Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

Editing financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Understanding the Financial Disclosure Statement Short Form

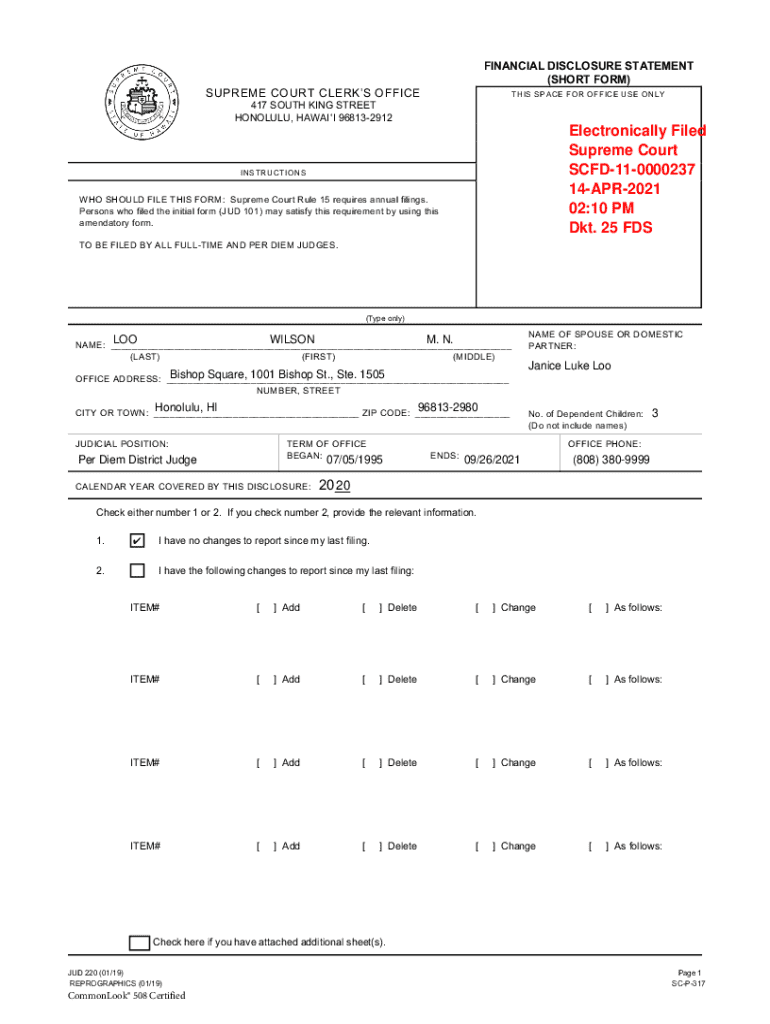

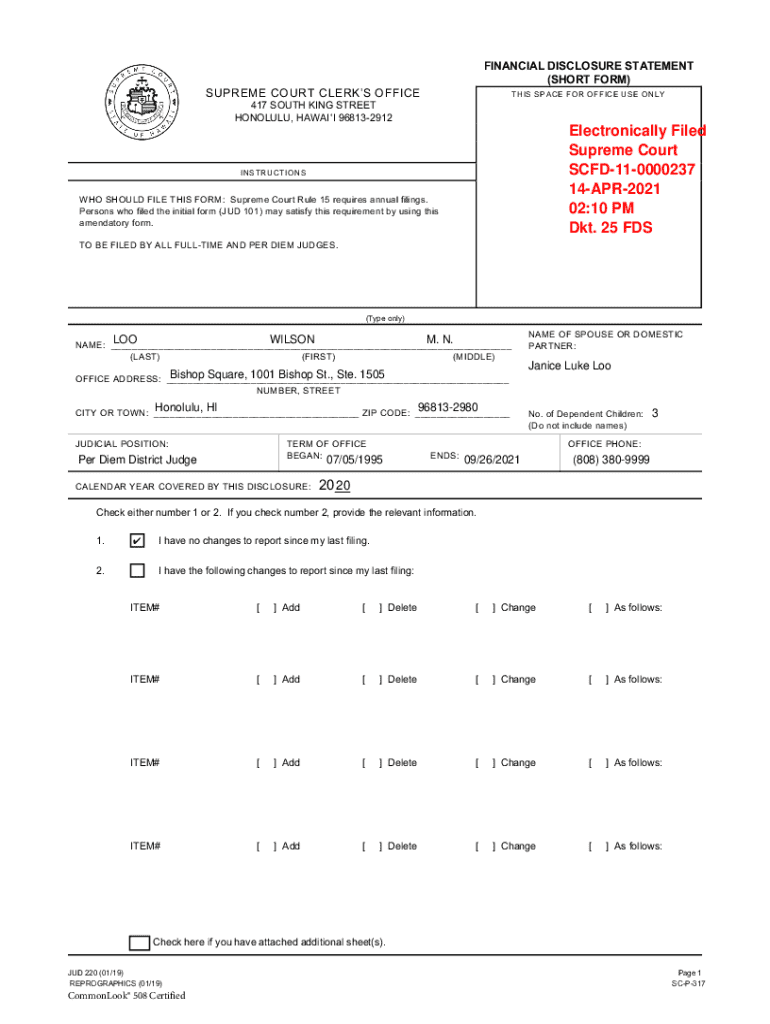

What is a financial disclosure statement short form?

The financial disclosure statement short form is a concise document utilized to provide essential financial information about an individual or organization. Its primary purpose is to promote transparency regarding financial interests, thereby fostering trust among stakeholders. This streamlined version focuses on key financial data, allowing filers to disclose pertinent details without the extensive information required in the long form.

Key components typically included in the short form involve personal information such as name, contact details, and position. Additionally, it covers financial interests, comprising assets, liabilities, and sources of income. Users may also be required to disclose gifts, travel reimbursements, and other financial benefits, ensuring comprehensive transparency.

Importance of financial disclosure statements

Filing a financial disclosure statement is imperative for various categories of individuals and organizations. Public officials, candidates for office, and trustees must adhere to these filing requirements to maintain integrity and avoid conflicts of interest. On the corporate side, non-profits, companies, and associations also need to file to demonstrate accountability to their stakeholders.

The significance of filing these statements cannot be overstated. It encapsulates the ideals of transparency and accountability, reinforcing public confidence. Compliance is not just best practice; the legal implications of non-compliance can be severe, including fines or disqualification from holding office. Thus, understanding the nuances of the financial disclosure statement short form is essential for safeguarding one’s career and organization.

Overview of the short form structure

Knowing the structure of the financial disclosure statement short form is critical for accurate completion. The sections usually entail personal information, financial interests, and additional disclosures. In the personal information segment, filers provide essential details such as name, contact information, and their position within an organization.

Next, the financial interests section demands a thorough report on assets, liabilities, and income sources. Disclosures regarding gifts and benefits also find place in this form. It's crucial to highlight how the short form deviates from the longer version; while the long form contains extensive details, the short form focuses on essential financial interests, making it easier to complete and file in a timely manner.

Preparing to fill out the financial disclosure statement short form

Preparation is key when dealing with the financial disclosure statement short form. Begin by gathering the necessary information and documents to ensure accuracy. This may include bank statements, investment records, tax returns, and any other relevant financial documentation. Having these organized will streamline the process and reduce the chance of errors.

Understanding what qualifies as reportable financial interests is also essential. Common pitfalls include failing to disclose joint assets or not acknowledging all income sources. Taking the time to familiarize yourself with reportable interests, such as stocks, bonds, or real estate investments, can save you from future legal headaches.

Step-by-step guide to completing the short form

Completing the financial disclosure statement short form can be straightforward when approached methodically. Start with filling in your personal information, ensuring all details are correct and up-to-date. Accuracy and completeness matter; minor mistakes can derail your filing and lead to unnecessary complications.

Next, move on to reporting financial interests, categorizing assets and sources of income responsibly. Be particularly mindful of joint assets and liabilities; each filer is responsible for accurately disclosing all interests. When disclosing gifts and benefits, follow specific guidelines to understand what qualifies. Complete your form by reviewing and editing it for clarity; digital tools such as pdfFiller can be invaluable for this step. Finally, ensure you sign and submit your disclosure on time, utilizing eSigning options for efficiency.

Electronic filing and submission options

Leveraging technology can enhance your experience while filing your financial disclosure statement short form. Platforms like pdfFiller provide a user-friendly, cloud-based solution that allows for seamless e-filing. The advantages include easy access to your forms from anywhere and interactive tools that simplify the process of editing and submitting your disclosures.

When submitting your forms electronically, best practices suggest confirming compliance with both state and federal requirements. Always follow up with confirmations of receipt after submission and familiarize yourself with filing deadlines to avoid inadvertently incurring penalties.

Common challenges and solutions

Filing the financial disclosure statement short form can come with its own set of challenges. Many filers encounter issues such as inaccuracies in reporting, which arise from misunderstanding what needs to be disclosed. Others tend to miss deadlines, resulting in non-compliance penalties.

To mitigate these issues, consider utilizing templates and seeking assistance from experts who have successfully navigated the process. The support feature within pdfFiller can also prove beneficial in guiding you through common hurdles and ensuring your form is completed accurately.

Maintaining your financial disclosure statement records

Managing your financial disclosure statement records is essential for personal and organizational compliance. Best practices for document management include keeping detailed, organized records of all filed disclosures, supporting documentation, and any correspondence related to your filings. This can provide crucial protection should there be any inquiries or audits.

Using pdfFiller can enhance your record-keeping capability by securely storing and organizing your forms in the cloud. This feature not only ensures easy retrieval of your past forms but also allows for efficient updates whenever there are changes to your financial circumstances.

Updates and changes to financial disclosure regulations

Staying informed of updates and changes to financial disclosure regulations is vital to ensuring compliance. Various resources, including government websites and non-profit watchdog organizations, offer alerts regarding any alterations in filing requirements or deadlines. Regularly monitoring these channels enables individuals and organizations to anticipate adjustments in required disclosures.

These changes may affect future filings significantly, depending on alterations in income or financial holdings. By maintaining a proactive stance on emerging regulations, you can safeguard your compliance strategy.

Conclusion of use cases

Numerous individuals and organizations have successfully navigated the complexities of the financial disclosure statement short form, and their real-life experiences serve as practical case studies. For instance, a recently elected public official utilized a systematic approach to filing, collaborating with a professional to ensure accuracy and completeness. This proactive method showcased how comprehensive disclosure fosters trust with constituents.

Testimonials from users reveal that platforms like pdfFiller not only alleviate the stress associated with financial disclosures but also empower individuals and teams to manage documents efficiently. These tools enhance collaboration and facilitate smoother filing processes, reinstating the value of transparency in financial matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement short to be eSigned by others?

Can I edit financial disclosure statement short on an Android device?

How do I fill out financial disclosure statement short on an Android device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.