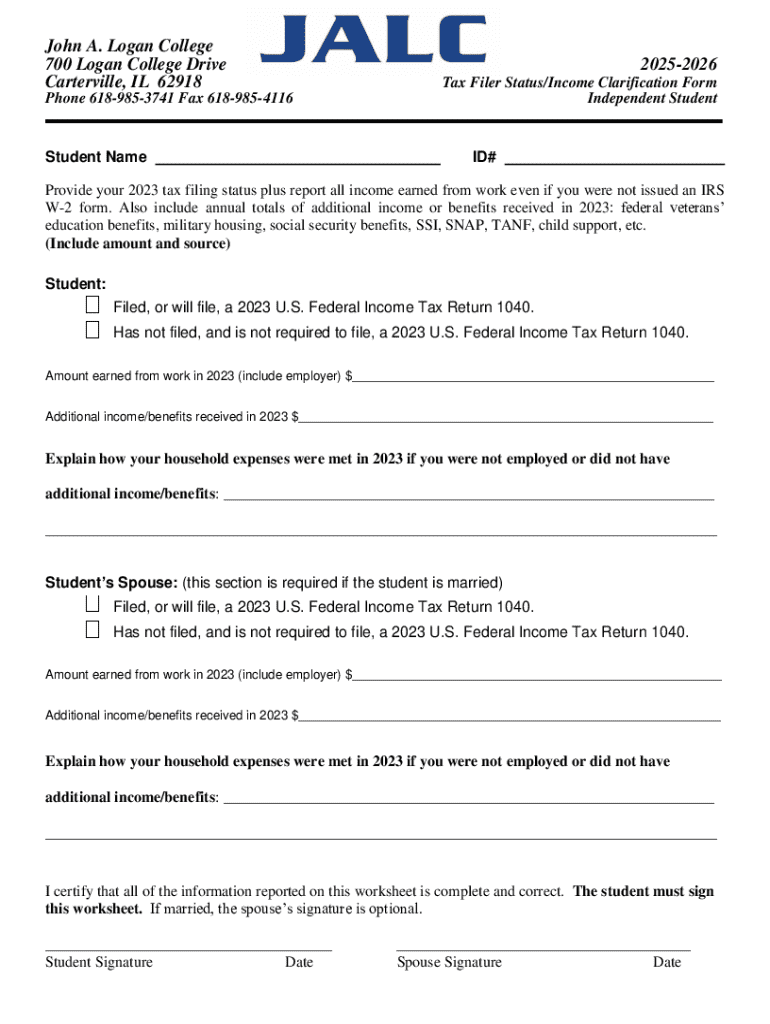

The tax filer status income clarification form is an essential document designed to help the IRS and other tax authorities accurately assess your tax situation. This form collects critical information regarding your tax filing status and the income you report. Its primary purpose is to ensure that all income sources are disclosed, providing clarity that can prevent potential audit issues or discrepancies.

Accurate tax filing information is crucial not only for compliance reasons but also for ensuring that you pay the correct amount of tax. Misreported income can lead to underpayment penalties or heightened scrutiny from tax agencies. Thus, understanding who needs to use this form is vital; anyone experiencing changes in their tax situation, such as newly acquired income streams or a change in marital status, may find this form necessary.

Types of tax filer status

Tax filer status plays a significant role in determining your tax liability and eligibility for certain credits and deductions. The IRS recognizes several different tax filer categories: Single, Married Filing Jointly, Married Filing Separately, and Head of Household. Each of these categories has distinct rules that influence tax rates and available financial benefits.

Choosing the correct tax filer status affects your tax return significantly. For instance, married couples often benefit from filing jointly by utilizing a more favorable tax bracket. Understanding these categories can help you navigate the complexities of tax reporting more effectively.

Common scenarios requiring clarification

Various life changes can necessitate the use of the tax filer status income clarification form. For instance, changes in marital status, such as divorce or separation, necessitate clarification of each individual's tax responsibility moving forward. Additionally, variations in dependent status from year to year can also lead to the need for this form, especially when claiming child-related credits.

Key components of the income clarification form

Filling out the tax filer status income clarification form correctly is essential for a successful filing process. The form typically comprises several key components: personal information, income sources, and any applicable deductions and credits. Each section is crucial as it helps paint a detailed picture of your tax situation.

To ensure accurate reporting, meticulous documentation of your incomes, such as W-2 forms and 1099s, is recommended. Moreover, maintaining records of potential deductions can save you time and trouble during the tax filing process.

Step-by-step instructions for completing the form

Completing the tax filer status income clarification form involves several steps that can help you avoid mistakes. Start by gathering all necessary documents, such as W-2s, 1099s, and other income statements. Having everything organized reduces the chance of missing critical information.

A section-by-section approach is beneficial, allowing you to focus on one aspect of your tax situation at a time. Commons pitfalls such as missing signatures, incorrect Social Security numbers, or underreported income can easily slow down the submission process.

Submitting the form

Submitting the tax filer status income clarification form marks the final step in ensuring your tax filings are comprehensive and accurate. There are several methods for submission, including electronic submission through platforms like pdfFiller or traditional mail. Each method has distinct advantages, so choose the one that best suits your needs.

Frequently asked questions (FAQs)

As individuals navigate the tax filing process, there are common questions that arise regarding the tax filer status income clarification form. This section aims to provide clarity on some prevalent issues like mistakes made on the form and how such changes can impact tax refunds.

Resources for further assistance

Navigating the complexities of tax filing can be daunting, but various resources are available to assist. Tax professionals can provide invaluable advice and help ensure compliance with IRS requirements. Similarly, online tools and calculators can give you easy access to necessary figures, optimizing the filing process.

Using pdfFiller for document management

pdfFiller offers an innovative solution for managing your tax paperwork online. Cloud-based editing and collaboration tools allow users to make real-time updates and share documents seamlessly. This ability streamlines the form completion process, helping you keep everything organized without the clutter of physical paperwork.

User tips for efficient form management

Efficient tax form management is key to a stress-free filing experience. All users should consider organizing their tax documents well in advance of the filing season. This includes categorizing documents by income, deductions, and necessary credits, which can make the process smoother and less overwhelming.

Conclusion of key points

Accurately completing the tax filer status income clarification form is crucial for an efficient tax filing experience. Remember that this form ensures your tax returns are reflective of your actual financial situation, helping you avoid future complications. Utilize the plethora of resources available, including the tools offered through pdfFiller, to streamline the process and ensure that your submissions meet all IRS regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax filer statusincome clarification online?

Can I sign the tax filer statusincome clarification electronically in Chrome?

How can I fill out tax filer statusincome clarification on an iOS device?

What is tax filer status income clarification?

Who is required to file tax filer status income clarification?

How to fill out tax filer status income clarification?

What is the purpose of tax filer status income clarification?

What information must be reported on tax filer status income clarification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.