Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

How to edit financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Comprehensive Guide to the Financial Disclosure Statement Form

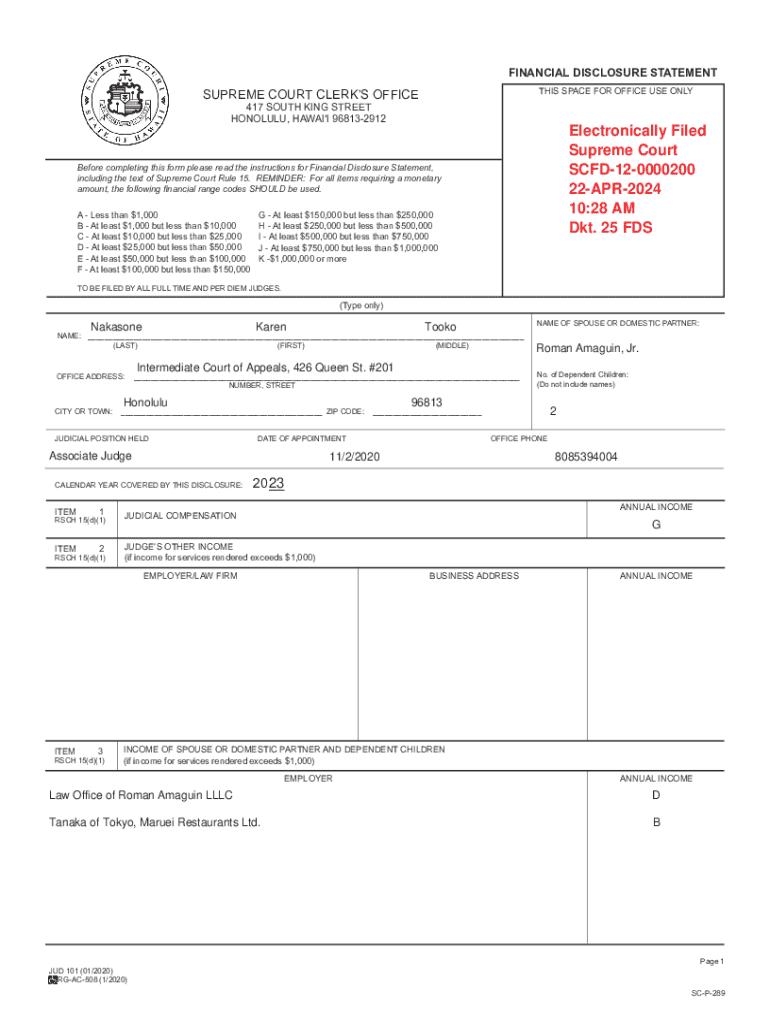

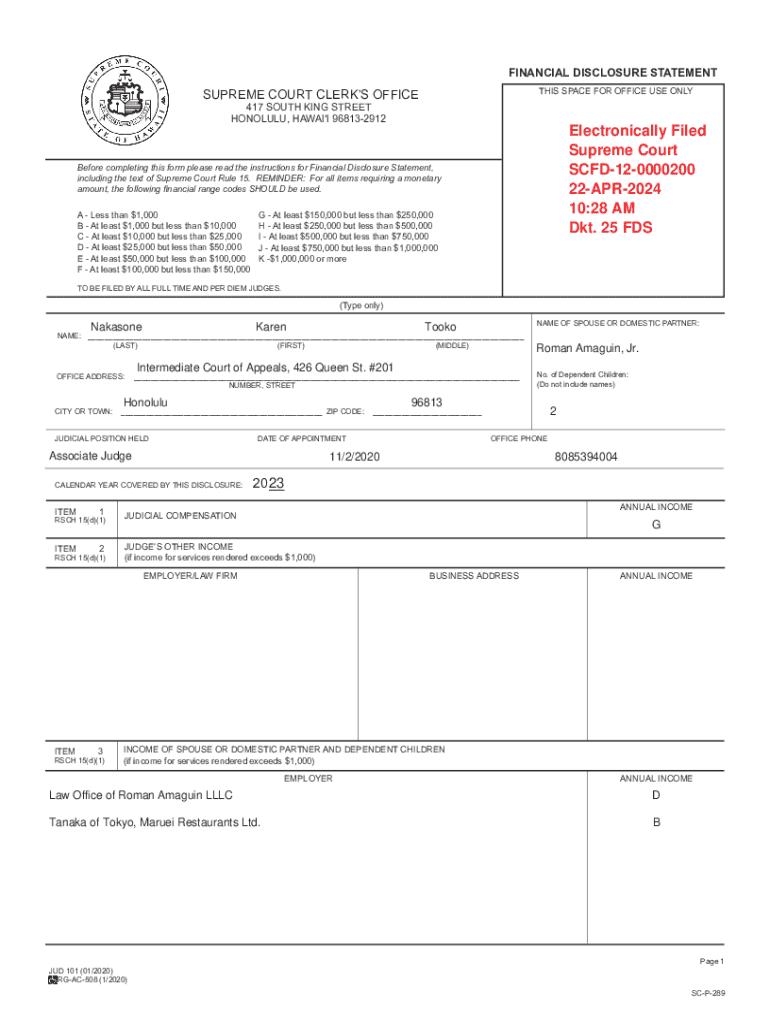

Understanding the financial disclosure statement form

The financial disclosure statement form is a crucial document that captures the financial status of individuals and entities, serving as a tool for assessing financial transparency. Its primary purpose lies in ensuring that stakeholders—whether they be regulators, partners, or the public—have access to accurate and complete financial information. This form plays a vital role in various sectors including government entities, non-profit organizations, and publicly traded companies.

Financial transparency helps to build trust and accountability, especially in sectors that manage public funds or operate under strict regulatory frameworks. As a result, various entities like public officials, board members, and certain government employees are often required to submit financial disclosure statements to comply with legal and ethical standards.

Key components of a financial disclosure statement

Having a solid grasp of the key components of the financial disclosure statement form is essential for accurate completion and compliance. The document typically contains several essential sections, including income reporting, asset disclosure, and liabilities information. Each of these components lends itself to understanding an individual or organization’s financial health.

Individuals must report their total income from all sources, including wages, bonuses, and passive income, in the income reporting section. The asset disclosure section requires a thorough listing of owned properties, investment accounts, and other valuable possessions. The liabilities section inquires about outstanding debts or obligations, ensuring that all aspects of financial status are well accounted for.

To further break down these sections, individuals must understand complex terms. For example, qualifying investment accounts refer to financial accounts that meet certain criteria, often influencing legal or regulatory obligations. It is essential to accurately report debts by detailing the type, amount, and nature of each liability to present a complete financial picture.

Step-by-step guide to completing your financial disclosure statement form

Completing the financial disclosure statement form can be daunting without proper preparation. Start with the pre-filling preparation phase, wherein you gather necessary documentation such as pay stubs, bank statements, and asset valuations. Ensuring the accuracy and honesty of your reporting is paramount, as any discrepancies could lead to questions of integrity or compliance.

Next comes the completion of the form itself. Thoroughly understand each section, starting with personal information, where accuracy is key to facilitating any later inquiries. In the income section, declare all income sources to capture a true financial snapshot. The assets section demands a detailed disclosure of properties and investments, while the liabilities section requires a careful assessment of debts. Make sure to double-check for common mistakes such as underreporting assets or omitting significant liabilities.

Electronic submission of financial disclosure statements

Embracing digital platforms for the submission of financial disclosure statements offers numerous benefits. Platforms like pdfFiller enable users to easily fill out forms, eSign, and submit documents from virtually any location. This convenience not only saves time but also enhances the accuracy of submissions by reducing the likelihood of errors associated with paper forms.

To submit your form via pdfFiller, utilize the straightforward upload feature, followed by a guided section-by-section filling process. Additionally, ensure compliance with electronic submission guidelines, including document format and file naming conventions, to facilitate smooth processing by the reviewing authority.

Editing and managing your financial disclosure statement

Once you have completed your financial disclosure statement form, managing it effectively is crucial for ongoing compliance. Utilizing pdfFiller's editing tools allows you to make adjustments seamlessly, whether correcting details or updating figures as your financial situation changes. Version control is also essential, ensuring that you can track changes and maintain a history of submissions.

Collaborating with team members or advisors can enhance the completeness and accuracy of your disclosure. By sharing access to the document, you can gather insights and verify information before finalizing your submission.

Signature and approval process

A crucial step in the submission of your financial disclosure statement is the signature and approval process. ESigning your financial disclosure statement certifies that you have reviewed the content and confirm its accuracy. Using pdfFiller's eSignature features streamlines this process, allowing for secure and legally binding electronic signatures.

After submission, your financial disclosure statement will enter the review process. Understanding what happens afterward, including potential feedback or additional requests for information, is essential for maintaining compliance and transparency.

Tips for staying compliant with financial disclosure regulations

Compliance with financial disclosure regulations requires awareness of the key regulatory bodies overseeing your sector. Familiarize yourself with their specific requirements, as these could differ based on the nature of your entity or role. Regular updates to your financial disclosure statement are advisable, reflecting your financial situation accurately over time.

Engaging in best practices for compliance fosters a culture of transparency. For instance, consider establishing an internal review process where updates and changes are verified and checked against regulatory guidelines to prevent potential oversights.

Troubleshooting common issues with financial disclosure statements

Many individuals encounter common issues when filling out the financial disclosure statement. Frequently asked questions often revolve around specific terminologies or complex reporting requirements. Being proactive about these questions will save you time and ensure accuracy.

In case of technical issues while using pdfFiller, their support team is readily available to assist with any challenges you may face during the editing or submission process. Additionally, having contact information for regulatory inquiries can expedite resolving any concerns that arise during the review process.

Additional tools and resources for financial disclosure management

To facilitate effective management of financial disclosures, integrating financial disclosure management with tools like pdfFiller provides multiple avenues for efficiency. Using templates and samples available via the platform allows for a streamlined filling process, ensuring that you do not miss any critical sections.

Learning from real-world examples of successful disclosures can also serve as a useful resource, equipping individuals with knowledge about common pitfalls or effective strategies that enhance the quality of financial reports.

Case studies: real-world applications of financial disclosure statements

Exploring case studies of successful submissions can offer valuable insights into the practical application of the financial disclosure statement form. These stories typically highlight unique challenges faced by submitters and the solutions they implemented to achieve compliance and transparency.

Moreover, analyzing notable financial disclosure issues provides a backdrop against which lessons learned can be understood. Individuals can draw from these experiences to be better prepared for their disclosures and avoid similar pitfalls.

Continuing education and updates on financial disclosure practices

To stay informed about ongoing changes in financial disclosure practices, engaging in continuing education resources is vital. Online courses and webinars focused on financial compliance can equip you with deeper insights into evolving regulations.

Monitoring upcoming changes in financial disclosure laws and regulations will help you remain proactive. Subscribing to relevant industry news outlets and updates can keep you abreast of critical developments that could impact your financial disclosure responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in financial disclosure statement without leaving Chrome?

Can I create an eSignature for the financial disclosure statement in Gmail?

Can I edit financial disclosure statement on an iOS device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.