Get the free 990-pf

Get, Create, Make and Sign 990-pf

How to edit 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-pf

How to fill out 990-pf

Who needs 990-pf?

Comprehensive Guide to the 990-PF Form: Everything You Need to Know

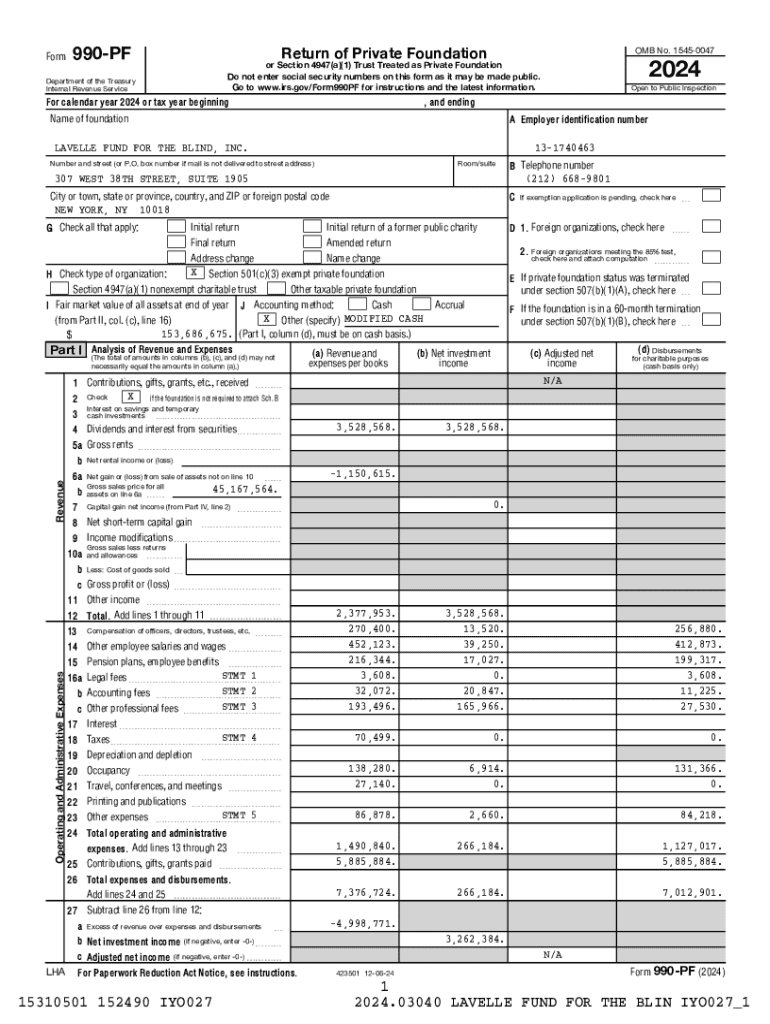

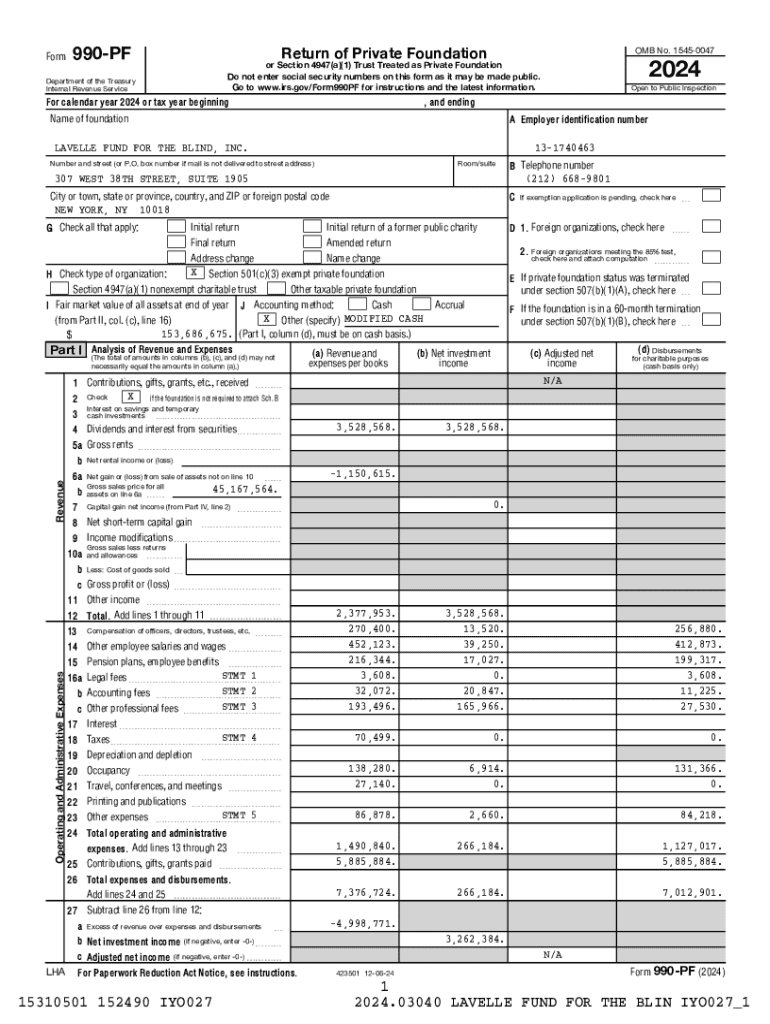

Understanding the 990-PF form

The 990-PF form is a critical document required by the IRS for private foundations operating in the United States. It serves as an annual informational return for these organizations, providing an overview of their financial activities, including income, expenses, and distributions. Completing the 990-PF is not merely a bureaucratic obligation; it allows the IRS and the public to verify that foundations are operating within the law and fulfilling their charitable missions.

The importance of the 990-PF form extends beyond compliance. It is a transparency tool, allowing potential donors, beneficiaries, and the community at large to understand how foundations are utilizing their resources. Furthermore, accurate reporting through the 990-PF can enhance a foundation's reputation, demonstrating a commitment to accountability.

Filing requirements for 990-PF

Filing the 990-PF form is mandatory for all private foundations, which IRS defines as organizations established with the principal purpose of distributing funds for charitable purposes. Domestic foundations are required to file regardless of income, while foreign foundations operating in the U.S. must also comply under specific circumstances. This filing requirement is critical for the continued tax-exempt status of these organizations.

Key eligibility criteria for private foundations include operational size and administrative setup. Foundations must primarily be funded by a particular individual, family, or corporation. Importantly, unlike public charities, private foundations typically cannot solicit donations from the general public, which adds a layer of exclusivity to their eligibility.

Filing timeline and deadlines

The 990-PF form is due on the 15th day of the fifth month after the close of the foundation’s fiscal year. For calendar year filers, this typically falls on May 15. If the foundation operates on a fiscal year basis, the due date will adjust accordingly. Understanding the timeline is crucial for ensuring compliance and avoiding penalties.

For organizations needing additional time, the IRS allows for a six-month extension. To request an extension, you must file Form 8868, which provides extra time but not an extension on any tax payments due. It's essential to submit this request before the initial filing deadline to avoid complications.

Detailed breakdown of the 990-PF form

The 990-PF form is structured into several sections, each offering a comprehensive snapshot of the foundation’s operations. Understanding each component of the form can simplify the filing process and ensure that all relevant information is accurately reported.

Part I summarizes the foundation’s activities and financial information, including revenue sources and expenditures. Part II identifies the foundation's board of directors and managers, an important aspect for accountability. Part III provides a detailed financial compilation, summarizing income, expenses, and net assets, while Part IV outlines the charitable purposes and program activities the foundation has undertaken.

Common challenges in completing the 990-PF

Completing the 990-PF can present various challenges, especially for individuals new to the process. Difficulties may arise from complex financial data compilation or ensuring compliance with IRS regulations. Missing a filing deadline can lead to significant repercussions, including financial penalties and the risk of losing tax-exempt status.

To mitigate these challenges, organizations should maintain meticulous records throughout the year and utilize reminders for filing deadlines. Employing a tax professional to review the form prior to submission can also help catch potential errors and enhance compliance. Strategies for avoiding common pitfalls include developing a checklist of information needed for filing and familiarizing oneself with IRS guidance on the form.

E-filing the 990-PF made easy

E-filing the 990-PF has transformed the way private foundations manage their compliance obligations. The benefits of e-filing over traditional paper methods include increased efficiency, immediate submission confirmations, and reduced paperwork. By utilizing pdfFiller’s cloud-based tools, users can streamline the filing process and alleviate many common burdens associated with paperwork.

To effectively e-file the 990-PF, organizations should prepare all necessary documentation beforehand. This includes financial statements, information on board members, and details about any grants distributed during the year. pdfFiller provides not only the capability to fill out the form digitally but also features for eSigning and collaboration, making it easy for teams to work together, regardless of location.

Preparing for the 990-PF filings

Preparation is essential for successfully filing the 990-PF form. Organizations should gather necessary information ahead of time to prevent last-minute scrambles. Key documents to have on hand include comprehensive financial data, income sources, and details regarding grants, contracts, and board members.

Establishing a routine for filing preparation can facilitate a smoother process. Regularly updating documentation throughout the year allows for quicker accumulation of necessary information. Additionally, utilizing tools like pdfFiller can make organization and access easier, allowing teams to collaborate effectively on the required filings.

Additional filing considerations

Navigating the complexities of the 990-PF form may require considering special circumstances that can complicate the filing process. Foundations might experience changes in operational status, funding, or mission that can require careful reevaluation of how they complete the form. Additionally, if a foundation is handling multiple filings for different years, ensuring compliance can become even more complex.

It's also important to note that the IRS is continually updating regulations regarding e-filing. Understanding the IRS mandates for e-filing - which many foundations must adhere to starting in 2024 - is essential for compliance. Staying informed about these changes can help foundations maintain their tax-exempt status and keep operations running smoothly.

Exploring the 990-PF and its impact

The impact of the 990-PF form extends beyond mere compliance; it significantly influences a foundation's legitimacy, accountability, and transparency. A properly completed 990-PF not only safeguards the foundation’s tax status but also enhances stakeholders' trust and promotes greater engagement with potential donors and the community.

Moreover, the detailed reporting required within the 990-PF plays a vital role in the foundation's grant-seeking efforts. By documenting past activities and financial dealings, foundations can effectively communicate their history and achievements, which can be persuasive for attracting future funding opportunities.

Accessing expert support for 990-PF filing

Filing the 990-PF form can be challenging; however, organizations have resources at their disposal to simplify the process. pdfFiller is designed to empower users by providing seamless editing, collaboration, eSigning solutions, and expert guidance throughout the filing journey. The built-in tools and resources support teams in managing documents more effectively, especially during high-pressure filing periods.

Beyond providing practical software tools, pdfFiller emphasizes customer support. Whether an organization ventures into filing for the first time or is a seasoned entity, having access to assistance and clarifications specific to their situation is invaluable. This holistic approach to document management fosters a sense of confidence among users about their compliance requirements.

Frequently asked questions (FAQs) about the 990-PF

As organizations approach filing the 990-PF form, they often have several questions regarding eligibility, alternatives, and filing processes. Can organizations file forms 990 or 990-EZ instead? The short answer is no; the 990-PF is specifically for private foundations and is tailored to their unique needs.

Another important question pertains to tax obligations. Do private foundations pay taxes on 990-PF filings? Typically no, but it is essential to remain compliant with all IRS rules to maintain tax-exempt status. Clarifications regarding various reporting requirements are vital, as any misstep could lead to penalties or increased scrutiny from regulatory bodies.

Tools and resources for successful filing

To navigate the 990-PF filing process with confidence, organizations should make use of essential software tools specifically designed for preparation. Various solutions available on the market cater to different needs, enhancing accuracy and simplifying the filing procedure. Importantly, familiarize yourself with other useful IRS forms and schedules that may be related to the 990-PF for comprehensive compliance.

Additionally, attending webinars and engaging with learning resources can enhance understanding of the form and its requirements. These sessions often address common issues and provide updates on regulatory changes, enabling foundations to remain informed and proactive in their filing efforts.

Engaging content and tutorials for a seamless experience

To further enhance the filing process, users can access a range of video tutorials focused on successfully completing the 990-PF form. These engaging resources cover each section of the form, providing step-by-step guidance and tips from experts in the field. Interactive tools available on pdfFiller also allow users to upload and manage documents, ensuring a comprehensive solution for teams working remotely.

Moreover, exploring case studies showcasing successful 990-PF filings can inspire confidence and provide practical insights into the filing process. Understanding how other foundations have navigated similar challenges can be beneficial when preparing your own submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 990-pf in Gmail?

How can I edit 990-pf from Google Drive?

How can I edit 990-pf on a smartphone?

What is 990-pf?

Who is required to file 990-pf?

How to fill out 990-pf?

What is the purpose of 990-pf?

What information must be reported on 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.