Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

Editing financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Understanding the Financial Disclosure Statement Form

Understanding the financial disclosure statement form

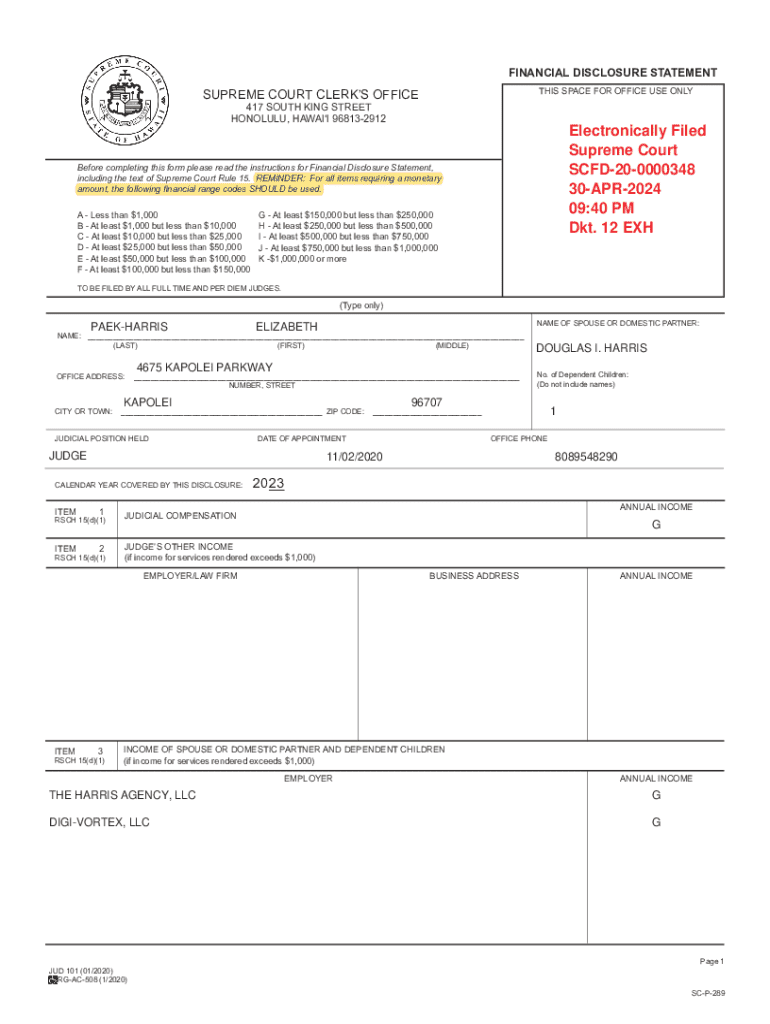

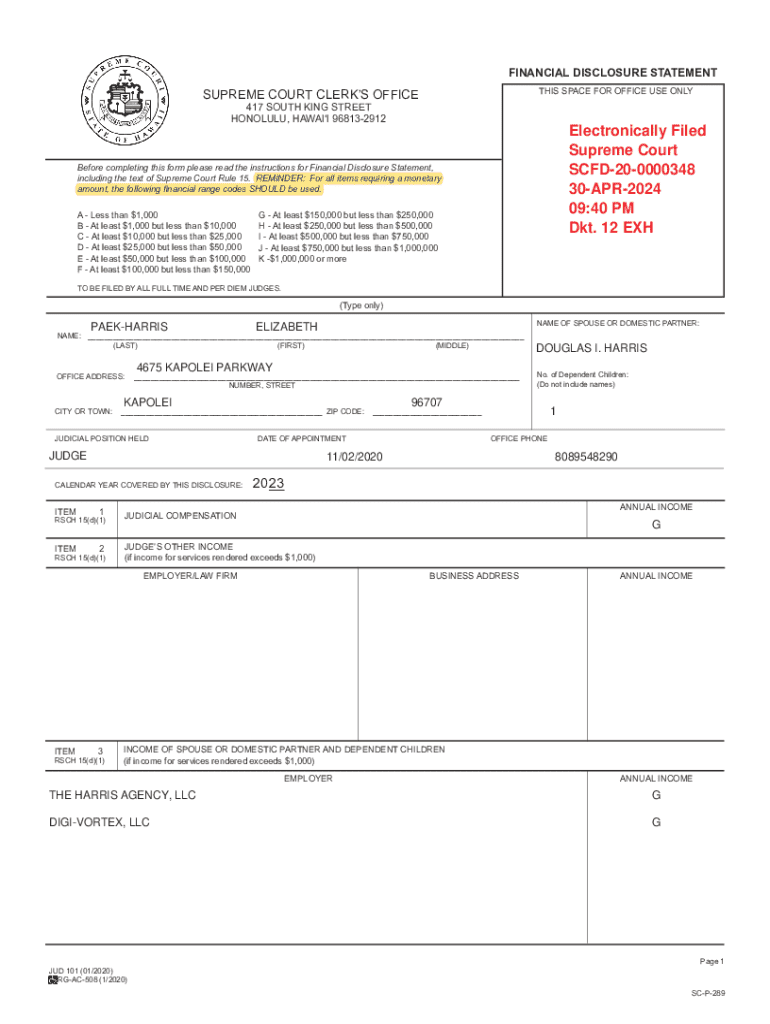

A financial disclosure statement form is a crucial document used to provide a transparent overview of an individual’s or organization’s financial interests and activities. This form allows officials, employees, and individuals in various sectors to declare their financial situations, ensuring accountability and transparency in decision-making processes. Its significance is heightened in contexts such as government, corporate environments, and non-profit organizations, where stakeholders must declare financial interests that could influence their decisions.

The importance of this form cannot be overstated; it is instrumental in maintaining ethical standards and public trust. By providing a clear picture of assets, liabilities, and financial involvements, the financial disclosure statement helps mitigate conflicts of interest and promotes integrity across sectors.

Legal requirements

Legal implications surrounding the financial disclosure statement form vary across jurisdictions. Entities such as government agencies often mandate these disclosures under laws aimed at promoting ethical behavior among public officials. Additionally, companies may require these statements from their employees to comply with securities regulations or to maintain good corporate governance. Understanding the localized legal requirements is crucial, as some states may have more stringent regulations than federal standards.

When is a financial disclosure statement needed?

Several common scenarios necessitate the completion of a financial disclosure statement form. Public officials and government employees are often required to file these forms as part of their commitment to transparency and ethical standards. In the private sector, particularly for publicly traded companies under the jurisdiction of the SEC, these disclosures are critical for maintaining investor trust and ensuring compliance with regulations.

Similarly, non-profit organizations may require financial disclosures from their board members or executives to safeguard against conflicts of interest and maintain donor trust. Understanding the specific contexts where this documentation is necessary will help you navigate compliance requirements effectively.

Components of the financial disclosure statement form

The financial disclosure statement form comprises several key sections designed to encapsulate the financial landscape of the individual or entity filing. Understanding these components is crucial for accurately completing the form. Key sections often include a listing of assets and liabilities, sources of income, and the identification of gifts and financial interests that could represent a potential conflict.

Defining terminology used in these forms is equally vital. For example, the term 'gifts' often refers to any financial benefits received without compensation, while 'liabilities' can encompass debts and obligations. Familiarity with these definitions will enhance comprehension and ensure precise disclosures.

Step-by-step guide to completing the financial disclosure statement form

Completing a financial disclosure statement form accurately requires meticulous attention to detail. Start by gathering all necessary documentation, which typically includes bank statements, tax returns, and records of assets and debts. This will provide a comprehensive view of your financial situation and make completing the form easier.

Once documentation is gathered, follow these steps to complete the form:

Watch out for common mistakes while filling out the form, particularly in the reporting of income or failing to include all required disclosures. Missing or inaccurate information can lead to legal consequences or challenges to your credibility.

Editing and reviewing the financial disclosure statement form

Once the financial disclosure statement form is completed, a thorough review is essential. One of the tools that can help in this process is pdfFiller, which offers features for editing and annotating PDF forms. Utilize these tools to ensure clarity and accuracy, while also collaborating with team members if necessary.

Having a second pair of eyes conduct a review can catch errors or omissions that may have been overlooked. It is advisable to establish a system of checks, which may include peer reviews or consultations with financial advisors.

Submitting the financial disclosure statement form

The method of submission for a financial disclosure statement form often depends on jurisdictional requirements. In many cases, electronic submissions are accepted, making the process more efficient. However, specific guidelines for submission must be followed, which can vary by state or federal regulations.

Tracking your submission is crucial, especially if submitted electronically. Ensure you receive a confirmation receipt and keep a record of submission dates, as this will facilitate any follow-up inquiries that may arise.

What happens after submission?

After submission, understanding the review process is important. Regulatory authorities will typically review the financial disclosure statement for compliance and accuracy. This may involve verifying the reported financial information against independent sources or databases.

Potential follow-ups or questions can arise post-submission, often focusing on discrepancies or requests for clarification. Being prepared for these inquiries will ensure a smooth follow-up process and maintain transparency.

Managing your financial disclosure statement form

Archiving your financial disclosure statement form securely is essential for referencing in future filings. Utilizing tools like pdfFiller can aid in safe electronic archiving, allowing you to access your documents from anywhere. Regular updates to your disclosures are necessary to reflect changes in your financial situation accurately.

Establishing a routine for updates and reviews will help maintain compliance and ensure that all disclosures are timely and accurate, thereby reducing the risk of legal ramifications.

Interactive tools and resources

pdfFiller provides various interactive tools that enhance document management and streamline the signing process. These features, including document templates and electronic signatures, make it easier to manage financial disclosure statements effectively.

Additionally, accessing governmental resources pertinent to financial disclosures will further strengthen your understanding of compliance requirements. These resources may provide specifics on filing deadlines, additional instructions, and sector-specific guidance that can be invaluable.

Frequently asked questions

Clarifying common confusions regarding the financial disclosure statement form is vital for both new and seasoned filers. FAQs often revolve around the contents required and the processes involved in filing. By addressing these questions early, filers can proceed more confidently through the submission process.

Addressing myths and misconceptions about the financial disclosure process is equally important. For instance, some might believe that certain individuals, such as part-time employees, do not need to file; understanding the full scope of filing responsibilities can prevent complications down the line.

Advanced tips for professionals

For professionals navigating the financial disclosure landscape, adhering to best practices for compliance is essential. Staying updated with changes in laws or organizational requirements will enhance your ability to file accurate statements. Regular professional development and training opportunities can be invaluable.

Leveraging pdfFiller for team implementations allows for collaborative filing and compliance management, ensuring that team members remain aligned on deadlines and requirements. Establishing clear communication channels and access control for document management will facilitate smooth operations and foster a culture of transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial disclosure statement in Gmail?

How do I edit financial disclosure statement online?

Can I edit financial disclosure statement on an Android device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.