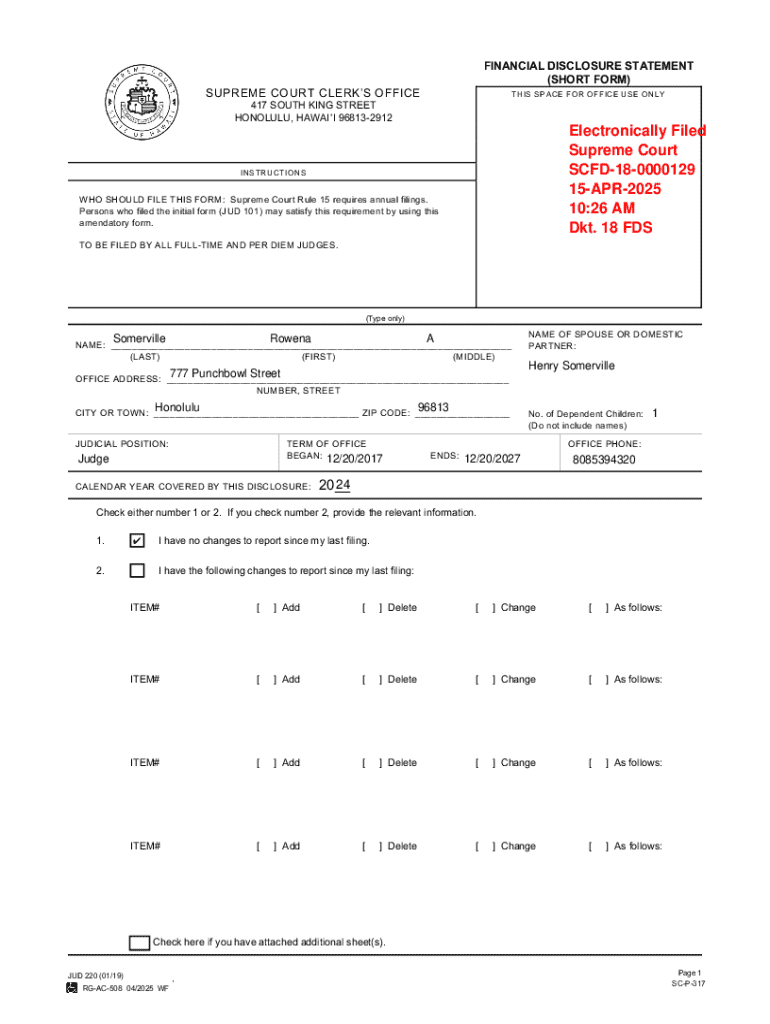

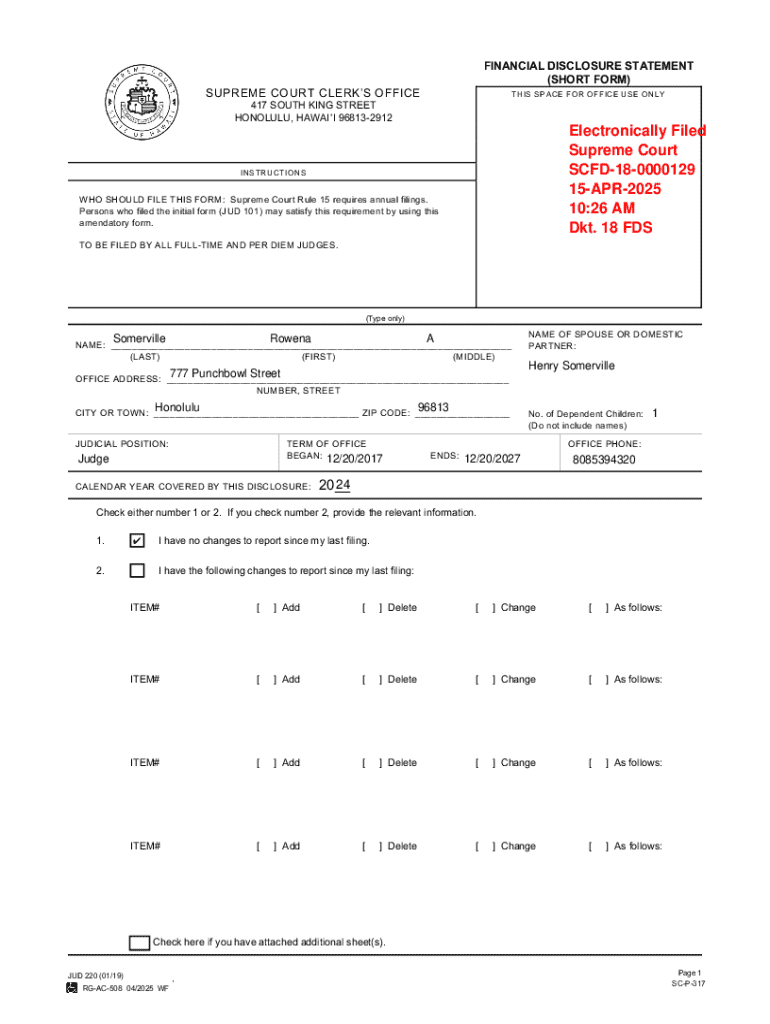

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

A comprehensive guide to the financial disclosure statement short form

Understanding the financial disclosure statement short form

A financial disclosure statement short form is a simplified document that outlines an individual’s or entity's financial position. It serves as a less cumbersome alternative to the comprehensive financial disclosure statement, primarily designed to collect essential information for various legal, financial, and regulatory purposes.

The primary purpose of this short form is to facilitate quick assessments of financial status without overwhelming the filer with extensive details. It's typically employed in contexts like divorce proceedings, public office applications, or loan applications where a full financial disclosure may not be immediately necessary.

Key differences between the short form and standard form involve the breadth and depth of information each requires. The standard form encompasses exhaustive details about income sources, assets, liabilities, and expenses, while the short form highlights the most pertinent financial aspects.

When to use the financial disclosure statement short form

The financial disclosure statement short form is useful in various scenarios. For instance, in divorce proceedings, the short form may suffice for initial asset identification or income verification before the complete financial picture is necessary.

Individuals or entities who typically need to fill out this form include those seeking loans, engaging in legal disputes, or applying for public office positions. Each situation often demands a snapshot of one’s financial status rather than a detailed report.

The benefits of using the short form over longer versions include reduced complexity and quicker processing times, allowing individuals to complete their submissions more efficiently.

How to complete the financial disclosure statement short form

Completing the financial disclosure statement short form begins with gathering necessary information. You need to collect personal identification details, income sources and amounts, and a declaration of your assets. Having this information readily available can make the process much smoother.

Gathering necessary information

Once you've gathered the necessary information, proceed with filling out the form section by section. Pay careful attention to provide accurate figures and descriptions.

Step-by-step instructions for filling out the form

Begin with the personal identification section, ensuring all details are correct. Next, accurately list your income and follow with your assets. Ensure you review each of your entries. A common mistake to avoid is underreporting income or misrepresenting asset values, as inaccuracies can have significant implications.

Utilizing pdfFiller tools for form completion

pdfFiller offers dynamic tools for editing your financial disclosure statement short form. You can easily fill in your information, edit existing content, and sign the document electronically. It also features collaboration tools, allowing others to review or assist in completing the form, ensuring greater accuracy and efficiency.

Legal considerations surrounding financial disclosure

Understanding privacy and confidentiality is crucial when dealing with financial disclosure statements. Information submitted could be sensitive, so ensuring that your data is protected is paramount. Legal standards may require you to disclose certain information, but remember to safeguard your personal details from being unnecessarily exposed.

The consequences of inaccurate disclosures can be severe, ranging from financial penalties to legal repercussions. In some cases, willful misrepresentation of financial information can lead to charges of fraud.

In complex situations, or if you're uncertain about what to disclose, it's advisable to seek legal advice. Professional guidance can help ensure that your disclosure aligns with legal obligations and best practices.

Submitting your financial disclosure statement short form

Once you've accurately filled out the financial disclosure statement short form, you need to submit it. The most common methods of submission are electronic and paper submissions. Depending on the specific requirements of the receiving party, one method may be preferable to the other.

Available submission methods

Utilizing pdfFiller for secure electronic submission enhances the process. This tool allows you to send your filled forms without concerns about privacy or unauthorized access. After submission, always track your submission status to ensure it has been received.

Managing your financial disclosure statement

After submission, it's critical to manage your financial disclosure statement effectively. Storing your form securely is imperative. Utilize secure storage solutions that keep your data safe from unauthorized access or breaches.

If there are changes in your financial situation post-submission, you may need to update your disclosure. Understanding the process for making changes is equally important as your initial submission. Be mindful that additional disclosures may also be necessary if your financial situation changes significantly.

Interactive tools available on pdfFiller

pdfFiller not only simplifies the filling of forms but also enhances the overall user experience with various interactive tools. The document editor allows users to make modifications to the form with ease, ensuring accuracy.

eSignature solutions within pdfFiller streamline the signing process, making it convenient to obtain necessary signatures electronically. Collaboration with team members is also facilitated, resulting in a cohesive effort in documentation management.

Frequently asked questions (FAQs)

One of the most common questions is what to do if you forget a piece of information while completing the form. In such instances, it's advisable to make a note of the missing details and provide them as soon as possible to avoid delays.

Another frequent concern is whether there are deadlines for submission. Depending on the context—such as divorce proceedings or loan applications—specific deadlines may apply; check with relevant authorities to ensure you're compliant.

Lastly, individuals often wonder how often they need to update their financial disclosure. Generally, significant life changes like job loss, new income sources, or substantial asset purchases merit an update to maintain accuracy.

Best practices for successful financial disclosure

To ensure a successful financial disclosure, accuracy in information is vital. Double-check figures and report all financial matters honestly to avoid complications. Transparency in your disclosure can foster trust, especially in legal contexts.

Maintaining records of your submission is also key. Keeping copies of your financial disclosure statement allows you to reference it in future dealings or updates. This practice not only helps with maintaining consistency in your disclosures but also aids in tracking any changes over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial disclosure statement short without leaving Google Drive?

How can I send financial disclosure statement short to be eSigned by others?

How can I get financial disclosure statement short?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.