Get the free Michigan Department of Treasury - Request to Transfer Met Educational Benefits

Get, Create, Make and Sign michigan department of treasury

How to edit michigan department of treasury online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigan department of treasury

How to fill out michigan department of treasury

Who needs michigan department of treasury?

Michigan Department of Treasury Form: A Comprehensive Guide

Understanding Michigan Department of Treasury forms

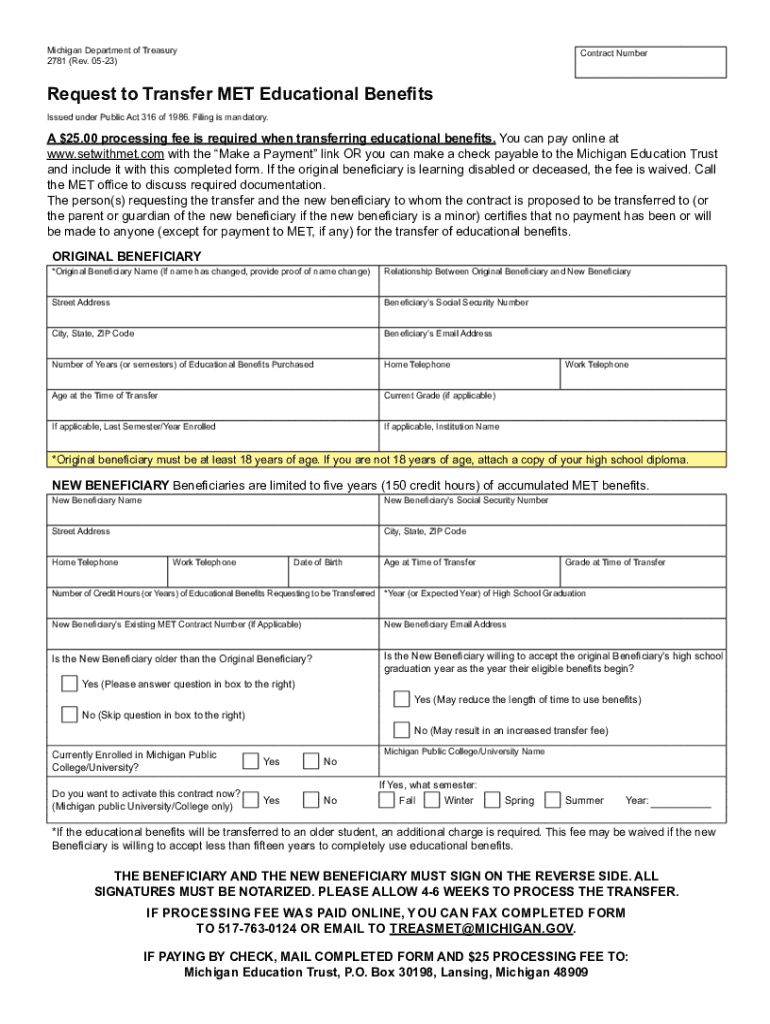

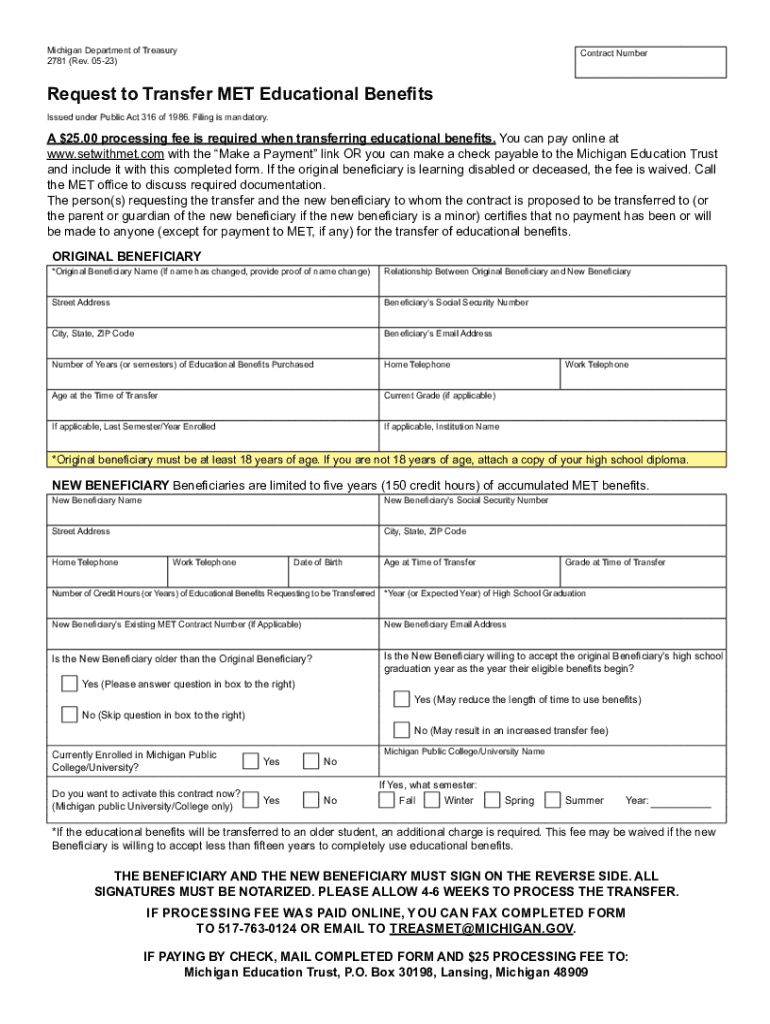

Michigan Department of Treasury forms are vital documents that facilitate various financial transactions and obligations within the state. These forms play an essential role in tax collection, property assessment, and business compliance, ensuring that both individuals and businesses meet their fiscal responsibilities.

Different forms correspond to specific processes—whether for property taxes, individual income taxes, or business taxes—making it crucial for taxpayers to familiarize themselves with the available options. The act of filling out these forms accurately and submitting them on time is not only a legal requirement but also essential for avoiding penalties and ensuring the smooth operation of financial processes.

Key forms and their purposes

Understanding the key forms offered by the Michigan Department of Treasury is essential for navigating the state’s financial landscape. Each form serves a distinct purpose and caters to different taxpayers and scenarios.

For home and property owners, various property tax forms facilitate exemptions and credits aimed at reducing tax burdens. Meanwhile, individuals must accurately complete income tax forms to report their earnings, while businesses are required to manage different tax obligations reflective of their operations.

Accessing forms through the Michigan Department of Treasury

To access forms from the Michigan Department of Treasury, the easiest route is to visit the official Michigan Treasury website. The site is designed with user experience in mind and categorizes various forms for effortless navigation.

When you land on the site, utilize the search bar for specific forms or filter options based on categories like property, income, or business taxes to streamline your search. Additionally, checking the most recent updates ensures you have the latest version of the needed forms.

Filing property tax forms

Filing property tax forms in Michigan involves a clear step-by-step approach to ensure compliance with local regulations. Begin by determining which specific form is necessary based on your situation, such as whether you qualify for exemptions or credits.

Once the correct form is identified, carefully complete it by providing accurate property details, descriptions, and owner information. Remember, submitting your property tax documents on time is crucial to avoid any potential late fees or penalties.

Common property tax forms include the Homeowners' Principal Residence Exemption (PRE) Form, designed to exempt primary residences from specific taxes, and the Michigan Homestead Property Tax Credit Claim (Form 604), which can offer eligible homeowners credit toward their property taxes.

Completing income tax forms

When completing income tax forms in Michigan, it's essential to gather all necessary documentation ahead of time. This includes W-2 forms, 1099 forms, and any applicable deduction documentation.

Start by filling out the Michigan Individual Income Tax Return (Form MI-1040), ensuring every section concerning your personal information and income is complete and accurate. If applicable, also include the Michigan Estimated Income Tax Payment Voucher (Form MI-1040ES) for your quarterly estimated tax payments.

Being aware of tax deductions, credits, and income adjustments is critical to maximizing refunds and minimizing tax liabilities. Consider consulting guidelines or professionals if questions arise during completion, ensuring that the most current regulations are accounted for.

Managing business tax forms

Business tax obligations in Michigan encompass several forms tailored to the unique needs of corporate entities. Businesses must ensure timely filing of these forms to comply with state regulations and avoid penalties.

To complete and submit a corporate income tax (CIT) form, gather your business’s financial records and prepare to disclose necessary information regarding earnings and deductions. Additionally, businesses must apply for a Sales Tax License Application if they sell taxable goods or services, ensuring proper collection of sales tax.

Editing and signing forms online

With the advancements in technology, utilizing tools like pdfFiller makes editing and signing Michigan Department of Treasury forms a streamlined experience. The platform allows users to easily upload PDFs and edit them directly.

Users can seamlessly add text, checkboxes, and signatures, ensuring that all necessary fields are complete. The electronic signature feature enables users to eSign documents securely within the platform, facilitating faster submission.

Collaborating on form preparation

Effective collaboration is critical when preparing forms, especially for teams and organizations handling multiple submissions. pdfFiller provides features that enhance collaboration, permitting team members to work on the same document simultaneously.

To ensure the preparation process is efficient, users can leave comments, track changes, and request input from various stakeholders. This collaborative approach not only enhances productivity but also ensures that everyone's contributions are accurately captured and integrated into the final submission.

Submitting your forms

When it comes time to submit your forms, Michigan offers both online and traditional paper filing options. Online submissions through the Michigan Treasury Online (MTO) system are generally faster and offer immediate confirmation of receipt.

If opting for paper filing, ensure that forms are mailed to the correct address and sent well before deadlines to guarantee timely processing. Continuously track your submission status through the MTO or contact the Michigan Department of Treasury for updates on your submissions.

Troubleshooting common issues

Filing forms can come with challenges, ranging from missing information to incorrect calculations. Address these issues proactively by double-checking entries for accuracy before submission. If mistakes occur, familiarize yourself with the amendment process for specific forms.

For assistance or clarification regarding specific forms, reaching out to the Michigan Department of Treasury is encouraged. Their dedicated team can provide guidance to resolve issues effectively and ensure compliance.

Additional tools and features with pdfFiller

In addition to editing and signing capabilities, pdfFiller offers various interactive tools for estimating tax obligations. Users can leverage form fill assistant features, checklists, and reminders that help track important deadlines and ensure timely submissions.

Furthermore, the platform's collaborative features enhance group productivity, allowing teams to engage efficiently in document preparation and ensure accuracy in all submissions. This positions pdfFiller as a comprehensive solution for those dealing with the intricacies of Michigan Department of Treasury forms.

Best practices for future filing

Maintaining organized documentation is an excellent practice that facilitates easier filing processes. Regularly reviewing your forms and updating your knowledge regarding changes in tax laws can prevent confusion and delays in submissions.

Establishing an annual routine to review all relevant forms and tax information ensures complete compliance ahead of deadlines. Staying proactive with these practices will empower individuals and businesses alike in successfully navigating the requirements set forth by the Michigan Department of Treasury.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify michigan department of treasury without leaving Google Drive?

How do I fill out the michigan department of treasury form on my smartphone?

How do I fill out michigan department of treasury on an Android device?

What is michigan department of treasury?

Who is required to file michigan department of treasury?

How to fill out michigan department of treasury?

What is the purpose of michigan department of treasury?

What information must be reported on michigan department of treasury?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.