Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

How to edit financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form: A How-to Guide

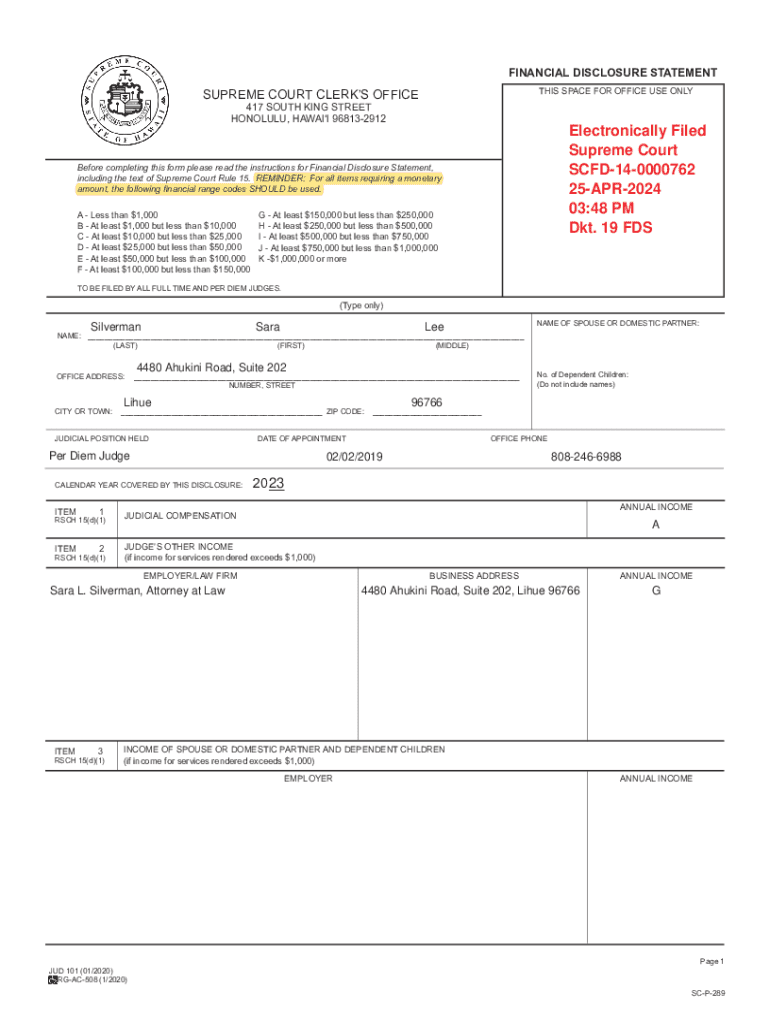

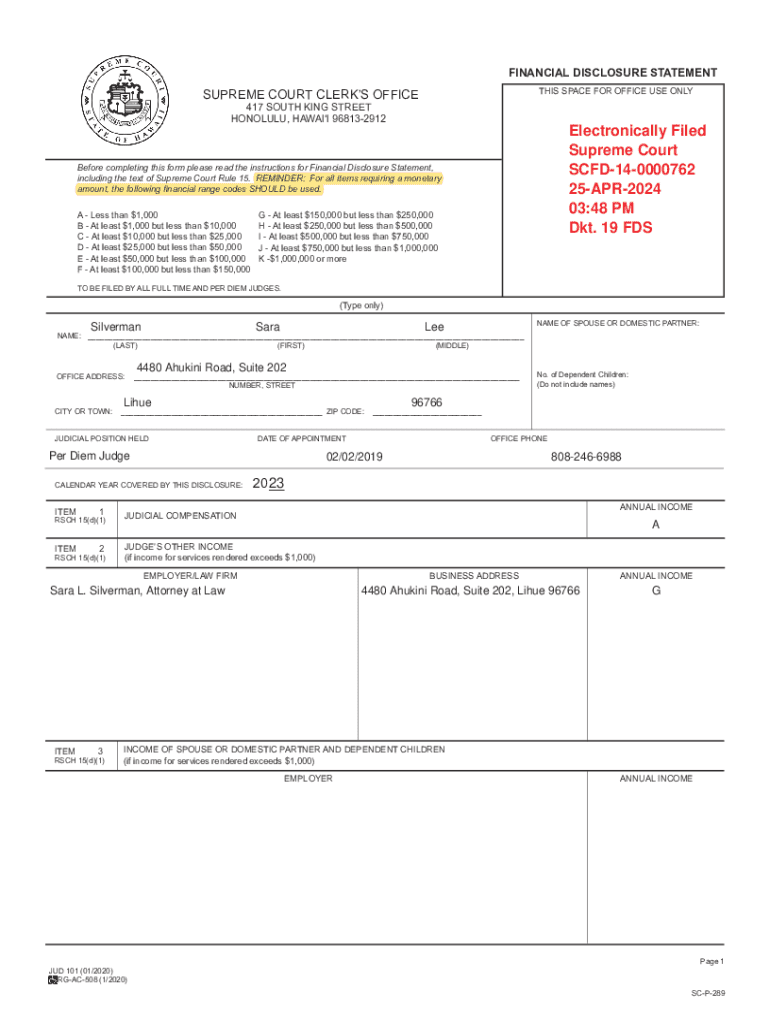

Overview of the financial disclosure statement form

A financial disclosure statement form is a critical document that provides a clear representation of an individual’s or organization’s financial standing. This form typically outlines various aspects of income, assets, and liabilities, ensuring transparency and compliance with regulatory standards. The importance of financial disclosure in contexts such as government employment, public office candidacy, or business dealings cannot be overstated, as it helps in preventing conflicts of interest and fosters trust among stakeholders.

In many cases, individuals such as public officials, candidates for political office, and certain employees in sensitive positions are required to file a financial disclosure statement. The aim is to provide essential insights into their financial dealings, ensuring accountability and ethical governance.

Understanding the components of the form

The financial disclosure statement consists of several key components designed to capture an individual's complete financial picture. A thorough understanding of each section is crucial for accurate reporting and compliance. Here’s a breakdown of the principal sections of the form:

Familiarity with common terminology and definitions in financial disclosures is essential to avoid confusion and misinformation. Knowing terms like 'net worth' or 'liquid assets' can significantly aid in accurately completing the form.

Step-by-step instructions for completing the form

Successfully completing the financial disclosure statement form requires careful preparation and attention to detail. Here’s a step-by-step guide to assist you throughout the process.

Editing and customizing your financial disclosure statement

Once you have completed the initial draft of your financial disclosure statement form, utilizing pdfFiller’s editing tools can significantly streamline your review process. Here’s how you can effectively edit and customize your disclosure:

Editing your form in a compliant manner not only ensures accuracy but also enhances your document’s professionalism, particularly when submitting to authorities or stakeholders.

Signing the financial disclosure statement

After completing and reviewing your financial disclosure statement form, signing it is the next vital step. The process of adding your signature has evolved with technology, making it simpler and legally binding through electronic signatures.

Collaborating on your financial disclosure

Collaboration is often necessary, especially when multiple individuals contribute to the financial disclosure statement. Utilizing features like shared access in pdfFiller fosters teamwork and enhances accuracy.

Managing your financial disclosure statements

Once your financial disclosure statements are completed and signed, implementing effective management practices is crucial to maintain an organized record. Here are strategies for securely managing your documents:

Proper management of financial disclosure statements not only streamlines future amendments but also reinforces accountability in ongoing financial matters.

Frequently asked questions (FAQs)

Navigating the processes associated with financial disclosure statements may lead to questions. Here are some frequently asked questions that can help clear up any uncertainties:

The advantages of using pdfFiller for financial disclosures

Utilizing pdfFiller for managing your financial disclosure statement form offers distinct advantages. As a cloud-based document management solution, it facilitates seamless handling of your forms from any location.

Making the switch to a digital platform like pdfFiller not only modernizes your document processes but also enhances overall efficiency in managing financial disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial disclosure statement directly from Gmail?

How do I make changes in financial disclosure statement?

How do I complete financial disclosure statement on an Android device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.