Letter of Credit Form: How-to Guide Long-read

Understanding letter of credit

A letter of credit is a formal document issued by a financial institution guaranteeing a buyer's payment to a seller. This assurance is crucial in international trade where buyer and seller may not be familiar with each other's financial standing. The bank or credit issuer acts as an intermediary, ensuring funds are available, thus providing security to both parties involved in the transaction.

The letter of credit works by outlining the payment terms agreed upon by the buyer and seller, dictating how funds will be transferred upon the receipt of specified documents indicating that goods or services have been delivered. This financial instrument mitigates the risk of non-payment and is vital for individuals and businesses looking to expand their operations internationally.

For businesses, letters of credit can open doors to larger markets, while individuals may find value in securing personal purchases from foreign vendors. Understanding the letter of credit form is essential to navigate the complexities involved.

Types of letters of credit

There are several types of letters of credit, each serving different transactional needs. Recognizing these varieties ensures that you select the appropriate form for your specific transaction.

A revocable letter of credit can be altered or canceled by the buyer or seller, while an irrevocable letter of credit cannot be changed without the consent of all parties involved.

A confirmed letter of credit includes a second bank, known as the confirming bank, which provides additional assurance to the seller, while an unconfirmed one does not.

Sight letters of credit require payment upon presentation of documents, whereas time letters allow for a deferred payment at a specified date.

Key components of a letter of credit form

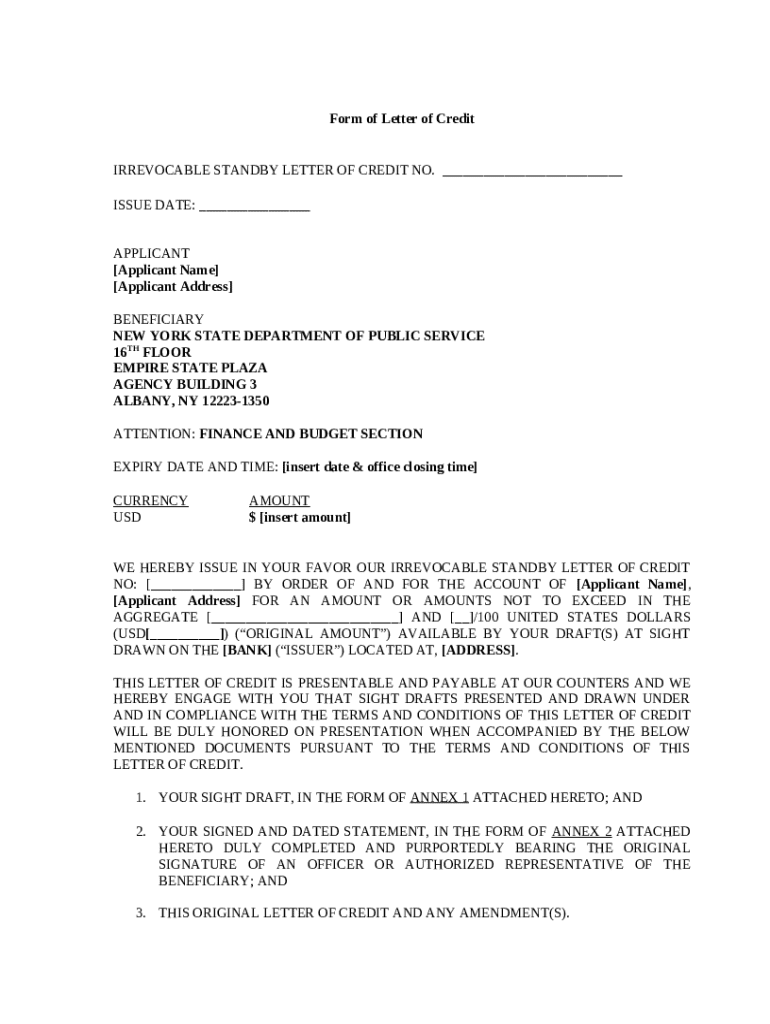

When filling out a letter of credit form, certain key components must be included to ensure clarity and comprehensiveness. Each component is foundational for the successful execution of transactions and provides a clear understanding for all involved parties.

Provide the name, address, and contact information of the buyer.

Include the seller’s name and contact details so that payment can be directed appropriately.

Clearly detail what is being traded, including quantities, types, and any identifiers (e.g., SKU).

Outline how and when payment will be made, covering aspects like payment method and required documents.

Specify when the letter of credit will expire and where the payment will take place.

Step-by-step guide to filling out the letter of credit form

Completing a letter of credit form may seem straightforward, but it's essential to be thorough to prevent delays and issues. Here's a detailed process to guide you through accurately filling out the form.

Identify all parties involved in the transaction: the applicant (buyer), beneficiary (seller), and issuer (bank). Ensure you have up-to-date contact information.

Fill out the fields with accurate information, checking for clarity and correctness. Watch out for common mistakes like misspellings or missing details.

Cross-check the details provided and ensure any required supporting documents are attached to avoid rejection.

Depending on the issuing bank, this may involve online submission through a secure portal or a physical hand-in at a branch.

Editing and customizing the letter of credit form

Customizing your letter of credit form can enhance clarity and ensure it meets your unique needs. Using sophisticated tools can simplify this process, with pdfFiller being a prime example.

pdfFiller allows you to create and modify PDFs easily with an array of editing tools available at your fingertips.

Import your form into pdfFiller, utilize drag-and-drop features to add or remove fields, and adjust the layout as needed.

Incorporating notes or comments can provide further explanation for stakeholders, making the form more understandable.

Signing and approving the letter of credit form

Once your letter of credit form is complete, it's essential to ensure it is signed and approved correctly. The signature can significantly affect the document’s legality and acceptance.

Consider whether a digital signature or physical (wet) signature is acceptable for your transaction. Digital signatures are often faster and can be legally binding in many jurisdictions.

Simply upload the document, add signature fields, and invite stakeholders to sign electronically to streamline approval.

Use pdfFiller’s collaboration features to route the document through necessary approvals, ensuring everyone has visibility into the process.

Managing and storing your letter of credit form

After ensuring your letter of credit is signed and approved, managing and storing it properly is critical to maintain its integrity and accessibility. This is where best practices come into play.

Make documentation systematic by categorizing files and using naming conventions that allow for easy retrieval.

Utilize the cloud storage provisions within pdfFiller for easy access anywhere, anytime, ensuring that backups are regularly conducted.

Use the built-in version control feature within pdfFiller to review changes made and revert to previous versions when necessary.

Common mistakes and troubleshooting

Navigating the letter of credit form can be fraught with challenges, and avoiding common pitfalls is key to ensuring a smooth transaction process. Here are some frequent mistakes to look out for, along with solutions.

Double-check all data entered into the form; missing details can lead to significant delays and complications in payment.

Stay vigilant for inconsistencies in documentation that may indicate fraudulent activity. Verify the details directly with the issuing bank.

If your submission is rejected, review the feedback provided and promptly rectify the identified issues before resubmitting.

Understanding regulatory requirements

Navigating the regulatory landscape surrounding letters of credit is essential for legal compliance in international transactions. Here are some considerations to keep in mind.

Ensure you are aware of the laws governing letters of credit in both the buyer's and seller's countries.

Familiarize yourself with trade regulations such as the UCP (Uniform Customs and Practice for Documentary Credits) which govern international letters of credit.

Consult with a legal team proficient in international trade law to help navigate complex regulations adequately.

Leveraging pdfFiller for efficient document management

Using pdfFiller can significantly streamline the document management process surrounding letters of credit, making workflows more efficient and accessible.

pdfFiller provides interactive features which allow you to easily create the letter of credit form without hassle.

Facilitate teamwork by using pdfFiller's collaborative tools, allowing multiple stakeholders to participate in the form creation and approval process.

With pdfFiller, important documents are available on a cloud platform, minimizing the risk of loss and ensuring easy access from anywhere.

Maximizing the potential of your letter of credit

To get the most out of a letter of credit, it's essential to optimize communication and negotiation strategies with financial institutions.

Maintain clear and professional communication with your bank regarding your needs and any concerns about your form.

Leverage your business history and transaction value to negotiate more favorable terms in your letter of credit agreements.

Incorporate letters of credit as a critical tool for securing financing for imports and exports, enhancing cash flow management.