Get the free Guarantee Application for Legal Entity

Get, Create, Make and Sign guarantee application for legal

How to edit guarantee application for legal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out guarantee application for legal

How to fill out guarantee application for legal

Who needs guarantee application for legal?

A comprehensive guide to guarantee application for legal forms

Understanding the guarantee application for legal forms

A guarantee application serves as a legally binding document wherein one party agrees to assume responsibility for another party's debt or obligation if they default. This form holds significant weight in legal contexts, as it often reassures lenders or service providers about the likelihood of payment. In business transactions, guarantees can mitigate risks associated with unpaid debts, making them a critical tool for facilitating trust and security.

Guarantee applications come in various forms, each tailored to specific contexts. Personal guarantees are common among individual borrowers seeking loans where lenders require the individual's assets to back the loan. Corporate guarantees, on the other hand, involve businesses providing security for another entity’s obligations. Specific use cases might include real estate contracts, where a guarantee application is part of a landlord-tenant agreement or other contractual arrangements.

The importance of choosing the right legal form

Selecting the appropriate legal form for a guarantee application is crucial for ensuring compliance and effectiveness. Various legal forms are available, most notably the general guarantee format, which is adaptable to many situations. Individual guarantee forms cater specifically to sole proprietors or personal loans, whereas business guarantee forms address corporate obligations. Each form has its nuances that must be understood.

Key considerations when selecting a legal form include jurisdiction-specific requirements, as laws governing guarantees vary significantly between states and countries. Moreover, understanding compliance and regulatory practices is essential; for instance, some jurisdictions may require additional documentation or specific verbiage in the guarantee application to ensure it’s enforceable. Using templates that align with your local laws can streamline the process.

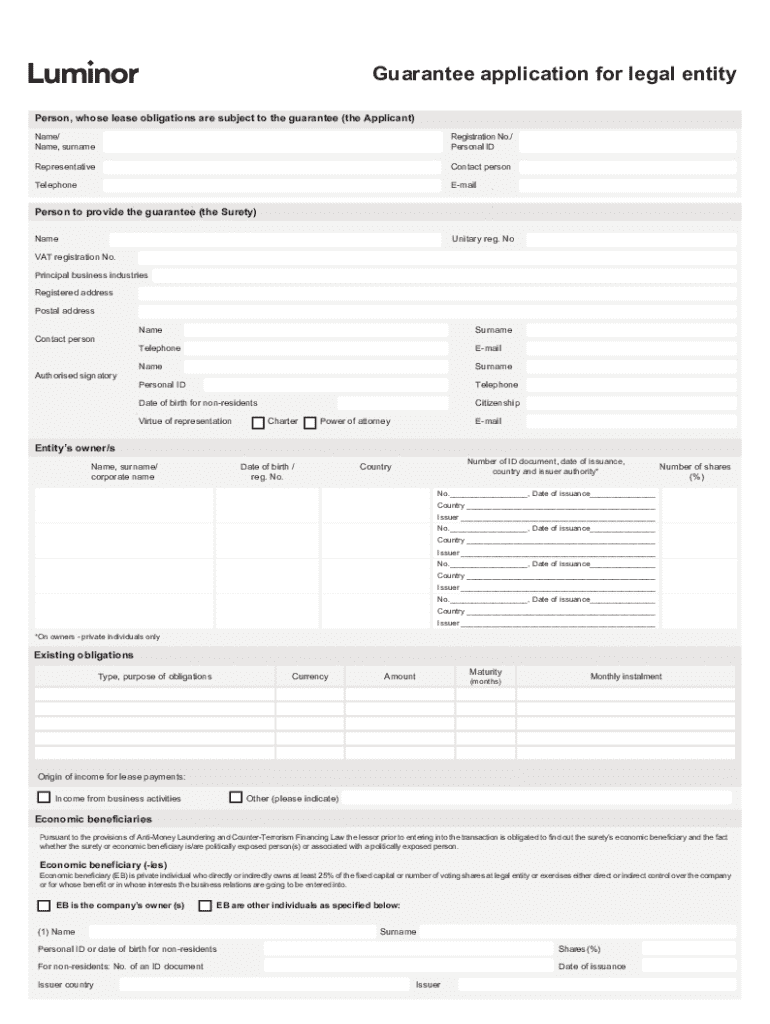

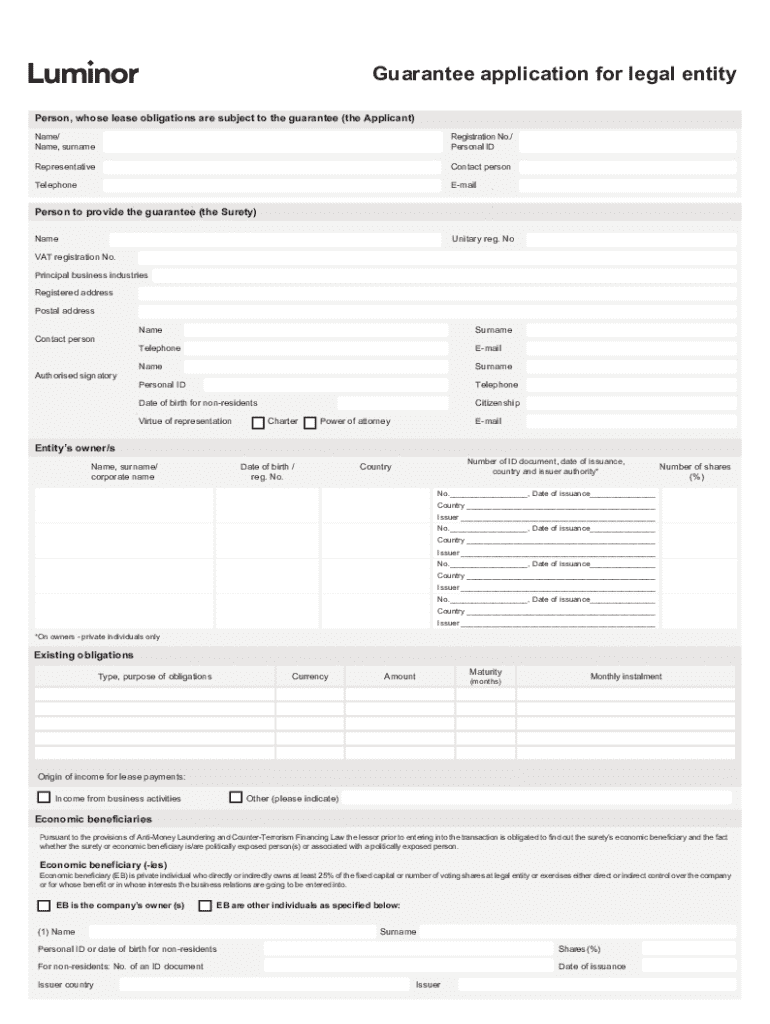

Step-by-step guide to completing a guarantee application

Completing a guarantee application effectively requires a systematic approach. First, gather necessary personal and financial information, which usually includes your name, address, income, credit history, and any existing obligations. Additionally, supporting documents such as tax returns or payslips may be necessary to substantiate your financial situation.

Next, reviewing the form layout is essential. Common sections in a guarantee application include the applicant’s information, details of the obligation being guaranteed, and the terms associated with the guarantee. Familiarizing yourself with common terminology will facilitate a smoother filling process. Lastly, when filling out each section, accurately reporting financial obligations is key, as discrepancies can lead to rejection. Ensure the application is signed by all required parties, as legal validity heavily relies on authorized signatures.

Editing and customizing your guarantee application form

Using tools like pdfFiller makes editing legal forms seamless and efficient. This platform provides interactive tools for real-time editing, allowing users to input specifics directly into templates. Such flexibility means you can customize guarantee applications according to individual needs or the demands of a given scenario, whether personal or corporate.

Best practices for document management also play a pivotal role in this stage. Implementing version control ensures that you keep track of any modifications made to the application, and maintaining a document history allows for easy reference. Furthermore, utilizing secure sharing and collaboration tools within pdfFiller simplifies obtaining feedback from multiple stakeholders before finalizing the application.

Signing and submitting your guarantee application

Electronic signatures have revolutionized how guarantee applications are submitted. Legally recognized in many jurisdictions, eSignatures provide a secure, convenient alternative to traditional signing methods. Using pdfFiller, you can employ a secure eSigning process that not only streamlines submission but also ensures your documents are valid and legally binding.

When it comes to submission, you'll need to follow specific guidelines. Typically, guarantee applications can be submitted online or offline, depending on the institution involved. If submitting online, ensure that you have confirmation of submission and any tracking mechanisms in place. Offline submissions may require you to retain postal receipts or delivery confirmations, so tracking your application through its lifecycle is crucial for follow-up.

Common challenges and FAQs related to guarantee applications

Filling out guarantee applications can sometimes be fraught with issues. Some common mistakes include submitting incomplete forms or misreporting financial obligations, both of which can lead to application rejections. To mitigate this, double-check all provided information against required documentation before submission. If your application is rejected, identify the reasons given and address them immediately upon resubmission.

Frequently asked questions delve into various concerns, such as the expected processing time for applications, which can vary. On average, it may take a few days to a few weeks depending on the institution's policies. Additionally, understanding the costs involved, whether they be associated with the application process or potential fees for guarantees, can aid in budgeting and financial planning.

Leverage collaborative features with pdfFiller

Collaboration is a vital aspect of managing guarantee applications effectively. With pdfFiller, sharing your guarantee application for team review is straightforward. You can invite colleagues or advisors to contribute feedback and make adjustments, ensuring that all aspects are thoroughly vetted before finalizing.

Utilizing comments and feedback tools enhances collaboration, allowing team members to communicate directly on the document for clarity. Furthermore, storing and managing all related documents in one centralized location simplifies organization. This feature not only keeps all files accessible but also promotes accountability within your team as all actions can be tracked.

Examples of guarantee applications in different scenarios

Guarantee applications can play vital roles in various scenarios. For example, individuals seeking a personal loan may submit a guarantee application to their bank, wherein someone—often a family member—agrees to cover the debt if the borrower defaults. Similarly, in the business realm, corporate entities often find themselves drafting guarantees when entering contracts with suppliers and clients, ensuring financial obligations are met as stipulated.

Real-life use cases showcase how these applications operate. For instance, a construction company might require a contractor to submit a guarantee application for a project, ensuring that financial backing is available should the contractor fall short on obligations. Such scenarios underline the necessity of guarantee applications and highlight the varied uses within both personal and corporate realms.

Future trends in guarantee applications

As the digital landscape evolves, so too do guarantee applications. Innovations in document management technology are paving the way for streamlined processes, enhancing user experience through automation and artificial intelligence. These advancements can facilitate quicker approval times and better tracking systems, ultimately benefiting all parties involved.

Additionally, potential changes to legal requirements may impact guarantee applications in the future. As regulatory bodies adapt to new technologies and market conditions, keeping abreast of these changes will be essential for individuals and businesses to maintain compliance and leverage guarantees effectively. The ongoing evolution of both technology and law suggests that the way guarantee applications are drafted, signed, and submitted will continue to become more efficient and user-friendly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in guarantee application for legal?

Can I sign the guarantee application for legal electronically in Chrome?

Can I edit guarantee application for legal on an iOS device?

What is guarantee application for legal?

Who is required to file guarantee application for legal?

How to fill out guarantee application for legal?

What is the purpose of guarantee application for legal?

What information must be reported on guarantee application for legal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.