Get the free Crs-rl33213 - stuff mit

Get, Create, Make and Sign crs-rl33213 - stuff mit

How to edit crs-rl33213 - stuff mit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs-rl33213 - stuff mit

How to fill out crs-rl33213

Who needs crs-rl33213?

Understanding the crs-rl33213 - Stuff mit form

Understanding the crs-rl33213 form

The crs-rl33213 form serves a critical role within various sectors, especially for individuals and organizations needing to document essential information accurately. Its purpose lies in facilitating streamlined communication for data collection, compliance, and formal applications.

You might encounter the crs-rl33213 form in contexts such as financial applications, employment verifications, or governmental compliance documentation. Understanding when and why to use this form can save time and ensure that all necessary data is collected efficiently.

Key features of the crs-rl33213 form

The crs-rl33213 form is characterized by its clear design and user-friendly layout. The distinct sections are organized to guide the user through providing information systematically.

Step-by-step guide to filling out the crs-rl33213 form

Filling out the crs-rl33213 form requires some preparation. Before you start, gather all necessary documents and information to facilitate a smooth process. This preparation includes verifying that you have all required details, which may include identification numbers, personal information, and supporting documents that align with the form's purpose.

Preparation before filling the form

Make sure to familiarize yourself with any specific requirements related to the crs-rl33213 form. For instance, different sectors might impose additional data requests, so it’s essential to know what applies to your situation.

Detailed breakdown of each section

Each section of the crs-rl33213 form has purpose-built fields designed to capture the necessary information effectively.

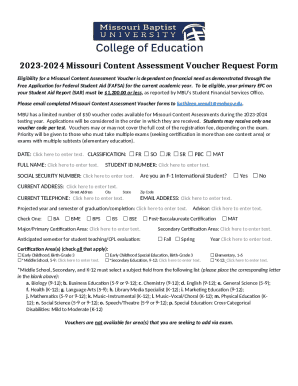

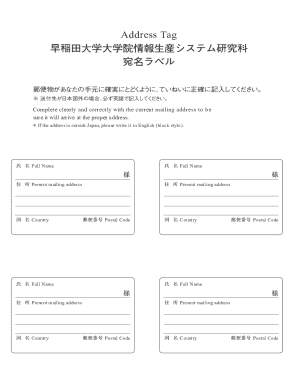

Section 1: Personal information

Personal information is typically the first section. You’ll need to provide details such as your full name, address, and contact information. Many users struggle here, often neglecting to check for typos or inconsistencies which can lead to processing issues later.

Section 2: Financial information

In this section, key data points often include income details, asset declarations, or relevant financial indicators. Be careful to report your information accurately, as errors can lead to complications.

Section 3: Additional statements

The additional statements section allows for extra disclosures or notes. Being methodical here can clarify your intentions and support your application or request.

Lastly, reviewing your entry before submission is crucial. Double-checking for accuracy can prevent delays and further inquiries.

Editing and customizing the crs-rl33213 form

Using pdfFiller to edit your crs-rl33213 form is straightforward. The platform offers a suite of tools designed to simplify the editing process.

How to use pdfFiller to edit your form

Start by uploading your form to pdfFiller and utilize the built-in tools for editing text, adding signatures, or annotating sections as needed. This step allows you to customize the document to fit your specific requirements.

Creating templates for future use

Once you have filled out the crs-rl33213 form, you can save it as a template for any future use. This feature significantly enhances efficiency, especially for repetitive submissions.

Having a custom template not only saves time but reduces errors by providing a consistent format, allowing users to ensure compliance with standards every time.

Signing and submitting the crs-rl33213 form

The signing and submission process of the crs-rl33213 form can vary based on organizational requirements, but pdfFiller simplifies this crucial aspect.

How to eSign the crs-rl33213 form

PDF signatures are increasingly common and pdfFiller provides multiple options for electronic signatures. You can draw your signature, upload an image, or choose from signature fonts available on the platform.

Submission process

Submissions of the crs-rl33213 form can typically be completed online, via email, or through a direct upload feature according to the specific guidelines provided by the recipient organization. Keep track of your submission status using available tracking features on pdfFiller.

Managing your crs-rl33213 forms

Once your crs-rl33213 form is completed, managing your documents effectively becomes essential. pdfFiller provides robust capabilities for organizing forms to ensure ease of access when you need them.

Storing and organizing your forms in pdfFiller

Adopting strategies such as using folders and tags will help immensely in organizing your forms. A structured approach to document management will ease retrieval when necessary.

Collaborating with team members

If your work involves collaboration, pdfFiller allows you to invite team members to review, edit, or comment on the crs-rl33213 form. Ensuring everyone has access to the most updated document fosters teamwork and increases efficiency.

Troubleshooting common issues with the crs-rl33213 form

Even with careful preparation, issues can arise when filling out the crs-rl33213 form. Recognizing common errors can help mitigate such challenges.

Common errors when filling out the form

Some frequent pitfalls include inaccurate personal information, incomplete financial data, or failure to sign the form correctly. Double-checking each section before submission is a key practice to avoid these mistakes.

Technical support for pdfFiller users

If you encounter technical difficulties while using pdfFiller or completing the crs-rl33213 form, access their help resources or customer support. pdfFiller provides an extensive FAQ section, live chats, and helpdesk services to resolve user concerns.

Best practices for using the crs-rl33213 form

Maintaining accuracy and compliance when using the crs-rl33213 form is crucial. Failure to do so may result in delays or denial of your request.

Maintaining compliance and accuracy

It’s essential to stay updated on any changes to regulations or requirements related to the crs-rl33213 form. Regularly reviewing guidelines related to your particular use case can ensure that your submissions are always compliant.

Tips for effective document management

To keep your forms well-organized, consider implementing a routine schedule for reviewing and archiving completed forms. This habit promotes efficient management of documentation and ensures compliance with any sector standards.

Leveraging pdfFiller for enhanced document solutions

pdfFiller emerges as a valuable tool for users engaging with the crs-rl33213 form. Its various features cater precisely to the needs of document management.

Advantages of using pdfFiller

This platform supports a myriad of features that simplify the process of filling out the crs-rl33213 form, including collaborative editing, easy sharing options, and robust security.

User testimonials and success stories

Many users have expressed how pdfFiller has improved their document handling processes. From increased productivity to enhanced ease of collaboration, the platform has proven to enhance everyday business operations significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get crs-rl33213 - stuff mit?

How do I edit crs-rl33213 - stuff mit straight from my smartphone?

How do I fill out crs-rl33213 - stuff mit on an Android device?

What is crs-rl33213?

Who is required to file crs-rl33213?

How to fill out crs-rl33213?

What is the purpose of crs-rl33213?

What information must be reported on crs-rl33213?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.