Get the free Financial Disclosure Statement for Public Employees

Get, Create, Make and Sign financial disclosure statement for

How to edit financial disclosure statement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement for

How to fill out financial disclosure statement for

Who needs financial disclosure statement for?

Financial Disclosure Statement for Form: A Comprehensive How-to Guide

Understanding financial disclosure statements

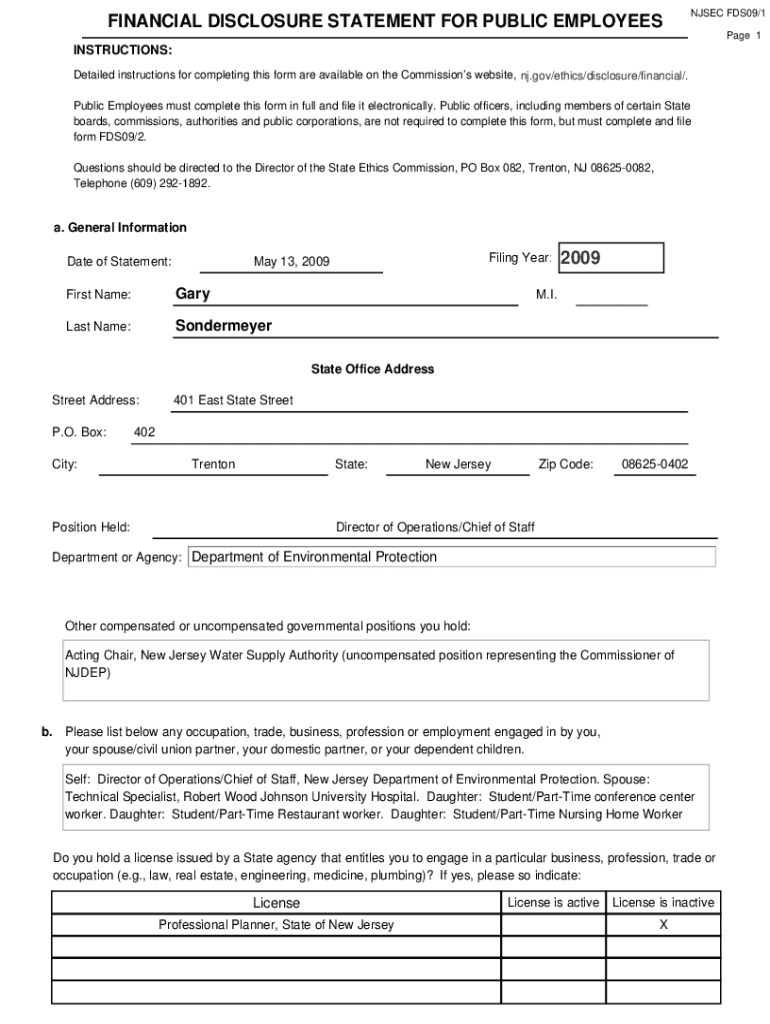

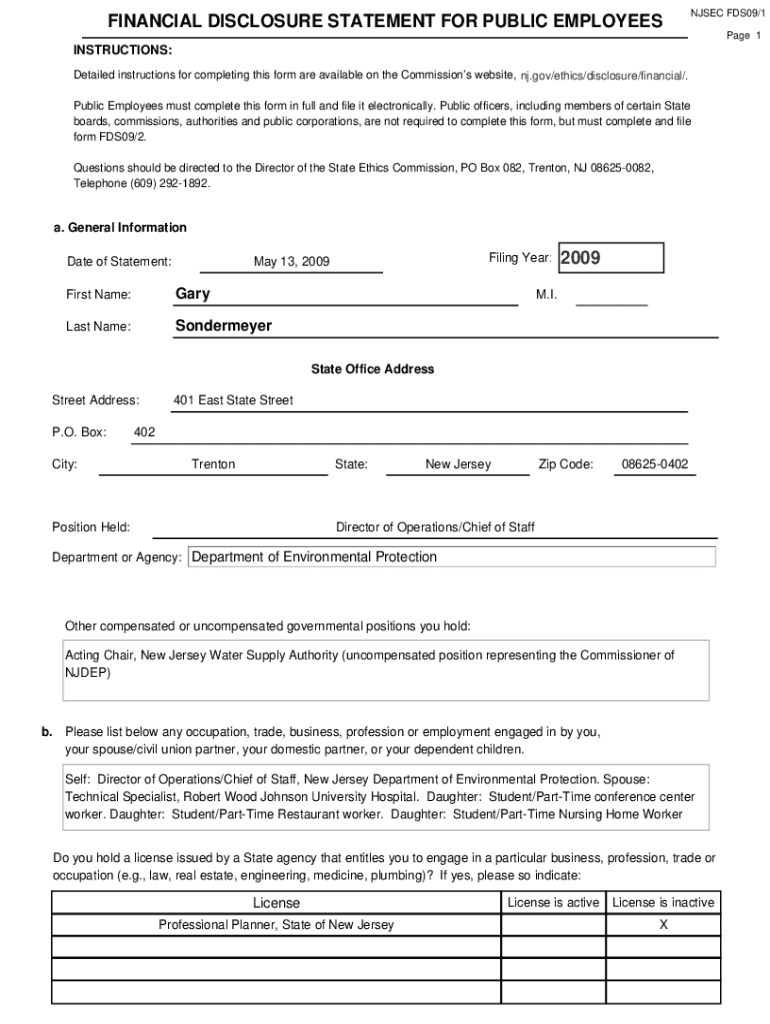

A financial disclosure statement is a critical document that individuals, particularly those in public office or candidates for election, must complete to provide transparency regarding their financial interests and obligations. The primary purpose of this statement is to ensure public trust and integrity in governance by disclosing potential conflicts of interest. Accurate financial reporting is vital not only for compliance with regulations but also for maintaining ethical standards in public service.

Legal requirements surrounding financial disclosure statements can vary significantly based on jurisdiction and the nature of the filer’s position. These legal implications emphasize the need for meticulous attention to detail when completing the statement, as inaccuracies can lead to penalties or reputational damage.

Types of financial disclosure statements

There are primarily two types of financial disclosure statements: public and confidential. Public financial disclosure statements are accessible to the general public and typically required for high-ranking officials, while confidential statements are used by employees in less prominent roles to protect sensitive information. Understanding the differences between employee or official filings and candidate filings is essential, especially for individuals transitioning between these roles.

Key components of a financial disclosure statement

A comprehensive financial disclosure statement consists of several key components that provide a thorough view of an individual's financial situation. Personal information is foundational, requiring details such as the individual's name, contact information, and current position or title. This ensures that the statements are accurately attributed to each individual.

The financial information portion breaks down into various subsections, including assets and liabilities, sources of income, and details regarding investments and trusts. It's also essential to report any gifts or honoraria received, as failure to do so could imply attempts to conceal conflicts of interest. Therefore, understanding what needs to be reported is vital.

Step-by-step guide to filling out the financial disclosure statement

Filling out a financial disclosure statement requires careful preparation to ensure accuracy. Begin by collecting all relevant financial records, such as bank statements, tax returns, and investment reports. Having all documentation ready provides clarity on which items need to be reported, reducing the risk of omissions.

When completing the statement form, take the time to understand the requirements of each section thoroughly. Interactive tools available on pdfFiller can help simplify this process, providing prompts and guidance while allowing you to fill out the form electronically. A major part of this section includes avoiding common mistakes, such as misreporting income or failing to account for related financial interests.

Editing and signing the financial disclosure statement

Once your financial disclosure statement is filled out, it's crucial to review it for errors and inconsistencies. pdfFiller offers robust editing tools that allow users to add annotations or comments directly on the document. This feature facilitates collaborative editing, making it ideal for organizations that may need multiple stakeholders to review the disclosures before final submission.

One important aspect of document finalization is the electronic signature. eSignatures are legally recognized in many jurisdictions, which streamlines the process of signing documents without the need for physical copies. Instructions on how to share files and track signatures are also easily accessible, enhancing both efficiency and accountability.

Submitting your financial disclosure statement

Submitting your financial disclosure statement can generally be done through electronic submission or traditional paper filing, depending on the requirements of your jurisdiction or organization. Many government entities now prefer electronic submissions because they simplify processing and reduce the risk of lost documents.

Awareness of submission deadlines and important dates is critical. Not adhering to these timelines could result in delays or penalties, thus emphasizing the need for proactive management of your disclosures. After submission, filers can expect confirmation notifications and should always retain a copy of the submitted document for their records.

Managing your financial disclosure statements

It is essential to regularly review and update your financial disclosure statements to reflect any changes in your financial situation. Schedule E within the statement is particularly useful for understanding and documenting specific amendments or updates effectively. For organizations that handle multiple disclosures, tools designed for financial disclosure coordinators can help manage these processes efficiently.

Furthermore, addressing delinquent filings is crucial, as neglecting to submit disclosures on time can have serious repercussions. Establishing a schedule for reviews and updates can mitigate this risk and promote accountability.

Resources for financial disclosure filers

Filers of financial disclosure statements can benefit from numerous resources available on pdfFiller. This includes templates, guides, and customer support to assist with any challenges faced during the filing process. Utilizing these resources ensures optimal compliance and accuracy in disclosures. Additionally, knowing where to seek further assistance can alleviate concerns regarding the legal and compliance aspects of financial disclosures.

Frequently asked questions (FAQs)

Common queries surround the nuances of financial disclosure statements, particularly regarding confidentiality and the public's right to access this information. Differentiating between confidential and public disclosures is vital for individuals who may be uncertain about the implications of their financial reporting obligations. Best practices for new filers should emphasize the importance of thoroughness, accuracy, and legality.

Advanced features of pdfFiller for financial disclosure management

For those managing multiple financial disclosures, pdfFiller offers advanced features to facilitate collaboration and secure document storage. Collaboration tools enable teams to work simultaneously on disclosures, ensuring all input is captured effectively. Cloud storage provides access from any location, making it easier for users to retrieve and update financial disclosures as needed.

Customizable templates can also be created for ongoing filings, streamlining the submission process while adapting to the changing requirements of financial disclosure. This adaptability is crucial for maintaining transparency and compliance without overburdening filers.

Conclusion and next steps

Proactively managing your financial disclosures enhances transparency and trust, both in personal and professional realms. Staying informed about changes in legal requirements surrounding financial disclosure statements is fundamental to prevent noncompliance. Leveraging tools available on pdfFiller not only simplifies the process but also supports continual improvement in document handling practices.

As you navigate the complexities of financial disclosures, remain diligent in updating statements and utilizing available resources. This approach will not only fulfill legal obligations but also contribute to a robust system of accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit financial disclosure statement for on an iOS device?

Can I edit financial disclosure statement for on an Android device?

How do I complete financial disclosure statement for on an Android device?

What is financial disclosure statement for?

Who is required to file financial disclosure statement for?

How to fill out financial disclosure statement for?

What is the purpose of financial disclosure statement for?

What information must be reported on financial disclosure statement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.