Get the free Declaring Certain Tax Foreclosed Property Subject to ...

Get, Create, Make and Sign declaring certain tax foreclosed

Editing declaring certain tax foreclosed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaring certain tax foreclosed

How to fill out declaring certain tax foreclosed

Who needs declaring certain tax foreclosed?

A comprehensive guide to declaring certain tax foreclosed forms

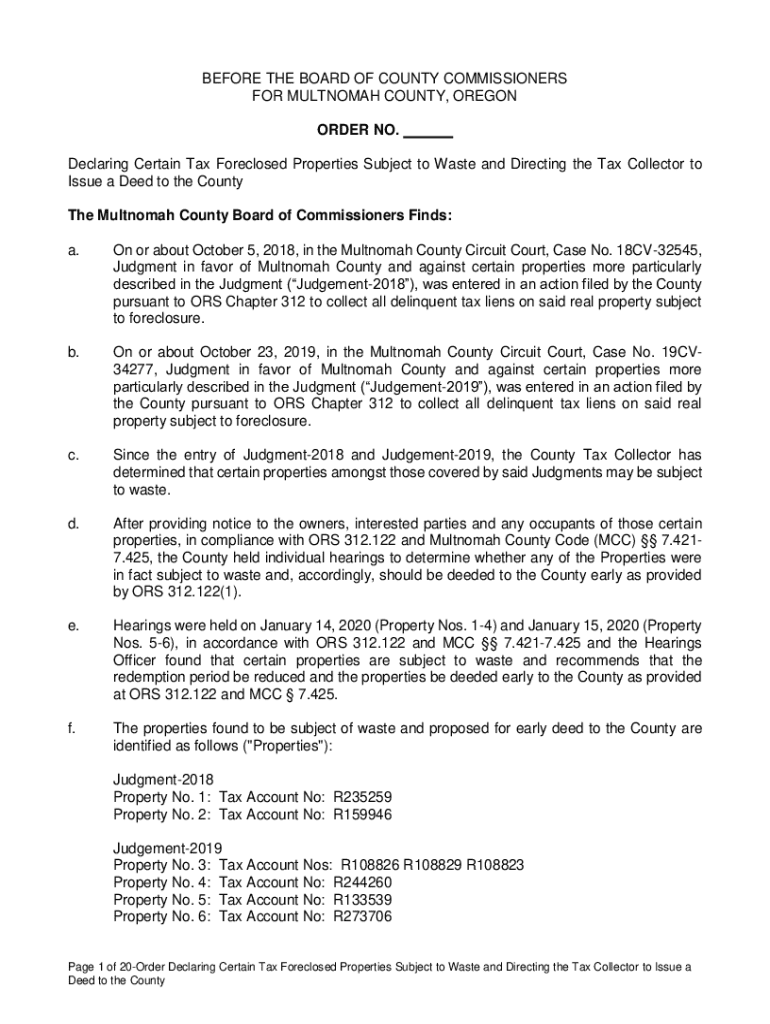

Understanding tax foreclosure

Tax foreclosure occurs when a government agency seizes a property due to the owner's failure to pay property taxes. This legal procedure grants the government the right to recover unpaid taxes by reclaiming the property, often leading to the sale of the asset to settle tax liabilities. In essence, tax foreclosure is the government’s mechanism to ensure tax revenue is collected, thus preventing the decline of public services funded by these revenues.

Common reasons for tax foreclosure include economic hardship, lack of awareness about property tax deadlines, or significant financial burdens that may affect a homeowner's ability to pay. The implications can be severe—property owners may lose their home, suffer damage to their credit rating, and face difficulties acquiring future financing.

Understanding the legal implications of tax foreclosure is crucial to preparing a defense, should it come to that. This often involves reviewing local laws to identify rights and duties as a property owner facing tax foreclosure.

The role of the declaring certain tax foreclosed form

The declaring certain tax foreclosed form serves a vital purpose: it notifies the relevant authorities about an individual’s or organization’s intention to report a foreclosure. This form allows for the formal processing of property tax foreclosure cases, ensuring transparency and accuracy within the government’s tax collection framework. It also plays a crucial role in assessing the impact of property closures on community resources.

Both individuals and organizations that own properties subject to tax foreclosure need to declare this form. This includes not only homeowners but also business owners, real estate investors, and any entity that holds property under municipal jurisdiction. By submitting this form correctly, you help expedite the processes while also establishing a clear record.

Accurate declaration is paramount. Any errors or omissions can potentially lead to complications in the legal process, resulting in further financial strain for the property owner. Thus, taking the time to ensure the form is properly filled out cannot be overstated.

Interactive tools and resources

pdfFiller offers robust cloud-based tools that simplify the process of declaring certain tax foreclosed forms. Users can access a user-friendly interface, allowing for easy document creation and submission directly from their devices. This functionality is particularly beneficial for individuals and teams juggling multiple responsibilities while managing their tax obligations.

The platform features a step-by-step guide to using its interactive features for tax foreclosure declaration. From form filling to e-signing, individuals can manage the entire process online without needing cumbersome paper forms. This ensures not only timeliness in declarations but also eases the management of documents.

Template customization is another aspect worth noting. Users can adapt existing templates to their needs, which can save valuable time. Ensuring your tax foreclosure declaration form reflects specific details pertinent to your situation is crucial for maintaining accurate records.

Detailed instructions for filling out the form

Filling out the declaring certain tax foreclosed form can be straightforward if approached methodically. The first step involves gathering necessary information and required documentation. Essential documents may include previous tax statements, property deeds, and identification information that authenticate your claim.

Following documentation collection, completing the form involves several fields that must be filled accurately. Avoid common mistakes such as inputting incorrect personal information or failing to provide required signatures. Pay close attention to details like property identification numbers and amounts owed, as inaccuracies can delay processing.

Once you complete the form, reviewing and editing your submission is crucial. Effective document management can include digitally storing versions of the form for future reference. Make sure to keep copies of both the submitted form and any correspondence received from tax authorities after submission.

Signing and submitting the declaring form

When it comes to signing the declaring certain tax foreclosed form, pdfFiller offers various e-signature options. This feature saves time and makes the submission process seamless, allowing users to sign their documents electronically. Once the form is filled out, review the content once more and then move on to the e-signature step.

Submitting your completed form can be done in two ways: online or through traditional mail. Choosing online submission generally leads to a faster response time, while mail submissions may require additional time for processing. Whichever method you select, ensure you receive confirmation of your submission, whether that be an email receipt or a tracking number for mailed documents.

Managing your tax foreclosure documentation

Keeping organized records is vital for anyone navigating tax foreclosure issues. Best practices for organizing tax documents include clearly labeling files and maintaining a separate folder specifically for tax documents. Consistency in organization aids in future reference and helps prevent lost documentation that may prove critical to resolving tax issues.

Using pdfFiller's features to store and retrieve forms can significantly simplify the management of your tax documents. The cloud-based storage ensures easy access whenever needed, and the collaboration features allow teams to work together on sharing and editing documents efficiently.

Frequently asked questions

After submitting the declaring certain tax foreclosed form, individuals may wonder about the next steps. Generally, you will receive an acknowledgment from the relevant authority, informing you of the form’s acceptance or any additional requirements. If there’s a need to amend your declaration due to any errors, train yourself to recognize the specific procedures for corrections, typically laid out in the instructions that accompany the original form.

It's important to also understand what happens if you need to retract your declaration. This process can depend on local regulations, and thus it's essential to consult with tax professionals or legal advisors in such instances. If your tax status changes after declaring, promptly inform the authorities following proper channels to avoid potential misunderstandings.

Recommendations for future tax management

To avoid future tax foreclosure issues, employing specific strategies can make a substantial difference. Budgeting and financial planning are pivotal in ensuring home and business owners remain on track with their tax obligations. Engaging in regular assessments of one's financial situation can highlight potential pending issues before they escalate toward crisis levels.

Additionally, staying informed about one’s tax liabilities through resources like governmental tax websites or financial advisors plays a crucial role in ongoing tax management. pdfFiller even offers access to webinars and workshops designed to educate users on effective tax planning strategies, which can range from understanding tax benefits to utilizing available relief programs.

Getting help with your tax foreclosure issues

When navigating the complexities surrounding tax foreclosures, knowing where to seek help can alleviate some of the burdens. pdfFiller provides multiple customer support options including live chat, email, and phone support dedicated to assisting users with their document needs. These platforms ensure that individuals can receive timely assistance whenever necessary, without falling into the trap of prolonged confusion.

Beyond these direct support features, pdfFiller also offers community forums and user guides which are great avenues for learning about common issues, solutions, and insights from a network of users facing similar challenges. In some cases, seeking legal assistance may also be warranted, and understanding the available resources can simplify the search for a qualified advisor.

Additional information on related tax topics

Understanding tax liens and their implications is crucial for those facing tax foreclosure. A tax lien is essentially a legal claim against property when taxes remain unpaid, often complicating the selling process as potential buyers may hesitate to purchase property with outstanding tax balances. Exploring tax relief programs and options is also vital, as they can provide ways to reduce tax burdens or negotiate payment plans.

Being proactive about timely tax payments is essential for maintaining financial health. Regularly reviewing payment schedules, understanding potential benefits from timely payments, and reaching out for resources can significantly ease the pressure surrounding tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit declaring certain tax foreclosed in Chrome?

How can I fill out declaring certain tax foreclosed on an iOS device?

How do I complete declaring certain tax foreclosed on an Android device?

What is declaring certain tax foreclosed?

Who is required to file declaring certain tax foreclosed?

How to fill out declaring certain tax foreclosed?

What is the purpose of declaring certain tax foreclosed?

What information must be reported on declaring certain tax foreclosed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.