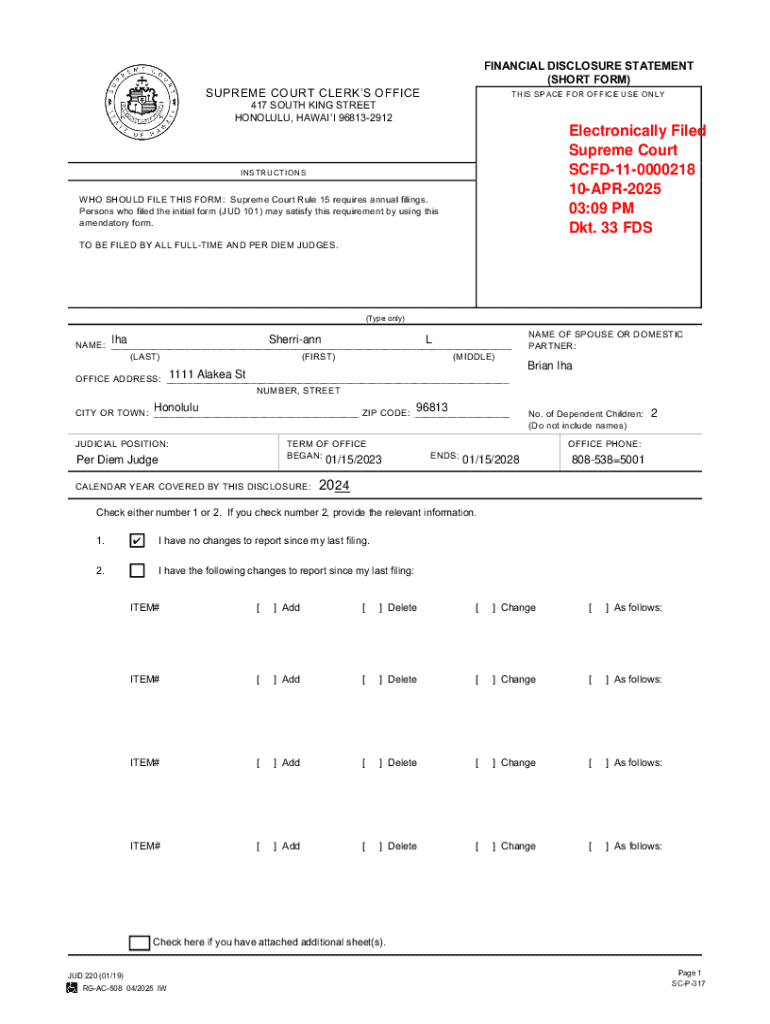

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

Editing financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Financial Disclosure Statement Short Form: How-to Guide

Understanding financial disclosure statements

Financial disclosure statements are formal documents that individuals or organizations use to disclose their financial interests. These statements serve as a tool to promote transparency and ethical behavior among stakeholders, including employees, shareholders, and the general public. By laying bare potential financial conflicts and interests, these forms drive integrity in governance and business practices.

The importance of financial disclosure cannot be overstated. In various sectors, such as government, corporate, and non-profit organizations, the act of disclosing financial information builds trust and ensures accountability. For instance, public officials are often required to submit financial disclosures to confirm that their decisions are not influenced by personal financial benefits. Similarly, corporations use financial disclosures to reassure shareholders and investors of their operational integrity and commitment to ethical standards.

Overview of the short form

The financial disclosure statement short form is a condensed version of the traditional financial disclosure statement. It aims to capture essential financial information in a more accessible format, which can be particularly useful for individuals or organizations with less complex financial situations.

Key differences between full and short forms lie primarily in the level of detail required. While a full financial disclosure statement may require exhaustive and detailed information on various assets, liabilities, and financial interests, the short form offers a simpler alternative that emphasizes only critical data. This efficiency in documentation can be indispensable, especially when filing deadlines are tight.

Essential components of the short form

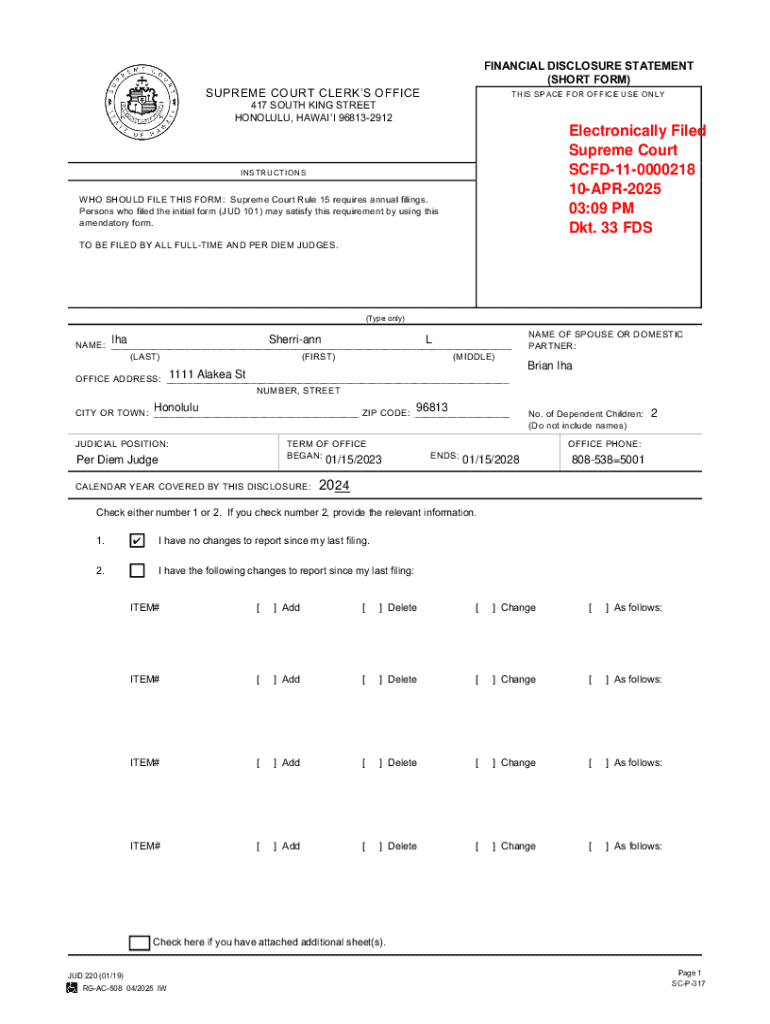

Completing a financial disclosure statement short form requires careful attention to several key components. Initially, personal information such as name, contact details, and employment information must be provided. This baseline data is crucial for identifying the disclosing party and ensuring that the disclosures are accurately attributed.

Next, the financial data you disclose must include sources of income, assets, liabilities, and any investments or financial interests. This information paints a comprehensive picture of your financial status and helps mitigate any potential conflicts of interest.

Step-by-step guide to completing the short form

To ensure a smooth experience while filling out a financial disclosure statement short form, begin by preparing adequately. Gather all necessary documents that provide relevant financial information, including pay stubs, investment statements, and property valuations. Familiarizing yourself with legal terminology associated with financial disclosures can also streamline the completion process.

When filling out the form, ensure you report your personal information accurately. Detail each aspect of your financial holdings correctly, being mindful of any potential variations in values. Once you have completed the form, take a moment to finish the declaration section, affirming that the information provided is true to your knowledge. Throughout this process, it is vital to avoid common mistakes such as omitting key data or incorrectly estimating the value of assets.

Lastly, review for accuracy, double-checking all entries to ensure completeness. Confirming compliance with relevant regulations and standards is critical, particularly as it can protect you from potential legal implications.

Best practices for editing and managing the short form

Effective document management can simplify the process of creating, editing, and storing your financial disclosure statement short form. Platforms like pdfFiller offer tools specifically designed for easy editing. It allows users to make changes quickly, which is beneficial for ensuring that information remains current and accurate.

Utilizing electronic signing features adds an extra layer of convenience, eliminating the need for physically printing documents before signing. For teams, collaboration is vital — pdfFiller’s platform allows for secure sharing of documents, making it easy to collaborate and collect feedback from colleagues before finalizing submissions.

Common pitfalls and how to avoid them

Filing a financial disclosure statement short form is not without its hurdles. One of the most significant risks is insufficient disclosure, which can lead to legal ramifications and damage reputations. Consequently, it’s essential to provide all required information, ensuring that every aspect of your financial profile is fully represented.

Another common pitfall is misunderstanding specific requirements dictated by state or agency regulations. Each jurisdiction can have unique guidelines concerning financial disclosures, and being unaware of these can lead to inaccuracies that may affect filings adversely. Technical issues with document submission, such as formatting errors or compatibility problems, can also impede successful submissions.

Frequently asked questions (FAQs)

The query of who needs to file a financial disclosure statement typically falls on public officials, employees in regulatory positions, and corporate executives, among others. Depending on local laws, various occupations may also require compliance with filing these statements. Thus, it’s critical to understand who is obligated to disclose their financial interests.

Missed deadlines for filing often result in penalties and administrative repercussions. It's essential to remain aware of the timelines for submission to avoid these scenarios. In the event of any inaccuracies or changes to your financial situation after submission, several jurisdictions allow for amendments of financial disclosure statements, which helps maintain the integrity of the filed information.

Conclusion: empowering financial transparency

Accurate financial disclosures are vital for maintaining trust and transparency within any organization or governance structure. The financial disclosure statement short form simplifies the process while ensuring the key points of financial standing are still captured. By understanding how to effectively complete this form, individuals and organizations can manage their financial obligations confidently.

Encouraging proactive financial management leads to better decision-making and strengthens compliance with relevant regulations. pdfFiller stands out as a robust solution for editing, signing, and managing documents, enabling users to focus on their financial responsibilities without the stress of cumbersome paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial disclosure statement short without leaving Google Drive?

Where do I find financial disclosure statement short?

Can I sign the financial disclosure statement short electronically in Chrome?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.