Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form - How-to Guide

Understanding financial disclosure statements

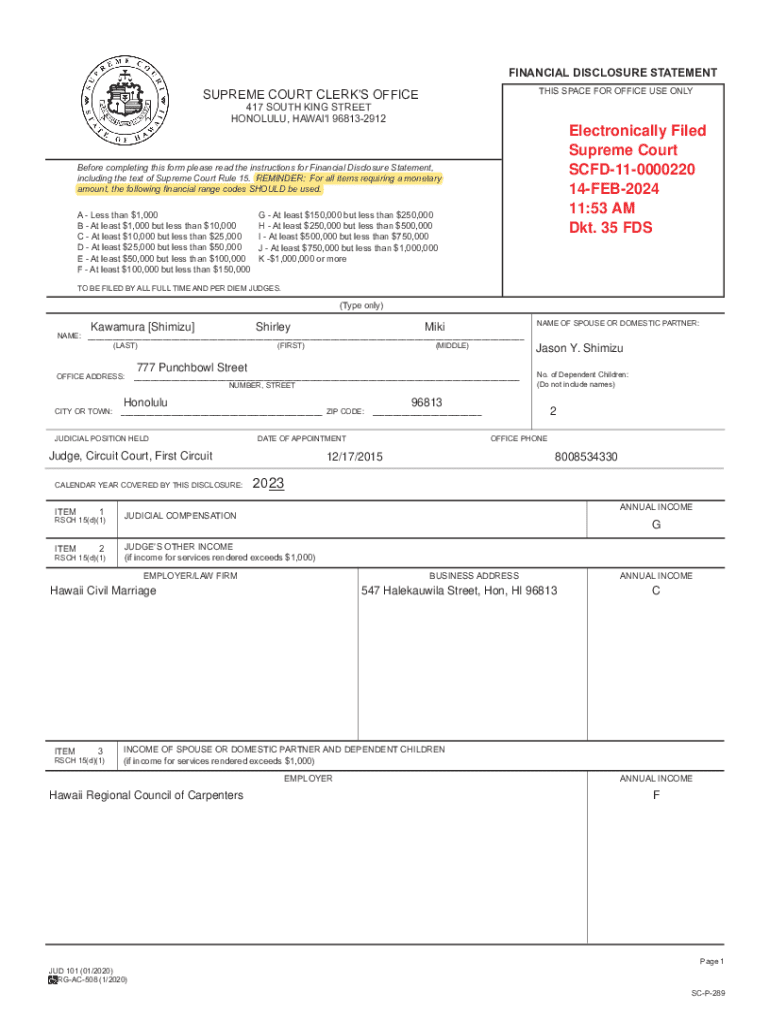

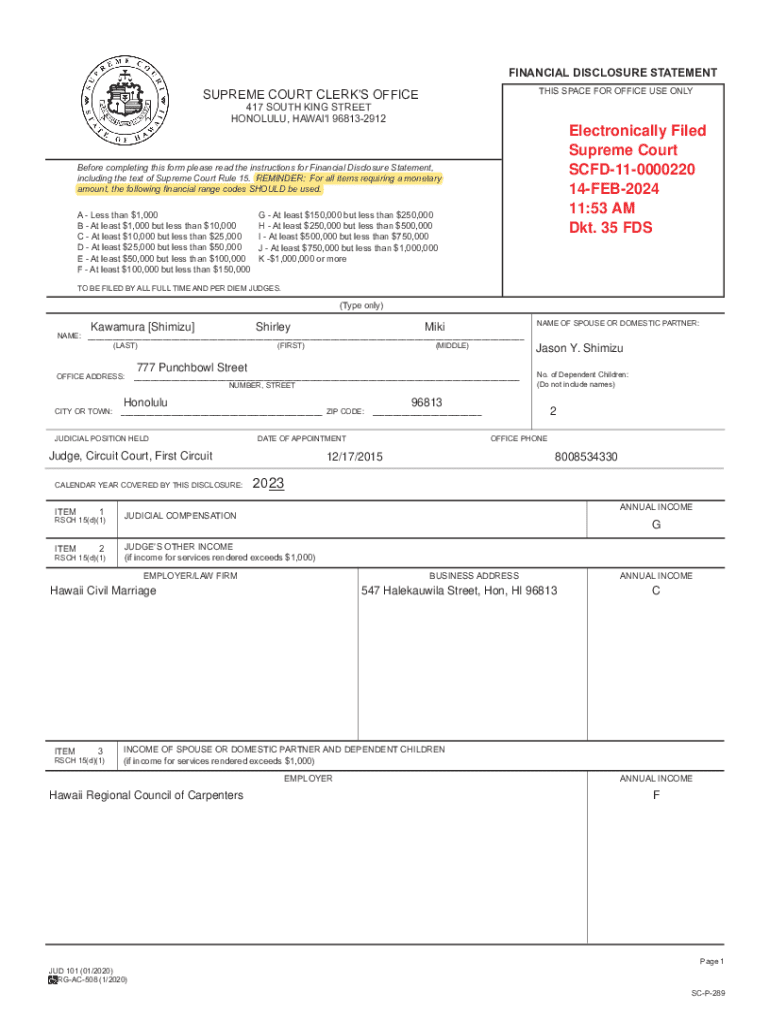

A financial disclosure statement form is a critical document that allows organizations, teams, or individuals to disclose their financial interests, income sources, assets, and overall financial status. Its primary purpose is to promote transparency and trust, particularly for individuals in public positions or fiduciary roles. Proper understanding of this form is essential, as it not only reflects personal financial health but also fulfills regulatory or legal obligations.

Financial disclosure is vital for various reasons. Firstly, it helps prevent conflicts of interest, ensuring that all parties are aware of potential biases. Secondly, it is often required by law for public officials, government employees, or grant recipients to maintain ethical standards. Common scenarios requiring disclosure include entering a new job, applying for grants, or participating in governmental processes where transparency about financial dealings is necessary.

Key components of a financial disclosure statement form

A financial disclosure statement form consists of several important components designed to capture a complete picture of your financial situation. The first major section includes personal information such as your full name, residential address, and contact details. This part is crucial, as it identifies who is making the disclosure.

The next crucial element is the disclosure of financial interests. Here, you will detail your income, assets, and liabilities. Be prepared to provide specific figures for all income streams, including salary, rental income, and investment returns. Lastly, a summary of financial activities reflects your investments and other income sources that may impact your financial status. This thorough overview helps instill confidence in stakeholders regarding your financial integrity.

The process of completing a financial disclosure statement

Completing a financial disclosure statement can seem daunting, but by following a systematic process, it can be made easier. The first step is to gather all required documentation. This includes tax returns, bank statements, and property deeds, which will provide the necessary data for accurate reporting.

Step two involves inputting personal information into the form. It’s crucial to check for accuracy and completeness as any mistake may result in delayed processing. Next, in step three, disclose all your financial interests carefully. Guidelines for reporting your income and assets must be followed meticulously. For the fourth step, make sure to review and double-check your entries against your documentation. A simple checklist for common errors can be beneficial—mistakes like omitting figures or typos in substantial amounts can lead to significant issues down the line.

Editing and customizing your financial disclosure form

Using pdfFiller’s editing tools simplifies the customization of your financial disclosure statement form. The platform’s drag-and-drop functionality allows for easy adjustments like adding or removing sections, while the options for annotations and comments enable you to clarify specific entries. This flexibility allows you to tailor your form to your unique circumstances.

Once your form is complete, saving and retrieving it is seamless, thanks to pdfFiller’s cloud storage options. No more worrying about lost documents or version control, as all your completed forms can be securely accessed from anywhere, making your financial management process much easier.

Signing your financial disclosure statement

Many users are concerned about the signing aspect of a financial disclosure statement. Fortunately, pdfFiller includes eSigning capabilities, meaning you can sign your document electronically without the need for a physical pen and paper. This is particularly advantageous for those who require quick submissions or are frequently traveling.

It is also essential to ensure that your electronic signature meets all legal requirements. The legality of eSignatures is widely recognized, but it’s important to confirm that the specific regulations governing your jurisdiction support this method—especially when dealing with official documents like financial disclosures.

Collaborating with team members on your financial disclosure form

If you are part of a team or organization, collaborating on the financial disclosure statement form can enhance accuracy and completeness. pdfFiller allows you to invite others to provide input and review your form, ensuring multiple perspectives can contribute to a more robust document.

Tracking changes in real time fosters a truly collaborative environment, where team members can see modifications as they happen. The comments and suggestion feature further enriches this process, enabling everybody involved to communicate effectively. This collective approach not only alleviates individual workload but also nurtures a culture of transparency within your team.

Managing and storing your financial disclosure statements

Managing your financial disclosure statements effectively ensures you maintain organization throughout the process. Setting up folders within pdfFiller allows for easy access to your documents whenever needed. By categorizing your forms—by year, purpose, or even team members who signed them—you create a streamlined system for quick reference.

In addition to organization, employing best practices for document management, like naming files appropriately and regularly backing up your data, further secures your financial information. pdfFiller also features security options designed to protect sensitive information, ensuring that your disclosures are stored safely and are only accessible to authorized individuals.

Legal considerations and compliance

Understanding the legal landscape surrounding financial disclosure statements is necessary for compliance. Various regulatory requirements exist depending on your jurisdiction, making it crucial to familiarize yourself with the specific norms governing financial disclosures in your area. This knowledge allows you to tailor your disclosure accurately and fulfill all legal obligations.

Failure to provide accurate or complete disclosures can lead to significant consequences, ranging from fines to legal repercussions. Therefore, it’s wise to consult legal resources or professionals if you have any uncertainties. Finding reliable sources for additional legal guidance ensures you stay informed as regulations evolve.

Frequently asked questions about financial disclosure statements

Understanding the nuances of financial disclosure statements can raise many questions. For instance, many individuals often wonder how frequently they need to file a financial disclosure statement. Usually, this depends on your regulatory body, but annual filing is common among public officials.

After submitting your financial disclosure, the next steps can include reviews or audits by regulatory agencies, ensuring compliance. Lastly, amendments can often be made to your financial disclosure statement after submission if financial circumstances change significantly. This flexibility recognizes that life can alter financial landscapes unexpectedly.

Accessing support for financial disclosure statement assistance

Having support when completing your financial disclosure statement is essential for a smooth process. pdfFiller provides various support features including live chat and dedicated customer service, ensuring that you can get help whenever needed. Accessing this support can clarify any uncertainties and streamline your completion process.

Moreover, pdfFiller offers comprehensive tutorials and user guides that enhance understanding of the disclosure process. These resources are particularly beneficial for those new to financial disclosures, serving as valuable tools to improve overall familiarity and confidence in handling financial documents.

Success stories and testimonials

Numerous users have found success in their financial disclosure processes when utilizing pdfFiller. Testimonials often highlight how the platform has simplified complex disclosure forms, allowing individuals to navigate their financial obligations efficiently. For instance, businesses have reported increased accuracy and reduced filing time, leading to a more effective approach to document management.

Real-world examples demonstrate that by employing pdfFiller, users engage in efficient document management without hassle. Elevated user satisfaction reflected in these success stories underscores pdfFiller’s positioning as a comprehensive solution for document editing, eSigning, and collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement for eSignature?

Can I create an eSignature for the financial disclosure statement in Gmail?

How do I complete financial disclosure statement on an iOS device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.