Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

How to edit financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form: A Comprehensive How-to Guide

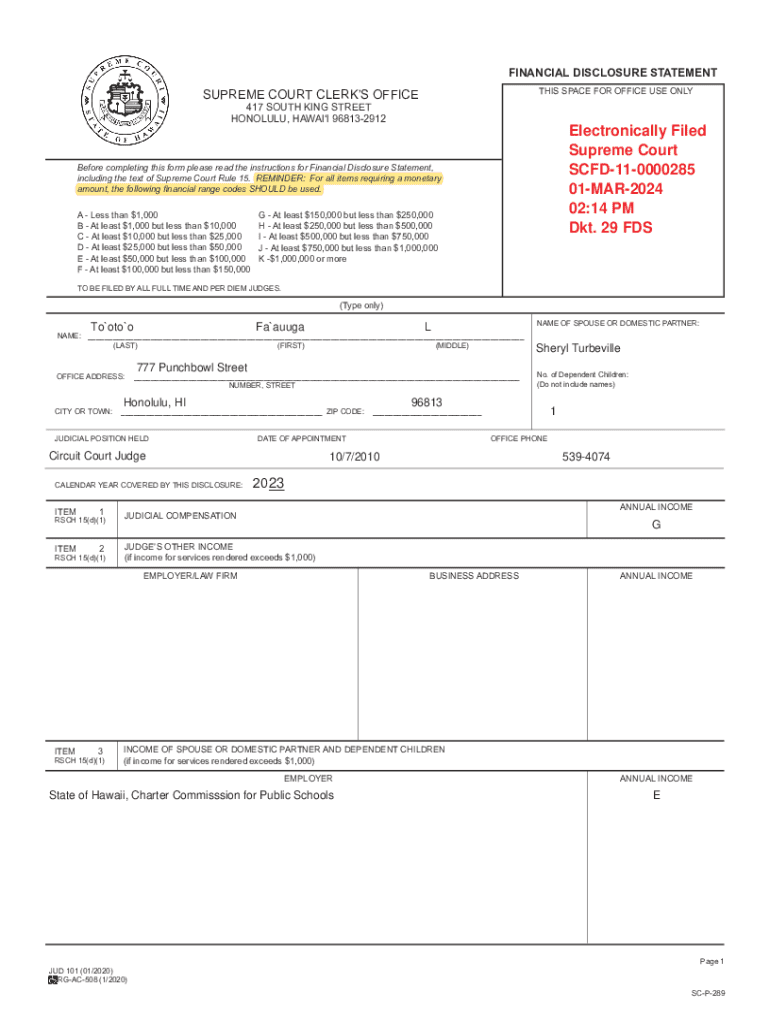

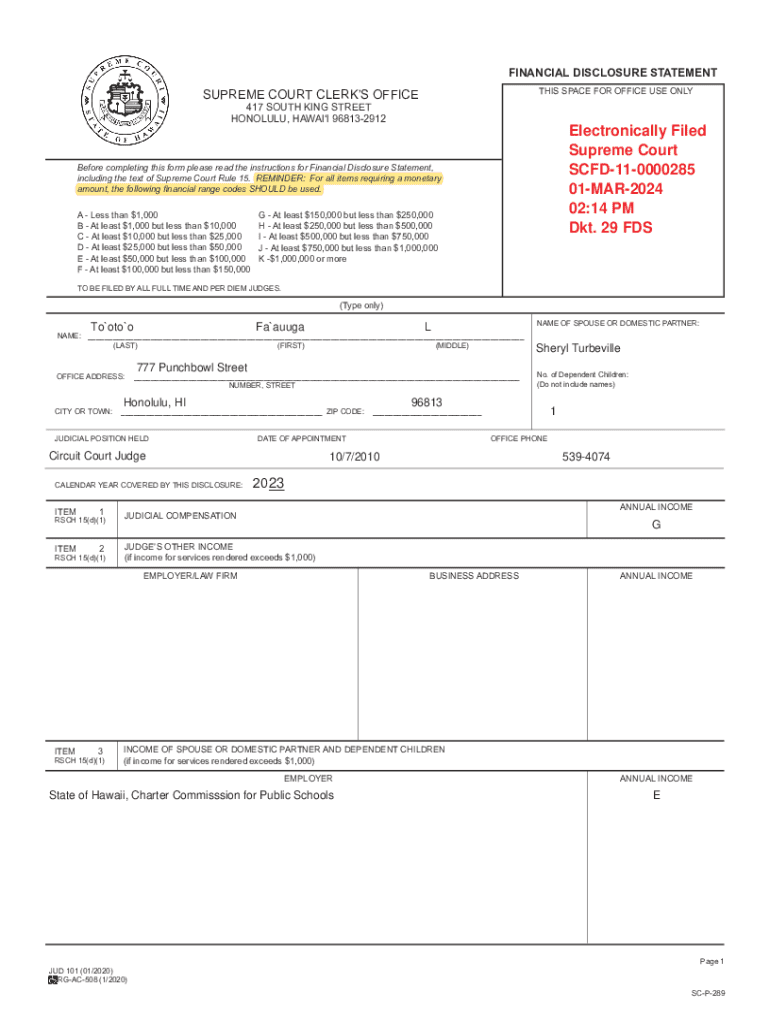

Understanding financial disclosure statement forms

A financial disclosure statement form is a crucial document that outlines an individual's or entity's financial interests and transactions. It's used primarily to provide transparency regarding potential conflicts of interest, particularly for public officials and candidates. Essentially, this form serves as a window into a person’s financial dealings and helps shore up public confidence in governance.

The importance of financial disclosure cannot be overstated. It helps maintain accountability and ensures that officials or individuals in positions of power are acting in the public's best interest. Additionally, such disclosures can protect individuals from allegations of malpractice or unethical behavior, demonstrating that they have nothing to hide.

Who needs to submit a financial disclosure statement?

Certain individuals are required by law to submit a financial disclosure statement form. This predominantly includes public officials, candidates running for office, and specific individuals involved in industries subject to regulatory oversight. By shining a light on their financial dealings, these forms are designed to limit corruption and enhance public trust.

Key categories of filers include legislators, political candidates, and even employees of government agencies in sensitive positions. Each of these groups may face different regulations depending on state and national laws. Notably, non-disclosure can lead to serious repercussions, including fines, loss of position, or criminal charges.

Preparing to fill out the form

Before filling out the financial disclosure statement form, it’s critical to gather all necessary documentation and information. Start with compiling personal financial information, which includes bank statements, tax returns, and records of any assets you hold. These documents will ensure that you provide thorough and truthful disclosures.

Additionally, detail your sources of income, including salaries, dividends, or any side gigs. Don't overlook liabilities; accurately reporting debts can provide a full picture of your financial situation. It’s also beneficial to familiarize yourself with common mistakes to avoid, such as underreporting income or failing to include all assets, as these can lead to complications down the road.

Step-by-step instructions for completing the financial disclosure statement form

Completing a financial disclosure statement form can seem daunting at first, but breaking it down into manageable sections can help. Start with Section 1, where you will enter your personal information such as your full name, address, and contact details. Be sure to double-check for accuracy, as errors here can lead to complications.

Moving to Section 2, you will detail your employment and compensation history. List all jobs held, including dates of employment and a brief description of your role and income. In Section 3, report your assets and investments; this may include real estate, stocks, or other financial holdings. Section 4 will require information on your liabilities, such as loans or any outstanding debts. Lastly, Section 5 covers gifts and other forms of income that must be reported. For tips on accurate reporting, consider revisiting your documentation to ensure completeness.

Editing and customizing your financial disclosure statement

Once you've filled out the financial disclosure statement form, use tools like pdfFiller to edit your document easily. This platform allows you to make necessary alterations without hassle, ensuring your disclosure is both clear and compliant with regulations. Common edits may include clarifying values or correcting any typos.

Once edits are complete, it’s vital to save and manage different versions of your form. This practice not only provides backup options but also allows for easier updates in the future, particularly during annual or bi-annual revisions.

Signing your financial disclosure statement

A financial disclosure statement requires a signature to validate the information provided. Understanding the legal implications of digital signatures is crucial; electronic signatures hold the same weight as handwritten signatures in many jurisdictions, a feature you can take advantage of using pdfFiller. General practices around eSigning can vary, so be sure to verify that your method complies with local regulations.

Using pdfFiller simplifies the signing process. You can eSign your form quickly, ensuring you meet submission deadlines while maintaining compliance. Always make sure to confirm that you signed the form correctly before submission, as missteps here can inadvertently delay processing.

Submitting your financial disclosure statement

After the form is completed and signed, the next step is submission. Depending on the requirements set by your local or state regulations, there may be both online and offline options for submission. Ensure you’re familiar with where to submit the forms, as submitting to the wrong entity can lead to delays.

Equally important are the deadlines for submission. Missing these deadlines can have serious consequences, including penalties or turning your submission invalid. To verify the receipt of your submission, follow up with the relevant agency; some organizations even provide confirmation emails or receipts for submissions, which can offer peace of mind.

Common challenges and how to overcome them

When filling out and submitting a financial disclosure statement form, many individuals face common challenges. For instance, the complexity of finance-related terms can be daunting. To alleviate confusion, consider creating a glossary of terms, or seek out explanations from financial advisors or online resources.

Technical issues may also arise during document submission, especially when dealing with digital forms. Familiarize yourself with the submission platform's requirements ahead of time, and do not hesitate to seek help from technical support services if needed. Knowing whom to contact for assistance in advance can save significant time and trouble.

Managing your financial disclosure statement over time

Maintaining accuracy over time with your financial disclosure statement is key to transparency. It’s not enough to submit the form once; keeping your disclosure statement updated is just as critical. This means revisiting your form after significant financial changes such as new investments, salary changes, or acquisitions of assets.

Platforms like pdfFiller can assist with ongoing financial transparency by allowing for easy updates and revisions. Consider establishing a routine annual review of your statement which enables you to proactively manage and maintain accuracy, reducing the likelihood of unreported changes that may lead to compliance issues.

Resources for further assistance

Various resources exist to assist individuals navigating the often-complex landscape of financial disclosure statements. Both state and federal government websites offer official guidance, including links to appropriate forms and submission guidelines. Additionally, consulting with financial advisors can offer tailored assistance, ensuring that your disclosures are accurate and complete.

Moreover, community support forums and groups can provide a platform for sharing experiences and strategies among filers. Engaging with others facing similar situations can enhance your understanding and provide invaluable insights into best practices for managing your financial disclosures.

Utilizing interactive tools for enhanced compliance

Interactive tools for completing forms can significantly enhance your experience and improve compliance. pdfFiller offers numerous features, such as templates and checklists, that streamline filling out the financial disclosure statement form. These resources help mitigate errors and ensure all required information is accounted for.

Additionally, utilizing visual aids and sample forms can demystify the filing process. By engaging with these resources, users can improve understanding and confidence, making the path to compliance much smoother.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find financial disclosure statement?

How do I execute financial disclosure statement online?

How do I complete financial disclosure statement on an Android device?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.