Get the free Financial Disclosure

Get, Create, Make and Sign financial disclosure

Editing financial disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure

How to fill out financial disclosure

Who needs financial disclosure?

Understanding Financial Disclosure Forms: A Comprehensive Guide

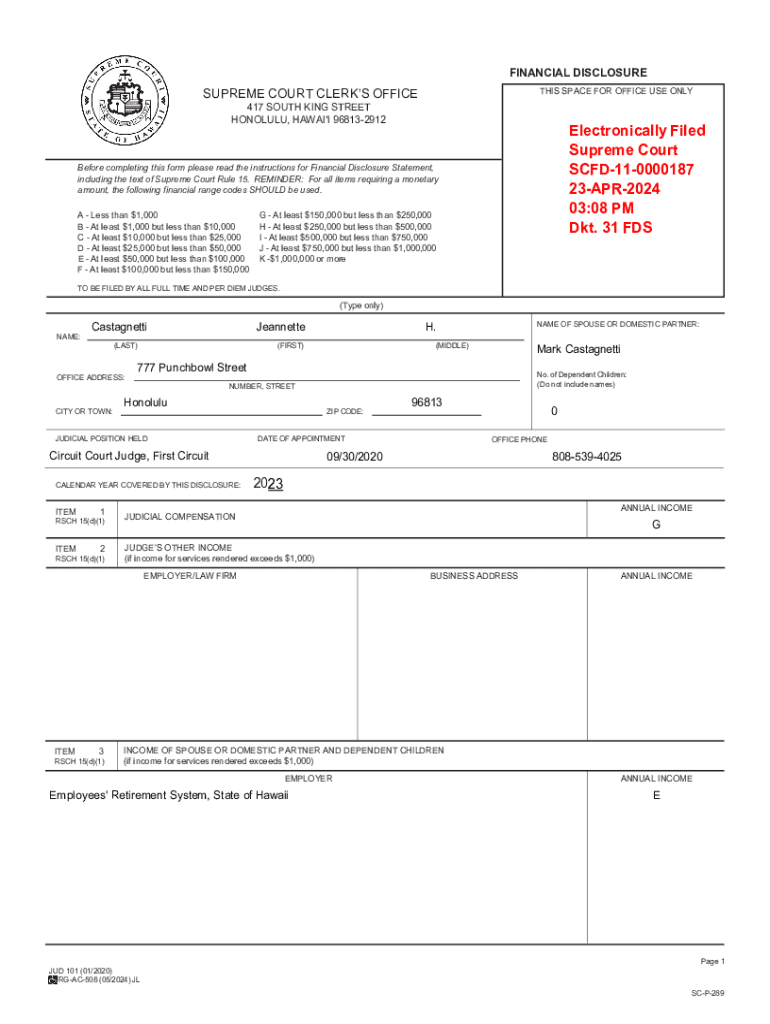

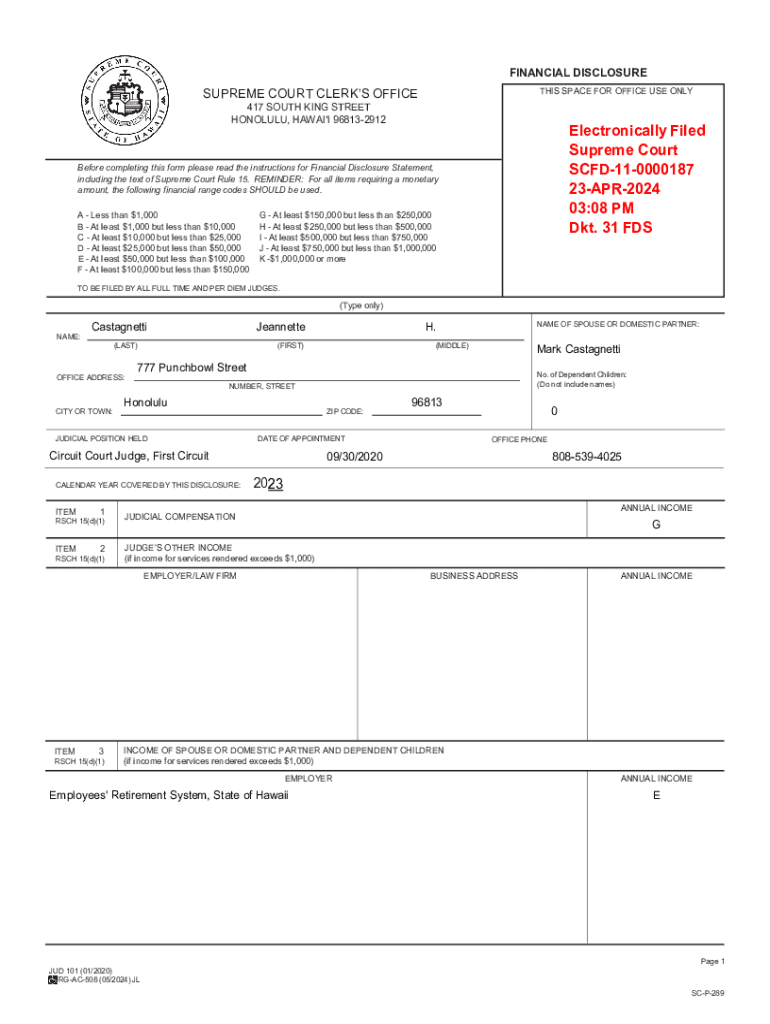

Understanding financial disclosure forms

A financial disclosure form is a document that provides a detailed account of an individual or organization's financial status. These forms are crucial for ensuring transparency and accountability, especially in government and corporate sectors. They typically include information about income, assets, liabilities, and investments, allowing regulatory bodies to assess financial integrity and monitor compliance with regulations.

The importance of financial disclosure forms cannot be overstated. They serve multiple purposes depending on the context; for instance, government officials must disclose financial interests to avoid conflicts, while corporations are required to provide disclosures to maintain investor trust. The legal requirements surrounding these disclosures vary by jurisdiction but generally aim to enhance transparency and prevent fraud.

Types of financial disclosure forms

Financial disclosure forms come in various types, tailored for specific purposes and audiences. Each type serves unique functions and is designed to capture relevant financial information.

Key instructions for completing financial disclosure forms

Completing a financial disclosure form accurately is vital to ensure compliance and avoid potential legal repercussions. Here’s a step-by-step guide to assist individuals and organizations in the process.

Common pitfalls to avoid include misreporting information and failing to provide required documentation. pdfFiller can facilitate the process by enabling users to edit and sign their forms efficiently in the cloud, which enhances accessibility.

Navigating unique situations in financial disclosure

Certain unique situations may complicate the financial disclosure process. For freelancers and independent contractors, the necessity of detailed disclosures can fluctuate significantly based on income variability and the nature of contracts.

Moreover, individuals with complex financial situations—such as numerous investments, partnerships, or business interests—may need to take extra caution when filling out disclosure forms to ensure all aspects are accurately represented. In cases of uncertainty, seeking professional assistance from accountants or legal advisors can be beneficial to navigate the complexities.

Modifying and updating financial disclosure forms

Financial circumstances are often dynamic, necessitating regular updates to disclosure forms. Individuals must be proactive in tracking changes to their financial status, such as acquiring new assets or incurring debts. Updating one’s disclosure form can help maintain compliance and uphold financial integrity.

Utilizing tools like pdfFiller makes editing and version control seamless. Users can compare different versions of their forms easily and collaborate with team members for accurate reporting. This aids in ensuring that all updates are made efficiently and with minimal risk of error.

Signing and submitting financial disclosure forms

Once a financial disclosure form is completed, the next step is signing and submitting it. The legality of electronic signatures is widely recognized, so using electronic signing tools can streamline the submission process. Best practices suggest ensuring that the form is signed just before submission to avoid any last-minute changes.

Common questions and troubleshooting

Navigating financial disclosure forms can lead to several questions and potential issues. In case of errors made after submission, the typical recourse is to submit a corrected form that highlights the previous error explicitly.

Individuals may also need access to previously submitted forms, which can usually be requested from the relevant regulatory body or accessed via a secure document management solution like pdfFiller. For further assistance or specific compliance questions, reaching out to support through pdfFiller’s platform can provide needed clarity.

Advanced features and tools available on pdfFiller

pdfFiller offers a range of advanced features for form completion and management. For instance, interactive tools facilitate the user experience by guiding through the filling process, ensuring compliance is met effortlessly.

Collaboration features encourage teamwork, allowing multiple users to edit and review forms simultaneously. The integrated e-signature feature further expedites the processing of these documents, making pdfFiller an invaluable resource for managing financial disclosure forms efficiently.

Case studies and examples

Several case studies demonstrate the advantages of maintaining accurate financial disclosure. For example, individual applicants for government positions who effectively managed their disclosures often experienced smoother vetting processes, which enhanced their credibility.

Similarly, corporations that adhered to transparent financial disclosure practices often reaped benefits such as increased investor confidence and reduced legal risks. Using pdfFiller in these scenarios can streamline the process, ensuring that all necessary disclosures are made accurately and promptly.

Legal and ethical considerations

Financial disclosures carry significant legal implications. Failure to disclose required information or misrepresentation of financial data can result in severe penalties, including fines and reputational damage.

Moreover, ethical considerations surrounding financial transparency are vital across various sectors. Individuals and organizations must recognize their accountability, as stakeholders increasingly demand integrity and transparency in financial dealings. Upholding these standards not only protects against legal repercussions but also builds trust with constituents and the public.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find financial disclosure?

How do I make edits in financial disclosure without leaving Chrome?

How can I edit financial disclosure on a smartphone?

What is financial disclosure?

Who is required to file financial disclosure?

How to fill out financial disclosure?

What is the purpose of financial disclosure?

What information must be reported on financial disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.