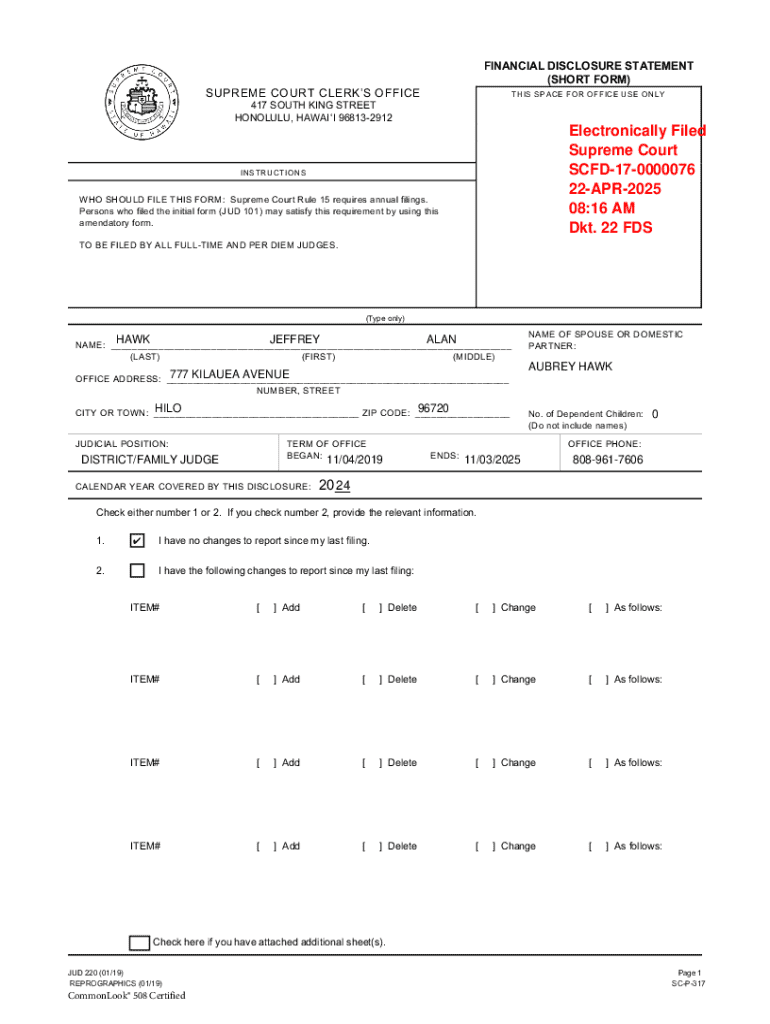

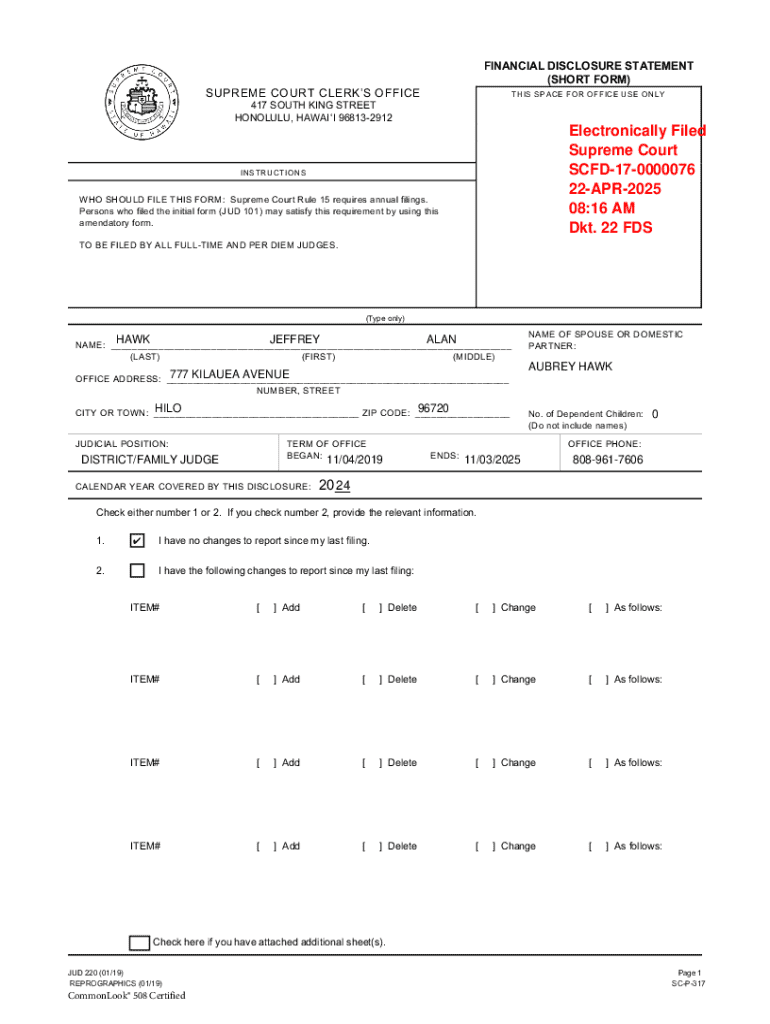

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Understanding the Financial Disclosure Statement Short Form

. Understanding the Financial Disclosure Statement Short Form

The financial disclosure statement short form is a condensed version of the comprehensive financial disclosure statement. Its primary purpose is to provide essential financial information in a concise, user-friendly format. It acts as a means for individuals and entities to disclose their financial status transparently, facilitating easier assessment by stakeholders. This short form is especially vital in contexts requiring quick and clear financial insights, such as loan applications or regulatory compliance.

. Key components of the financial disclosure statement short form

The financial disclosure statement short form comprises several crucial components that provide a snapshot of someone's financial condition. Understanding what information is required can streamline the completion process. Generally, the necessary information includes personal identification details, financial assets and liabilities, and income sources. Each piece of information contributes to a comprehensive understanding of the financial landscape.

Each section of the financial disclosure statement short form serves a definitive purpose, providing insights into personal and business financial health.

Detailed breakdown of each section

. Steps to complete the financial disclosure statement short form

Filling out the financial disclosure statement short form can seem daunting, but breaking it down into manageable steps makes the process straightforward. The first step is to prepare yourself by gathering all necessary documents, such as bank statements, tax returns, and any other financial documents you may need. Having a clear insight into your financial situation before you begin is crucial.

Once you have prepared, begin filling out the form. Proceed methodically through each section, ensuring all questions are answered accurately. It's wise to check for inaccuracies or misreporting, as these errors can lead to compliance issues.

Avoid common mistakes by double-checking your entries for omissions and ensuring that your information is consistent throughout the form.

. Editing and reviewing your financial disclosure statement

Reviewing your completed financial disclosure statement short form is crucial before submitting your document. This review process ensures that your information is complete and clearly presented. Errors or omissions can lead to negative repercussions, so a careful check is necessary. Engaging a third party to review your form can provide an additional level of assurance.

Utilizing editing tools like those found on pdfFiller enhances the clarity and presentation of your financial disclosure statement. Interactive features allow for easy adjustments and improvements.

. esigning the financial disclosure statement

Understanding the importance of eSigning is vital in today's financial landscape. eSigning your financial disclosure statement confirms its authenticity and legality. Digital signatures streamline the signing process, allowing for faster processing and submission.

Using pdfFiller, signing the financial disclosure statement short form can be accomplished easily and securely. The following steps guide you through the eSigning process.

. Submitting your financial disclosure statement

Submitting your financial disclosure statement requires attention to the methods and avenues available. You can choose from various submission methods based on your needs, allowing for convenience and efficiency in management.

After submission, tracking your financial disclosure statement is vital. Knowing what to expect after submission can aid in your planning and response strategies.

. Managing and storing your financial disclosure statement

Properly managing and storing your financial disclosure statement is equally important as completing it. Sensitive financial information needs to be securely stored while remaining accessible for future reference. The right management practices help safeguard against unauthorized access.

Using pdfFiller for document management offers seamless cloud storage benefits, allowing for easy categorization and searching of your financial disclosure statement and related documents.

. Frequently asked questions about the financial disclosure statement short form

Users often have questions related to the financial disclosure statement short form, reflecting the variety of user experiences and needs. Addressing these frequently asked questions can help clarify common uncertainties and improve user confidence.

For further assistance beyond common queries, consulting professionals or utilizing resources provided by pdfFiller can offer additional guidance.

. Tips for ensuring compliance and avoiding issues

Ensuring compliance with financial disclosure regulations is critical in maintaining transparency and trust. Staying informed about regulatory changes and best practices can safeguard you against potential legal issues.

Incorporating best practices for maintaining transparency also strengthens relationships with stakeholders. Regular reviews and proactive communication are foundational components.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit financial disclosure statement short straight from my smartphone?

How do I complete financial disclosure statement short on an iOS device?

How do I fill out financial disclosure statement short on an Android device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.