Get the free Business Check Card Application

Get, Create, Make and Sign business check card application

How to edit business check card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business check card application

How to fill out business check card application

Who needs business check card application?

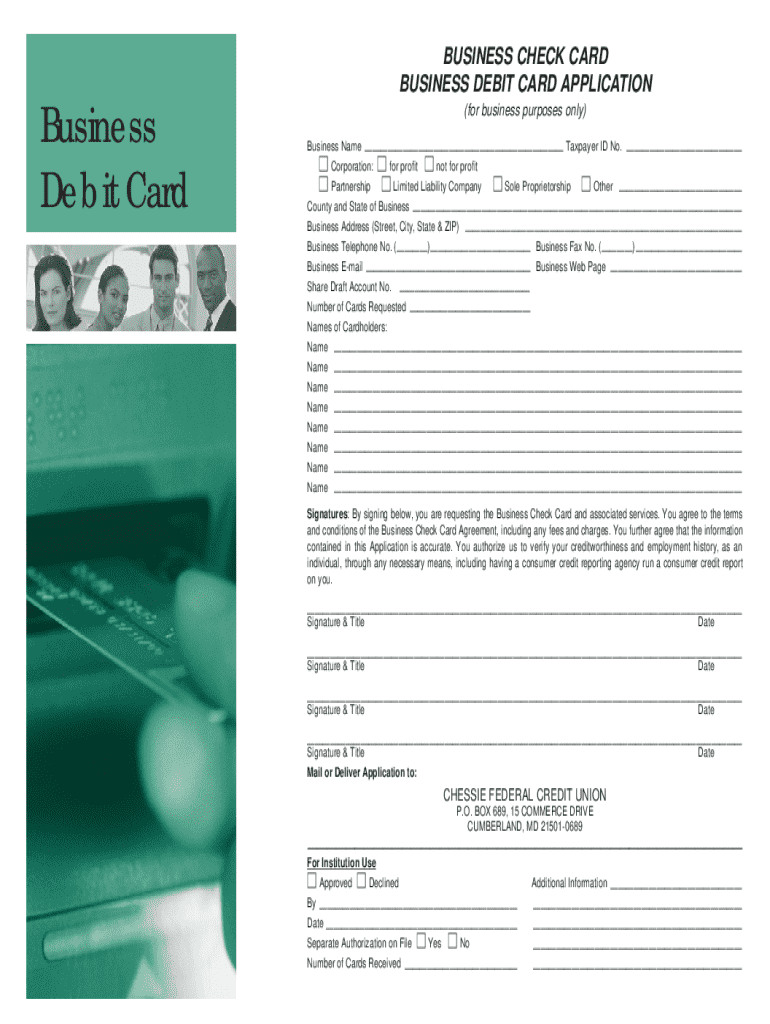

Your Guide to the Business Check Card Application Form

Understanding business check cards

A business check card, also known as a business debit card, is a financial tool that allows business owners to make purchases directly from their business checking account. Unlike personal debit cards, business check cards are specifically designed to cater to the unique needs of businesses, providing a convenient way to manage expenses while keeping personal and business finances separate.

One of the primary benefits of employing a business check card is enhanced expense management. These cards help streamline spending by categorizing transactions automatically, thereby improving cash flow. Furthermore, they often come with customizable spending controls, allowing businesses to set individual limits for employees and manage cash flow more effectively.

It's essential to differentiate business check cards from traditional credit or debit cards. While credit and debit cards enable borrowing against credit limits or withdrawing directly from personal accounts, business check cards operate solely on available funds within the business's checking account, minimizing the risk of overspending.

Preparing for your business check card application

Before diving into the application process, it's vital to understand the eligibility requirements. Different business structures may have varying implications. For instance, LLCs and corporations often face more stringent checks compared to sole proprietorships, which might encounter fewer hurdles but sometimes limited options for credit.

In addition to understanding the eligibility criteria, gathering the required documentation is crucial. Standard requirements often include the following crucial documents:

Step-by-step application process

Starting the application for a business check card may feel overwhelming, but knowing what to expect simplifies the process. First, read through the entire application form to familiarize yourself with its sections and requirements.

When filling out the application form, pay special attention to the following sections:

Common mistakes to avoid include inaccuracies in your business details, providing inconsistent documentation, or omitting critical information that could delay your application. Double-checking your inputs can make a significant difference in expediting the process.

Interactive tools for application assistance

Utilizing tools like pdfFiller can enhance your ability to manage business check card application forms effectively. With features designed to simplify form completion, users can fill out, edit, and sign documents digitally from anywhere.

One particularly helpful feature is real-time collaboration. You can share the application with team members for their input, which can be beneficial for ensuring accuracy and completeness before submission. This capability encourages teamwork and mitigates the risk of missing crucial information.

Additionally, pdfFiller enables document storage and management in a secure cloud environment, allowing easy access to your financial documents whenever needed.

Submitting your application

After completing the application, always perform a thorough review before submission. Check for errors and ensure all required documentation is attached. Submitting an incomplete application can lead to significant delays in receiving your business check card.

If applying via mail, ensure you include all necessary documents and clearly label your submission. Keeping a copy of everything submitted for your records is highly recommended.

After submission: What to expect

Once you’ve submitted your application, you might wonder about the timeline for approval. Typically, financial institutions take anywhere from a few days to a few weeks to review and process applications. Factors like the completeness of your documentation and the institution's internal processes can influence this timeline.

To check the status of your application, utilize any tracking tools or contact customer service of the financial institution. Some institutions may also provide online portals where you can see progress updates.

Staying proactive in following up ensures your application remains a priority and demonstrates your eagerness to work with the financial institution.

Managing your business check card

Once your business check card is in hand, familiarize yourself with its features to maximize efficiency. Modern business check cards often come equipped with various tools to track expenses, create spending limits, and categorize purchases automatically.

Security measures are paramount when handling business finances. Ensure that all transactions are secure by adopting best practices such as immediately reporting lost or stolen cards and regularly monitoring your transaction history.

Troubleshooting common issues

Issues may arise even after submission, including application rejections. Reviewing the specific reasons provided related to the rejection is crucial for understanding what adjustments are necessary for a resubmission. Many institutions offer an appeals process, so don’t hesitate to request reconsideration if you believe your application deserves a second look.

In the unfortunate event that your business check card gets lost or stolen, act quickly. Notify your financial institution immediately to report the incident and secure your account. Many institutions provide options for quickly freezing or replacing your card.

If you need to adjust your account or card limits, familiarize yourself with the procedures required. Most changes can be managed online or via a customer service call, ensuring you remain in control of your business finances.

Frequently asked questions

Navigating the intricacies of business check cards can prompt several questions. Here are some answers to the most common queries:

Real-world examples and case studies

Analyzing businesses that successfully secured their business check cards can provide insights into navigating the application process effectively. For instance, a local restaurant chain streamlined its operations by employing check cards for each restaurant location, enabling the centralized management of resources and expenditures.

Their experience highlighted critical lessons, including the importance of preparing comprehensive financial documentation and ensuring accuracy in the application form. Simply put, their meticulous approach facilitated a seamless application process that led to timely card approval, enhancing their operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business check card application from Google Drive?

Can I edit business check card application on an iOS device?

How can I fill out business check card application on an iOS device?

What is business check card application?

Who is required to file business check card application?

How to fill out business check card application?

What is the purpose of business check card application?

What information must be reported on business check card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.