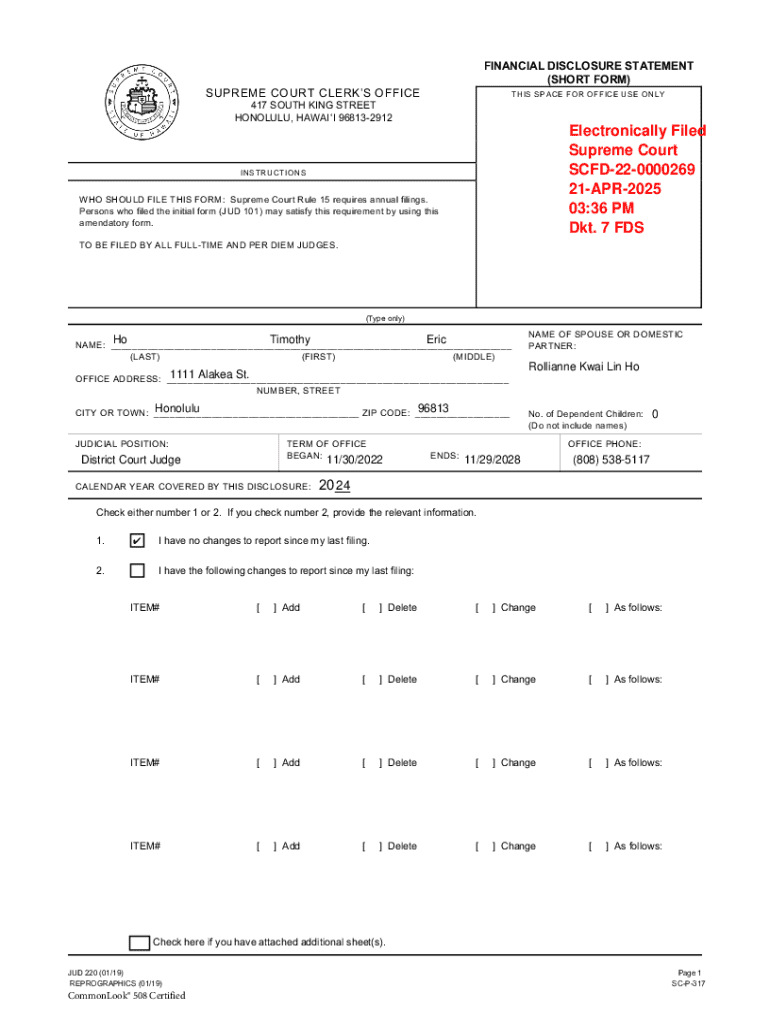

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Understanding Financial Disclosure Statement Short Form

Understanding financial disclosure statements

A financial disclosure statement short form serves as a vital instrument for ensuring transparency in personal and organizational finance. As a concise version of its longer counterpart, the short form simplifies the process of revealing financial interests to regulatory bodies, stakeholders, or the public. Its significance lies in fostering trust, demonstrating accountability, and delivering essential insights into one's financial activities.

In today’s context, financial accountability is more crucial than ever. Various fields—ranging from public office to nonprofit organizations—mandate such disclosures to prevent conflicts of interest and uphold ethical standards. By supplying a clear overview of one’s financial situation, individuals and entities can present a straightforward account of their economic engagements.

Types of financial disclosure statements

Financial disclosure statements can be categorized into two main forms: the short form and the long form. The financial disclosure statement short form focuses on essential financial data, excluding less critical details typically captured in longer versions. It is particularly applicable in situations where the financial intricacies involved are minimal or where regulatory bodies are satisfied with a high-level overview.

Examples of scenarios that might require a financial disclosure statement short form include new applicants for public office, candidates for specific boards, or employees in sensitive positions within organizations. This streamlined form allows for easier processing while still meeting necessary regulatory requirements.

Key components of a financial disclosure statement short form

Completing a financial disclosure statement short form involves compiling various vital categories of information. Each component is pivotal in providing a holistic view of one’s financial standing, contributing to transparency and compliance. Here’s a breakdown of the primary sections:

How to complete a financial disclosure statement short form

Filling out the financial disclosure statement short form requires careful attention to detail and organized documentation. Below, we provide a step-by-step guide to successfully completing this document:

Common mistakes to avoid

When filling out the financial disclosure statement short form, inaccuracies or omissions can lead to problems. Common mistakes include skipping essential sections, providing outdated information, or misrepresenting income sources. To avoid these pitfalls, double-check entries for consistency, confirm all relevant data is included, and seek a second opinion if necessary.

Tips for editing and managing your financial disclosure statement

Utilizing tools such as pdfFiller can enhance your experience in managing financial disclosure statement short forms. With its cloud-based platform, users can easily edit, sign, collaborate, and store documents, all in one central location. This not only streamlines the process but also ensures your documents are secure and accessible at any time.

Using pdfFiller for document management

pdfFiller offers robust features for editing PDF forms, including easy-to-use templates for financial disclosure statements. Users benefit from e-sign functions for quick approvals, significantly expediting the completion process.

Additionally, the platform allows seamless collaboration by enabling team members to review and comment on documents. This ensures that everyone on your team is aligned and aware of the financial disclosures being made, leading to enhanced accuracy and compliance.

Electronic submission and compliance

Submitting your financial disclosure statement short form electronically is often a requirement, depending on your jurisdiction or organizational policies. Understanding the specific submission requirements is crucial, as different agencies may have their timelines and protocols for submission.

Ensuring compliance with prevailing regulations is essential to avoid penalties. By consulting relevant guidelines and adhering to submission deadlines, one can mitigate the risk of legal repercussions. It's worthwhile to remember that accuracy in your financial report is not only beneficial for compliance but also strengthens your credibility.

FAQs about financial disclosure statement short form

As you navigate the process of completing a financial disclosure statement short form, you may have some common questions. Here’s a quick look at the answers:

Leveraging the benefits of pdfFiller for your financial disclosure statement

pdfFiller's platform not only allows for efficient document completion but integrates smoothly with other workflows, which is essential for organizations dealing with multiple financial disclosures. Having everything on a single platform means you save time and reduce the risk of errors.

Cloud access and security features

As financial documents are sensitive in nature, pdfFiller ensures high levels of security and compliance with industry standards. The accessibility of cloud-based solutions means that important files can be retrieved from anywhere, making collaboration among team members seamless without compromising security.

User support and resources

For users navigating the intricacies of financial disclosure statements, pdfFiller offers robust customer support resources to assist with any issues or inquiries. Accessing tutorials, FAQs, and direct support through the platform ensures that users always have the help they need while managing their financial documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in financial disclosure statement short without leaving Chrome?

Can I create an electronic signature for signing my financial disclosure statement short in Gmail?

How can I fill out financial disclosure statement short on an iOS device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.