Get the free Financial Disclosure

Get, Create, Make and Sign financial disclosure

How to edit financial disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure

How to fill out financial disclosure

Who needs financial disclosure?

Understanding Financial Disclosure Forms: A Comprehensive Guide

Understanding financial disclosure forms

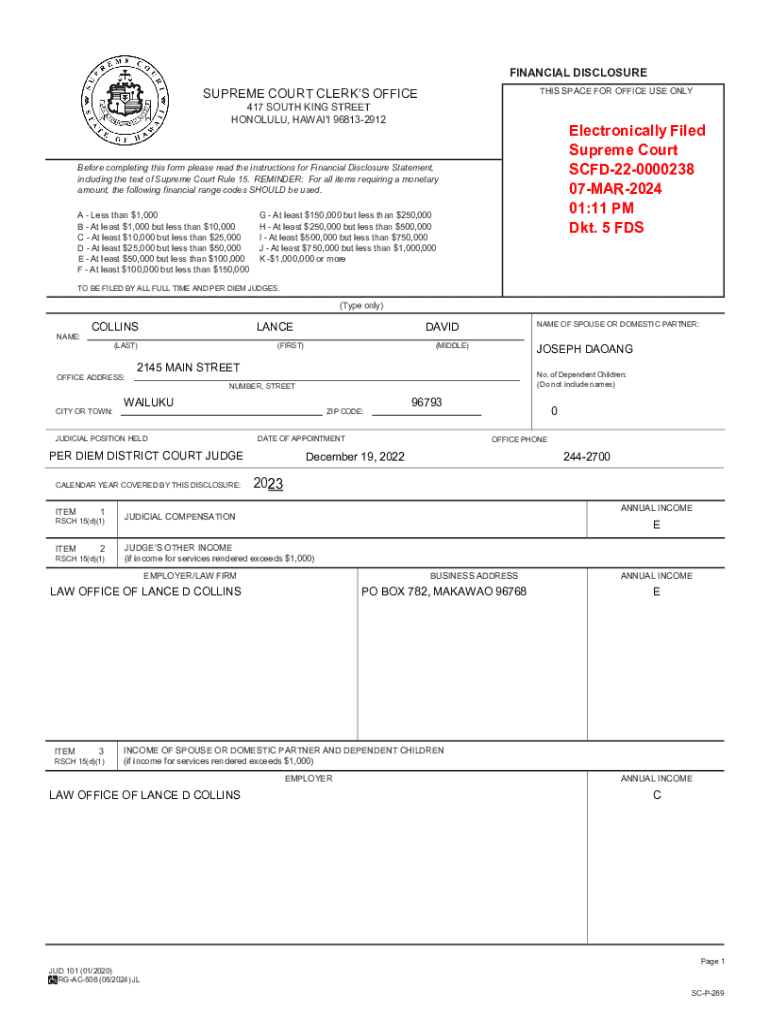

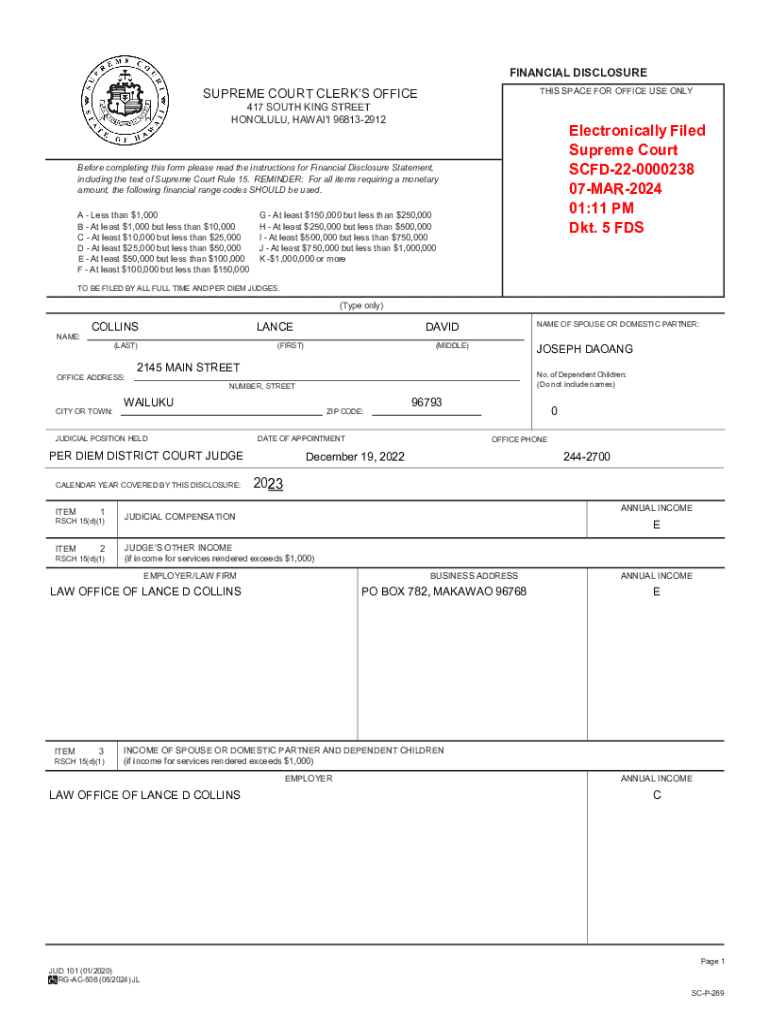

A financial disclosure form is a document that individuals or organizations fill out to report their financial interests, income sources, and liabilities. It serves as a tool for transparency and accountability, allowing stakeholders to disclose any potential conflicts of interest, especially in roles where trust is paramount. These forms can differ in complexity, ranging from simple one-page reports to detailed multi-page documents depending on the requirements set forth by governing bodies or organizational policies.

The purpose of financial disclosure forms is multilayered. They not only protect the integrity of the individuals involved by ensuring transparent reporting but also safeguard the public interest by preventing corruption and misuse of power. As financial activities are disclosed, entities like government institutions, corporations, and non-profits can better manage conflicts of interest and uphold ethical standards.

Who needs a financial disclosure form?

Various stakeholders are required to fill out financial disclosure forms, each adhering to specific regulations set by relevant governing bodies. Government officials, such as members of congress, judges, and executive branch employees, often must file these forms to ensure that their decisions are not unduly influenced by personal financial interests. Similarly, corporate executives may need to submit disclosures, particularly regarding their stock transactions, to maintain compliance with regulations such as the Sarbanes-Oxley Act.

Non-profit leaders are not exempt from these requirements either. Many organizations must file IRS Form 990, which provides transparency surrounding their financial activities, including income, expenditures, and executive compensation. By establishing and adhering to a framework for financial reporting, these stakeholders can uphold ethical standards and cultivate trust, making it essential for specific entities to maintain complete and accurate financial disclosures.

The importance of financial disclosure

Financial disclosures play a crucial role in establishing transparency and accountability. By mandating the reporting of personal and organizational financial activities, stakeholders can foster an atmosphere where trust is paramount. Citizens, investors, and other interested parties rely on these disclosures to assess the integrity of their leaders or organizations. When people understand the financial dealings of those in power, they can act accordingly, making informed decisions based upon the credibility of the information presented.

Legal implications surround the need for financial disclosures as well. Many jurisdictions have specific statutes requiring that financial disclosures be filed regularly. The consequences for failing to submit these forms can range from fines to disqualification from holding office or positions of authority. Non-compliance can lead to investigations, damage to reputation, and loss of public confidence, highlighting the importance of adhering to these legal mandates.

Types of financial disclosure forms

Financial disclosure forms can vary widely based on the sector and jurisdiction. In government entities, for instance, officials often complete a Personal Financial Disclosure Report (PFDR) detailing specific income sources, assets, and potential conflicts. In the corporate sector, the Securities and Exchange Commission (SEC) mandates insiders to file Form 4, which discloses changes in their ownership of company stock, ensuring compliance with regulations preventing insider trading.

Non-profit organizations utilize IRS Form 990 to report their financial status, program activities, and compensation of key employees. This form is critical not only for compliance purposes but also for informing the public about the organization’s operations and financial health. By providing insight into revenues, expenditures, and overall financial practices, these forms enhance transparency in the nonprofit sector and help stakeholders make informed choices.

Detailed walkthrough: filling out a financial disclosure form

Filling out a financial disclosure form properly is essential, and following systematic steps can simplify this process. Before starting, gather all necessary documents such as income statements, asset declarations, and any records related to gifts received. Understanding the specific requirements for your type of disclosure will also help ensure that your form is complete and accurate.

Here’s a step-by-step guide to completing your financial disclosure form:

Tools for managing financial disclosures

The process of filling out and managing financial disclosures can be streamlined using functional tools like pdfFiller. Their interactive features allow users to customize and complete form templates tailored to their specific needs effortlessly. The platform also offers e-signature capabilities, making submission more accessible and professional.

Collaboration tools on pdfFiller enable users to share documents for team reviews and input. The version history feature allows for tracking document changes over time, ensuring all parties are aligned and informed throughout the process. This collaborative approach enhances accuracy and refines the disclosure process from start to finish.

Best practices for completing a financial disclosure form

To ensure that your financial disclosure form is not only complete but also accurate, adhere to some best practices. First, double-check all figures to ensure correctness. Accuracy is vital as incorrect information can lead to serious legal repercussions or credibility issues. Additionally, timely submission of your form can prevent potential complications and fines; always be aware of the deadlines detailed at the beginning of the submission process.

Confidentiality and security are also crucial when handling sensitive information. As you gather data for your financial disclosure form, ensure that it is stored securely. Utilize password protections, encrypted storage, and other security tools to protect your personal financial data from unauthorized access.

Resources for assistance

Filing a financial disclosure form can raise various questions. To ease this process, having access to a comprehensive FAQ section can guide filers through common issues they may face. It is crucial to understand the different requirements and regulations set forth by each governing body to prevent mistakes.

Additionally, if you encounter any challenges while using pdfFiller to manage your documentation, the customer service team is available for support. They can assist you with specific inquiries about financial disclosure forms, ensuring clarity and ease throughout the filing process. Engaging with educational articles and webinars offered by pdfFiller provides further insight into requirements and best practices.

Compliance and monitoring

Understanding compliance with financial disclosures is paramount. Regulatory bodies such as the SEC or IRS are responsible for overseeing the submission of these forms, tasked with ensuring that all stakeholders meet their obligations. Staying informed about changes in disclosure requirements allows filers to plan accordingly, helping them adapt to new regulations that may affect the way financial information should be reported.

To keep abreast of any alterations in disclosure laws, it is essential to subscribe to updates from relevant agencies, participate in forums, and utilize professional networks. Maintaining this knowledge not only helps in compliance but also bolsters organizational integrity and public trust, key components in effective financial management.

Conclusion of service offerings

Using pdfFiller for financial disclosure forms enhances the filing experience significantly. The platform’s cloud-based accessibility allows users to edit PDFs, eSign documents, collaborate, and manage forms from any location seamlessly. This not only simplifies the completion of financial disclosure forms but also reduces the operational hurdles often associated with document preparation.

Client testimonials underscore the value that pdfFiller provides. Many users have reported their satisfaction in streamlining the financial disclosure process using pdfFiller’s features. By empowering individuals and teams with comprehensive tools that address their document creation needs, pdfFiller truly stands out in making the completion of financial disclosure forms more efficient and manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit financial disclosure online?

How do I edit financial disclosure straight from my smartphone?

Can I edit financial disclosure on an Android device?

What is financial disclosure?

Who is required to file financial disclosure?

How to fill out financial disclosure?

What is the purpose of financial disclosure?

What information must be reported on financial disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.