Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Understanding the Financial Disclosure Statement Form

Understanding the Financial Disclosure Statement Form

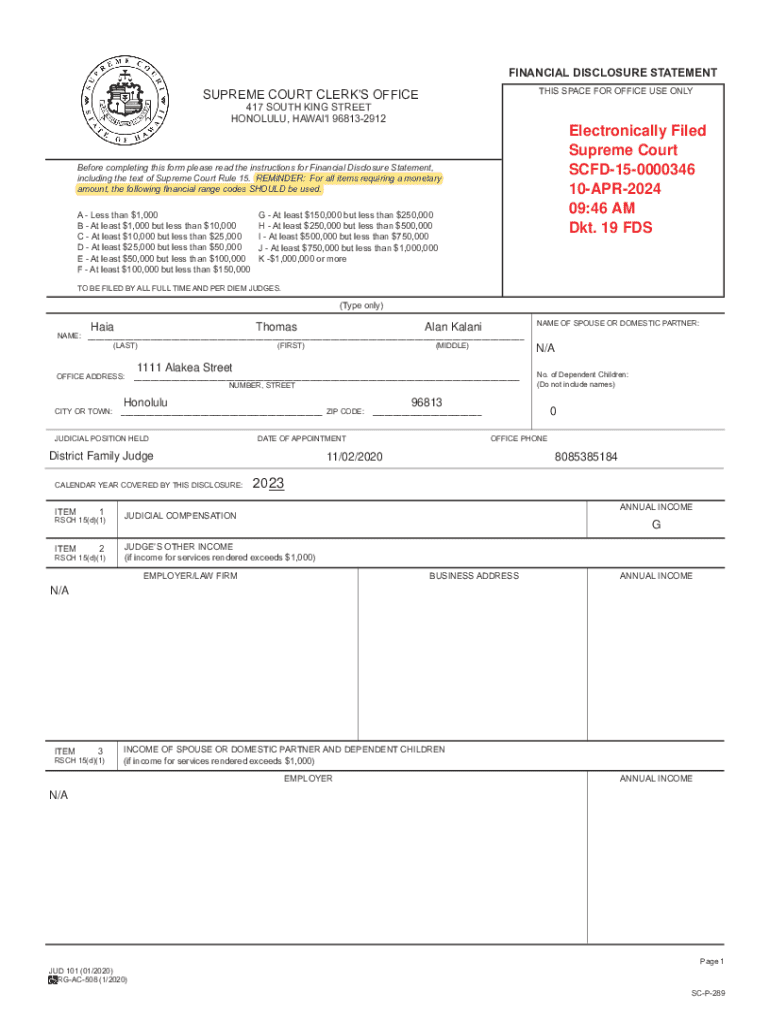

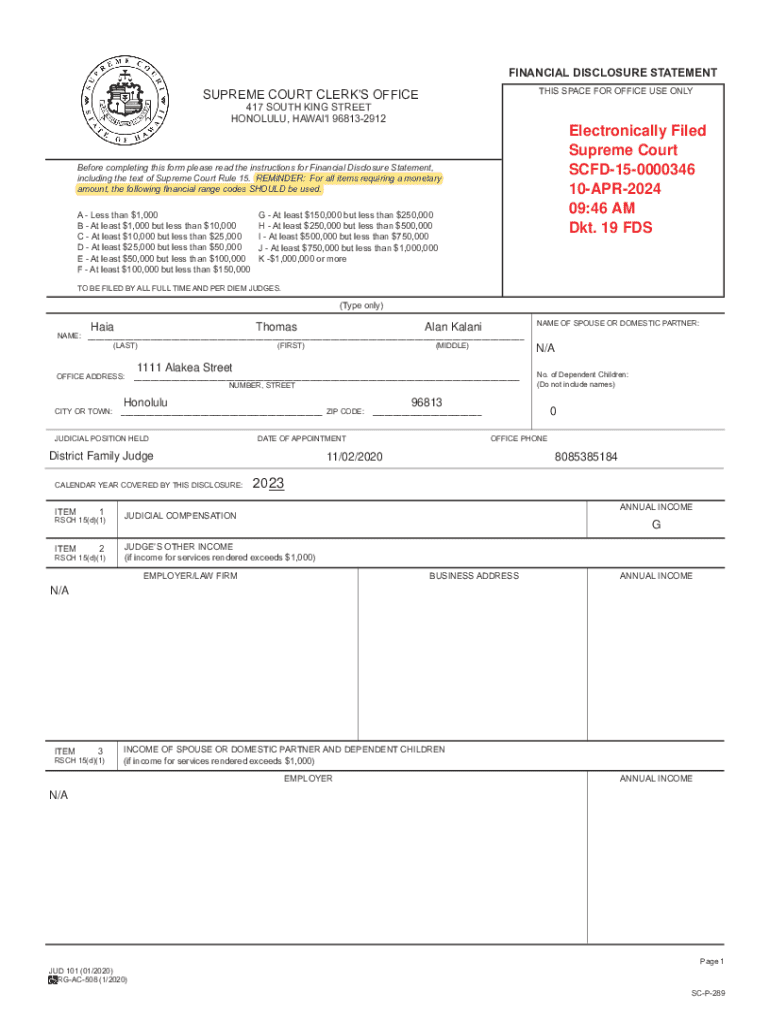

The financial disclosure statement form serves as a vital tool for individuals and organizations to transparently report their financial status. Defined as a comprehensive document that details one's income, assets, and liabilities, this form allows for accountability and insight into financial dealings. Its primary purpose is to promote transparency among public officials, candidates for public office, and certain corporate entities, facilitating public trust and integrity.

The importance of the financial disclosure statement is twofold. On a personal level, it encourages individuals to reflect on their financial health, while on an organizational level, it helps ensure that entities are operating within ethical parameters. In doing so, it enhances stakeholder confidence and safeguards against potential corruption or conflicts of interest.

Who needs to file?

Several categories of individuals are typically required to file a financial disclosure statement. Public officials, candidates for public office, and certain high-ranking employees in government positions are among the most common. Each jurisdiction may have distinct criteria that outline who must submit this form, which often extends to corporate executives and board members, especially for publicly traded companies.

For organizations, especially corporations, compliance with financial disclosure regulations is essential. Failure to meet these requirements may lead to significant consequences. Stakeholders, including investors and regulators, should be aware of any potential conflicts of interest that may arise from undisclosed financial relationships.

Key components of the form

The financial disclosure statement form comprises several crucial components that collectively paint a comprehensive picture of an individual’s or an organization’s financial position. Divided into sections, the form typically covers income disclosure, assets declaration, liabilities, and related interests.

The income disclosure section captures various sources of income. Individuals must list earned income, investment returns, or any additional revenue streams, while adhering to specific frequency and reporting requirements.

Next, the assets declaration section demands details on various types of assets, including real estate holdings and investments. Accurate valuation methods need to be employed to ensure transparency, and individuals should strive to avoid under- or overestimating their net worth.

On the other hand, the liabilities section requires disclosing types of liabilities, such as loans and mortgages. Specific reporting thresholds define what qualifies for inclusion, ensuring that all significant financial obligations are recorded.

Lastly, the related interests section focuses on any business affiliations that might conflict with official duties or responsibilities. Disclosure may necessitate affidavits of spouses or related entities to maintain a robust oversight mechanism.

Step-by-step guide to completing the form

Completing the financial disclosure statement form can be a daunting task, but a systematic approach simplifies the process. Begin by gathering necessary documentation, including bank statements, tax returns, and any other documents pertinent to your financial situation. This preparation lays the groundwork for accurate reporting.

Next, fill out the personal information section accurately. This includes your name, address, and identification details. Accuracy here is crucial, as errors can lead to complications during the review process.

The income reporting process follows. When detailing your income sources, ensure that you present all revenue streams accurately, including additional calculations to give a comprehensive view of your financial health.

When addressing asset and liability reporting, guidelines provided in the form will assist you in correctly listing these elements. Be aware of any financial thresholds that apply and ensure you follow them closely.

Finally, a thorough review checklist is essential before submission. Double-check all reported figures and personal information, ensuring nothing significant has been overlooked. A meticulous review can save you from future complications.

Editing and customizing your financial disclosure statement

As the financial disclosure statement form often requires adjustments and updates, utilizing tools provided by platforms like pdfFiller makes this process seamless. With its features, users can edit fields and sections easily, ensuring the form meets their specific requirements.

Customization options allow individuals to fine-tune templates, adapting them for unique circumstances. With real-time collaboration features, stakeholders can work on the document together, giving feedback and suggesting changes efficiently. This collaborative approach is invaluable, particularly for organizations where multiple parties may be involved in the filing process.

E-signing the financial disclosure statement

Understanding e-signatures is crucial, as they carry legal validity and security that traditional signatures may not provide. Users can utilize the e-sign capabilities within pdfFiller to streamline the signing process, ensuring that both signatory parties can complete the form without needing in-person meetings.

The step-by-step e-signing process on pdfFiller offers an intuitive workflow. Users can prepare their documents for signing, invite others within their organization or relevant parties to sign, and manage the overall signatory workflow efficiently.

Management and storage of your financial disclosure statement

In today's digital world, managing and storing your financial disclosure statement securely is paramount. Cloud storage provides unmatched benefits, offering access from virtually anywhere. Moreover, secure cloud services ensure sensitive information remains protected, minimizing the risk of data breaches.

Organizing your documents effectively enhances ease of retrieval when needed. Implement categorical strategies for organizing financial disclosure statements and related documents by date or type, ensuring that your records are both comprehensive and easy to navigate.

Tracking changes over time is also essential for maintaining version control. Regular updates and an audit trail help individuals and organizations remain accountable for their disclosures, allowing for a history of changes that can be referenced when needed.

Compliance and filing guidelines

Timeliness is critical when it comes to submitting your financial disclosure statement. Each jurisdiction establishes specific deadlines for submission of the form, often correlating with the election cycle or annual reporting periods for businesses.

Failure to disclose required information can carry severe legal repercussions and penalties. Understanding these potential consequences should motivate individuals and organizations alike to comply with filing requirements diligently.

Lastly, individuals should evaluate the options available for filing—whether electronically or via paper submission. Each method has its own pros and cons; electronic submission can often expedite the process, while paper submission might be preferred in certain situations, depending on local regulations.

Frequently asked questions

Individuals frequently have queries surrounding the financial disclosure statement, particularly regarding issues of accuracy and amendments. For example, if a mistake is made on the form, it's crucial to determine the process for correction promptly to avoid implications of misinformation.

Additionally, many wonder if they can amend their disclosure after submission. The answer typically hinges on jurisdictional guidelines, but most places do allow for amendments under specific conditions. Users turning to pdfFiller will find ample support and customer service to assist with these queries.

Additional support and resources

For users of pdfFiller, accessing help is straightforward. The platform offers live chat options and dedicated customer support for any questions that arise during the form-filling process. Tutorials and guides further enhance usability, catering to users with varying levels of experience.

It's also essential to engage with key regulatory bodies relevant to financial disclosures. These authorities provide official guidelines and additional documentation that users might find beneficial in completing their forms accurately.

Case studies and examples

Real-life scenarios often shed light on the complexities surrounding financial disclosures. For instance, individuals navigating complicated financial ecosystems have successfully filed disclosure statements by adopting strategic approaches that emphasize transparency.

Conversely, an analysis of common errors reveals significant lessons learned from past filing mistakes, such as overlooking crucial income sources or failing to declare related interests. These examples highlight the value of diligence in completing financial disclosure statements and adhering to regulatory standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete financial disclosure statement online?

How do I edit financial disclosure statement on an iOS device?

How do I complete financial disclosure statement on an iOS device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.