Get the free Dividend Mandate Form

Get, Create, Make and Sign dividend mandate form

How to edit dividend mandate form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dividend mandate form

How to fill out dividend mandate form

Who needs dividend mandate form?

Dividends Mandate Form – A Comprehensive How-to Guide

Overview of dividend mandate form

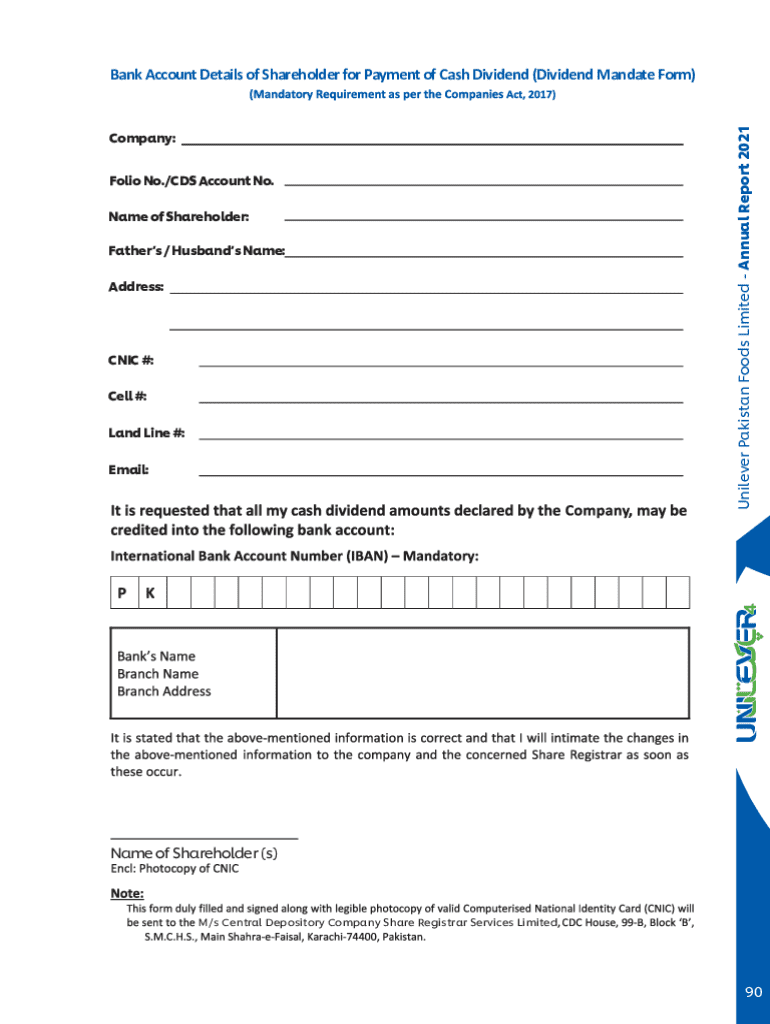

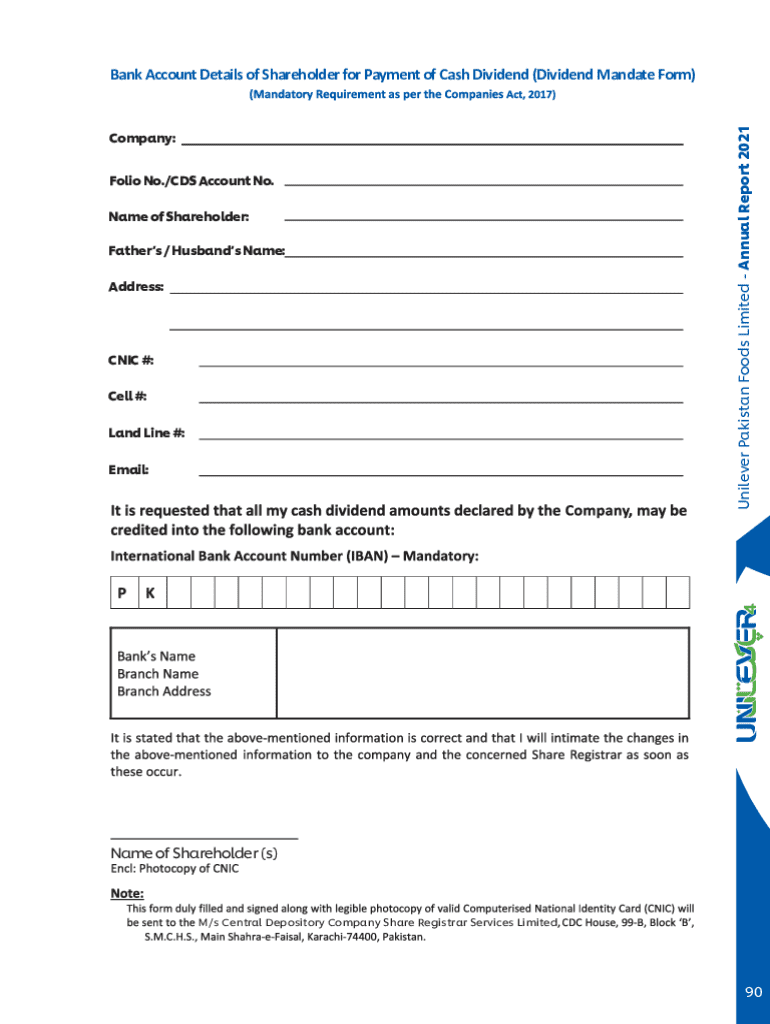

A dividend mandate form is a critical document used by shareholders to authorize a company to pay dividends directly into specified bank accounts. The primary purpose of this form is to streamline the process of dividend payments, ensuring that shareholders receive their returns promptly and without unnecessary delays. This form serves as a legal authorization for the company to deposit funds and is vital for maintaining efficient dividend management.

The importance of a dividend mandate lies in its ability to simplify financial transactions for investors. By allowing companies to process dividend payments automatically, shareholders can focus on their investments without worrying about the logistics of receiving payments. This document is especially crucial for individuals who may not want to handle checks or manual payments.

Key benefits of using a dividend mandate form

Using a dividend mandate form comes with several significant benefits that can enhance the shareholder experience. When properly implemented, this form streamlines the dividend payment process, making it easier and more efficient.

Understanding the parts of a dividend mandate form

A typical dividend mandate form consists of several essential components that facilitate the processing of payments. Understanding these parts is crucial for filling out the form accurately.

Familiarizing yourself with common terminology is also beneficial. For instance, the term 'mandate' refers to the authorization given to the company to make payments on your behalf, while 'dividends' are the earnings distributed to shareholders from a company’s profits.

Step-by-step instructions for filling out a dividend mandate form

Filling out a dividend mandate form may seem daunting, but breaking it down into steps can make the process straightforward. Here’s a step-by-step guide to completing this important document.

Interactive tools for efficient form management

To streamline the process of filling out a dividend mandate form, leveraging interactive tools can be particularly helpful. pdfFiller offers robust solutions for completing this paperwork efficiently.

Common mistakes to avoid when submitting your dividend mandate form

When submitting a dividend mandate form, certain errors can lead to significant delays or complications. Being aware of common pitfalls can help ensure your submission processes smoothly.

How to submit your dividend mandate form

Submitting your dividend mandate form is the final step in ensuring you receive your dividends directly into your bank account efficiently. There are several methods to submit the form, making it flexible for shareholders.

What to do after submission

Once you've submitted your dividend mandate form, there are steps you can take to ensure everything is on track. Knowing what to expect will ease any concerns regarding your payments.

Frequently asked questions (FAQs) about dividend mandate forms

Addressing common queries about dividend mandate forms can help demystify the process for investors. Here are some frequently asked questions that may arise.

Conclusion: Embrace the ease of document management with pdfFiller

Utilizing pdfFiller to manage your dividend mandate form can significantly simplify the process. The platform provides robust features for filling out, editing, and managing your documents seamlessly. With its cloud-based capabilities, users can handle their mandate forms from anywhere, making the entire experience much more efficient.

By embracing the use of pdfFiller, both individuals and teams can empower themselves to manage their documents better. The ability to easily create, edit, and eSign forms ensures that users stay on top of critical financial processes without unnecessary hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dividend mandate form to be eSigned by others?

Can I edit dividend mandate form on an iOS device?

How do I complete dividend mandate form on an Android device?

What is dividend mandate form?

Who is required to file dividend mandate form?

How to fill out dividend mandate form?

What is the purpose of dividend mandate form?

What information must be reported on dividend mandate form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.