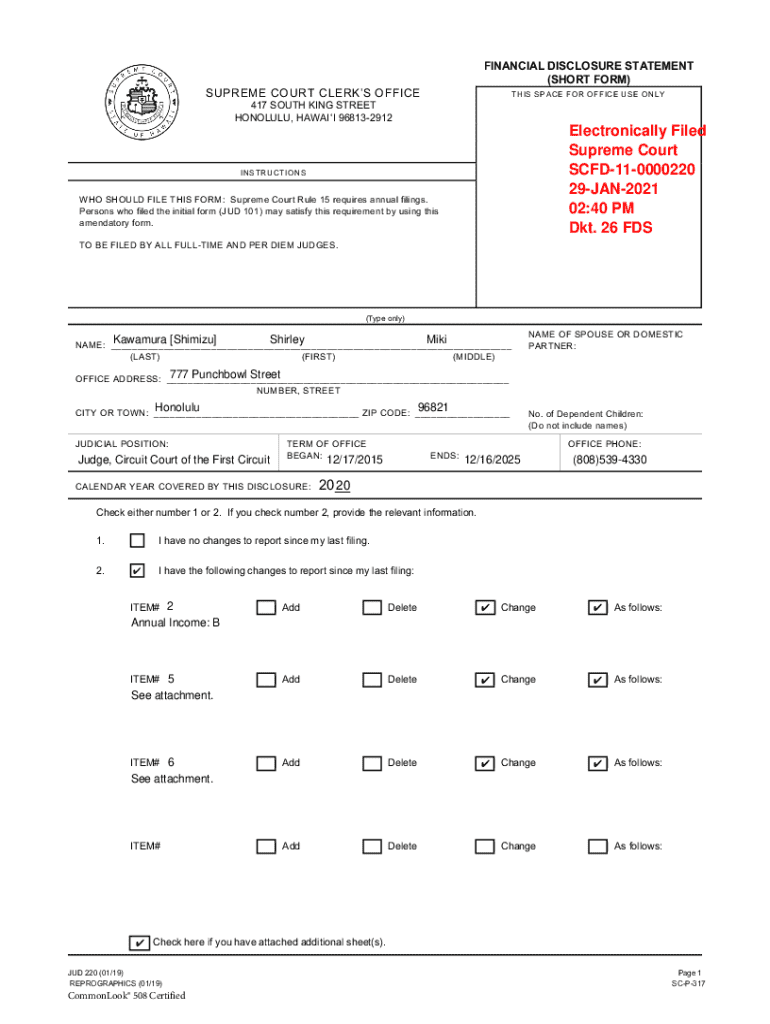

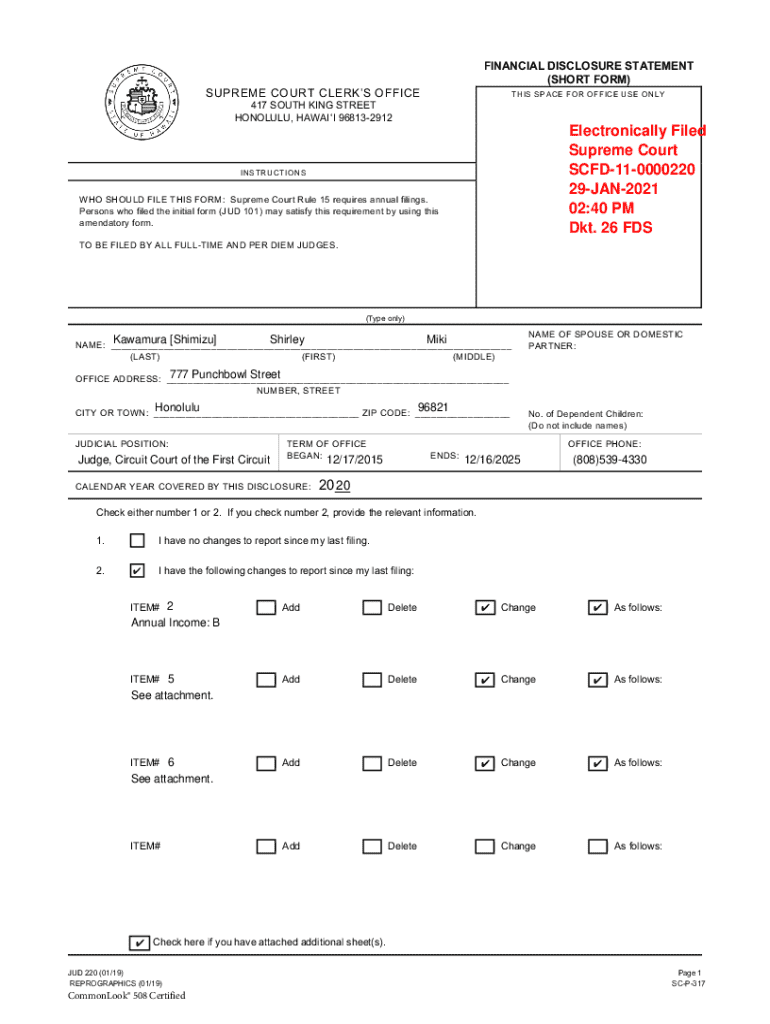

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Financial Disclosure Statement Short Form: How-to Guide

Understanding financial disclosure statements

A financial disclosure statement is a crucial document that outlines an individual's or organization's financial interests, assets, liabilities, and income sources. Its primary purpose is to ensure transparency and prevent conflicts of interest. This is particularly important for public officials, business executives, and non-profit organizations where accountability is paramount. The short form of this statement simplifies the process, allowing users to present essential information in a concise manner.

The importance of financial disclosure statements extends beyond compliance; they foster trust among stakeholders. For individuals or organizations, having a clear understanding of one's financial standing can also aid in financial planning and strategy.

Key components of financial disclosure statements

A financial disclosure statement includes several key components designed to give a full picture of an individual's financial situation. Typically, the document may feature personal information, income sources, assets and liabilities, and any other financial interests. Understanding these elements is crucial for accurate reporting and compliance with legal standards.

Regulations often dictate what needs to be disclosed and can vary by jurisdiction. Therefore, it's essential to familiarize oneself with local compliance requirements. Common components include:

Benefits of using the short form

Choosing a short form for a financial disclosure statement can be advantageous in several scenarios. The primary benefit lies in its simplicity, which allows users to focus on the essential information without becoming overwhelmed by unnecessary details. This brevity is particularly useful for individuals or teams who may not have complex financial situations.

Moreover, short forms are ideal for contexts where quick review and clarity are required, such as in preliminary stages of team assessments or for individuals who are reporting straightforward financial details.

Preparing to fill out the financial disclosure statement short form

Before you begin completing a financial disclosure statement short form, it is crucial to gather all necessary financial information. This includes up-to-date details on your income, assets, liabilities, and any other relevant financial interests. Proper organization of information will streamline the process and improve accuracy.

In addition to gathering numerical data, it's helpful to collect supporting documents. This might include tax returns, bank statements, and other financial records that corroborate your entries on the form. Being prepared will not only expedite the process but also enhance transparency in your disclosures.

Understanding your obligations

Completing a financial disclosure statement comes with legal obligations that must be understood and respected. It's essential to know the regulations applicable to your situation, including deadlines for submission and the specifics of what needs to be disclosed. This is especially true for public officials or corporate executives who may face stricter scrutiny.

Moreover, accuracy and transparency are non-negotiable. Falsifying information can lead to severe consequences, including legal penalties and reputational damage. Therefore, it is critical to approach this task with diligence and integrity.

Step-by-step instructions for completing the form

To successfully fill out the financial disclosure statement short form, start with accessing the document. The pdfFiller platform provides a simple way to obtain this form online, allowing users to seamlessly navigate through the required sections.

Once you've accessed the document, you can begin entering your information. It’s wise to approach the process methodically, which includes filling out each section in detail. Key areas to focus on include:

To maximize accuracy, utilize pdfFiller’s editing and collaboration tools, which help ensure that your financial details are properly documented and verified.

Utilizing pdfFiller’s tools

pdfFiller offers various features designed to enhance the efficiency of managing your financial disclosure statement. One of the standout features includes the ability to edit your PDF with ease, allowing users to make changes quickly as financial situations evolve.

E-signing tools enable a seamless signing experience, eliminating the need to print and scan documents. Additionally, collaboration features allow team members to review and co-edit the document allowing for smoother teamwork processes.

Common pitfalls to avoid

Completing a financial disclosure statement can pose several challenges, mainly related to data entry. Common errors include slipping up on numerical entries, neglecting to disclose certain assets, or providing outdated information. To prevent these mistakes, remain vigilant throughout the completion process.

Double-checking your entries can help catch errors before submission, safeguarding against possible implications of non-compliance. It is also important to stay attuned to reporting standards and any changing regulations that could affect your disclosures.

Managing your financial disclosure statement

Once the financial disclosure statement short form is submitted, it’s essential to keep track of any updates or changes to your financial situation. Keeping your document current is vital for maintaining compliance and preserving transparency. The financial landscape can change quickly, and your disclosures should reflect an accurate picture.

Through pdfFiller, revising your statement is straightforward. You can access your document at any time, make the necessary updates, and resubmit as required. Knowing when and how often to revise depends largely on your financial changes, whether there’s a significant life event or a shift in income.

When and how to resubmit

Understanding the timeline for updates to your financial disclosure statement is crucial. Typically, resubmission may be required annually or following any significant changes in your financial situation. Knowing when these updates are necessary can save you from potential fines or legal complications that arise from outdated disclosures.

Through pdfFiller, the resubmission process is streamlined. Simply edit your existing form to incorporate the necessary changes and follow the submission guidelines specific to your jurisdiction.

Privacy and security considerations

Given that financial disclosure statements contain sensitive data, protecting this information should be a top priority. It’s crucial to take steps to safeguard your personal and financial data from unauthorized access. This not only ensures compliance with privacy regulations but also builds trust with stakeholders.

pdfFiller incorporates several security measures, such as encryption and access controls, to help secure your documents. Utilizing these features is a smart move in protecting your sensitive financial information.

Legal implications of data handling

Understanding data privacy laws applicable to financial disclosures is imperative. Users must be aware of their responsibilities in document management, particularly regarding how financial information is shared and stored. Non-compliance with data privacy regulations can lead to significant legal issues.

Users should familiarize themselves with local ethical standards and compliance obligations connected to financial disclosures. Ensuring the proper management of personal data not only adheres to the law but also protects individual reputations.

Frequently asked questions (FAQs)

Clarifying common confusions can help users navigate the financial disclosure statement short form effectively. Many individuals may wonder about the specific requirements or the implications of incomplete disclosures. Addressing these concerns promotes better understanding and compliance.

Additionally, it is beneficial to provide strategies for managing disclosures over the long term, utilizing pdfFiller as an ongoing resource for precise documentation.

Exploring additional features of pdfFiller

Beyond the financial disclosure statement short form, pdfFiller provides access to a wide array of other forms and templates that individuals and teams can utilize to enhance their documentation needs. This versatility allows users to streamline various processes, taking advantage of pre-designed templates for efficiency.

Moreover, the platform encourages team collaboration, making it a perfect solution for organizations that rely on multiple users accessing and updating documents. Features supporting teamwork enhance productivity and ensure that all members remain informed and aligned in their documentation efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit financial disclosure statement short from Google Drive?

Can I create an electronic signature for signing my financial disclosure statement short in Gmail?

How do I edit financial disclosure statement short straight from my smartphone?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.