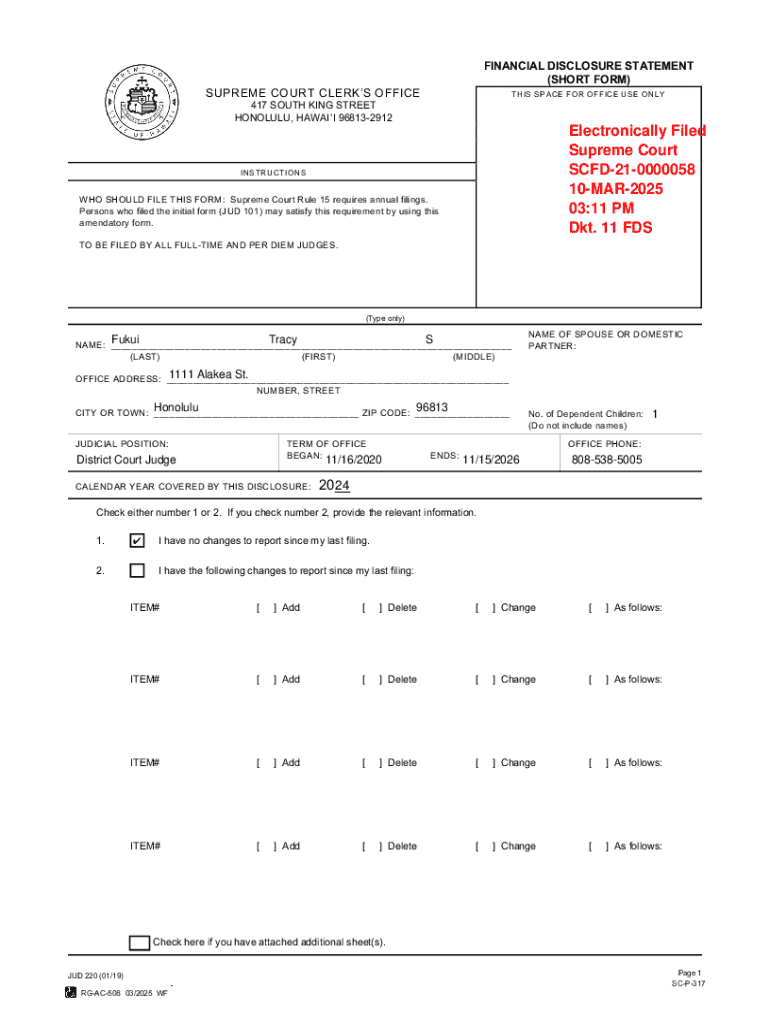

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

A comprehensive guide to financial disclosure statement short form

Understanding financial disclosure statements

A financial disclosure statement is a formal document that provides a detailed account of an individual or organization's financial position. It includes essential information regarding assets, liabilities, and income sources, offering a transparent view of their financial health. Financial disclosure statements are critical in various sectors, particularly in government and corporate environments, where transparency and accountability are paramount.

The importance of financial disclosure statements lies in their role in promoting ethical standards and preventing conflicts of interest, especially for public officials and corporations. By mandating the disclosure of financial information, stakeholders can assess and ensure that individuals or organizations act in the public interest.

Types of financial disclosure statements

Financial disclosure statements come in different formats and lengths, primarily categorized as short form and long form. The short form is succinct, primarily designed for straightforward disclosures, while the long form requires more detailed reporting. The choice between the two formats typically depends on the individual's or organization's circumstances, the industry standards, and specific legal requirements.

In jurisdictions with varying disclosure regulations, there may be specific guidelines detailing when to use a short form versus a long form. Key components of a short form financial disclosure statement usually include sections related to income, assets, and liabilities, summarized in a clear and concise manner, making it easier for reviewers to assess financial standing without sifting through extensive details.

Step-by-step guide to completing the financial disclosure statement short form

Completing the financial disclosure statement short form requires accurate and organized information. Initially, gather all necessary documents, including income statements, tax returns, and asset information. Organizing these documents efficiently will expedite the completion process and minimize errors.

To fill out the form, begin with the personal information section, which typically includes identification details such as your name, address, and contact information. Next, disclose your income, providing necessary specifics such as salary, bonuses, and other sources of income. The third section entails reporting your assets and liabilities, detailing properties, bank accounts, loans, and outstanding debts. Finally, there may be space for additional notes or clarifications that need context or explanation.

Common mistakes to avoid include overlooking sources of income, failing to accurately assess asset values, and providing incomplete information. Ensuring accuracy in disclosures is vital, as inaccuracies can lead to legal repercussions or a loss of trust from stakeholders.

Tools for filling out and managing financial disclosure statements

Using pdfFiller for financial disclosure statements can greatly streamline the process of completing these forms. This platform offers seamless online editing tools for PDFs, enabling users to fill out forms efficiently and accurately. Moreover, the ability to eSign and collaborate makes it easier for individuals and teams to finalize their documents.

One of the most beneficial features of pdfFiller is its library of templates designed specifically for financial disclosure statements. Users can effectively leverage these templates, which guide the completion process and ensure compliance with legal standards. Additionally, the platform allows for easy saving and sharing options, ensuring that users have constant access to their documents from any location.

To effectively manage your documents, consider organizing your financial disclosures in the cloud. Utilize folders to categorize disclosures by year or type, and set reminders to track upcoming deadlines and submissions. This organizational structure will enhance your ability to respond promptly to any requests for updated disclosures.

Frequently asked questions about financial disclosure statements

Many individuals and organizations often have questions regarding who needs to file a financial disclosure statement. Typically, public officials, corporate executives, and individuals in positions of power are required to submit these forms to ensure transparency and accountability in their financial dealings.

Understanding the potential repercussions of not filing a statement is also critical. Failing to submit required disclosures can lead to penalties, including fines or even criminal charges in serious cases. If errors are discovered in a filed financial disclosure statement, it is essential to know the steps to amend the form, which usually involves resubmitting with the corrected information and notifying the relevant authorities.

Best practices for maintaining your financial disclosure records

Regular updates and reviews of your financial disclosure records are essential for maintaining accurate information. It is advisable to conduct reviews at least annually or following significant financial changes, such as a new job or acquiring new assets. Keeping your data current not only ensures compliance with legal standards but also enhances your credibility in financial dealings.

Ensuring the secure storage of sensitive information is also a critical practice. Utilize cloud-based services with strong encryption to protect your disclosures, and regularly update your passwords. Implementing these best practices for data protection minimizes risks related to data breaches and guarantees that your information remains confidential.

Conclusion

Effectively managing financial disclosure statements empowers individuals and teams to maintain transparency, accountability, and trust in their financial dealings. Through platforms like pdfFiller, users can navigate the complexities of financial disclosures with ease, enabling efficient completion, editing, eSigning, and secure document management from a centralized, cloud-based solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial disclosure statement short in Gmail?

How can I send financial disclosure statement short for eSignature?

Where do I find financial disclosure statement short?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.