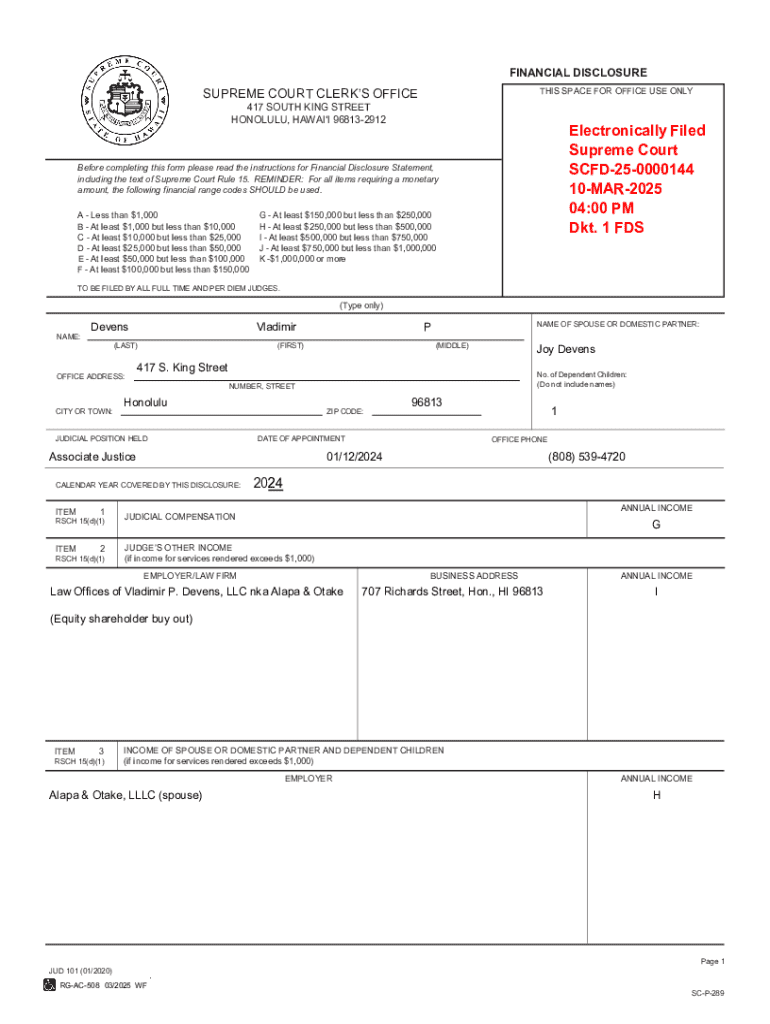

Get the free Financial Disclosure

Get, Create, Make and Sign financial disclosure

How to edit financial disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure

How to fill out financial disclosure

Who needs financial disclosure?

A Comprehensive Guide to Financial Disclosure Forms

Understanding financial disclosure forms

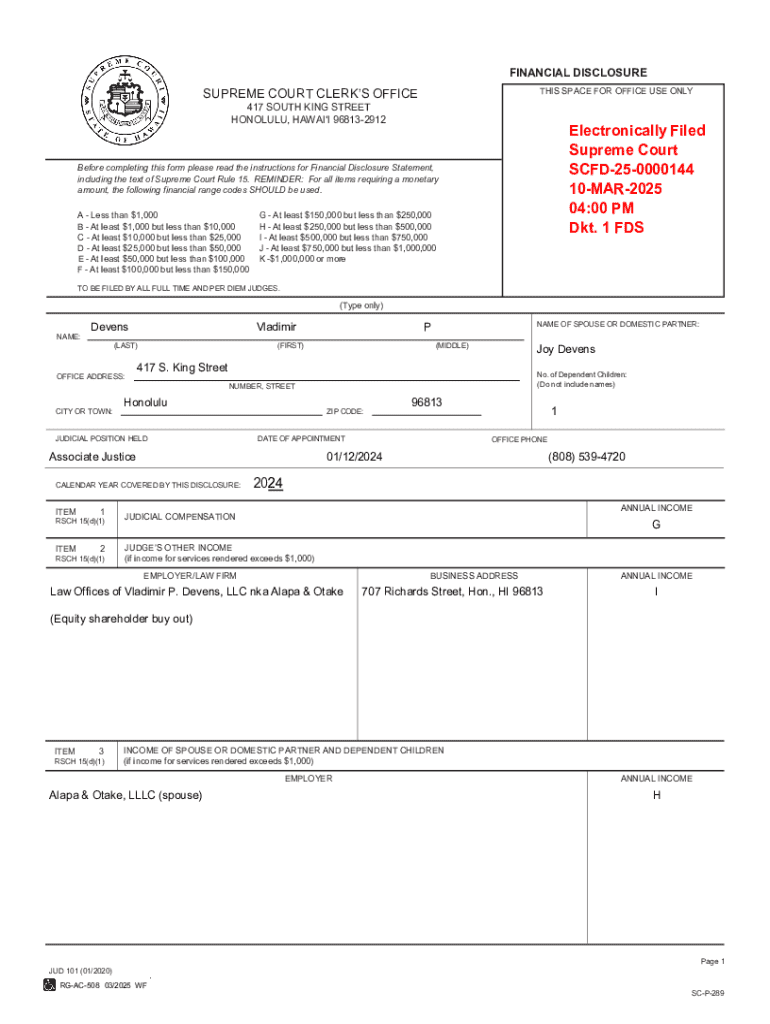

Financial disclosure forms are essential documents that require individuals or organizations to disclose their income, assets, debts, and financial transactions. The primary purpose of these forms is to promote transparency and mitigate conflicts of interest, ensuring that individuals are held accountable for their financial dealings.

For both individuals and organizations, financial disclosure forms serve as a critical mechanism for maintaining integrity in various sectors. They are commonly used in government, non-profit, and corporate settings to evaluate the financial standing of a person or entity. Common scenarios requiring financial disclosure include applications for government positions, public office, and certifications for certain professions.

Types of financial disclosure forms

There are several types of financial disclosure forms, each tailored to specific requirements based on the respondent's status—be it personal, business, or regulatory. These can broadly be classified into personal financial disclosures and financial disclosures for business entities.

Key information required on financial disclosure forms

Completing a financial disclosure form accurately is vital. The form typically requires a range of personal information and financial data to ensure full disclosure of an individual’s or organization’s fiscal health. This includes personal identification details, employment information, assets, and debts.

Step-by-step guide to completing a financial disclosure form

Filling out a financial disclosure form may seem daunting, but breaking it down into manageable steps can simplify the process significantly. Here’s a detailed approach to ensure accuracy.

Editing and managing your financial disclosure form

Once your financial disclosure form is completed, managing it effectively is essential, especially for future updates or corrections. A digital management solution can significantly ease this process.

Submitting your financial disclosure form

Once your financial disclosure form is complete and reviewed, you're ready to submit it. Different submission methods have options that cater to various needs.

Common questions and troubleshooting

Even after thorough preparation, questions or issues may arise while dealing with financial disclosure forms. Here are some frequently asked questions and common troubleshooting advice.

Legal and ethical considerations

Filing a financial disclosure form isn’t merely a procedural task; it carries significant legal and ethical responsibilities. Understanding these dynamics is essential.

Additional considerations for specialists

Certain professionals, such as politicians or real estate agents, face unique financial disclosure regulations that demand heightened scrutiny.

Tools and resources for managing financial disclosure

In today’s digital world, leveraging technology can facilitate the efficient handling of financial disclosure forms. Utilizing interactive tools streamlines the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure to be eSigned by others?

How do I make edits in financial disclosure without leaving Chrome?

Can I edit financial disclosure on an iOS device?

What is financial disclosure?

Who is required to file financial disclosure?

How to fill out financial disclosure?

What is the purpose of financial disclosure?

What information must be reported on financial disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.