Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out ss4 form

Who needs ss4 form?

SS-4 Form: A Comprehensive How-to Guide

Understanding the SS-4 form

The SS-4 Form is a crucial document used by businesses to apply for an Employer Identification Number (EIN) through the Internal Revenue Service (IRS). This number acts as a unique identifier for your business entity, akin to a Social Security Number for individuals.

Entities ranging from small sole proprietorships to large corporations require this form to fulfill tax obligations, open business bank accounts, and apply for various licenses.

Obtaining an EIN is imperative for those planning to hire employees or establish a formal structure. The SS-4 form serves as the first step in that journey.

Importance of Form SS-4 in business operations

The EIN obtained through the SS-4 is vital for establishing a business's creditworthiness, facilitating easier financial transactions, and aiding in business expansion. With an EIN, businesses can distinguish themselves as a separate legal entity, which helps in protecting the owner’s personal assets.

Moreover, an EIN is often required for partners and shareholders to form the necessary tax structure of the business. This is particularly important in ensuring compliance with US tax regulations and for operating efficiently across states.

Types of entities that require an SS-4 form

Different types of business entities require an SS-4 form, each with unique characteristics and implications when it comes to taxes and legal structures.

Preparing to complete your SS-4 form

Before filling out the SS-4 form, businesses should gather all necessary information to ensure a smooth application process. Proper preparation can minimize the risk of errors or delays.

Essential details include your business's legal name, the physical address, a phone number, and other particulars such as the type of business entity. Understanding your business status is also crucial to determining whether you actually need an EIN.

Prior to submitting your SS-4, confirm your business's structure complies with federal and state laws, and ascertain whether an EIN is necessary.

Step-by-step guide to filling out the SS-4 form

Completing the SS-4 form requires attention to detail and accuracy. Each section must be filled out according to the current guidelines provided by the IRS.

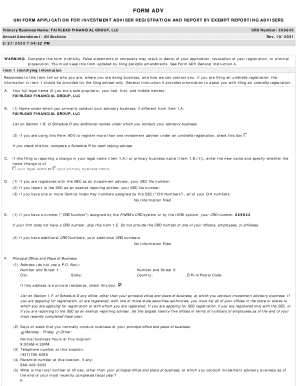

Section 1: Basic identifying information about your business

Begin by providing the legal name of the business entity, followed by any trade names under which you operate. Ensure to include your business address along with a contact number to facilitate communication with the IRS.

Section 2: Business status details

This section focuses on identifying your entity's structure. Choose the appropriate classification, indicate when your business was started, and provide relevant information regarding the number of employees you anticipate hiring.

Section 3: Third party designation and signature

If you want to allow a third-party to handle EIN inquiries on your behalf, designate them here. It's crucial to have the form signed by the individual responsible for the completion, typically an owner or principal officer.

Submitting your SS-4 form

Once your SS-4 form is accurately completed, you can submit it to the IRS. Various methods are available to ensure your submission reaches the IRS without delay.

Processing times can vary; online submissions generally yield results within a matter of minutes, while mailed forms might take several weeks. After submission, keep a copy of the form for your records, and monitor for the confirmation notice from the IRS.

Frequently asked questions about Form SS-4

Understanding common queries regarding the SS-4 form can help demystify the process for many applicants. Below are some of the most frequently asked questions.

Common challenges when filling out the SS-4 form

Filling out the SS-4 form can raise several challenges, particularly for first-time applicants. Understanding these common hurdles can ensure a smoother process.

Post-SS-4 submission: managing your EIN

Once your SS-4 form has been submitted and you’ve obtained your EIN, effective management ensures your business operates smoothly. Firstly, it's important to keep a physical or digital record of your EIN in a secure location.

What happens if you lose your EIN? You can recover it by calling the IRS. Furthermore, ensure to keep your information updated; if there are changes in your business structure, you need to notify the IRS, confirming that all relevant records are accurate for tax and business purposes.

Effectively using your EIN for tax reporting is crucial. Certain businesses must file payroll taxes, property taxes, and income taxes with the IRS based on their entity type.

Additional tips and resources

Navigating the complexities of taxes and legal documents can be overwhelming. However, tools like pdfFiller simplify the process by providing easy access to forms, editing functionalities, and e-signature capabilities.

Related articles and further reading

For those interested in diving deeper into business operations and further enhancing their understanding of the business landscape, explore related articles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pdffiller form without leaving Google Drive?

How do I edit pdffiller form online?

Can I create an electronic signature for the pdffiller form in Chrome?

What is ss4 form?

Who is required to file ss4 form?

How to fill out ss4 form?

What is the purpose of ss4 form?

What information must be reported on ss4 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.