Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out it nrs ohio nonresident

Who needs it nrs ohio nonresident?

IT NRS Ohio Nonresident Form: A Comprehensive How-To Guide

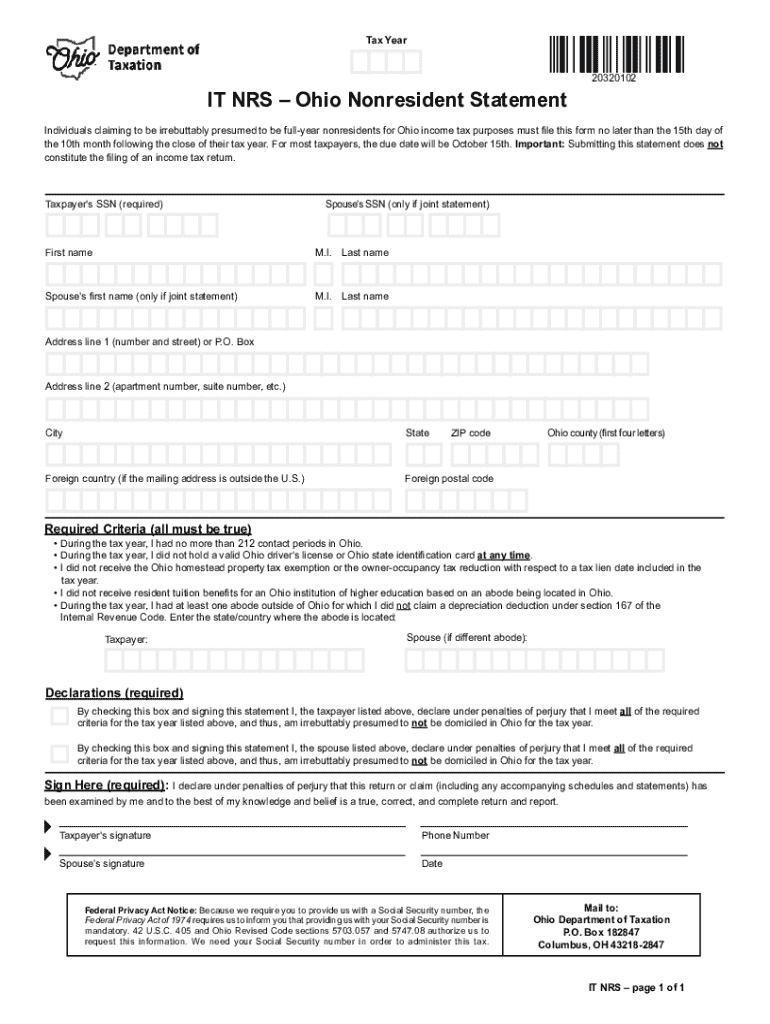

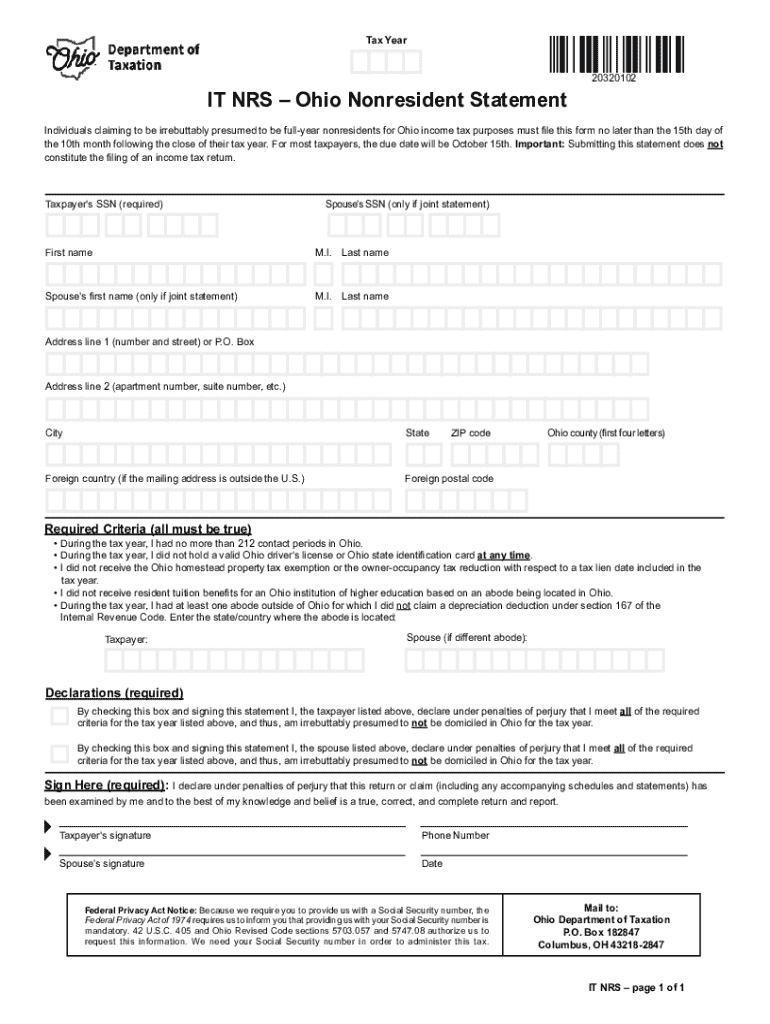

Understanding the IT NRS form: a nonresident overview

The IT NRS form, also known as the Income Tax Nonresident Statement, is a vital document for nonresidents of Ohio who earn income sourced within the state. This form serves multiple purposes, including reporting taxable income, calculating Ohio tax obligations, and potentially applying for refunds on overpaid taxes. Understanding the IT NRS form is crucial for anyone who meets the criteria for filing, ensuring compliance with Ohio tax laws while maximizing potential benefits.

Nonresidents who need to file this form include individuals who live outside Ohio but receive income generated from Ohio sources. Common examples of taxable Ohio-sourced income include wages from an Ohio employer, rental income from Ohio properties, and certain business revenues earned within the state. If you meet these criteria, you are required to file the IT NRS form to accurately report your earnings.

Preparing to complete the IT NRS form

Before completing the IT NRS form, it’s essential to gather the necessary documents and information. Key documents include your W-2 forms, which detail salary and wages, and 1099 forms, which report additional income sources such as freelance work or dividends. You will also need to compile details of your Ohio-sourced income, ensuring all figures are accurate and up-to-date.

Familiarizing yourself with Ohio tax regulations for nonresidents can significantly ease the filing process. This includes understanding how nonresident income is taxed differently than resident income, noting applicable deductions, and knowing essential tax rates that will aid in correctly calculating your overall tax responsibility.

Step-by-step instructions for filling out the IT NRS form

Filling out the IT NRS form can seem daunting at first, but following a systematic approach can simplify the process. Here’s a detailed, section-by-section breakdown of how to complete the form.

Common mistakes to avoid when filing the IT NRS form

Filing the IT NRS form presents numerous opportunities for error. To ensure a smooth filing experience, be mindful of common pitfalls. One frequent mistake involves inaccuracies in personal information, such as misspelled names or incorrect addresses, which can complicate processing.

Moreover, incorrect income reporting can lead to serious implications, including audits and penalties. It’s also vital to avoid misapplying applicable deductions or credits. Finally, failing to meet filing deadlines can result in penalties, so mark your calendar and adhere to Ohio’s submission timeline diligently.

Using pdfFiller to complete your IT NRS Ohio nonresident form

Utilizing pdfFiller to complete your IT NRS Ohio nonresident form can aid in streamlining the process efficiently. The platform is designed to be accessible from any device, making it a convenient choice for busy individuals or teams. With user-friendly editing and signing features, pdfFiller simplifies form management, ensuring a hassle-free experience.

Here's a step-by-step guide on how to effectively use pdfFiller for your IT NRS form:

Submitting your IT NRS form to the Ohio Department of Taxation

Once you have completed the IT NRS form, the next step is submission. Ohio offers various methods for filing these forms. An online filing option is available through the Ohio Department of Taxation’s website, which provides a convenient and expedited method for submission.

Alternatively, if you choose to mail your form, ensure to address it correctly and consider postage requirements to avoid delays. Pay close attention to deadlines and important submission dates, as filing late could result in fees, and understanding state-specific deadlines is crucial to compliance.

Frequently asked questions (FAQs) about the IT NRS form

Understanding the intricacies of tax forms can often raise many questions. When it comes to the IT NRS form, common inquiries include clarifications about who must file, what constitutes Ohio-sourced income, and how specific terms and tax jargon are defined. Nonresidents occasionally struggle with understanding the various income types and how they are taxed.

Additionally, knowing how to address any issues or disputes with Ohio tax authorities is critical, especially if you find discrepancies in your tax obligations or filing status. It is advisable to maintain open communication with tax officials and seek guidance as necessary.

Conclusion of your filing journey with the IT NRS form

Successfully navigating the filing process for the IT NRS Ohio nonresident form requires diligence and attention to detail. As you complete this form each year, remember to keep abreast of any changes in Ohio tax laws that may impact your future filings. Staying informed can help you maintain compliance while potentially maximizing your tax benefits.

In summary, whether you are new to completing this form or a seasoned filer, utilizing tools like pdfFiller can enhance your experience, ensuring your submissions are accurate, timely, and secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pdffiller form online?

How can I edit pdffiller form on a smartphone?

Can I edit pdffiller form on an iOS device?

What is it nrs ohio nonresident?

Who is required to file it nrs ohio nonresident?

How to fill out it nrs ohio nonresident?

What is the purpose of it nrs ohio nonresident?

What information must be reported on it nrs ohio nonresident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.