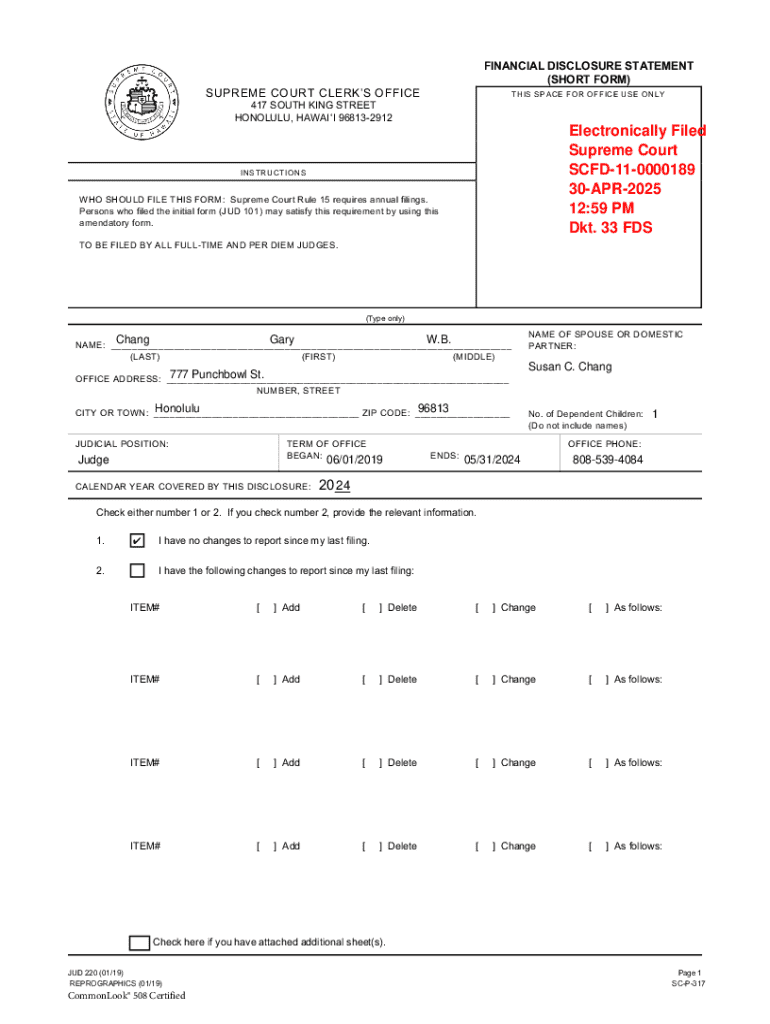

Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

Editing financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

A Comprehensive Guide to the Financial Disclosure Statement Short Form

Understanding financial disclosure statements

A Financial Disclosure Statement (FDS) is a document that outlines an individual’s or entity’s financial status. It includes detailed information about assets, liabilities, income sources, and other relevant financial data. The purpose of this statement is to provide a transparent overview of one’s financial situation, which is essential for legal compliance and accountability, particularly in contexts such as employment applications, legal proceedings, and requests for financial assistance.

The importance of financial disclosure cannot be overstated. It facilitates transparency in financial reporting, helping to build trust between individuals, corporations, and regulatory bodies. For instance, in corporate settings, the FDS acts as a safeguard against conflicts of interest, ensuring that stakeholders are well-informed about the financial health and activities of the organization.

When to use the financial disclosure statement short form

Certain situations necessitate the completion of a Financial Disclosure Statement Short Form. Job applications, especially in finance, public service, and educational institutions, often require candidates to disclose their financial circumstances to ensure suitability and avoid conflicts of interest. Similarly, individuals requesting financial assistance from government programs or charities may need to provide their financial information.

Legal proceedings can also trigger the need for this document. Courts may request a financial disclosure statement to assess a party’s financial capabilities, particularly in divorce cases, child support hearings, or bankruptcy filings. Understanding who needs to file is equally important.

Preparing to fill out the short form

Before completing the Financial Disclosure Statement Short Form, it is crucial to gather all necessary documentation. This includes income statements, bank statements, tax returns, and any other documents that indicate your financial status. Proper preparation helps ensure that your disclosure is accurate and thorough.

Understanding the key components of the short form is just as vital. Most forms include sections that ask for detailed information about assets, such as cash accounts, investment portfolios, and real estate, as well as liabilities, including loans and credit card debt. Having an organized view of these components will assist in accurately reporting financial data.

Step-by-step instructions for completing the short form

Completing the Financial Disclosure Statement Short Form can be straightforward if you follow these detailed steps. Start with the header information by filling out your personal details, including your name, address, and contact information. This ensures that the form is properly attributed to you.

Next, move on to the financial information breakdown. Here, you’ll list your assets first. Be thorough; include cash accounts, any investments, properties, and other valuables. After listing your assets, it is time to detail your liabilities. Include all loans, credit obligations, or any other debts that impact your financial status. The income declaration follows, where you must declare all types of income such as salary, rental income, and other revenue streams.

Finally, ensure to sign and date the form. It's critical to be mindful of deadlines and submission guidelines based on the requirements of the institution or entity requiring the disclosure.

Editing and managing your financial disclosure statement

After filling out the Financial Disclosure Statement Short Form, reviewing and editing your document is essential for accuracy. Using online platforms like pdfFiller can simplify this process significantly. With pdfFiller, you can easily upload your form, allowing for instant editing and adjustments. This feature is particularly useful when collaborating with others, like advisors or lawyers, who may also need to input or verify data.

Additionally, pdfFiller provides tools to ensure that your submission is accurate. Before submitting your disclosure statement, utilize the error-checking tools available on the platform. Reviewing your form with fresh eyes or getting a second opinion can assist in catching potential mistakes or missing information.

Submitting your financial disclosure statement

Once your Financial Disclosure Statement Short Form is complete and accurate, the next step is submission. There are various methods available for submission, depending on the entity requiring your disclosure. Many organizations now offer online submission options, which are generally the quickest and most efficient way to ensure your documentation is received. Alternatively, for those who prefer traditional methods, submitting a physical copy may be necessary. Always follow the specific submission guidelines provided by the requirements of the organization.

After submitting your form, it’s beneficial to know what to expect. Processing times can vary; be sure to check the entity's website or contact their office for typical turnaround times. Additionally, keeping track of your submission status through any provided tracking codes or confirmation emails can alleviate concerns regarding your application.

Common mistakes to avoid

When completing the Financial Disclosure Statement Short Form, it is crucial to avoid common pitfalls that can lead to complications or delays. One prevalent mistake is providing incomplete information. Omitting assets, liabilities, or income sources can result in the rejection of your application or even legal repercussions.

Another mistake often made is failing to update information after significant financial changes. For example, if you receive new income or incur new debts, these changes should be reflected in your disclosure statement promptly. Lastly, ensure that you thoroughly understand the legal requirements surrounding financial disclosures specific to your situation to avoid misunderstandings that could jeopardize your application.

FAQs about financial disclosure statement short form

Navigating the complexities of the Financial Disclosure Statement Short Form can raise several questions. One common inquiry arises when individuals experience changes in their financial situation after submission. In such cases, it is essential to update the relevant entity as soon as possible to maintain accuracy. Additionally, many wonder whether they can amend their disclosure statement. Generally, amendments can be made; however, the process may vary by organization, so referencing the specified guidelines is crucial.

Concerns over penalties for inaccurate disclosures also arise. It’s vital to understand that discrepancies can have serious consequences, including legal action or the denial of financial assistance. Thus, being as precise and truthful as possible is paramount to avoid these risks.

Leveraging pdfFiller features for efficient document management

pdfFiller empowers users to enhance their document management experience significantly. One of its standout features is the ability to collaborate in real-time on document creation and editing. This is particularly beneficial for teams working on Financial Disclosure Statements, allowing for input from multiple stakeholders seamlessly.

Furthermore, pdfFiller includes eSignature capabilities, enabling users to sign documents quickly without the hassle of printing and scanning. Cloud storage is another noteworthy feature; it ensures that all your documents are easily retrievable from anywhere, limiting the risk of misplacing vital information.

Best practices for financial transparency

Maintaining financial transparency requires diligence and regular reviews of your financial documentation. Establishing a routine that incorporates periodic assessments of your financial standing can significantly improve accuracy and integrity in your reporting. Keeping organized records year-round, rather than scrambling to compile information at the last moment, streamlines the process and reduces stress when completing forms like the Financial Disclosure Statement Short Form.

In complex financial situations, seeking professional guidance can often be beneficial. Financial advisors or accountants can provide valuable insights and ensure compliance with all regulations, thus enhancing your financial standing and reputation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial disclosure statement short directly from Gmail?

How do I complete financial disclosure statement short online?

Can I edit financial disclosure statement short on an Android device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.