Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form: How-to Guide

Understanding financial disclosure statement forms

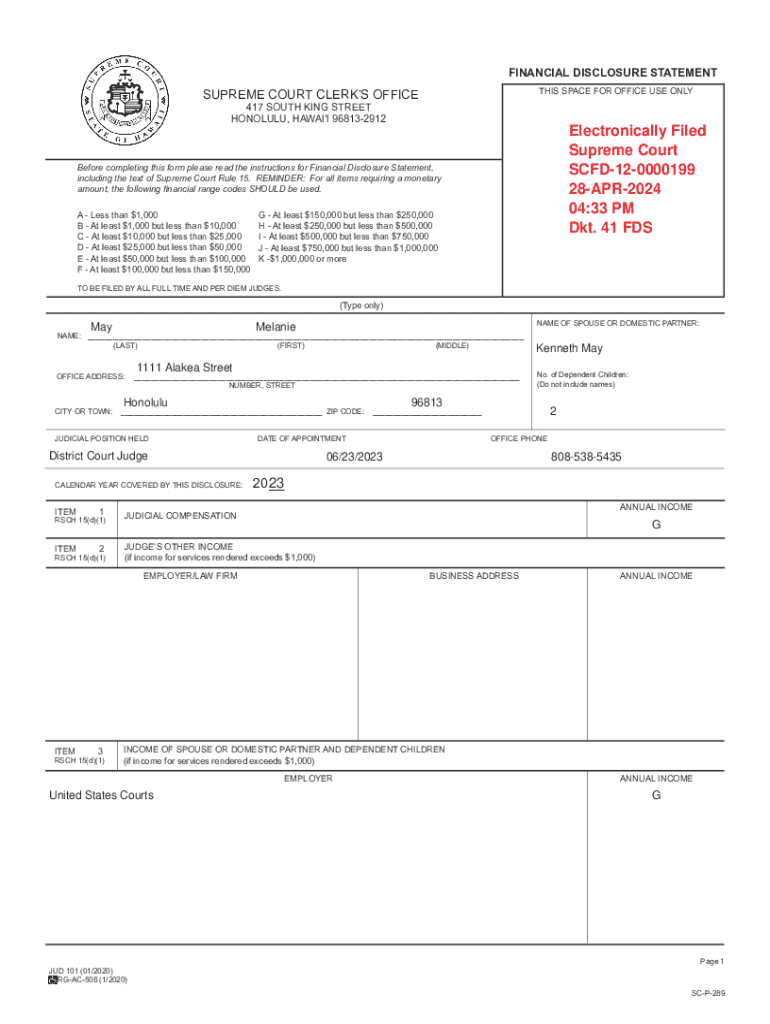

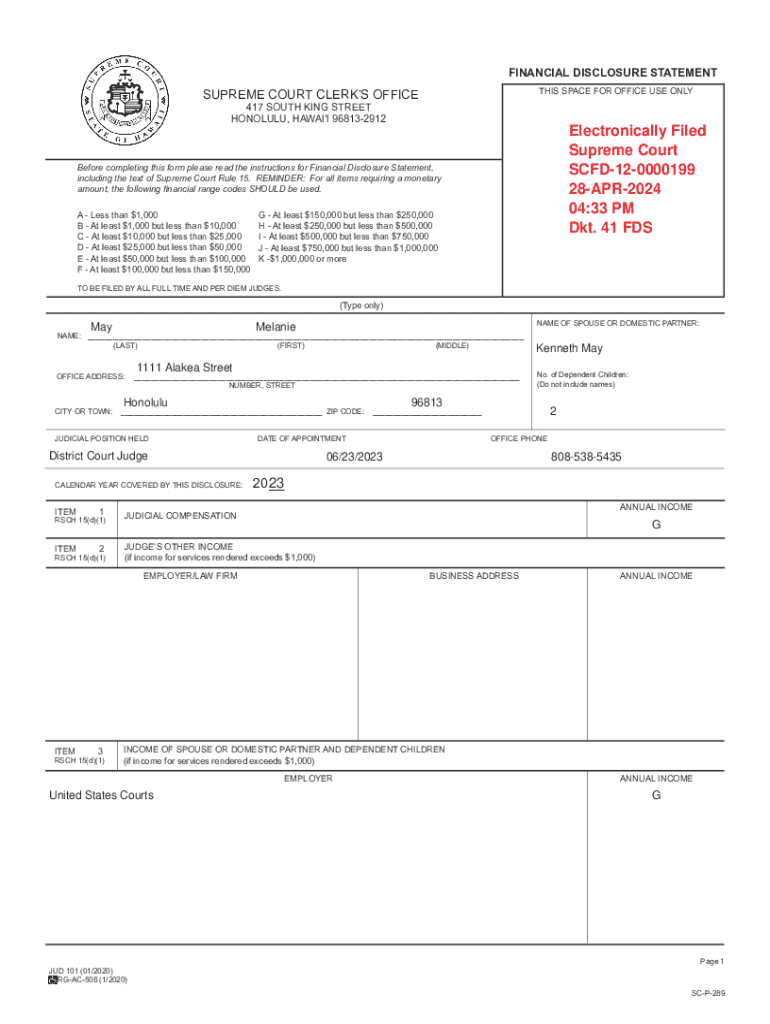

A financial disclosure statement form is a document that provides a detailed account of an individual's or an organization's financial status. This form serves multiple purposes, primarily revolving around transparency and accountability in financial reporting. By disclosing financial information, organizations and individuals enable stakeholders to assess performance and understand potential conflicts of interest. It becomes a tool for regulatory compliance and fosters trust in financial transactions.

The essence of transparency in financial reporting cannot be overstated—especially for public entities and those seeking funding. A well-maintained financial disclosure statement establishes credibility and can lead to better relationships with investors or donors.

Types of financial disclosure statements

Financial disclosure statements come in various forms depending on the sector in question. For personal finance, individuals may fill out forms to disclose assets for loan applications or estate planning. Corporations prepare detailed annual reports that disclose financial statements to shareholders, whereas non-profit organizations often need to disclose their financials to maintain tax-exempt status while also soliciting donations.

Some common types include:

Key components of a financial disclosure statement form

Understanding the structure of a financial disclosure statement is essential for accurate completion. These forms typically contain various sections that outline different aspects of financial health, including personal assets, liabilities, and income sources.

Some of the key sections usually included in a financial disclosure statement are:

Understanding mandatory disclosures

Compliance with laws and regulations is an integral part of financial disclosure. Depending on where you reside or operate, there may be both state and federal requirements that must be met. For example, government employees or those who hold positions in certain organizations may be required to file financial disclosures regularly to avoid conflicts of interest.

Familiarizing oneself with these mandatory disclosures is crucial. Ignoring them can result in legal consequences that may tarnish reputations or even lead to financial penalties.

Step-by-step guide to completing a financial disclosure statement form

Gathering necessary information

Completing a financial disclosure statement requires a variety of supporting documents. Start by gathering income statements, tax returns, bank statements, and any other proof of assets or liabilities. This foundational knowledge is essential as it not only aids in accuracy but also simplifies the process.

Organizing your data effectively can streamline the completion process. Consider using digital tools such as spreadsheets to categorize your assets and liabilities logically.

Completing each section

When filling out each part of the form, take your time and ensure accuracy. Start with straightforward sections, which will build your confidence for the more complex areas. One common pitfall is neglecting smaller assets or liabilities, which could lead to discrepancies in your final report.

Review and verification process

After completion, it’s vital to double-check your information. Look out for common mistakes such as typos or omitted figures, which could undermine the credibility of your disclosure. Utilizing review tools on platforms like pdfFiller can substantially reduce errors and ensure everything is accurately recorded.

Editing and customizing your financial disclosure statement

How to effectively edit your form

Once you have completed your financial disclosure statement form, pdfFiller provides you with various options for editing. Enhanced features allow you to adjust text, tweak formatting, or rearrange sections as necessary. Maintaining clarity will enhance the reader's understanding and the document's overall integrity.

Adding signatures

An important aspect of financial disclosure forms is the signature. E-signatures are a convenient and legal way to authenticate documents in today's digital landscape. Consider the various electronic signature options available through pdfFiller, ensuring that they align with legal considerations in your respective field.

Managing your financial disclosure statement form

Storing and organizing your documents

Once your financial disclosure statement is completed, efficient storage and organization are crucial. Digital filing systems can keep your documents accessible and organized, which is important for future reference, especially during audits or compliance checks. Utilizing features on pdfFiller allows you to store your forms securely while ensuring they are easily retrievable when needed.

Sharing your form with relevant parties

When it's time to share your completed form, pdfFiller allows for secure methods of sharing documentation. Whether it's with team members, legal advisors, or regulatory authorities, ensuring secure and clear communication is vital for maintaining integrity and confidentiality.

Common questions and troubleshooting

Frequently asked questions about financial disclosure statements

Many users encounter common questions while completing financial disclosure statement forms. For instance, what happens if I omit information or fail to follow submission protocols? These FAQs can provide valuable guidance, ensuring that submitters avoid undue stress and adhere to requirements effectively.

Troubleshooting issues

Technical issues can arise during the form-filling process. Whether it’s problems with saving, editing, or submitting your document, having a troubleshooting guide can save you time and frustration. Familiarizing yourself with pdfFiller's support resources can greatly enhance your experience and streamline the documentation process.

Additional resources and tools

Interactive tools available on pdfFiller

pdfFiller not only allows you to fill out and manage your financial disclosure statement forms but also provides interactive tools that enhance your overall experience. Features like templates and financial calculators can further simplify the disclosure process and assist with financial analyses related to your statements.

Recommended readings and further assistance

Those looking to expand their knowledge on financial disclosures may find related articles and tutorials beneficial. These resources can provide deeper insights into best practices in financial reporting, compliance, and the significance of accurate disclosures in maintaining trust with stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete financial disclosure statement online?

How do I make edits in financial disclosure statement without leaving Chrome?

How do I complete financial disclosure statement on an iOS device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.