Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form: A Comprehensive How-To Guide

Understanding financial disclosure statement forms

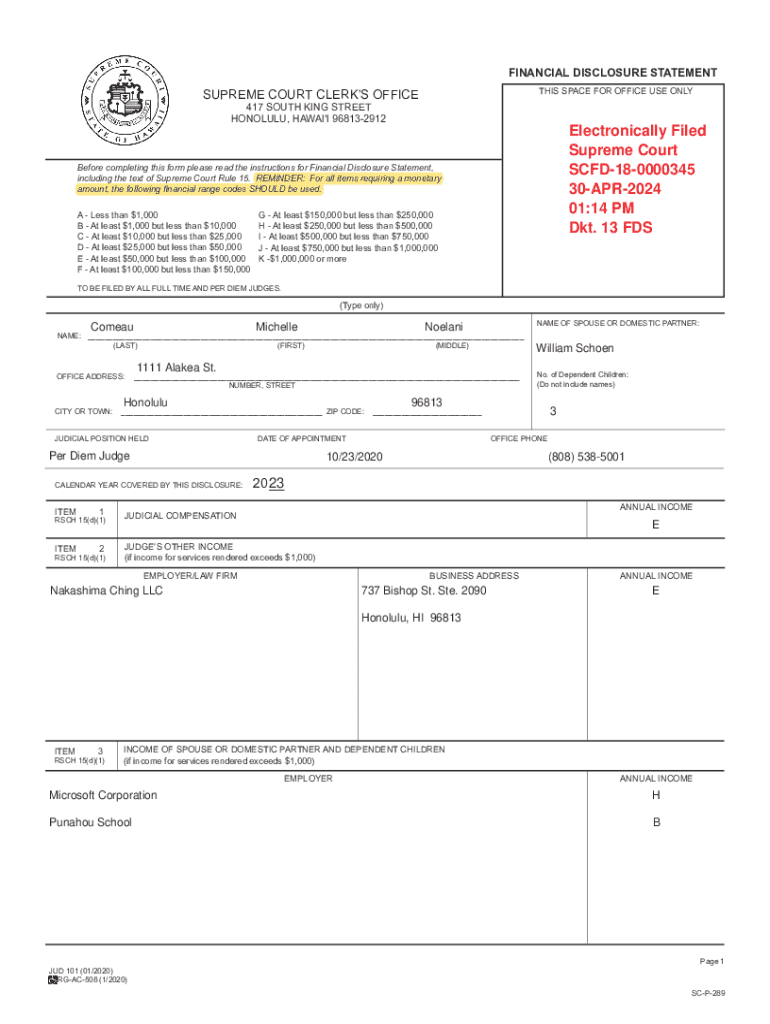

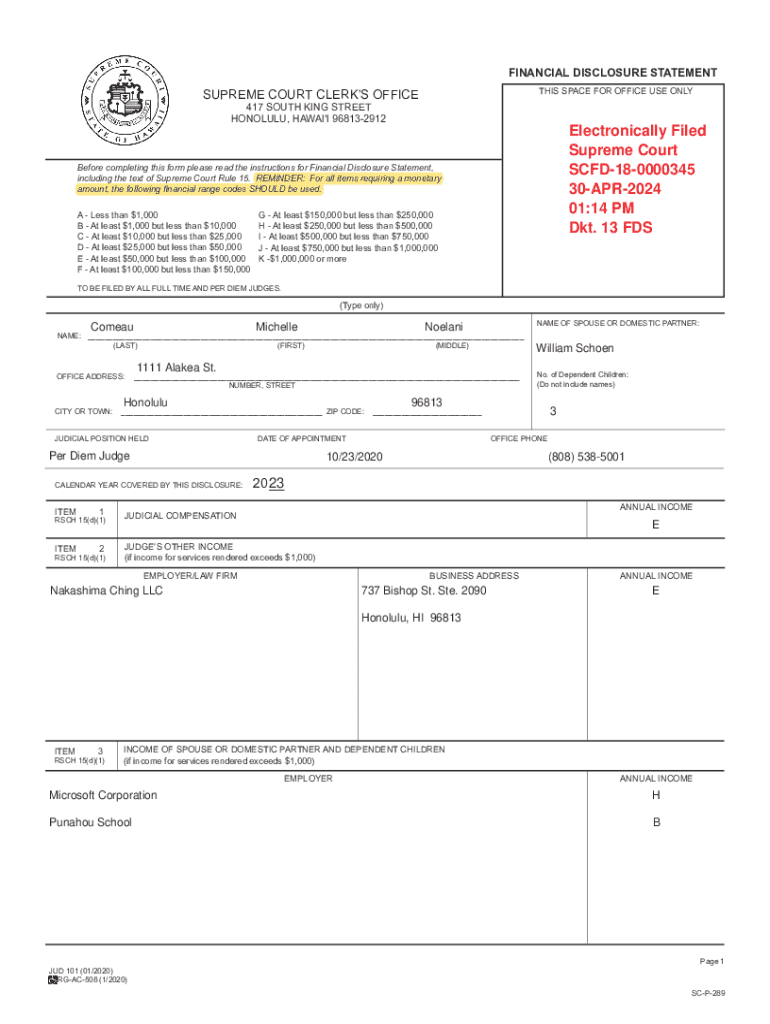

A financial disclosure statement form is a formal document that provides a detailed account of an individual’s or entity’s financial status. This encompasses sources of income, liabilities, and other financial interests. The primary purpose of these statements is to foster transparency and accountability, particularly in sectors like government, where ethical reporting is paramount.

The importance of transparency in financial reporting cannot be overstated. It cultivates trust among stakeholders, aligns with legal requirements, and mitigates the risk of financial misconduct. Individuals in public positions, along with businesses that engage with governmental bodies, often find themselves required to file this statement.

Types of financial disclosure statement forms

There are several variants of financial disclosure forms tailored to different requirements and regulations. Understanding these types can save time and ensure compliance with varying legal standards.

Common distinctions include individual versus entity disclosures. While individual disclosures detail personal finances, entity disclosures cover the financial status of organizations or corporations. Furthermore, specific states or federal entities have their own versions, which may differ in complexity and information required.

Preparing to fill out your financial disclosure statement

Preparing to fill out your financial disclosure statement requires meticulous attention to detail. Start by gathering necessary documents to ensure that all information you provide is accurate. Commonly required documents include recent pay stubs, bank statements, property deeds, and investment portfolios.

During this preparation phase, categorize your financial information into three main areas: income sources, assets, and liabilities. Be thorough, as incomplete or inaccurate data can lead to complications or allegations of dishonesty.

Step-by-step guide to completing the financial disclosure statement form

Completing the financial disclosure statement form can seem daunting at first, but breaking it down into sections makes it manageable. Each section of the form typically requests different types of information, which we will outline in detail.

Begin with your personal and contact information. Ensure that all details are accurate as they are crucial for identification purposes. Next, disclose your employment and income, detailing all income streams, including basic salary to any additional earnings. Following this, you will be prompted to report your assets and liabilities. Be precise and honest, as discrepancies can lead to legal issues. Finally, include any other relevant financial information and double-check your entries for accuracy.

Common errors to avoid include providing outdated information, underreporting assets, or omitting certain income sources. Follow these guidelines carefully to ensure that your submission meets all legal criteria.

Editing and customizing your financial disclosure statement

After drafting your financial disclosure statement, utilizing pdfFiller’s editing tools can enhance the document’s accuracy and presentation. If you find mistakes during your review, correcting them is straightforward.

With pdfFiller, you can easily correct errors, add or remove sections as needed, and format the document to meet your professional standards. Ensure that your final document is polished and legible before submission.

Signing and submitting your financial disclosure statement

In the digital age, eSigning has become increasingly important for document validation. Using pdfFiller’s eSigning features makes it easy to securely sign your financial disclosure statement. It’s crucial to ensure all parties involved can verify their identity through secure methods.

Once signed, you must decide on your submission method. Though electronic submissions are favored due to their convenience and speed, ensure you follow the specific guidelines of the entity requesting the form, as some may still require paper copies.

Managing and storing your financial disclosure statement

After submission, it’s prudent to manage and store your financial disclosure statement effectively. Utilizing digital document management strategies ensures that your records are organized and easily accessible. pdfFiller’s platform allows you to store documents securely in the cloud, facilitating retrieval at any time.

Maintaining compliance with storage regulations is also vital, particularly for sensitive financial information. pdfFiller provides features to safeguard your data, including password protection and secure sharing protocols, which help ensure that your financial data remains confidential.

Frequently asked questions about financial disclosure statement forms

Understanding the frequency and updates related to financial disclosure statements can alleviate concerns for filers. Typically, these forms must be filed annually or whenever there are significant changes in financial status. Those who fail to file may face penalties, including fines or restrictions on future employment opportunities.

If an individual’s financial situation changes after submission, updating the disclosure is essential. Keeping stakeholders informed supports transparency and builds trust, which is critical in professional and governmental contexts.

Resources for ongoing support

Navigating financial disclosure statements can be challenging, but resources are available for assistance. pdfFiller offers interactive tools that simplify the process of editing and managing documents. Additionally, tutorials and video guides on their website provide valuable insights into using the software effectively.

If you encounter difficulties or have specific questions, pdfFiller’s customer support is readily available. Their team can provide tailored help to address individual needs and ensure that your financial disclosure statement is handled correctly.

Navigating legal and ethical considerations

Legal compliance when preparing a financial disclosure statement is non-negotiable. Adhering to applicable laws not only safeguards your interests but also reinforces your credibility. Specific requirements can vary by location and organization, hence understanding these nuances is crucial for anyone involved in financial disclosures.

The ethical implications of transparency and disclosure extend beyond legal obligations. Upholding a high standard of ethics in financial reporting contributes to a culture of integrity within professions, especially in fields like finance and governance. Regularly reviewing your practices and ensuring all disclosures reflect your true financial state will assist in maintaining these standards.

Conclusion of the financial disclosure process

Completing a financial disclosure statement form involves a series of systematic steps, from gathering accurate data to submitting the form. Understanding the key components and following best practices not only ensures compliance but also promotes a culture of honesty. Regularly reviewing and updating your statement is vital to reflect your current financial picture accurately.

Utilizing resources like pdfFiller can simplify this process, making it easier to manage documents effectively. A strong commitment to transparency can ultimately enhance your credibility and foster trustworthy relationships within your professional sphere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get financial disclosure statement?

How can I edit financial disclosure statement on a smartphone?

How do I complete financial disclosure statement on an Android device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.