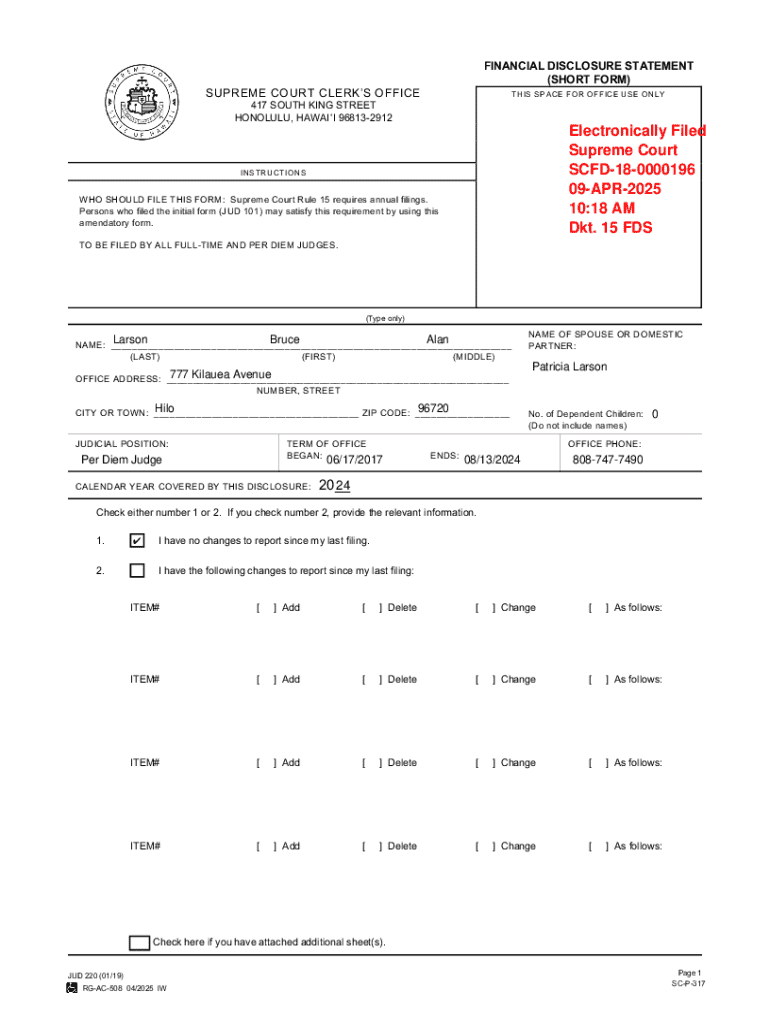

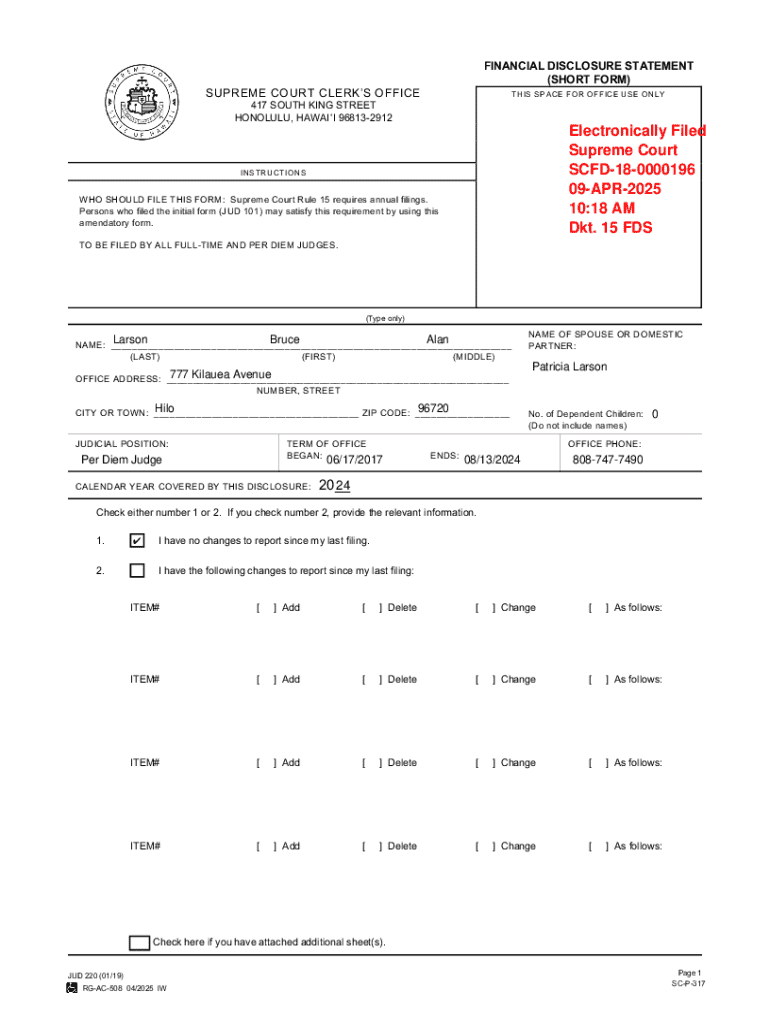

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

A Comprehensive Guide to Financial Disclosure Statement Short Form

Understanding financial disclosure statements

A financial disclosure statement is an essential document that provides a detailed account of an individual's or organization's financial status. Its primary purpose is to inform stakeholders, including regulators, investors, or the public, about the financial activities and conditions of the disclosing party. This transparency fosters trust and accountability, especially in sectors like finance, real estate, and public service.

Transparency in financial matters is not just a legal requirement; it is a cornerstone of ethical practice. Individuals and organizations that adhere to financial disclosure norms are viewed favorably, as they reflect integrity and a commitment to ethical standards.

Types of financial disclosure statements

There are various types of financial disclosure statements, each tailored to specific needs and regulatory requirements. Common forms include long-form disclosures, which provide exhaustive details, and short-form disclosures, which summarize key financial information more succinctly.

The key differences between short-form and long-form disclosures lie primarily in their depth and comprehensiveness. The short form is streamlined, focusing on crucial data points, while the long form delves into granular financial specifics, making it ideal for detailed analyses.

Short form overview

The short form of a financial disclosure statement is typically utilized in scenarios where concise financial reporting is sufficient. For example, smaller businesses or individuals applying for loans might use the short form to summarize their financial standing without delving into exhaustive details. This form is particularly beneficial in situations where time constraints exist or where the audience for the disclosure requires quick insights.

Choosing the short form over a long form can save time and effort, as it typically requires less comprehensive data collection and documentation, making it more user-friendly for individuals who may not possess extensive financial backgrounds.

Key components of the short form

A financial disclosure statement short form includes certain essential sections designed to give a clear snapshot of financial health. The common components typically break down into critical areas, including personal financial details, summary of income, major expenses, assets, and liabilities.

Preparing to fill out the financial disclosure statement short form

Before diving into completing the financial disclosure statement short form, it is crucial to gather all necessary information and documentation. Preparation will ease the process and ensure accurate disclosures. The list of documents typically includes income statements, bank records, loan agreements, and tax returns.

When preparing your personal financial information, make sure to compile accurate records, as discrepancies could lead to legal implications. For instance, failing to report specific assets or misrepresenting liabilities can have serious consequences, including penalties or loss of credibility.

Understanding legal implications

Disclosure statements are often governed by specific legal frameworks, emphasizing the need for accuracy. By understanding the regulatory landscape, you can better appreciate the necessity for compliance in your disclosures. Failure to meet the required standards can result in legal action or financial penalties.

Inaccuracies in your financial disclosure can lead to unintended consequences, including an investigation into your financial practices or damage to your reputation. Hence, taking the time to ensure every detail is correct is critical.

Steps to complete your financial disclosure statement short form

Accessing the form

Accessing the financial disclosure statement short form is straightforward. You can obtain it directly from regulatory websites or platforms that offer financial document templates. pdfFiller provides an accessible solution, allowing users to easily find and utilize the necessary forms online, streamlining the entire process.

Filling out the form

Filling out the financial disclosure statement short form involves several critical steps. Start by entering your personal information, followed by detailing your financial position, including your income, assets, and liabilities. Use the following structure for guidance:

Review and verification process

After completing the form, it’s essential to review and verify the information provided. Look for any inconsistencies or missing data, as accuracy is paramount. Recommended best practices include cross-referencing with original documents and asking a trusted colleague or financial advisor to review the information for completeness.

Editing and customizing your form

Utilizing pdfFiller’s editing tools

One of the significant benefits of using pdfFiller is its robust editing capabilities. Users can modify PDFs seamlessly, ensuring document accuracy and clarity. Adding comments or additional information directly onto the form is straightforward, allowing for a more personalized disclosure that meets specific needs.

Collaborating with others

Collaboration is enhanced with pdfFiller’s features, permitting multiple team members to contribute to the document’s completion. Such collaboration facilitates managing changes effectively, ensuring everyone’s input is accounted for and resulting in a cohesive final document.

Signing and finalizing your financial disclosure statement short form

eSigning the document

Adding an electronic signature to your document is essential for finalization. To do this securely within pdfFiller, follow clear steps to generate and place your eSignature. Electronic signatures hold legal validity, making this process just as binding as a handwritten signature.

Saving and sharing the form

After eSigning, you can save the document in various formats, depending on your needs. pdfFiller allows users to save in common formats such as PDF, DOCX, and more. Additionally, sharing options within the platform make it easy to distribute your financial disclosure statement to necessary stakeholders, ensuring seamless communication.

Managing stored financial disclosure statements

Organizing your documents in the cloud

Cloud storage plays a vital role in document management. To ensure organization, categorize your financial disclosure statements effectively, utilizing tags and search functions to find documents quickly. This practice not only enhances accessibility, but also ensures you maintain order across your files.

Accessing and updating your forms later

Over time, you may need to revisit and revise your financial disclosures. pdfFiller allows easy access for updates, ensuring that your statements remain compliant with periodic review requirements. Staying on top of your document management is crucial for ongoing transparency and maintaining financial integrity.

Frequently asked questions (FAQs)

Common queries on short form usage

Users often have questions regarding the submission process and deadlines associated with the financial disclosure statement short form. Typical inquiries include how quickly the form should be submitted after completion and the differences in submission criteria based on jurisdiction.

By addressing these common queries, individuals can better prepare their documentation and understand the nuances required by varying regulatory bodies.

Troubleshooting issues

Common errors during form completion can frustrate users. Issues often include missing information or miscalculated figures. Having a checklist can help mitigate these errors and ensure smooth submission. pdfFiller offers support resources to help users troubleshoot any issues that arise.

Best practices for financial disclosure

Tips for maintaining financial integrity

To maintain financial integrity, keeping accurate records and disclosures is essential. Regularly update your financial documents and secure all related receipts or statements to support your disclosures. This practice not only enhances trust but also ensures compliance with legal requirements.

Staying current with regulatory changes

Laws and regulations regarding financial disclosures can change over time. Staying informed about any new policies or revisions that affect how disclosures should be made is vital for all individuals and organizations. Subscribing to relevant newsletters or following regulatory bodies on social media can keep you updated.

Leveraging pdfFiller for an enhanced document experience

Features of pdfFiller to simplify your workflow

pdfFiller excels in providing tools that assist users in document management. Features such as cloud-based access, real-time collaboration capabilities, and customizable templates make the platform an invaluable resource for anyone preparing a financial disclosure statement short form.

Testimonials and success stories

Real-life examples of users who have benefited from pdfFiller’s functionalities abound. From small business owners achieving compliance for financing to teams collaborating on disclosure statements, testimonials highlight the effective management of documents in an increasingly complex financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the financial disclosure statement short in Gmail?

How do I edit financial disclosure statement short straight from my smartphone?

Can I edit financial disclosure statement short on an iOS device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.