Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Comprehensive Guide to the Financial Disclosure Statement Form

Understanding financial disclosure statements

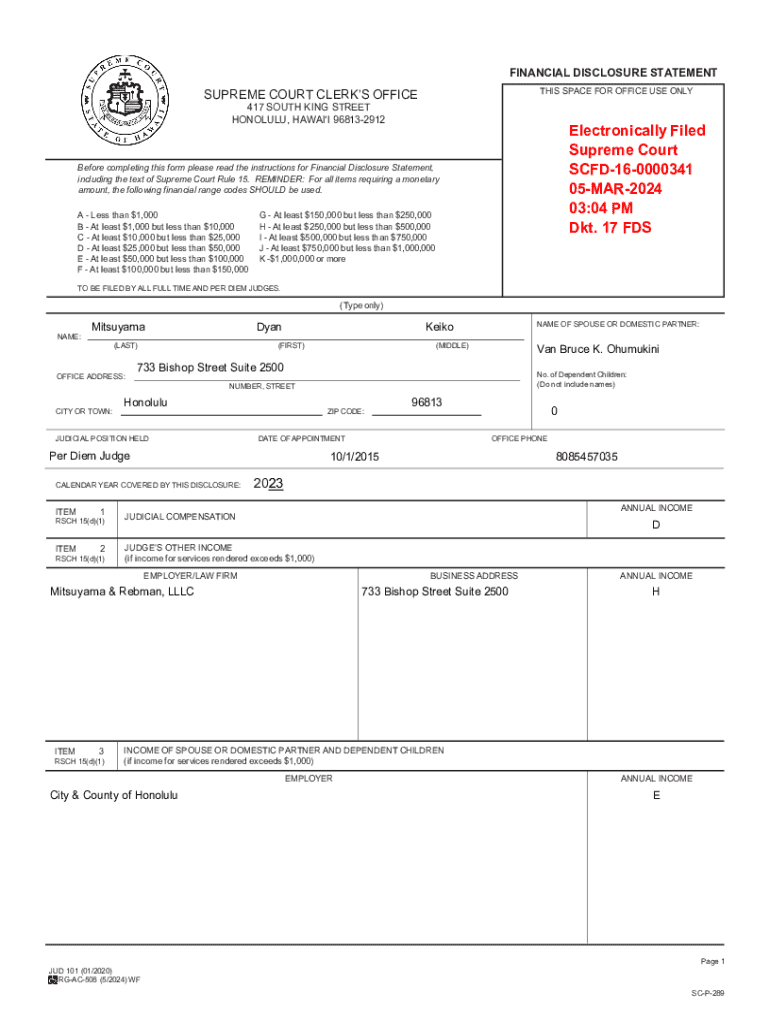

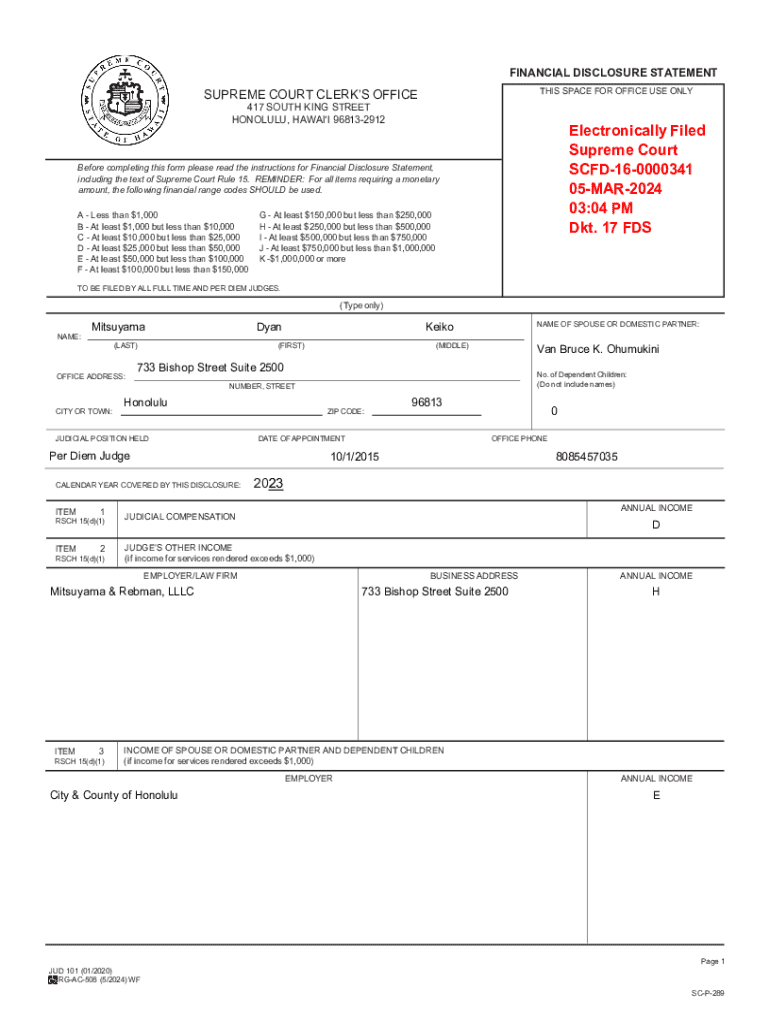

A financial disclosure statement form serves as a formal declaration of an individual’s financial status. It provides a detailed account of one's assets, liabilities, and income sources. The fundamental purpose of this form is to promote transparency in financial matters, especially for public officials and employees in sensitive positions. By disclosing financial information, individuals help establish trust and accountability in their roles, particularly where conflicts of interest could arise.

Moreover, the importance of financial disclosure statements extends beyond personal ethics; they are often mandated by law in various jurisdictions. This regulation underscores the need for individuals and organizations to comply with legislative requirements, ensuring comprehensive oversight and protection against corruption.

Who needs to file a financial disclosure statement?

Understanding the categories of individuals required to file a financial disclosure statement can clarify any confusion. Typically, filers include public officials, government employees, and sometimes even those in private organizations with significant influence or control. This requirement may vary significantly depending on local, state, or federal jurisdiction.

Each jurisdiction may have specific requirements and deadlines for submission, making it crucial for individuals to familiarize themselves with local laws to ensure compliance.

Key components of a financial disclosure statement

Every financial disclosure statement form includes key components necessary for a comprehensive overview of an individual's financial situation. At the core of the statement, you will typically find sections dedicated to assets, liabilities, and income sources. These components allow for an accurate portrayal of one's financial dealings.

By meticulously filling out these sections, filers help authorities assess potential conflicts of interest and maintain the integrity of their position.

Steps to fill out the financial disclosure statement form

To streamline the process of filling out the financial disclosure statement form, it’s recommended to start by gathering all necessary information. This preparation not only saves time but also reduces the likelihood of error. Essential documents often include bank statements, tax returns, and records of assets and liabilities.

Once all information is compiled, it's time to complete the form. Here’s a step-by-step guide to assist you.

Completing the form

Filling out the financial disclosure statement involves several sections, including assets, liabilities, and income.

Assets section

In this section, you’ll detail properties such as homes or vehicles, financial investments, and savings accounts. It’s important to assess the current value of these assets for an accurate portrayal.

Liabilities section

Here, report all outstanding debts, including loans and credit obligations. Provide precise figures to reflect your financial responsibilities.

Income section

List all forms of income, including salaries, investments, and any side businesses. This transparency helps maintain accountability.

After filling out the sections, reviewing your statement for accuracy is paramount. Check for common mistakes such as incorrect figures, missed entries, or inconsistent information.

Editing and enhancing your financial disclosure statement

Using pdfFiller can greatly enhance your experience when managing financial disclosure statements. With its document management features, users can edit their forms seamlessly, ensuring that every detail is correct before submission. The platform allows for easy modifications, so you can update your statements as your financial situation evolves.

Moreover, adding signatures and annotations electronically has simplified the process significantly. Electronic signatures save time and facilitate paperless transactions. pdfFiller provides step-by-step instructions to guide users on how to integrate signatures and include notes for clarity.

Submitting your financial disclosure statement

Understanding submission guidelines is critical to ensuring your financial disclosure statement is appropriately filed. Depending on your location and organization, submission methods may vary. Most jurisdictions allow for both online and paper submissions, but the deadlines for each can differ, making it essential to verify timelines.

Once submitted, it’s advisable to confirm successful submission. Tracking the status of your financial disclosure statement provides peace of mind and should ideally include obtaining a confirmation receipt from the respective authority.

Managing your financial disclosure statements

Proper management of your financial disclosure statements ensures both compliance and readiness for future examinations. Storing your documents safely is crucial, particularly in a digital format. Utilizing cloud-based solutions such as pdfFiller allows for easy access and organization of your documents.

Updating your financial disclosure statement promptly after any significant changes in your financial situation, such as acquiring new assets or changes in income, is vital. Regular assessments will keep your records current and compliant with regulations.

Resources and tools for financial disclosure statements

pdfFiller is equipped with several interactive tools designed to aid in filling out, editing, and submitting financial disclosure statements. Users can access a variety of templates and features that enhance the document creation process, significantly promoting efficiency.

Additionally, users often have questions regarding the process. pdfFiller offers a comprehensive FAQ section addressing common inquiries about filing financial disclosure statements. Furthermore, detailed tutorials and user guides are available to help navigate any complexities involved.

Best practices for transparent financial disclosure

Maintaining a high level of transparency through accurate financial disclosure is essential for upholding ethics and compliance in any role. Individuals should recognize the impact of their disclosures on public trust and accountability. Regular updates to your documents reflect a commitment to responsible financial practices.

By adopting these best practices, individuals can navigate the complexities of financial disclosures while reinforcing their integrity and commitment to transparency.

Legal considerations surrounding financial disclosure statement forms

Understanding the legal landscape surrounding financial disclosure statements is essential for compliance. Failing to file or misrepresenting information can lead to severe penalties, ranging from fines to criminal charges, depending on jurisdiction.

Conversely, filers have rights that protect their disclosures, including confidentiality protections that prevent unauthorized access to sensitive information. Understanding these rights can empower individuals and promote a culture of compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find financial disclosure statement?

How do I edit financial disclosure statement online?

Can I create an electronic signature for the financial disclosure statement in Chrome?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.