Get the free Adult Dependent Care Credit Worksheet

Get, Create, Make and Sign adult dependent care credit

How to edit adult dependent care credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out adult dependent care credit

How to fill out adult dependent care credit

Who needs adult dependent care credit?

Comprehensive guide to the adult dependent care credit form

Understanding the adult dependent care credit

The adult dependent care credit is a tax benefit that aids families in managing the costs associated with caregiving for adult dependents, which can include elderly parents or disabled individuals. This credit can help alleviate some of the financial burdens associated with adult care, making it an essential resource for many families.

Specifically, this credit allows taxpayers to claim a percentage of qualifying care expenses when they pay for care while they work or look for employment. Understanding who qualifies for this credit and what expenses can be included is critical to ensuring that you're maximizing your tax benefits.

Who qualifies for the adult dependent care credit?

Eligibility for the adult dependent care credit hinges on several factors. Generally, the adult dependent must reside in your home and meet age or disability criteria to be considered for the credit. Additionally, it’s important to note the employment status of the caregiver paying for the care services, as this also affects eligibility.

The primary criteria for qualification include:

Differences between the adult dependent care credit and other credits

It's essential to distinguish the adult dependent care credit from related credits such as the child dependent care credit. While both credits aim to support caregiving, the requirements and benefits differ significantly. The adult dependent care credit is designed specifically for adult dependents, expanding to those with disabilities, whereas the child care credit pertains to children under age 13.

Another relevant comparison lies between care expenses and medical expenses. Care costs typically encompass daily assistance services—like those provided by in-home caregivers or adult day care facilities—whereas medical expenses might include hospital visits or therapy. Understanding these differences helps streamline the tax filing process!

How to analyze your eligibility

Analyzing your eligibility for the adult dependent care credit starts with gathering the necessary documentation. Key documents include care provider statements and proof of your relationship to the dependent. Organized records not only streamline your tax preparation but also ensure compliance with IRS requirements.

Follow these steps to assess your eligibility:

Qualifying care expenses

It’s equally crucial to understand which expenses can be claimed under this credit. Qualifying costs generally include adult daycare services and at-home care while specifically excluding expenses related to medical treatment or housing. Familiarizing yourself with what is and isn’t claimed helps avoid any future issues with tax filings.

Calculating your credit amount

Calculating the adult dependent care credit requires understanding the permissible percentage and limits established by the IRS. Typically, you can claim 20% to 35% of the qualifying expenses depending on your adjusted gross income (AGI). Therefore, meticulous documentation of eligible expenses is imperative to ensure accurate calculation.

To break this down clearly:

Examples of credit calculations

For instance, if your qualifying care expenses total $4,000 and your AGI places you in the 20% bracket, your credit would amount to $800. Conversely, if you qualify for the 35% bracket, the credit increases to $1,400. Using this example, it’s evident how much your reported expenses directly affect your final credit.

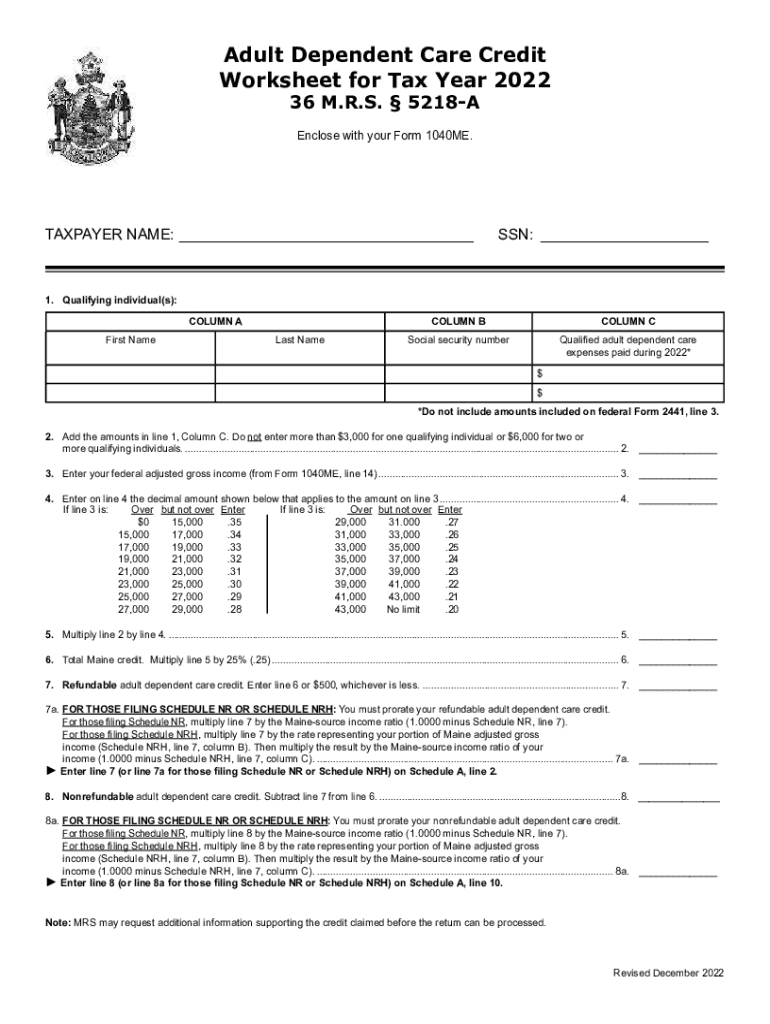

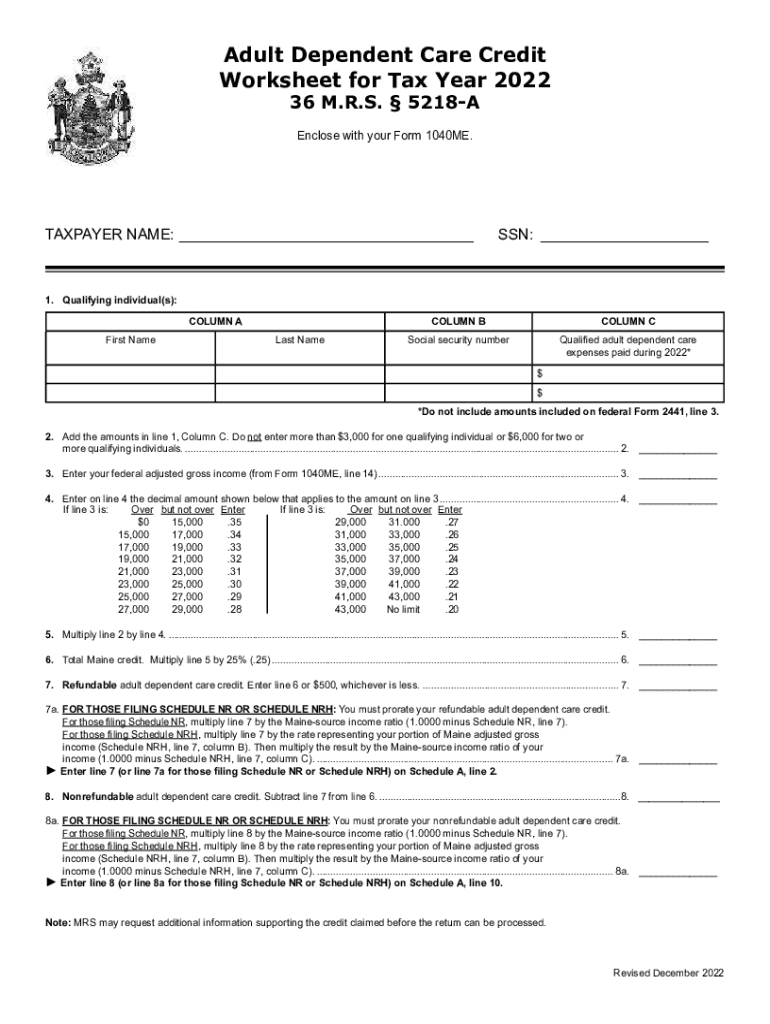

Filling out the adult dependent care credit form

Before diving into the completion instructions, having an overview of the adult dependent care credit form is invaluable. This particular form requires various pieces of information, including caregivers’ details, expenses incurred, and personal identification. Accuracy in reporting is necessary to avoid issues down the line with your submission.

Here's how to accurately fill out the form:

Common mistakes and how to avoid them

One of the most frequent errors occurs when taxpayers misreport expenses or fail to include required documentation. Additionally, not maintaining a clear record of expenses can lead to inaccuracies. To steer clear of these pitfalls, always double-check each section and ensure you have your backing documents ready for submission.

Submitting your form: best practices

After completing the adult dependent care credit form, submitting it appropriately is the next crucial step. You have options for submission, whether electronically or via traditional paper methods. Each method has its advantages, with electronic filing typically being faster and offering immediate confirmation.

Consider these best practices:

Tracking your submission

Post-submission, it’s vital to confirm receipt of your adult dependent care credit form. Using tracking numbers or online submission confirmations can provide peace of mind. Being aware of the processing timelines, especially during busy tax seasons, allows you to manage expectations for credit approval.

Managing your documentation and findings

Effective document management is essential, especially when preparing multiple claims or if a team is involved. Platforms like pdfFiller empower users to keep their documentation organized and accessible. With features enabling cloud storage and easy collaboration, tracking each phase of your credit claim becomes seamless.

Additionally, maintaining records for future claims is crucial. Establishing a method for organized file storage protects against lost documents and facilitates easy access when tax time approaches.

Frequently asked questions (FAQs)

As inquiries surrounding the adult dependent care credit arise, several common questions typically surface. Understanding these points can demystify the process and provide clarity when filling out the adult dependent care credit form.

Common queries include:

Where to find further assistance

If additional assistance is necessary, resources abound. Local tax professionals and online tools, including those available at pdfFiller, can provide tailored help. Collaborating with experts ensures that individuals have the guidance they need to navigate the intricacies of their unique tax situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the adult dependent care credit electronically in Chrome?

Can I create an electronic signature for signing my adult dependent care credit in Gmail?

How do I fill out adult dependent care credit using my mobile device?

What is adult dependent care credit?

Who is required to file adult dependent care credit?

How to fill out adult dependent care credit?

What is the purpose of adult dependent care credit?

What information must be reported on adult dependent care credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.