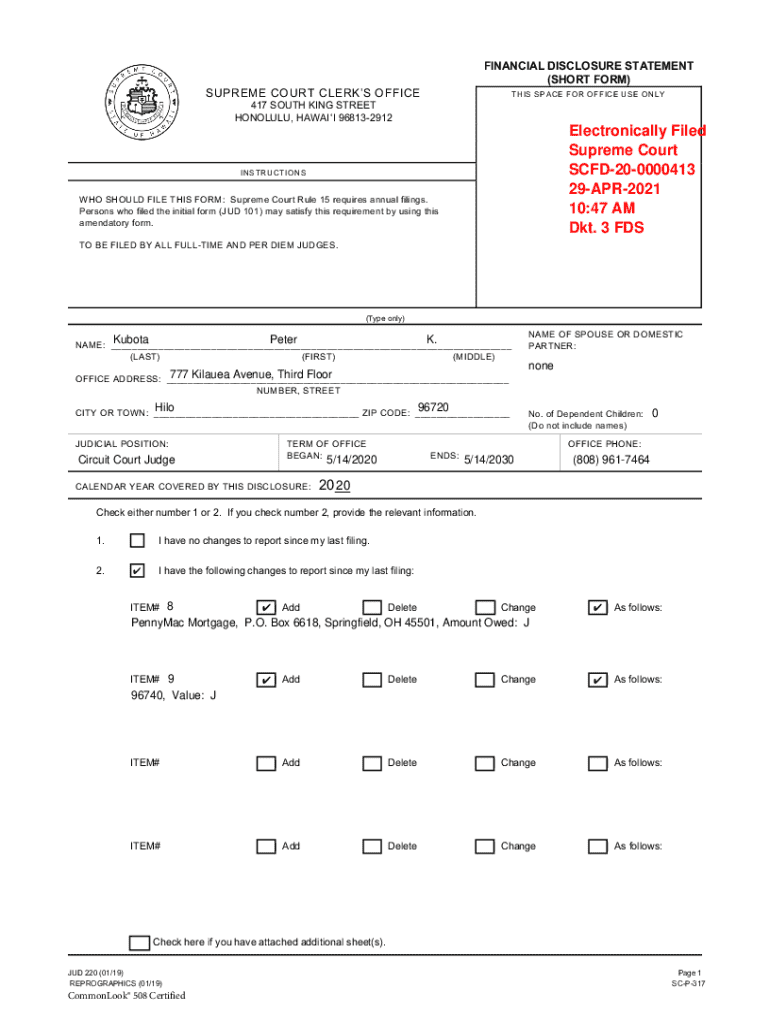

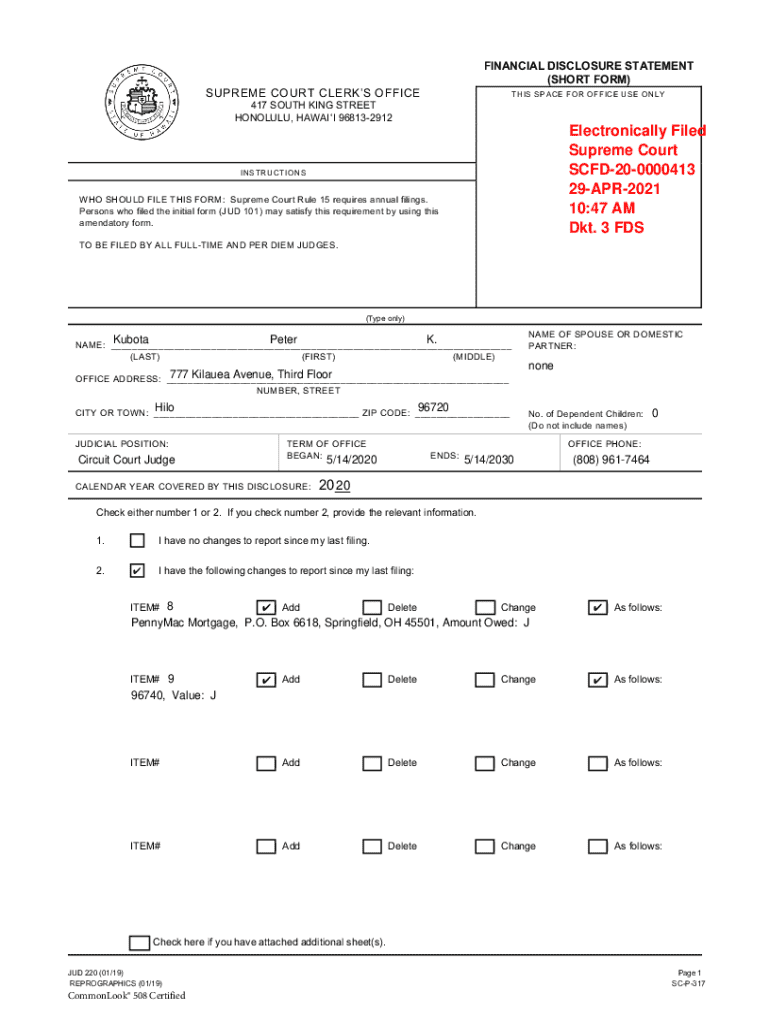

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Understanding the Financial Disclosure Statement Short Form

Understanding the financial disclosure statement

A financial disclosure statement is a formal record that details an individual's or organization's financial situation. It serves specific purposes, including assessing financial stability, ensuring compliance with legal requirements, and fostering transparency among stakeholders. By mandating disclosure of personal assets, liabilities, and income sources, these statements play an essential role in various contexts, such as loan applications, job applications for certain public positions, or even divorce proceedings.

Transparency in financial reporting is critical. It establishes trust between parties and is essential for maintaining accountability. When financial data is shared openly, it allows stakeholders to make informed decisions based on reliable information. This transparency builds the foundation of financial integrity, particularly in scenarios involving public trust, like government jobs or nonprofit organizations.

When to use a financial disclosure statement short form

Knowing when to use a financial disclosure statement short form is key to navigating various financial and legal situations effectively. Common instances include job applications in government sectors, loan applications for personal or business needs, or family law matters. In these situations, a detailed analysis of your financial position is often necessary but should be presented concisely to facilitate quick review by involved parties.

Utilizing the short form yields numerous benefits. Firstly, it allows stakeholders to quickly assess an individual's financial position through a streamlined process. This expediency can prevent delays in critical decision-making contexts. Secondly, the simplified reporting process reduces the burden on individuals, allowing them to quickly organize their financial information without excessive complexity.

Components of the financial disclosure statement short form

The composition of a financial disclosure statement short form is critical to its utility. Required sections typically include personal identification details such as name, address, and contact information. Financial assets are succinctly categorized, typically listing cash, investments, properties, and other valuable items. The statement also requires a summary of liabilities which encompasses outstanding debts like loans, mortgages, or credit card balances.

In addition to the mandatory information, some individuals opt to include optional data to enrich their disclosure. This may encompass additional assets (like personal property), contextual notes explaining significant fluctuations in financial status, or income sources that may not fit traditional classifications. However, caution is warranted to avoid overloading the document with extraneous detail.

Step-by-step guide to completing the financial disclosure statement short form

Completing the financial disclosure statement short form is a straightforward process but requires careful preparation. Start by gathering all necessary documents, such as bank statements, investment documents, loan agreements, and any other records relevant to your financial situation. Organize these documents to ensure ease of access; categorizing them by asset type and liability can be particularly helpful.

Begin with filling out the identification details, ensuring your information is accurate and up to date. Next, disclose your financial assets. List each asset systematically, accompanied by their current market value where applicable. Once you’ve disclosed your assets, turn your attention to liabilities. Report all debts, providing details about their current amounts and dates incurred. After completing each section, meticulously review your form for accuracy and completeness. Use a final checklist to ensure all required elements are present before submission.

Editing and managing your financial disclosure statement

Using tools like pdfFiller can streamline the editing and managing of your financial disclosure statement. This platform offers a range of features that allow users to edit PDF documents seamlessly. Its collaborative tools enable multiple users to contribute, ensuring that the document remains up to date with input from relevant stakeholders.

When making changes, utilize pdfFiller to easily incorporate edits without compromising the document's integrity. Once revisions are complete, eSigning your financial disclosure statement is straightforward. The benefits of eSigning include enhanced security through encryption and a reduction in time spent on collecting physical signatures. Follow the step-by-step guide to eSigning, ensuring your statement is signed electronically in compliance with legal standards.

Sharing your financial disclosure statement with stakeholders

Secure and efficient sharing of your financial disclosure statement with relevant stakeholders is a critical step in the process. Utilizing cloud platforms not only allows users to share documents quickly but also ensures that sensitive information remains protected through various security measures such as password protection and encryption.

Collaborate effectively using collaborative features offered by platforms like pdfFiller, which facilitates real-time editing and feedback. This collaborative work environment fosters better communication among teams, ensuring that all financial backgrounds are accurately reflected in disclosures. Moreover, version control and audit trails enable users to track changes, providing clarity about who made what adjustments.

Frequently asked questions (FAQs)

After submitting your financial disclosure statement, you might wonder how changes in your financial situation will affect your submission. Generally, it's wise to update your statement as soon as material changes occur. This proactive approach maintains accuracy and ensures your financial position is appropriately represented in any context.

How often should you update your disclosure statement? Regular reviews, ideally on an annual basis or following a significant life event, can ensure your document remains a clear reflection of your current situation. As for penalties, failing to disclose relevant financial information may result in legal consequences and loss of trust among the involved parties, so prioritize accuracy and honesty in your disclosures.

Best practices for financial disclosure statements

Incorporating best practices into your creation and management of financial disclosure statements can significantly enhance both the quality and reliability of the information presented. Prioritize transparency; consistently provide clear, factual data without any embellishments. Regularly review and update your statement to reflect any changes in your financial situation, ensuring accuracy and trustworthiness.

Utilizing tools like pdfFiller can also facilitate effective ongoing management of your statement. By taking advantage of its editing capabilities, you can easily make necessary adjustments, ensuring your financial disclosure statement remains as up to date as possible. Tailoring your document to reflect current conditions will serve to foster stronger relationships with stakeholders who rely on this important information.

Case studies: Effective use of financial disclosure statement short form

Examining real-world applications of financial disclosure statement short forms can provide valuable insights. Individual filers often share their personal journeys, highlighting the importance of accuracy and the impact of clear disclosures on job prospects or loan approvals. For example, candidates applying for government jobs have successfully landed positions by providing thorough yet concise financial disclosures.

Moreover, organizations that adopt a team approach often witness impressive results, enhancing collaboration through shared disclosures. Teams can ensure all members are aligned regarding financial positions, facilitating smoother decision-making. Lessons learned from common mistakes include the importance of completeness, timeliness, and the clarity of explanations for any financial deviations. These insights can guide future filers toward more effective disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement short to be eSigned by others?

Can I create an eSignature for the financial disclosure statement short in Gmail?

How do I complete financial disclosure statement short on an Android device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.