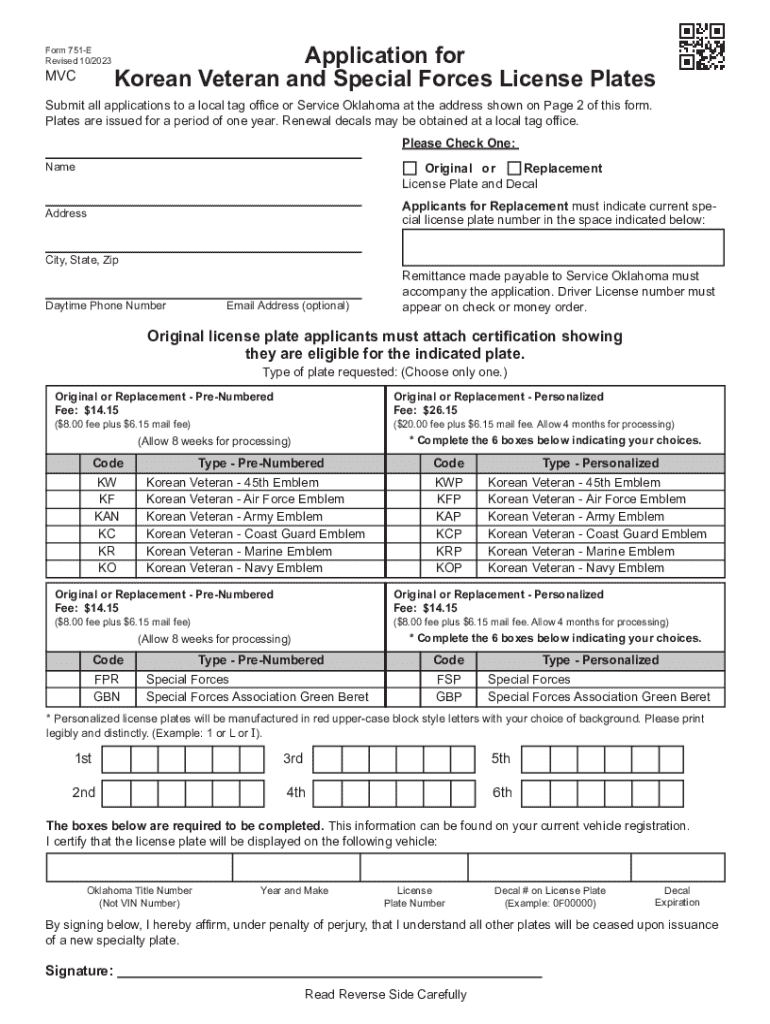

Get the free Form 751-e

Get, Create, Make and Sign form 751-e

Editing form 751-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 751-e

How to fill out form 751-e

Who needs form 751-e?

How to Fill Out Form 751-e: A Comprehensive Guide

Understanding Form 751-e

Form 751-e is a vital document used in specific administrative processes, often associated with claims, applications, or notifications. This form is designed to gather essential information relevant to the situation at hand, ensuring that all necessary data is collected in an organized manner.

The purpose of Form 751-e in the document creation process is to standardize filing procedures, making it easier for organizations and individuals to submit information efficiently. By implementing a uniform structure, stakeholders can reduce processing time and minimize errors.

Who needs to fill out Form 751-e?

The primary users of Form 751-e include individuals and teams involved in administrative processes that require formal documentation. This could range from employees within corporate structures to freelancers working on various projects.

Scenarios where Form 751-e is required typically include reporting changes in business structure, submitting claims for expenses, or responding to regulatory inquiries. Utilizing this form helps clarify communication and expectations between parties.

When should you fill out Form 751-e?

Timing is critical when it comes to submitting Form 751-e. Understanding when to fill out this form can significantly impact the processing and acceptance of your submission. It's best to complete the form as soon as the need arises, especially if it pertains to time-sensitive information.

Deadlines for Form 751-e will depend on the specific context in which you are utilizing it. Urgency factors, such as pending audits or close dates for claims, should prompt immediate action to avoid potential issues or delays.

Documents required for Form 751-e

Before diving into filling out Form 751-e, it's essential to gather all necessary documents that will support your submission. Essential documents may include identification, proof of previously submitted information, or documentation specific to the requirements of the process at hand.

To streamline your process, create a checklist of required documents to ensure you do not miss anything crucial. Utilizing a digital management tool like pdfFiller can greatly enhance your ability to upload and manage these documents seamlessly.

Step-by-step instructions for filling out Form 751-e

Accessing the Form 751-e

To begin, locate Form 751-e by visiting pdfFiller. Simply use the search functionality on the website, which easily directs you to the form you need. Once located, download the form in the format that best suits your requirements.

Filling out the form

Filling out the form requires careful attention to detail. Each section of the document has specific fields where precise information is needed. Begin with your personal information, followed by details pertinent to the application or claim you are submitting.

Common pitfalls include omitting information or misinterpreting the instructions for specific fields. Always double-check your entries, ensuring that numbers and names match with supporting documents to avoid discrepancies.

Editing and customizing the form

Utilizing pdfFiller's editing tools enhances your experience with Form 751-e. These tools allow you to modify fields or insert necessary comments as required. For collaboration, adding signatures can also be accomplished within the platform.

If additional information is needed, pdfFiller allows you to insert new fields easily. Knowing how and when to do this can tremendously aid in effectively conveying the information required from your submission.

Where and how to submit Form 751-e

Once you have completed Form 751-e, the next step is submission. You can choose to submit electronically via pdfFiller, which simplifies the e-filing process. Ensure all signatures are gathered before hitting submit to eliminate last-minute rework.

For those opting for physical submission, follow the specific mailing address outlined in your guidelines or instructions. Double-check your submission for accuracy and completeness before mailing.

Common mistakes to avoid when filling out Form 751-e

Many users encounter typical errors when dealing with Form 751-e. Common mistakes can include misalignment of information, incorrect field selection, or failure to provide supplemental data required by the specifications.

To ensure accuracy in your submission, consider utilizing tools provided by pdfFiller to cross-check fields. Additionally, having another set of eyes review the completed form can provide valuable oversight.

Following up after submission

After filing Form 751-e, it’s important to stay informed about the status of your submission. Depending on the process, you may receive acknowledgment or require follow-up action from the receiving party.

Ways to check the status include contacting the relevant department or using any online tracking systems provided. If questions arise, don't hesitate to reach out for support to clarify any uncertainties.

Frequently asked questions about Form 751-e

Understanding the nuances of Form 751-e can lead to many questions. Some common queries include concerns about submission timing, the implications of errors made, and how to amend previously filed forms.

Providing clear answers to these FAQs can help users navigate potential hurdles. For instance, if errors are found after submission, knowing the correct process for corrections can save time and prevent frustration.

Getting help with Form 751-e

For any challenges you face when approaching Form 751-e, pdfFiller offers assistance through multiple channels. From tutorials to direct customer support, users can find the help they need to handle document creation effectively.

Utilizing pdfFiller's customer support can provide personalized help, ensuring that your submissions are complete and correct. Additionally, various resources available on the platform facilitate self-service problem resolution when tackling common issues.

Useful links and resources

For comprehensive navigation through the functionalities of Form 751-e, consider exploring direct links to related forms and templates on pdfFiller. Additional resources focused on document management and e-signing provide further insight into addressing your needs.

Utilizing government websites can also yield official guidelines for the specifics surrounding Form 751-e, providing clarity on requirements and procedural correctness.

Related posts and topics

Exploring further articles related to form management can enrich your understanding of document creation processes. Review guides that focus on the nuances of similar forms and strategies for effective management in various contexts.

Recommendations for further reading may also include best practices for creating legally binding documents online and advice on how to streamline the document workflow in your individual or team settings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 751-e without leaving Google Drive?

How do I edit form 751-e online?

How do I edit form 751-e on an iOS device?

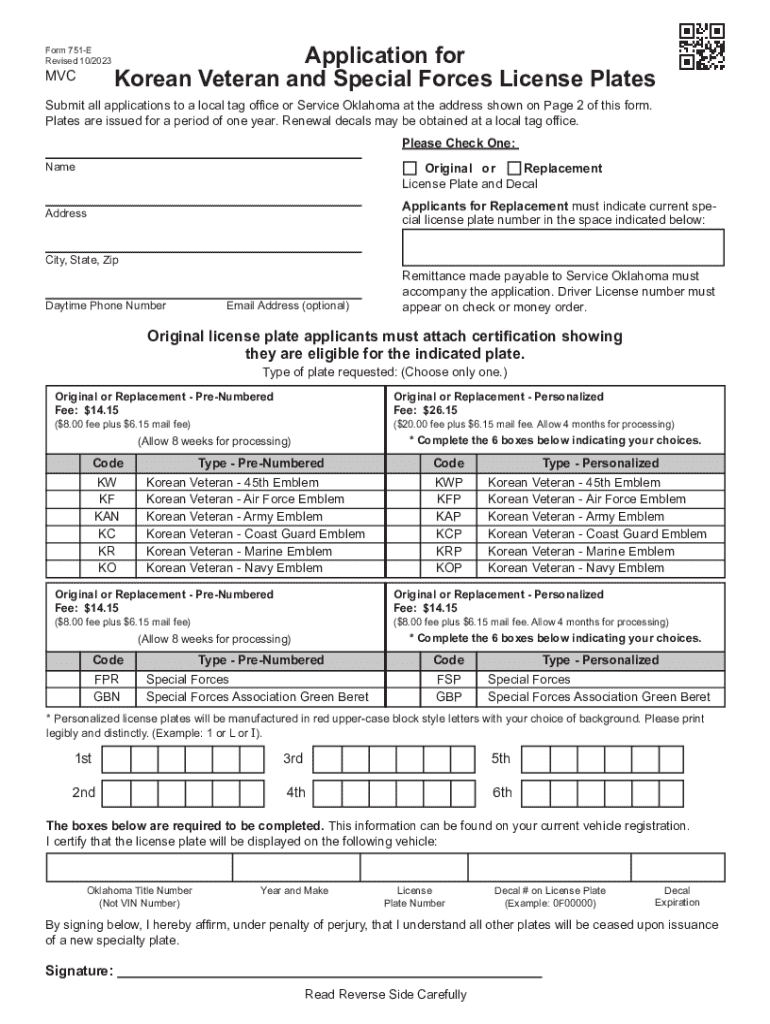

What is form 751-e?

Who is required to file form 751-e?

How to fill out form 751-e?

What is the purpose of form 751-e?

What information must be reported on form 751-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.