Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Financial Disclosure Statement Short Form: A Comprehensive Guide

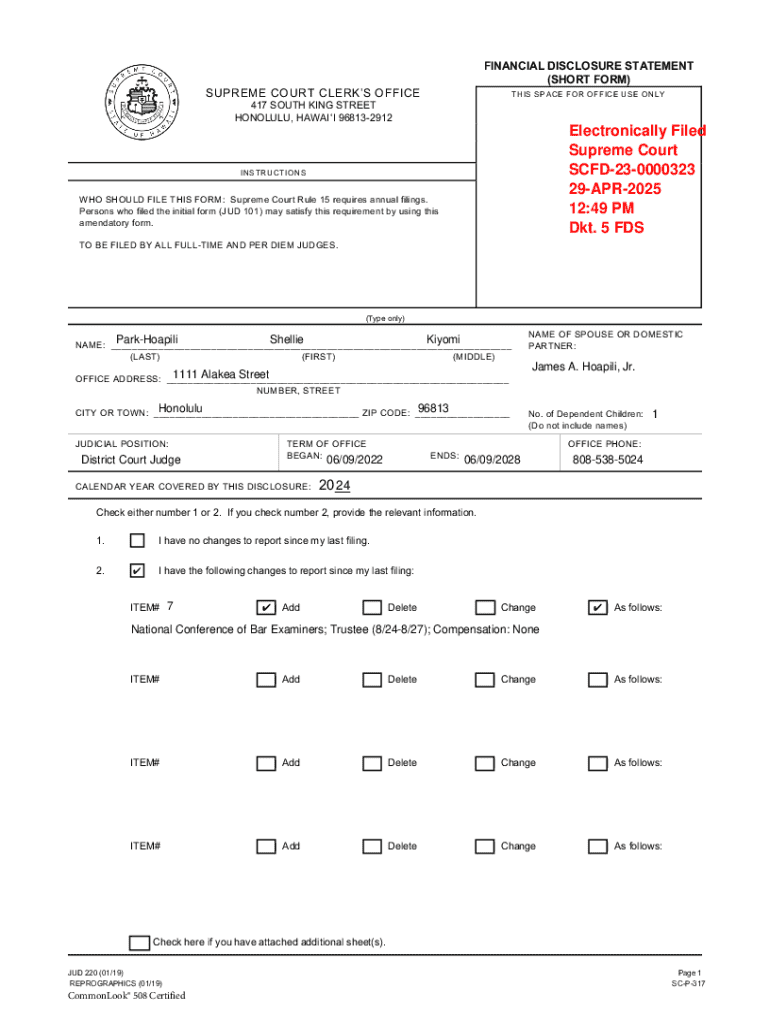

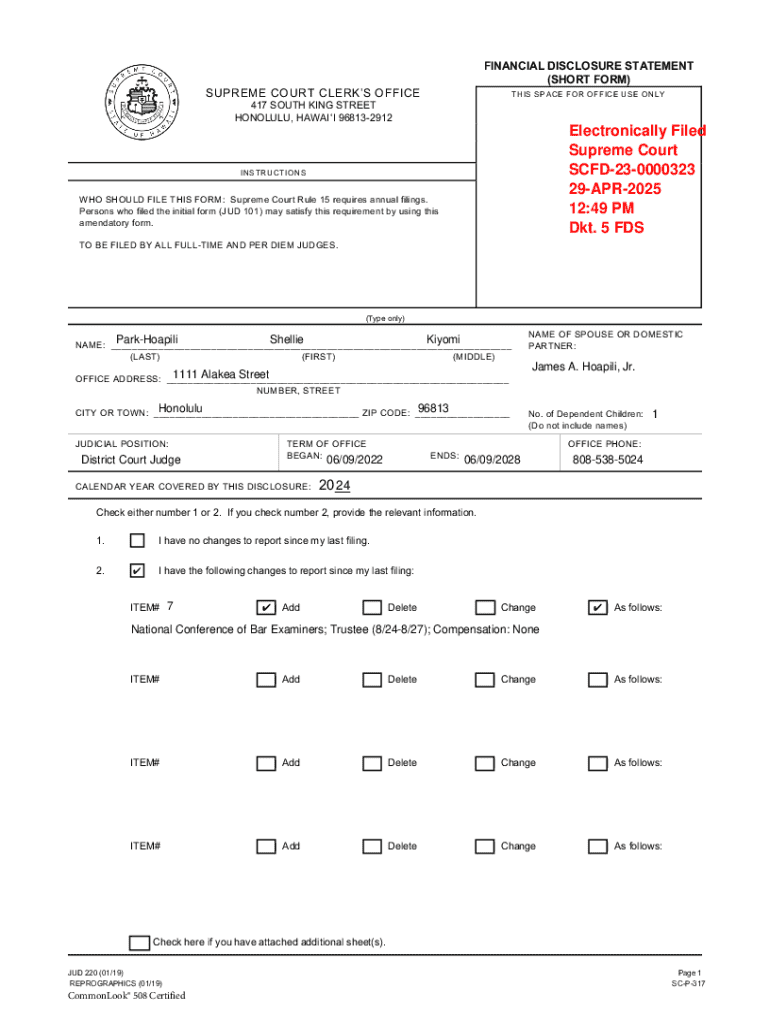

Understanding the financial disclosure statement short form

A financial disclosure statement short form is a simplified version of the full financial disclosure statement. Its primary purpose is to provide a concise overview of an individual's or an organization’s financial interests and activities. By distilling complex financial information into a shorter format, the short form facilitates easier reporting and communication.

Using the financial disclosure statement short form is particularly important in various professional contexts. This format not only saves time for both the filer and the reviewing entity but also helps streamline the extensive paperwork often associated with financial disclosures. It is crucial for transparency and accountability, especially in fields such as government, law, or academia.

When compared to the long form, the short form typically omits certain intricate details, focusing instead on crucial data points. This makes it a popular choice for individuals and organizations with straightforward financial situations.

Who needs to file a financial disclosure statement short form?

Filing a financial disclosure statement short form is necessary for several professionals, particularly those in public service or certain regulated roles. Individuals such as government officials, attorneys, and financial advisors often have to disclose their financial interests to prevent conflicts of interest and uphold ethics in their professions.

Organizations may also need to file these disclosures, particularly when bidding on government contracts or receiving public funding. Additionally, small business owners or independent contractors might find it beneficial to use the short form for reporting, especially when their financial activities are straightforward and less complicated.

Preparation steps before filling out the short form

Before diving into the completion of the financial disclosure statement short form, preparation plays a pivotal role in ensuring accuracy and compliance. To begin, gather critical financial information that will be needed for the form, which includes sources of income, and a list of assets and liabilities.

Understanding the applicable regulations is also crucial. Different jurisdictions may have varying requirements and guidelines on what needs to be disclosed. Familiarizing yourself with these rules can prevent oversights that might lead to compliance issues.

Step-by-step guide to completing the financial disclosure statement short form

Completing the financial disclosure statement short form can initially seem daunting, but breaking it down into manageable steps can demystify the process. Start by reviewing the layout of the form to familiarize yourself with its sections.

Typically, the short form will require personal information, income disclosure, and asset reporting. Each section serves to highlight different aspects of your financial status without requiring excessive detail. Ensure that you carefully read the instructions associated with each part of the form to avoid common pitfalls.

Common mistakes include underreporting income or failing to list all assets. Double-check your entries for completeness and accuracy before submission.

Filling and editing the short form using pdfFiller

pdfFiller offers an efficient platform for filling out and editing the financial disclosure statement short form. Start by uploading your completed form to pdfFiller. Its intuitive interface allows users to easily add or edit fields as necessary.

With interactive tools, users can effectively manage text fields, insert annotations, and provide explanations directly on the form, enhancing clarity and understanding. Once completed, saving your form in the cloud ensures it is accessible from anywhere.

Electronic signature and submission process

Signing your financial disclosure statement short form electronically through pdfFiller adds a layer of convenience. Electronic signatures are legally recognized and expedite the submission process. To navigate the eSignature features, first, ensure your form is finalized.

Once ready, follow the steps to add your signature digitally. This not only saves time but also ensures that your document is readily prepared for submission. It is advisable to follow best practices, such as reviewing the completed form once more before sending it off to the relevant authority.

Managing your financial disclosure statement with pdfFiller

After filing your financial disclosure statement short form, managing the document effectively is equally important. pdfFiller allows users to organize and store documents securely in the cloud, ensuring easy access and retrieval anytime.

Collaborative features also offer opportunities for team access and feedback, making it easier for organizations to handle multiple disclosures efficiently. It’s also wise to keep track of your filing deadlines and renewal requirements to ensure timely compliance each reporting period.

Understanding the implications of non-compliance

Failing to file a financial disclosure statement short form can result in significant penalties. Regulatory bodies view compliance seriously, especially in fields where integrity is paramount. Non-compliance may draw scrutiny or lead to disciplinary actions, tarnishing an individual's or an organization's reputation.

Thus, understanding the importance of timely and accurate disclosures cannot be overstated. Those facing filing issues or uncertainties about their responsibilities should reach out to professional resources or legal advisors for guidance.

FAQs about the financial disclosure statement short form

Many users have common queries surrounding the financial disclosure statement short form. Understanding eligibility and the specifics of what needs to be reported can help clarify confusion. For example, questions may arise concerning necessary documents or details about reporting periods.

Additionally, addressing specific scenarios such as how to report certain income types or asset valuations is crucial. Seeking out advice through FAQs or legal counsel can provide needed clarity.

Case studies and examples of completed short forms

Examining illustrative examples of completed financial disclosure statements can be instrumental in understanding how to approach your own form. Case studies often showcase various methods of effectively reporting financial situations, helping to demonstrate best practices.

These real-life examples can highlight common challenges faced by others, providing insight into successfully navigating the process. Learning from both successes and missteps can empower users to improve their own financial disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial disclosure statement short in Gmail?

How do I execute financial disclosure statement short online?

Can I create an electronic signature for signing my financial disclosure statement short in Gmail?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.