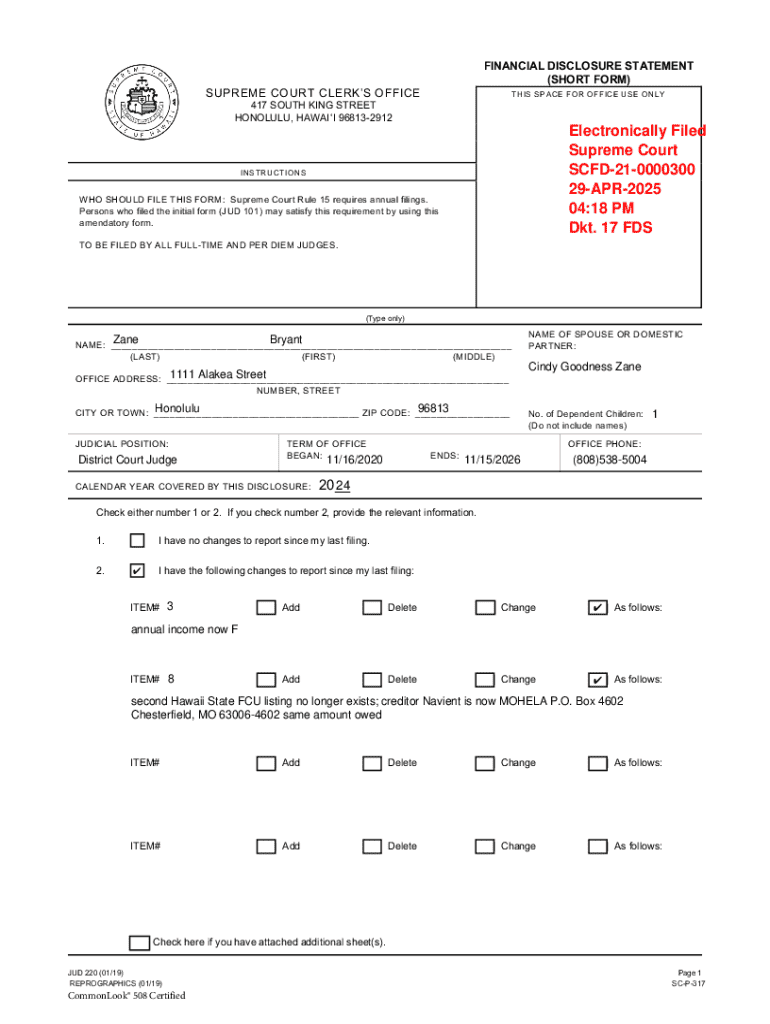

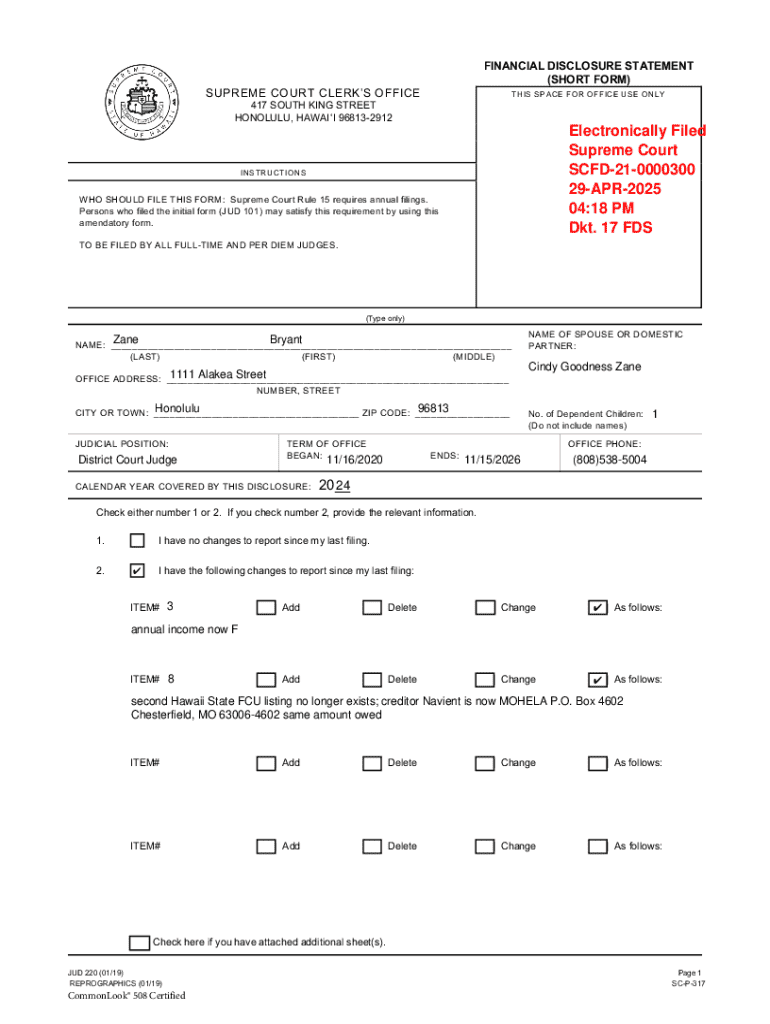

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Your Ultimate Guide to Financial Disclosure Statement Short Form

Understanding financial disclosure statements

A financial disclosure statement is a vital document that provides a snapshot of one’s financial situation. It serves as a formal declaration outlining personal and business financial details, ensuring transparency and accountability. This is particularly important in various contexts, such as legal proceedings, applications for licenses, or positions of significant responsibility where trust is paramount.

Transparency in finance promotes honesty and integrity in transactions. Organizations and individuals must be truthful about their financial status to maintain ethical standards and foster trust with stakeholders, clients, and regulators.

Types of financial disclosure statements

Financial disclosure statements can be broadly categorized into long form and short form. The long form includes comprehensive details and is often used for in-depth financial reporting, while the short form provides a summarized version of essential financial data. Each type is suited for different situations; for instance, short forms are typically required in simpler financial disclosures, like those for job applications or small business licensing.

Key components of the financial disclosure statement short form

A well-structured financial disclosure statement short form contains several key components that offer a clear view of one’s financial health. The first essential section includes personal identification information, which typically requires basic details such as names, addresses, social security numbers, and contact information. This information is crucial as it establishes the identity of the individual submitting the disclosure.

Next is the assets and liabilities breakdown. Listing assets accurately—such as cash, real estate, stocks, and vehicles—is essential to provide a complete picture of financial health. Likewise, evaluating liabilities like mortgages, loans, and credit card debts offers insight into financial obligations that may affect one's net worth.

Finally, the form should report income and expenses. This section requires detailing income sources—like salaries, rental income, or investment earnings—as well as classifying expenses such as housing, transportation, and discretionary spending. Accurate reporting here helps assess financial viability.

Step-by-step guide to completing the financial disclosure statement short form

Completing a financial disclosure statement short form can seem daunting, but by following a systematic approach, you can simplify the process. Start with step one: gathering necessary documents. You'll need current bank statements, tax returns, credit reports, and any documents that reflect your assets and liabilities.

Step two involves filling out the form. When entering data, use user-friendly techniques like breaking down complex information into digestible bits. Avoid common pitfalls such as misreporting figures or forgetting to include an asset or liability. Accuracy is paramount; therefore, step three necessitates a thorough review of all entries to ensure no errors have occurred.

For your final step, follow the submission guidelines carefully. Many organizations now permit digital submissions, offering convenience and speed in processing these vital documents.

Practical tips for effective disclosure

Maintaining privacy and security when filling out a financial disclosure statement short form is critical. Use secure storage for your documents and protect sensitive information with strong passwords. Additionally, ensure no one has access to your personal and financial information during completion.

Be aware of common mistakes that individuals often make in disclosures, such as underreporting income or leaving out significant debts. A checklist can help you verify all sections are completed thoroughly and accurately. Lastly, adhering to deadlines is crucial. Missing a disclosure deadline can result in penalties or other legal ramifications, so keep a calendar reminder for important dates.

Leveraging technology (with pdfFiller)

Technology can greatly simplify the completion of a financial disclosure statement short form. Using pdfFiller, users can quickly fill out the form online, taking advantage of a user-friendly interface. Step-by-step instructions guide you through each field, ensuring clarity and accuracy as you complete your disclosure.

Features like eSigning and document sharing streamline the process further, allowing for seamless collaboration among team members. The platform's cloud-based document management enables you to access your forms from anywhere, ensuring flexibility and efficiency in handling your disclosures.

Cloud-based access offers additional benefits, including real-time collaboration, where multiple stakeholders can review and comment on disclosures. Such efficiency can lead to a more refined and accurate financial disclosure statement.

FAQs related to financial disclosure statements

Individuals often have questions about the necessity and implications of financial disclosure statements. One common question is whether a financial disclosure statement is legally required; in many cases, yes, particularly for public officials and certain professionals. If you miss a disclosure deadline, you may face penalties, so it is advisable to file as soon as possible and explain your situation to the relevant authority.

Another frequent concern pertains to amending submitted disclosures. Fortunately, most jurisdictions allow individuals to amend their financial disclosure statements, but you must follow specific procedures. Lastly, providing false information can result in severe consequences, including legal action, so utmost honesty must be maintained.

Case studies and examples

Real-world examples often illustrate the successful execution of financial disclosure statements. Consider a small business seeking funding that utilized a well-drafted short form, clearly outlining its assets and liabilities, which helped in securing a loan from a reputable investor.

Additionally, case studies demonstrate how tools like pdfFiller have transformed the financial disclosure process, enabling businesses and individuals alike to streamline their submissions, ensuring accuracy and compliance with necessary regulatory standards.

Additional considerations for specific audiences

While financial disclosure statements serve a broad audience, the needs differ between individuals and teams. Individuals may require different information based on personal financial situations, such as creditors or tax obligations, whereas teams in a corporate setting must consider the financial impact of collective liabilities and assets, as well as the responsibilities of individual team members.

For teams, it's vital to standardize disclosures across all members to maintain consistency and legality, especially when the organization is subject to strict regulatory oversight.

Navigating post-submission steps

After submitting your financial disclosure statement short form, it's essential to know what to expect. Typically, you should receive confirmation of receipt and an estimated timeline for processing. Tracking the status of your submission may also be possible via an online portal or by contacting the relevant authority.

If follow-up requests or inquiries arise, responding promptly and accurately helps maintain your credibility and ensures that any required clarifications or additional details are promptly addressed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit financial disclosure statement short online?

Can I sign the financial disclosure statement short electronically in Chrome?

How do I fill out financial disclosure statement short using my mobile device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.