Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form: A Comprehensive Guide

Understanding financial disclosure statements

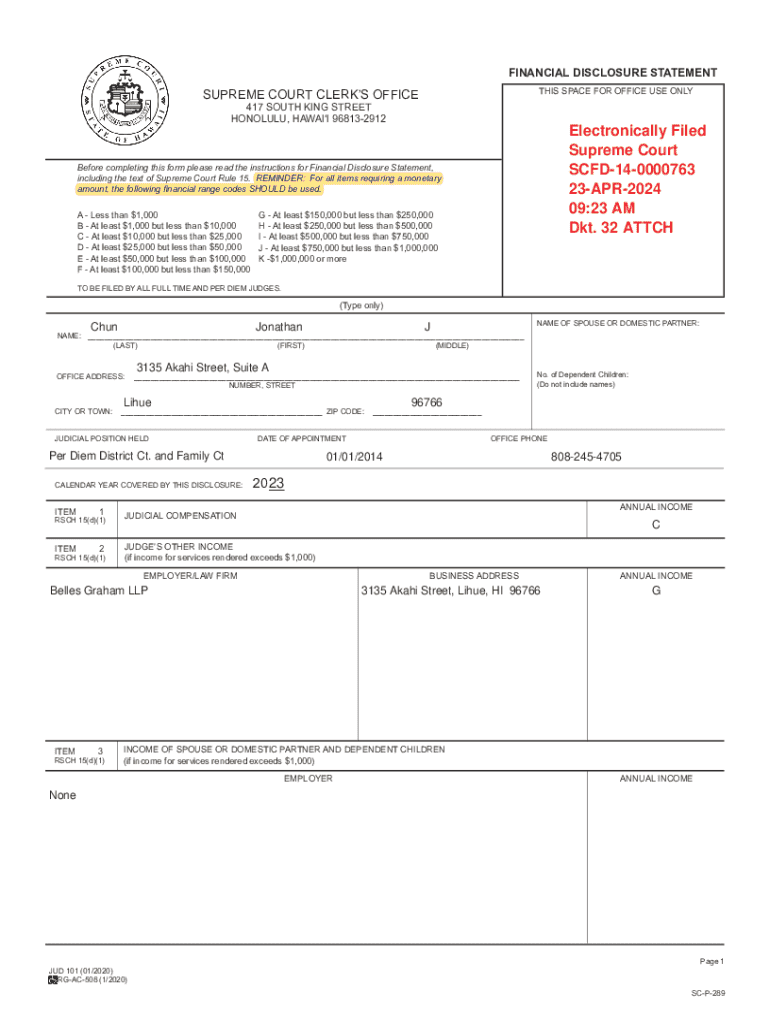

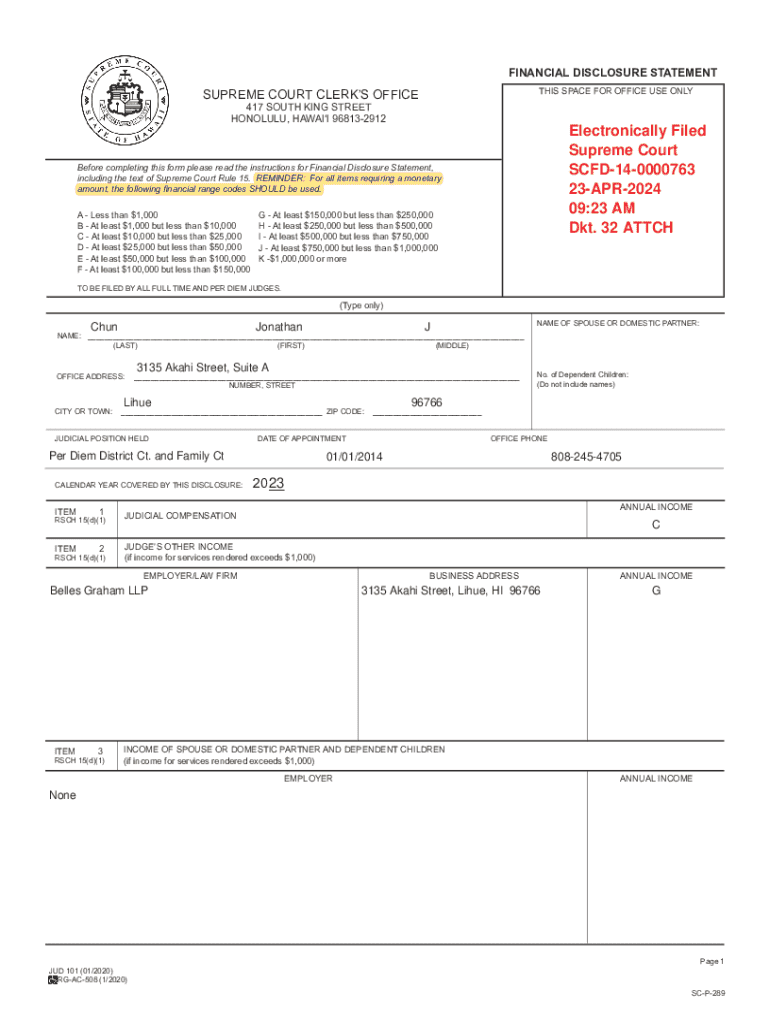

A financial disclosure statement form is a crucial document used to provide a transparent view of a person's or organization's financial situation. This statement is designed to reveal income, assets, liabilities, and other financial information that may be relevant to stakeholders, investors, or regulatory authorities. Its primary purpose is to ensure that the involved parties have a clear and honest representation of financial circumstances.

The importance of financial disclosure cannot be understated; it serves as a means of promoting transparency and integrity within financial transactions and governance. By requiring individuals and organizations to disclose their financial standing, it helps establish accountability, reduces the risk of fraud, and fosters trust among stakeholders. Essential components generally include income sources, property and investments, debts, and any pertinent affiliations that may influence financial decisions.

Legal and ethical requirements for completion

Filling out a financial disclosure statement is not merely an administrative task; it comes with specific legal obligations that depend on the jurisdiction and the context in which the statement is being filed. Individuals may be required by law to disclose their financial information when applying for certain positions or engaging in transactions requiring significant assets. Failure to comply with these requirements can lead to legal repercussions, including fines or restrictions.

In addition to legal considerations, ethical obligations demand that disclosures are accurate and comprehensive. This integrity ensures that all stakeholders are accurately informed and can make decisions based on complete information. Inaccurate or incomplete disclosures can have serious ramifications, including loss of reputation and trust, legal action, or financial penalties. Therefore, thoroughness and honesty are paramount.

Types of financial disclosure statements

Financial disclosure statements can vary significantly in type and purpose. Personal financial disclosure statements are typically required for individuals in public service roles, while corporate financial disclosure forms are essential for companies, particularly publicly traded ones, to inform investors and regulators about financial health. Governmental financial disclosures are also prevalent, as they provide transparency regarding public entities’ financial dealings, ensuring that taxpayer funds are managed appropriately.

Each type of financial disclosure serves a unique purpose but generally follows similar principles of transparency and accuracy. Organizations must understand the specific requirements associated with each form to ensure compliance and maintain credibility with their respective audiences.

Preparing to fill out a financial disclosure statement

Preparation is key before tackling a financial disclosure statement form. First, gathering all necessary documents is essential for providing an accurate picture of personal or organizational finances. These documents usually include financial statements, recent tax returns, and any supporting documentation that corroborates the information you will report, such as deeds or investment statements. Ensuring all data is current and organized ensures a smoother and more efficient filing process.

Understanding the required information is another critical step. Familiarize yourself with the specific sections of the form and the types of information needed in each. It’s also advisable to set up a secure workspace where you can focus on filling out the form without interruptions. When security is paramount, adopting digital solutions that offer encrypted storage can also significantly enhance the safety of sensitive information.

Step-by-step instructions for filling out the form

Filling out a financial disclosure statement is a structured process. Begin with the basic personal information, where you will input your name, address, and any identifying details relevant to your situation. This section establishes the foundation of your disclosure and helps authorities identify the statement accurately.

Next, move on to income reporting. This section necessitates a thorough accounting of all income sources, including salaries, rental income, dividends, and any other earnings. Follow this with asset reporting, which captures all owned properties, bank accounts, stocks, and other investments. Similarly, the liability reporting section requires any debts, such as mortgages or loans, to be accurately documented. Finally, include any additional disclosures that may be required, such as affiliations with other organizations, which may be pertinent to your financial standing.

Editing and reviewing your financial disclosure statement

After filling out the financial disclosure statement form, the task of reviewing and editing your submission is crucial. Utilizing online tools such as pdfFiller can enhance this process by allowing for easy editing of PDFs. You can make necessary adjustments quickly and efficiently, ensuring that every detail is correct before submission.

Collaborating with team members or financial advisors for feedback can also significantly improve the accuracy of your disclosures. They may catch inconsistencies you might overlook and ensure your information is presented clearly and professionally. Finally, be aware of common mistakes, such as incorrect figures or missing information, that could result in delays or issues post-submission.

Signing and submitting your financial disclosure statement

Once the financial disclosure statement is complete and has been reviewed for accuracy, it's time to sign and submit the document. The digital eSigning process offered by platforms such as pdfFiller can streamline this step by allowing you to apply your electronic signature securely and efficiently. This method not only saves time but also ensures the legitimacy of your signature under various legal frameworks.

After signing, it’s essential to follow the submission guidelines based on the type of disclosure. For personal forms, ensure they reach the relevant authority, such as a public agency, on time. For corporate and governmental disclosures, follow the specific protocols applicable to those forms to ensure compliance and avoid potential legal issues.

Managing your financial disclosure documents

Managing financial disclosure documents effectively is key to maintaining oversight of your financial history and obligations. Starting with proper storage and organization, utilizing cloud-based services, like pdfFiller, ensures easy access and security. A well-organized digital filing system can help locate important documents quickly when needed.

Setting reminders for updates is also crucial as financial situations can change frequently. Regularly review and refresh your financial disclosures to reflect your current circumstances accurately. Cloud-based features enable you to edit documents on the go, providing flexibility in managing your financial disclosures no matter your location.

Special considerations for specific audiences

Different audiences may have unique considerations when completing financial disclosure statements. For public officials, disclosures are crucial to maintaining public trust and accountability; they often undergo rigorous scrutiny to ensure adherence to ethical standards. Similarly, corporate executives and board members must disclose their personal financial interests to manage potential conflicts of interest in their professional roles.

Nonprofit organizations also face specific requirements, as financial transparency is vital to securing donations and maintaining trust with the community. They must demonstrate that funds are allocated responsibly and in line with their mission. Overall, these unique audiences must navigate specific guidelines to ensure compliance while upholding transparency.

Interactive tools and resources

To facilitate the completion of financial disclosure statements, several interactive tools and resources are available. pdfFiller provides various templates that cater to different financial disclosure needs, ensuring users have the right starting point for their documents. Customizable financial disclosure statement examples offer a practical preview of how to structure and present your information effectively.

Moreover, an FAQ section and troubleshooting tips can be invaluable as users may encounter uncertainties during the process. These resources make navigating the financial disclosure statement form easier and more efficient while empowering users with the knowledge needed for compliance and best practices.

Understanding the review process

After submitting your financial disclosure statement, understanding what happens next is essential. The review process may involve examination by regulatory authorities, which assess the accuracy and completeness of the submitted information. Metrics for success in transparency and compliance often include deadlines met, accuracy of reported information, and timely responses to any inquiries or requests for clarification.

Preparing for possible requests for clarifications can save time and stress. Having organized documentation and ready explanations ensures a smooth follow-up process. Whether you're dealing with a personal, corporate, or governmental disclosure, being proactive in addressing potential questions can lead to a more favorable outcome.

Future of financial disclosure requirements

As we look ahead, the landscape of financial disclosure requirements is likely to evolve due to technological advancements and changing regulatory environments. Trends influencing financial disclosure regulations include increasing public demand for transparency and accountability, as well as advancements in data analytics. Organizations may face more stringent reporting requirements and expectations for how disclosures are made available to the public.

Moreover, technology is playing a pivotal role in enhancing financial transparency. Digital solutions, such as those offered by pdfFiller, enable users to streamline the disclosure process, making it easier to edit, sign, and manage documents. As the push for transparency continues to grow, staying informed about potential changes to disclosure requirements will be crucial for all stakeholders.

Support and assistance options

To aid users in navigating the complexities of filling out financial disclosure statements, support and assistance options are readily available. pdfFiller offers a dedicated support team that users can reach out to for help with specific issues, from technical troubleshooting to questions about compliance. Additionally, community forums allow for peer support where users can share insights and experiences related to financial disclosures.

Expert consultations are also an option for those seeking specialized advice on financial disclosures, particularly for organizations with complex financial situations. With additional learning resources and webinars offered through pdfFiller, users can enhance their understanding and skills related to financial disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement to be eSigned by others?

Can I edit financial disclosure statement on an iOS device?

How do I fill out financial disclosure statement on an Android device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.