Get the free Business Integrated Account Application Form

Get, Create, Make and Sign business integrated account application

How to edit business integrated account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business integrated account application

How to fill out business integrated account application

Who needs business integrated account application?

Business integrated account application form: A comprehensive how-to guide

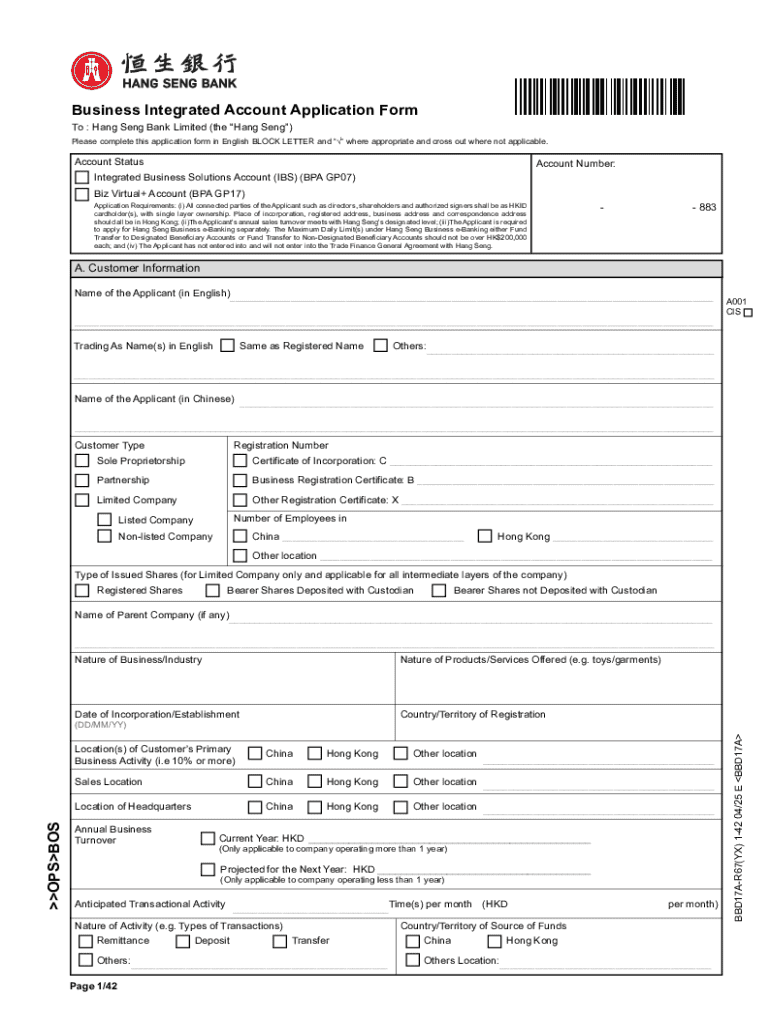

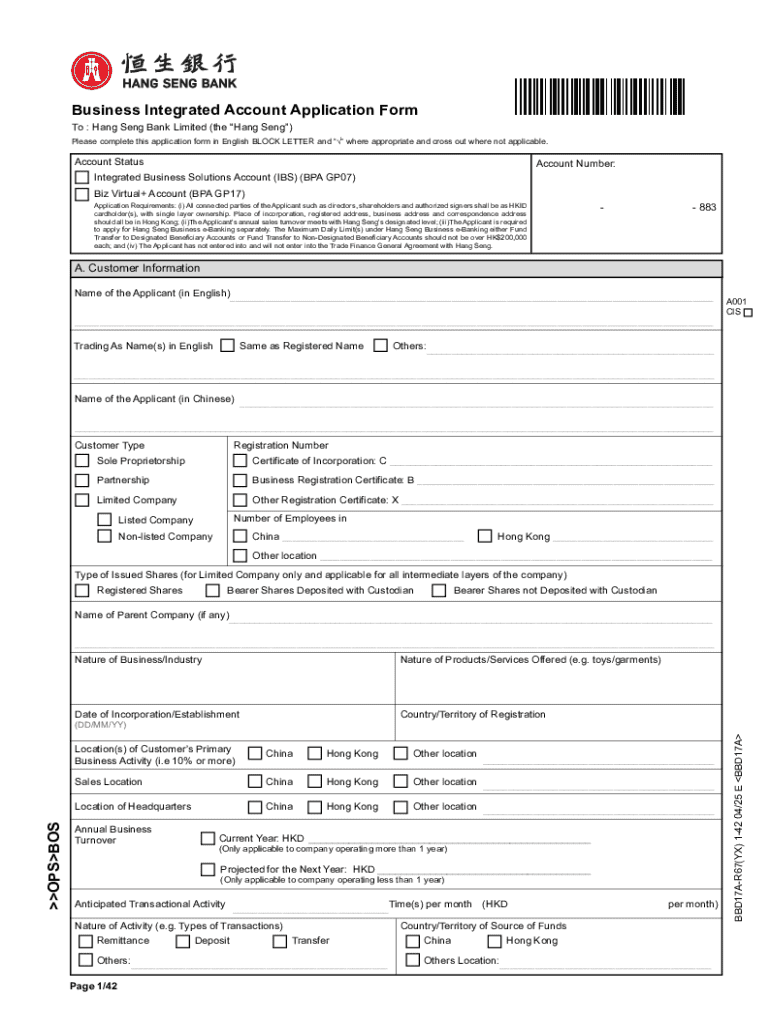

Understanding the business integrated account application form

The business integrated account application form serves a crucial role for organizations seeking streamlined financial services. This form encompasses a series of steps designed to gather all necessary information about a business and its operations, allowing financial institutions to conduct thorough evaluations for account creation. Essentially, it acts as the bridge between a business and the financial entity it aims to collaborate with.

Integrated accounts are designed to combine various banking services into one manageable account. The significance of integrated accounts for businesses cannot be understated. It allows for the consolidation of various financial services, including checking, savings, and possibly loan facilities within a singular platform. This results in easier financial management, reduced operational costs, and greater oversight of company finances.

Different types of integrated accounts may include options like business checking accounts, savings accounts, investment accounts, and even payroll accounts. Each serves a unique purpose, catering to the multifaceted needs of a business. Understanding these options is vital before filling out the application form.

The pdfFiller advantage

When it comes to completing the business integrated account application form efficiently, using pdfFiller brings clear advantages. First and foremost, pdfFiller allows users to seamlessly edit and customize PDFs, which simplifies the process of filling out the application. Users can input their data quickly, change fields, and adapt the form to meet their specific business needs.

Beyond editing, pdfFiller offers cloud-based collaboration, enabling team members to work on documents from anywhere. This is essential for businesses with remote teams or multiple stakeholders involved in the application process. Having the ability to collaborate in real-time can significantly enhance communication and efficiency.

Another standout feature is the ease of eSigning. Financial applications often require swift approvals, and pdfFiller facilitates an instant approval process through its electronic signature solutions. Users can sign documents digitally, which not only saves time but also increases security and reduces the risk of lost paperwork.

Lastly, pdfFiller centralizes document management on a single platform, allowing users to store, organize, and retrieve essential business documents effortlessly. This functionality ensures that all necessary paperwork and information related to the business integrated account application form are readily accessible throughout the application process.

Step-by-step guide to completing the business integrated account application form

Pre-application preparation

Before filling out the business integrated account application form, adequate preparation is vital. Start by gathering all necessary documentation. Typically, you will need to provide identification for all owners, business licenses, tax identification numbers, and financial statements. Collecting these documents beforehand will streamline the filling process significantly.

Financial statements are critical for the application. These may include your balance sheet, income statement, and cash flow statement. Keeping your records organized and up-to-date reduces stress when applying. Additionally, ensure that you understand the different types of required identifications and certifications specific to your business type.

Filling out the application form

The filling process can be broken down into several sections that need to be addressed meticulously.

Page 1: Business information

Begin with the basic details of your business, including the company name and structure, which is crucial for identifying the legal entity. Provide your business address and reliable contact information, ensuring that it reflects your current operational specifics. Additionally, describe the nature of your business and its operations concisely to facilitate a comprehensive understanding of your organization.

Page 2: Ownership details

This section requires information about the owners and stakeholders involved in the business. You must include each owner’s name and their respective roles within the company. Distributing ownership percentages reveals how equity is shared and ensures clarity about decision-makers during the application process.

Page 3: Financial overview

Provide a comprehensive list of your business's assets and liabilities. This gives the financial institution insight into your company's financial health. Additionally, be prepared to submit detailed financial projections for the upcoming year, assisting in determining your capacity to manage accounts responsibly.

Page 4: Additional documentation

Ensure that all necessary additional documentation is included. This might consist of your GST registration and tax identification, as well as any pertinent licenses and permits your business requires to operate legally. Having these documents ready could expedite the approval process.

Reviewing your application

Once you complete the form, it is crucial to review the entire application for accuracy. Double-checking all entries can save time later, especially if corrections or additional documents are needed. Common mistakes include typos and omission of required information, which can delay the process.

Utilize pdfFiller’s review features to ensure nothing is overlooked. The platform often highlights errors or missing information, making it easier to catch issues before submitting.

Submitting your application

After thorough review, you are ready to submit your business integrated account application form. Submission methods typically vary. Many institutions offer electronic submission, which facilitates immediate processing. Using pdfFiller’s electronic submission feature can streamline this final step significantly.

If you need to submit physical copies, ensure you send them to the designated address specified by the financial institution. It's prudent to verify submission guidelines to avoid any missteps and ensure that your application is processed smoothly.

After submission: What to expect

Once you have submitted the application, understanding the typical processing times is essential. Most applications can take anywhere from a few days to several weeks, depending on the complexity of the business and the institution's workload.

Tracking your application status is straightforward with pdfFiller tools, where you can monitor progress and changes associated with your submission. If the financial institution requires more information, be prepared to respond swiftly to requests for clarification to keep the process moving.

Frequently asked questions (FAQs)

What happens if my application is denied?

If your application is denied, it’s crucial to seek feedback from the financial institution. Usually, they cite specific reasons for the denial, allowing you to improve your application or rectify issues for future attempts.

Can modify my application after submission?

In most cases, modifications can be requested, but it may not always be guaranteed. It’s best to check directly with the financial institution you are applying to understand their policy regarding changes post-submission.

How secure is my information with pdfFiller?

pdfFiller prioritizes the security and confidentiality of user information. The platform utilizes advanced encryption and security protocols to ensure that all personal and business data remain protected throughout the application process.

Customer experiences and testimonials

Many businesses have found success using the business integrated account application form through pdfFiller. Feedback reflects that streamlined document management and efficient collaboration led to smoother financial relationships.

Testimonials emphasize not only the ease of use of pdfFiller’s tools but also the effective documentation support, which ultimately improved their outcomes when dealing with financial institutions. These stories highlight the power of efficient document management.

Additional tools and resources within pdfFiller

In addition to the business integrated account application form, pdfFiller offers a range of tools that enhance document management. Features such as document storage and accessibility ensure that essential records are organized and retrievable when needed.

Moreover, pdfFiller provides a template library catering to various business documents, allowing you to admit other forms relevant to your business needs. Integration capabilities with other business applications further enhance its usability, ensuring a centralized approach to document management.

Related products and services

pdfFiller doesn’t just stop at the business integrated account application form. The platform integrates various document services that complement your business needs, addressing everything from tax forms to employment contracts. This interconnected functionality can greatly simplify your overall documentation process.

By linking related forms and services, pdfFiller ensures that businesses can manage paperwork more efficiently, reducing time spent on document creation and submission.

Engage with us

Stay connected with pdfFiller for ongoing updates and tips on managing your documentation effectively. Follow us on social media and subscribe to our newsletter for insights into document management strategies that can elevate your business operations.

Join our community by participating in webinars or forums centered around document management. Engaging with others can inspire innovation and help you learn new ways to optimize your document-related tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in business integrated account application without leaving Chrome?

Can I edit business integrated account application on an Android device?

How do I complete business integrated account application on an Android device?

What is business integrated account application?

Who is required to file business integrated account application?

How to fill out business integrated account application?

What is the purpose of business integrated account application?

What information must be reported on business integrated account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.