Get the free Financial Disclosure Statement (short Form)

Get, Create, Make and Sign financial disclosure statement short

How to edit financial disclosure statement short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement short

How to fill out financial disclosure statement short

Who needs financial disclosure statement short?

Understanding and Completing Your Financial Disclosure Statement Short Form

Understanding financial disclosure statements

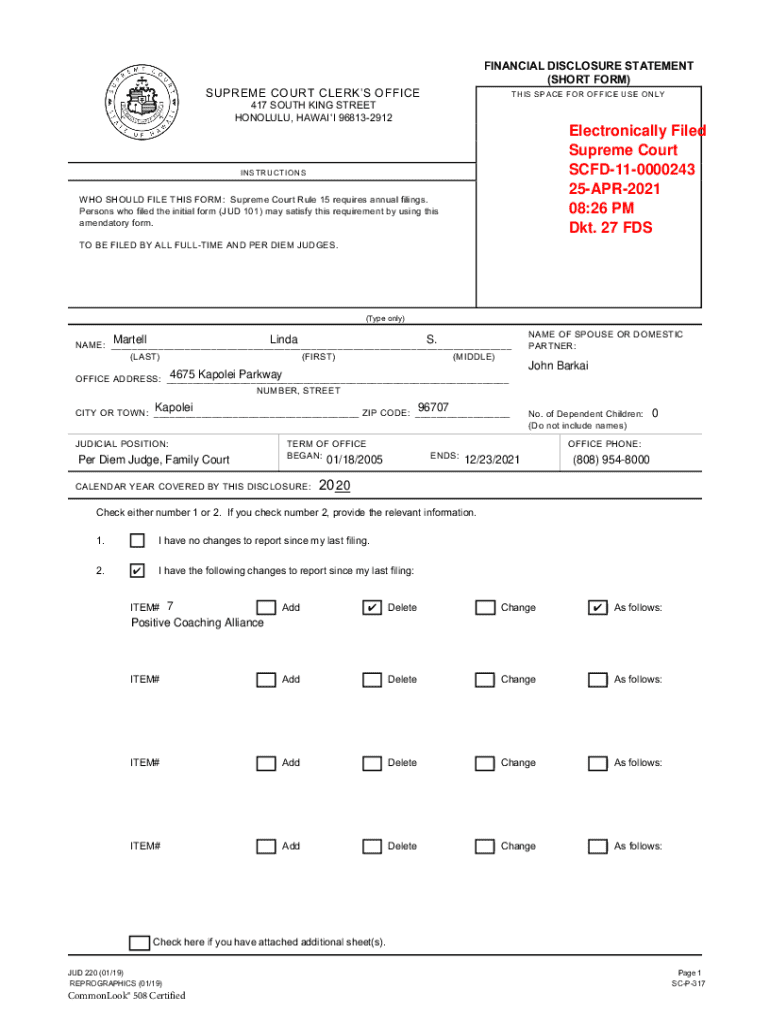

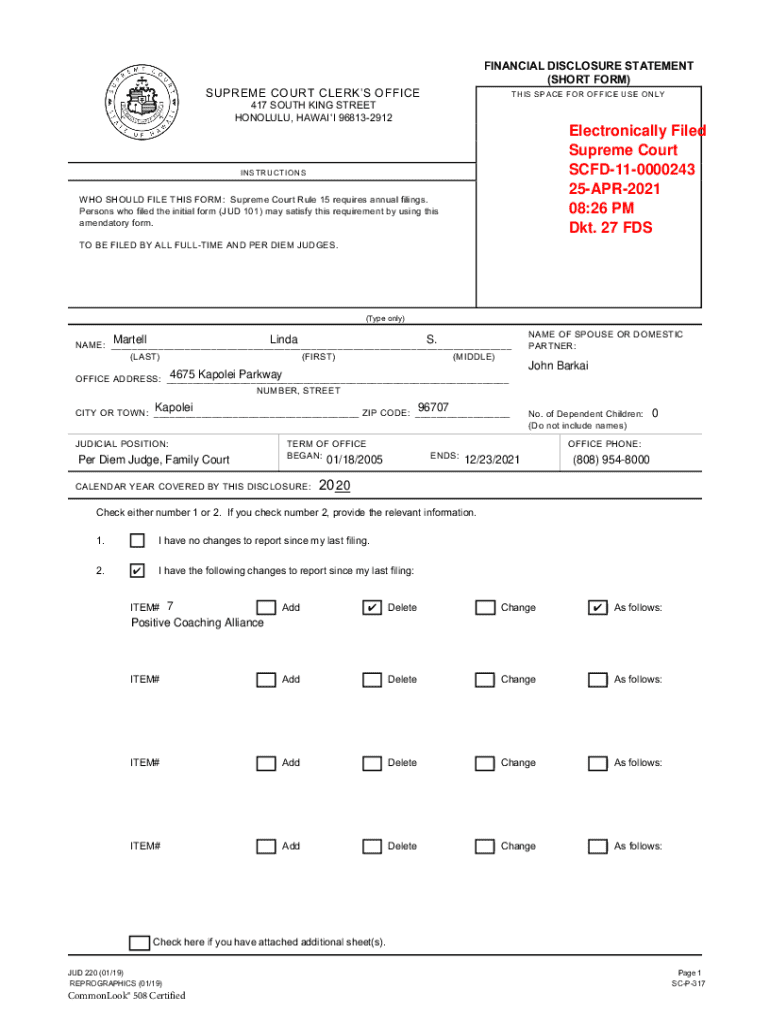

A financial disclosure statement short form is a concise document that outlines an individual’s or entity's financial situation. Its primary purpose is to ensure transparency in financial dealings, whether for employment, legal proceedings, or regulatory compliance. By summarizing necessary financial information, this document allows stakeholders to understand a party's financial capabilities and obligations.

The significance of financial disclosure cannot be overstated; it fosters trust, accountability, and is often a legal requirement in various contexts. Individuals applying for government positions or contracts, for example, typically must provide this form to ensure they have no conflicts of interest that could compromise their integrity.

Various demographics may need to fill out a financial disclosure statement, including public officials, contractors, and those entering financial agreements. By understanding the parameters of this documentation, individuals can effectively portray their financial standing.

Key components of the financial disclosure statement short form

The design of the financial disclosure statement short form includes several critical sections that collectively provide a snapshot of the individual’s financial status.

Preparing to complete your financial disclosure statement

Before diving into completing your financial disclosure statement short form, it's crucial to gather all relevant documents and information. Ensuring that your data is accurate and comprehensive will save time and prevent complications later on.

Understanding when to submit your financial disclosure statement is equally important. There are specific deadlines, especially related to employment applications or legal requirements, that dictate when this information must be provided.

Step-by-step guide for completing the financial disclosure statement short form

Completing the financial disclosure statement can be a straightforward process if done correctly. Here’s a step-by-step guide to assist you.

Editing and managing your financial disclosure statement

Following the initial completion, you may need to edit your financial disclosure statement short form. Using tools like pdfFiller can streamline this process.

eSigning your financial disclosure statement

Once your disclosure statement is finalized, the next step is to sign it electronically. eSigning through pdfFiller offers significant advantages.

Common mistakes to avoid

Navigating the financial disclosure statement short form can be challenging, and there are common pitfalls that you should avoid.

Frequently asked questions (FAQs)

It's natural to have questions about the financial disclosure statement short form. Here are some frequently asked questions:

Additional features of pdfFiller for financial management

Beyond creating and signing your financial disclosure statement short form, pdfFiller offers additional features to enhance your financial management capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial disclosure statement short without leaving Google Drive?

Where do I find financial disclosure statement short?

Can I edit financial disclosure statement short on an Android device?

What is financial disclosure statement short?

Who is required to file financial disclosure statement short?

How to fill out financial disclosure statement short?

What is the purpose of financial disclosure statement short?

What information must be reported on financial disclosure statement short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.